LUMINT vs BTC: The Battle for Crypto Dominance in the Digital Asset Era

Introduction: LUMINT vs BTC Investment Comparison

In the cryptocurrency market, LUMINT vs BTC comparison remains an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset landscape.

LUMINT (LUMINT): Since its launch, it has gained market recognition for combining blockchain and AI technologies to deliver sustainable rewards.

Bitcoin (BTC): Since 2008, it has been hailed as "digital gold" and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between LUMINT and BTC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning investors:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

LUMINT (Coin A) and BTC (Coin B) Historical Price Trends

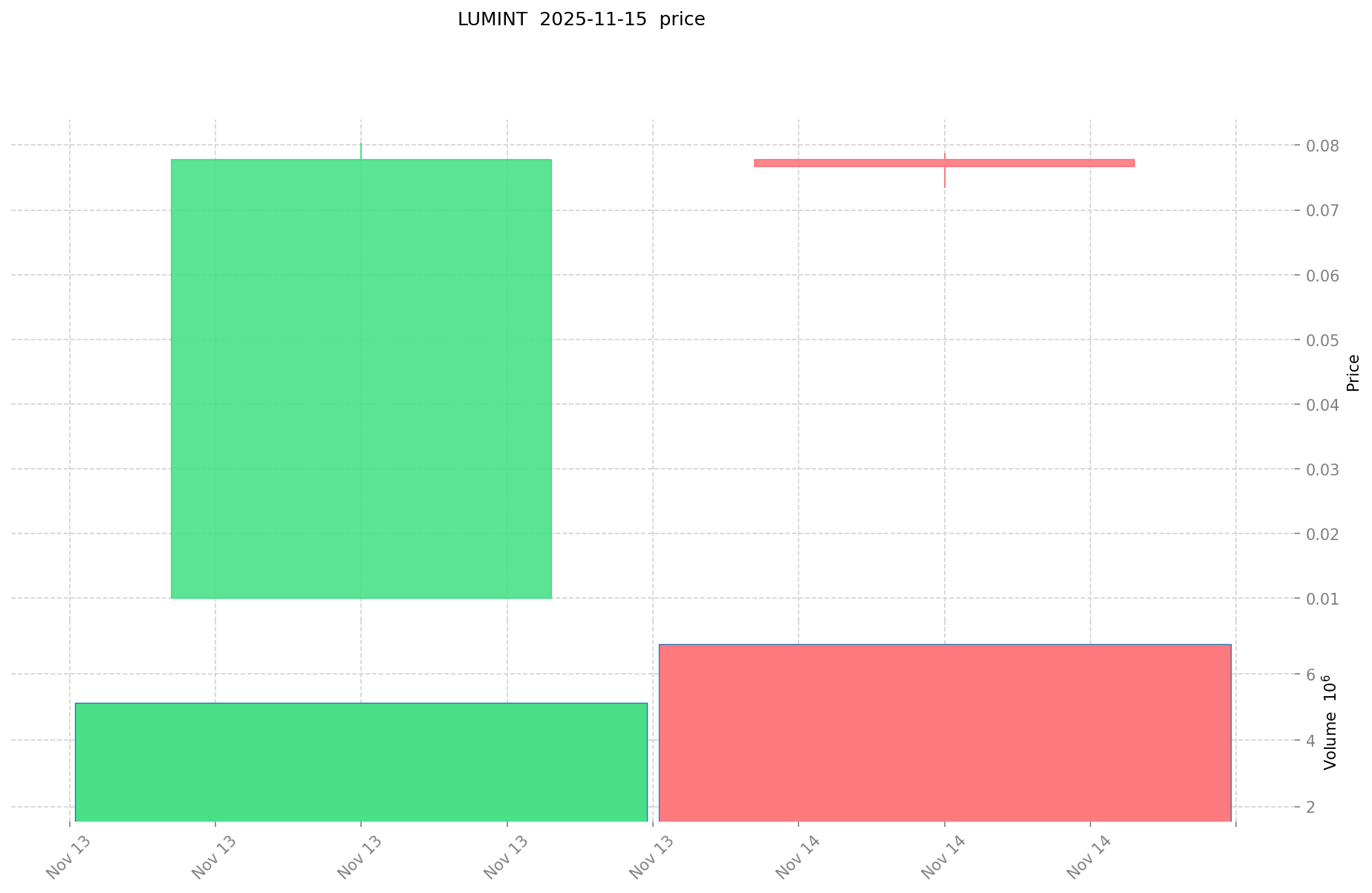

- 2025: LUMINT reached its all-time high of $0.08042 on November 13, 2025.

- 2025: Bitcoin (BTC) hit its all-time high of $126,080 on October 7, 2025.

- Comparative Analysis: In the recent market cycle, LUMINT has shown significant growth, rising from its all-time low of $0.01 to its all-time high of $0.08042. Meanwhile, Bitcoin has demonstrated long-term appreciation, climbing from its all-time low of $67.81 to its recent all-time high.

Current Market Situation (2025-11-16)

- LUMINT current price: $0.07748

- BTC current price: $96,133.6

- 24-hour trading volume: LUMINT $699,620.12 vs BTC $1,099,547,593.05

- Market Sentiment Index (Fear & Greed Index): 10 (Extreme Fear)

Click to view real-time prices:

- Check LUMINT current price Market Price

- Check BTC current price Market Price

II. Core Factors Affecting the Investment Value of LUMINT vs BTC

Supply Mechanism Comparison (Tokenomics)

- BTC: Fixed supply cap of 21 million coins with halving mechanism every four years

- LUMINT: Fixed total supply of 1,000,000,000 tokens with deflationary mechanism through burning

Institutional Adoption and Market Applications

- Institutional Holdings: BTC has significantly broader institutional adoption with major companies like MicroStrategy and Tesla holding it as treasury reserves

