LUCIC vs LRC: A Comparative Analysis of Two Novel Machine Learning Algorithms for Image Classification

Introduction: LUCIC vs LRC Investment Comparison

In the cryptocurrency market, the comparison between LUCIC vs LRC has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

LUCIC (LUCIC): Launched in 2025, it has gained market recognition for its focus on transparency and ethical wealth creation in the Web3 space.

LRC (LRC): Since its introduction in 2017, it has been hailed as a protocol for decentralized token exchanges, becoming one of the pioneering projects in the Layer 2 scaling solutions for Ethereum.

This article will provide a comprehensive analysis of the investment value comparison between LUCIC vs LRC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most crucial to investors:

"Which is the better buy right now?"

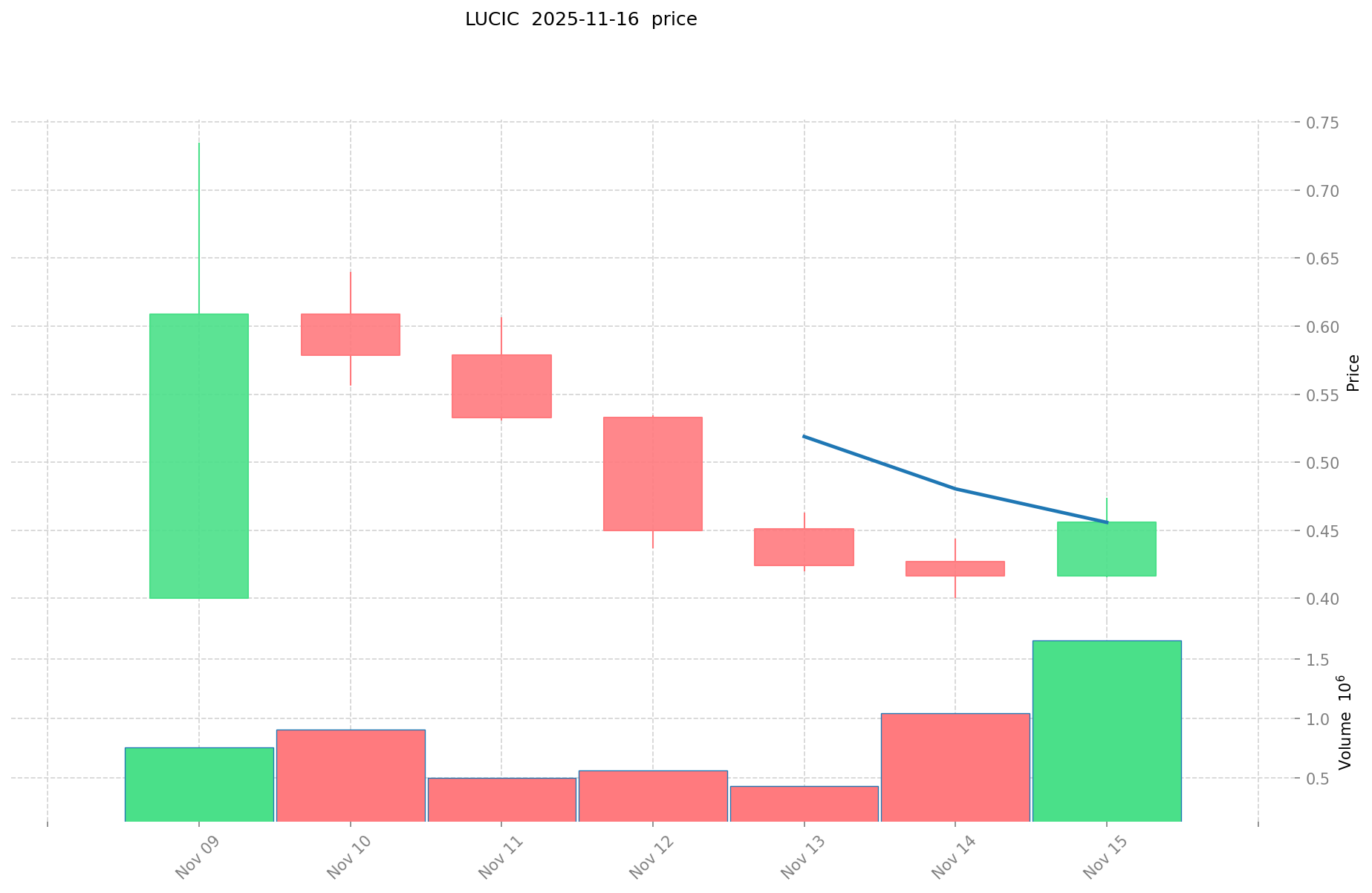

I. Price History Comparison and Current Market Status

LUCIC (Coin A) and LRC (Coin B) Historical Price Trends

- 2025: LUCIC reached its all-time high of $0.735 on November 9, 2025.

- 2021: LRC hit its all-time high of $3.75 on November 10, 2021, likely due to increased interest in layer-2 scaling solutions.

- Comparative analysis: While LUCIC is a relatively new token with limited historical data, LRC has experienced significant volatility, dropping from its all-time high of $3.75 to its current price of $0.05867, a decrease of over 98%.

Current Market Situation (2025-11-17)

- LUCIC current price: $0.458

- LRC current price: $0.05867

- 24-hour trading volume: LUCIC $740,939.63 vs LRC $143,122.67

- Market Sentiment Index (Fear & Greed Index): 10 (Extreme Fear)

Click to view real-time prices:

- View LUCIC current price Market Price

- View LRC current price Market Price

II. Core Factors Affecting LUCIC vs LRC Investment Value

Supply Mechanism Comparison (Tokenomics)

- LUCIC: Fixed maximum supply of 200 million tokens, with 150 million currently in circulation. Implements deflationary tokenomics through built-in burning mechanisms.

