MMT vs VET: Comparing Modern Monetary Theory and Vocational Education Training in Economic Development

Introduction: MMT vs VET Investment Comparison

In the cryptocurrency market, the comparison between Momentum (MMT) and VeChain (VET) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different cryptocurrency asset positions.

Momentum (MMT): Launched on March 31, 2025, it has gained market recognition for its role as the "Robinhood of the tokenized era" and its integrated financial ecosystem.

VeChain (VET): Since its inception in 2017, it has been hailed as a platform for supply chain management and business processes, becoming one of the cryptocurrencies with significant global transaction volume and market capitalization.

This article will provide a comprehensive analysis of the investment value comparison between MMT and VET, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors are most concerned about:

"Which is the better buy right now?"

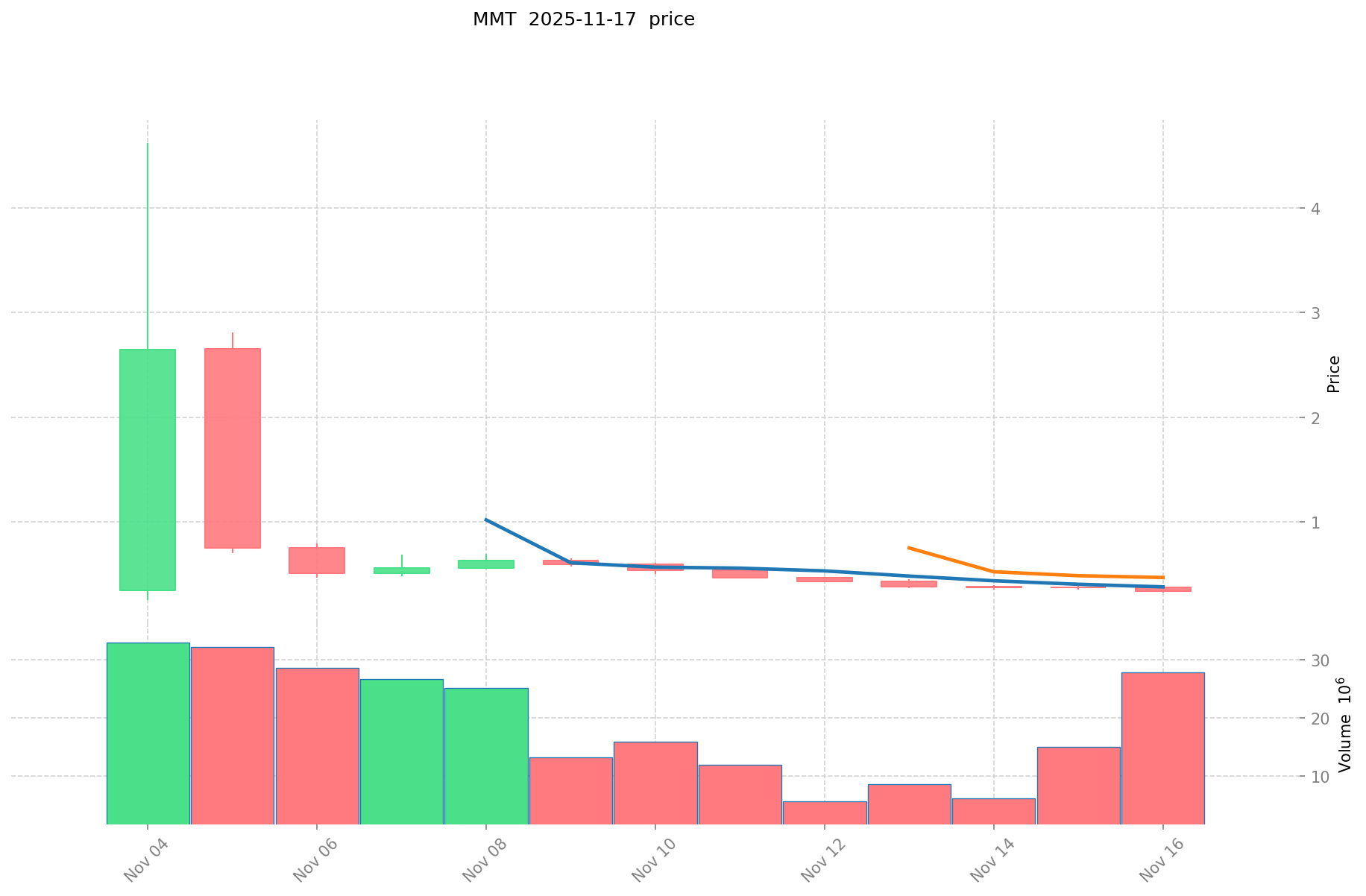

I. Price History Comparison and Current Market Status

MMT (Coin A) and VET (Coin B) Historical Price Trends

- 2025: MMT launched on March 31, quickly gaining traction with $500M in liquidity and over 2.1 million users.

- 2021: VET reached its all-time high of $0.280991 on April 19, amid a broader cryptocurrency market rally.

- Comparative analysis: In the recent market cycle, MMT has declined from its all-time high of $4.6188 to its current price of $0.3319, while VET has fallen from its peak to $0.01512.

Current Market Situation (2025-11-17)

- MMT current price: $0.3319

- VET current price: $0.01512

- 24-hour trading volume: MMT $9,602,950.04 vs VET $486,896.04

- Market Sentiment Index (Fear & Greed Index): 10 (Extreme Fear)

Click to view real-time prices:

- Check MMT current price Market Price

- Check VET current price Market Price

II. Core Factors Affecting MMT vs VET Investment Value

Supply Mechanisms Comparison (Tokenomics)

- MMT: Fixed supply cap of 1 billion tokens, with 86.5% currently in circulation

- VET: Total supply of 86.7 billion tokens, with 79% already in circulation