- Enterprise Adoption: BTC has established itself in cross-border payments and as an inflation hedge, while LUMINT is focusing on developing real-world applications

- National Policies: Bitcoin has received varied regulatory treatment globally, with El Salvador adopting it as legal tender while other nations impose restrictions

Technical Development and Ecosystem Building

- BTC Technical Development: Layer-2 solutions like Lightning Network enhance scalability and transaction speeds

- LUMINT Technical Development: Recently launched its blockchain infrastructure focused on high-throughput capabilities

- Ecosystem Comparison: BTC has a vast ecosystem spanning payments, DeFi, and digital asset platforms, while LUMINT is in earlier stages of ecosystem development

Macroeconomic and Market Cycles

- Performance in Inflationary Environments: BTC has demonstrated strong performance as an inflation hedge during monetary expansion periods

- Macroeconomic Monetary Policy: Both assets show sensitivity to interest rate changes and USD strength, with BTC having longer historical data to analyze these correlations

- Geopolitical Factors: BTC has proven utility in regions with currency instability and cross-border transaction needs

III. Price Prediction for 2025-2030: LUMINT vs BTC

Short-term Prediction (2025)

- LUMINT: Conservative $0.0409796 - $0.07732 | Optimistic $0.07732 - $0.088918

- BTC: Conservative $65,261.436 - $95,972.7 | Optimistic $95,972.7 - $139,160.415

Mid-term Prediction (2027)

- LUMINT may enter a growth phase, with expected price range $0.08850926715 - $0.13990174485

- BTC may enter a consolidation phase, with expected price range $95,934.31092 - $139,104.750834

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- LUMINT: Base scenario $0.13690651511264 - $0.143751840868272 | Optimistic scenario $0.143751840868272+

- BTC: Base scenario $130,416.862889636064 - $155,258.1701067096 | Optimistic scenario $192,520.130932319904+