- LRC: Maximum supply capped at 1.37 billion tokens, with approximately 1.3 billion already in circulation. Features regular token burns to reduce supply over time.

- 📌 Historical pattern: Deflationary models like LUCIC's tend to drive price appreciation over time as supply decreases while demand increases, particularly during bull markets.

Institutional Adoption and Market Applications

- Institutional holdings: LRC has garnered more institutional interest due to its longer market presence and integration with established Layer 2 solutions.

- Enterprise adoption: LRC has wider adoption in payment systems and trading platforms through Loopring's zkRollup technology, while LUCIC is positioning itself in the cross-chain interoperability space.

- Regulatory attitudes: Both tokens face similar regulatory scrutiny in major markets, though LRC's established position may provide more regulatory clarity.

Technical Development and Ecosystem Building

- LUCIC technical upgrades: Recent introduction of cross-chain infrastructure and interoperability solutions aimed at connecting isolated blockchain networks.

- LRC technical development: Ongoing improvements to zkRollup technology for Ethereum scaling, with focus on reducing gas fees and increasing transaction throughput.

- Ecosystem comparison: LRC has a more established ecosystem within the Ethereum Layer 2 space, particularly in DEX and payment applications, while LUCIC is building out its cross-chain DeFi and NFT capabilities.

Macroeconomic Factors and Market Cycles

- Inflation performance: Both tokens exhibit deflationary characteristics that theoretically provide inflation resistance, though neither has a long enough track record to conclusively demonstrate this property.

- Macroeconomic monetary policy: Both tokens show correlation with broader crypto market reactions to Federal Reserve policy, particularly interest rate decisions.

- Geopolitical factors: Growing cross-border transaction demand benefits both tokens, with LUCIC potentially benefiting more from its cross-chain positioning in fragmented regulatory environments.