- 📌 Historical pattern: Supply mechanisms have traditionally influenced price cycles, with fixed supply models like MMT potentially creating scarcity value over time.

Institutional Adoption and Market Applications

- Institutional holdings: VET has gained more institutional traction, with partnerships across various industries

- Enterprise adoption: VET has stronger enterprise integration through VeChainThor blockchain platform for supply chain management and product authentication

- Regulatory attitudes: Both tokens face varying regulatory approaches globally, with VET's established business partnerships providing some regulatory clarity advantage

Technical Development and Ecosystem Building

- VET technical development: Continuous improvements to the VeChainThor blockchain with focus on enterprise solutions and sustainability tracking

- Ecosystem comparison: VET has a more developed ecosystem with established use cases in supply chain management, while MMT's ecosystem remains more limited in scope

Macroeconomic Factors and Market Cycles

- Performance during inflation: Neither token has demonstrated significant anti-inflationary properties compared to established cryptocurrencies like Bitcoin

- Macroeconomic monetary policy: Both tokens show sensitivity to broader market conditions, including interest rates and USD strength

- Geopolitical factors: VET's focus on global supply chain solutions may provide resilience during international trade disruptions

III. 2025-2030 Price Prediction: MMT vs VET

Short-term Prediction (2025)

- MMT: Conservative $0.18249 - $0.3318 | Optimistic $0.3318 - $0.374934

- VET: Conservative $0.0115216 - $0.01516 | Optimistic $0.01516 - $0.015918

Mid-term Prediction (2027)

- MMT may enter a growth phase, with estimated prices $0.2980650645 - $0.46412988615

- VET may enter a growth phase, with estimated prices $0.011452243 - $0.021878912

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- MMT: Base scenario $0.585912352137131 - $0.802699922427869 | Optimistic scenario $0.802699922427869+

- VET: Base scenario $0.02665038648855 - $0.035445014029771 | Optimistic scenario $0.035445014029771+