Disclaimer

LUMINT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.088918 | 0.07732 | 0.0409796 | 0 |

| 2026 | 0.10722351 | 0.083119 | 0.04322188 | 7 |

| 2027 | 0.13990174485 | 0.095171255 | 0.08850926715 | 22 |

| 2028 | 0.126939419919 | 0.117536499925 | 0.06699580495725 | 51 |

| 2029 | 0.15157507030328 | 0.122237959922 | 0.06234135956022 | 57 |

| 2030 | 0.143751840868272 | 0.13690651511264 | 0.130061189357008 | 76 |

BTC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 139160.415 | 95972.7 | 65261.436 | 0 |

| 2026 | 122269.2198 | 117566.5575 | 88174.918125 | 22 |

| 2027 | 139104.750834 | 119917.88865 | 95934.31092 | 24 |

| 2028 | 158003.81008524 | 129511.319742 | 110084.6217807 | 34 |

| 2029 | 166758.7752997992 | 143757.56491362 | 87692.1145973082 | 49 |

| 2030 | 192520.130932319904 | 155258.1701067096 | 130416.862889636064 | 61 |

IV. Investment Strategy Comparison: LUMINT vs BTC

Long-term vs Short-term Investment Strategy

- LUMINT: Suitable for investors focused on emerging technologies and ecosystem potential

- BTC: Suitable for investors seeking stability and inflation-hedging properties

Risk Management and Asset Allocation

- Conservative investors: LUMINT: 10% vs BTC: 90%

- Aggressive investors: LUMINT: 30% vs BTC: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- LUMINT: Higher volatility due to lower market cap and liquidity

- BTC: Susceptible to macroeconomic factors and institutional sentiment shifts

Technical Risk

- LUMINT: Scalability, network stability

- BTC: Mining concentration, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- LUMINT advantages: Emerging technology integration, potential for rapid growth

- BTC advantages: Established market leader, wider institutional adoption, proven track record

✅ Investment Advice:

- New investors: Consider a small allocation to LUMINT while maintaining a larger position in BTC

- Experienced investors: Diversify portfolio with both assets, adjusting based on risk tolerance

- Institutional investors: Focus on BTC for its established market presence and regulatory clarity

⚠️ Risk Warning: The cryptocurrency market is highly volatile, and this article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between LUMINT and Bitcoin in terms of investment potential? A: LUMINT represents emerging technology with potential for rapid growth, while Bitcoin is an established market leader with wider institutional adoption and a proven track record. LUMINT may offer higher returns but with increased volatility, whereas Bitcoin provides more stability and is considered a better inflation hedge.

Q2: How do the supply mechanisms of LUMINT and Bitcoin compare? A: Bitcoin has a fixed supply cap of 21 million coins with a halving mechanism every four years. LUMINT has a fixed total supply of 1 billion tokens with a deflationary mechanism through token burning.

Q3: Which asset is better suited for long-term vs. short-term investment strategies? A: LUMINT is more suitable for investors focused on emerging technologies and ecosystem potential, potentially offering higher short-term gains. Bitcoin is better suited for investors seeking long-term stability and inflation-hedging properties.

Q4: How do institutional adoption rates differ between LUMINT and Bitcoin? A: Bitcoin has significantly broader institutional adoption, with major companies like MicroStrategy and Tesla holding it as treasury reserves. LUMINT is in earlier stages of institutional adoption, focusing on developing real-world applications.

Q5: What are the recommended asset allocation ratios for LUMINT and Bitcoin? A: For conservative investors, a suggested allocation is 10% LUMINT and 90% Bitcoin. For aggressive investors, the recommendation is 30% LUMINT and 70% Bitcoin. These ratios should be adjusted based on individual risk tolerance and investment goals.

Q6: How do the price predictions for LUMINT and Bitcoin compare for 2030? A: For LUMINT, the base scenario predicts a range of $0.13690651511264 - $0.143751840868272, with an optimistic scenario exceeding $0.143751840868272. For Bitcoin, the base scenario predicts a range of $130,416.862889636064 - $155,258.1701067096, with an optimistic scenario exceeding $192,520.130932319904.

Share

Content