Disclaimer

MMT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.374934 | 0.3318 | 0.18249 | 0 |

| 2026 | 0.49824747 | 0.353367 | 0.2120202 | 6 |

| 2027 | 0.46412988615 | 0.425807235 | 0.2980650645 | 28 |

| 2028 | 0.57400944314175 | 0.444968560575 | 0.39602201891175 | 34 |

| 2029 | 0.662335702415887 | 0.509489001858375 | 0.458540101672537 | 53 |

| 2030 | 0.802699922427869 | 0.585912352137131 | 0.457011634666962 | 76 |

VET:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.015918 | 0.01516 | 0.0115216 | 0 |

| 2026 | 0.0186468 | 0.015539 | 0.0093234 | 2 |

| 2027 | 0.021878912 | 0.0170929 | 0.011452243 | 13 |

| 2028 | 0.02747512746 | 0.019485906 | 0.01305555702 | 28 |

| 2029 | 0.0298202562471 | 0.02348051673 | 0.0216020753916 | 55 |

| 2030 | 0.035445014029771 | 0.02665038648855 | 0.022919332380153 | 76 |

IV. Investment Strategy Comparison: MMT vs VET

Long-term vs Short-term Investment Strategies

- MMT: Suitable for investors focused on emerging financial ecosystems and potential for rapid growth

- VET: Suitable for investors interested in supply chain solutions and established enterprise partnerships

Risk Management and Asset Allocation

- Conservative investors: MMT: 30% vs VET: 70%

- Aggressive investors: MMT: 60% vs VET: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- MMT: Higher volatility due to newer market entry and less established ecosystem

- VET: Susceptibility to broader cryptocurrency market trends and supply chain industry fluctuations

Technical Risks

- MMT: Scalability, network stability

- VET: Network congestion, potential vulnerabilities in smart contract implementation

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with VET potentially facing less scrutiny due to its established enterprise use cases

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- MMT advantages: Potential for rapid growth, fixed supply cap, innovative financial ecosystem

- VET advantages: Established partnerships, real-world applications in supply chain management, more mature ecosystem

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight bias towards VET due to its established track record

- Experienced investors: Explore a diversified portfolio including both MMT and VET, adjusting based on risk tolerance

- Institutional investors: Focus on VET for its enterprise solutions, while keeping an eye on MMT's ecosystem development

⚠️ Risk Warning: The cryptocurrency market is highly volatile, and this article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between MMT and VET? A: MMT is a newer cryptocurrency focused on creating an integrated financial ecosystem, while VET is an established platform for supply chain management and business processes. MMT has a fixed supply cap of 1 billion tokens, whereas VET has a total supply of 86.7 billion tokens. VET has more institutional adoption and enterprise partnerships, while MMT is still building its ecosystem.

Q2: Which coin has performed better in terms of price? A: As of November 17, 2025, MMT is priced at $0.3319, while VET is at $0.01512. MMT has shown higher volatility and potential for rapid growth, having declined from its all-time high of $4.6188. VET has been more stable but has also declined from its peak of $0.280991 in April 2021.

Q3: What are the key factors affecting the investment value of MMT and VET? A: Key factors include supply mechanisms, institutional adoption, market applications, technical development, ecosystem building, and macroeconomic factors. VET has an advantage in institutional adoption and established use cases, while MMT's fixed supply cap could potentially create scarcity value over time.

Q4: How do the long-term price predictions compare for MMT and VET? A: By 2030, MMT's base scenario price range is predicted to be $0.585912352137131 - $0.802699922427869, while VET's base scenario range is $0.02665038648855 - $0.035445014029771. Both tokens are expected to show growth, with MMT potentially offering higher returns but with increased risk.

Q5: What are the main risks associated with investing in MMT and VET? A: MMT faces higher volatility risks due to its newer market entry and less established ecosystem. VET is susceptible to broader cryptocurrency market trends and supply chain industry fluctuations. Both face regulatory risks, though VET may have a slight advantage due to its established enterprise use cases.

Q6: How should investors allocate their portfolio between MMT and VET? A: Conservative investors might consider allocating 30% to MMT and 70% to VET, while aggressive investors could opt for 60% MMT and 40% VET. The exact allocation should be based on individual risk tolerance and investment goals.

Q7: Which coin is better suited for different types of investors? A: New investors might prefer a balanced approach with a slight bias towards VET due to its established track record. Experienced investors could explore a diversified portfolio including both MMT and VET. Institutional investors may focus more on VET for its enterprise solutions while monitoring MMT's ecosystem development.

Share

Content