III. 2025-2030 Price Prediction: LUCIC vs LRC

Short-term Prediction (2025)

- LUCIC: Conservative $0.36-$0.46 | Optimistic $0.46-$0.57

- LRC: Conservative $0.039-$0.058 | Optimistic $0.058-$0.060

Mid-term Prediction (2027)

- LUCIC may enter a growth phase, with an estimated price range of $0.47-$0.85

- LRC may enter a moderate growth phase, with an estimated price range of $0.046-$0.087

- Key drivers: Institutional capital inflow, ETF developments, ecosystem growth

Long-term Prediction (2030)

- LUCIC: Base scenario $1.01-$1.45 | Optimistic scenario $1.45-$1.80

- LRC: Base scenario $0.080-$0.13 | Optimistic scenario $0.13-$0.16

Disclaimer: These predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

LUCIC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.565316 | 0.4559 | 0.360161 | 0 |

| 2026 | 0.71995728 | 0.510608 | 0.3574256 | 11 |

| 2027 | 0.8490900432 | 0.61528264 | 0.4676148064 | 34 |

| 2028 | 1.017739014824 | 0.7321863416 | 0.461277395208 | 59 |

| 2029 | 1.1374514816756 | 0.874962678212 | 0.62997312831264 | 91 |

| 2030 | 1.448938195119072 | 1.0062070799438 | 0.774779451556726 | 119 |

LRC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0600387 | 0.05829 | 0.0390543 | 0 |

| 2026 | 0.073363794 | 0.05916435 | 0.03549861 | 0 |

| 2027 | 0.08680593432 | 0.066264072 | 0.0463848504 | 12 |

| 2028 | 0.0933727038552 | 0.07653500316 | 0.0681161528124 | 30 |

| 2029 | 0.11468770223526 | 0.0849538535076 | 0.073060314016536 | 44 |

| 2030 | 0.133759842347716 | 0.09982077787143 | 0.079856622297144 | 70 |

IV. Investment Strategy Comparison: LUCIC vs LRC

Long-term vs Short-term Investment Strategies

- LUCIC: Suitable for investors focusing on cross-chain interoperability and ecosystem potential

- LRC: Suitable for investors interested in Layer 2 scaling solutions and established Ethereum ecosystem

Risk Management and Asset Allocation

- Conservative investors: LUCIC 30% vs LRC 70%

- Aggressive investors: LUCIC 60% vs LRC 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- LUCIC: Limited historical data, potential volatility due to newer market entry

- LRC: Significant price decline from all-time high, market saturation in Layer 2 solutions

Technical Risks

- LUCIC: Scalability, network stability in cross-chain operations

- LRC: Dependence on Ethereum ecosystem, potential vulnerabilities in zkRollup technology

Regulatory Risks

- Global regulatory policies may impact both tokens, with LRC potentially facing more scrutiny due to its longer market presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- LUCIC advantages: Focus on cross-chain interoperability, deflationary tokenomics, potential for growth in emerging cross-chain DeFi and NFT markets

- LRC advantages: Established presence in Layer 2 scaling solutions, wider adoption in payment systems and trading platforms, ongoing technical improvements

✅ Investment Advice:

- New investors: Consider a balanced approach, leaning towards LRC for its established market presence while allocating a smaller portion to LUCIC for potential growth

- Experienced investors: Explore opportunities in LUCIC's cross-chain ecosystem while maintaining exposure to LRC's Layer 2 developments

- Institutional investors: Evaluate LUCIC for its potential in cross-chain infrastructure and consider LRC for its established position in Ethereum scaling solutions

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between LUCIC and LRC? A: LUCIC is a newer token focused on cross-chain interoperability and transparency in Web3, while LRC is an established Layer 2 scaling solution for Ethereum. LUCIC has a fixed maximum supply of 200 million tokens, while LRC has a cap of 1.37 billion tokens. LUCIC is building its ecosystem in cross-chain DeFi and NFTs, whereas LRC has a more established presence in DEX and payment applications.

Q2: Which token has performed better in terms of price? A: LRC reached its all-time high of $3.75 in November 2021 but has since declined by over 98% to its current price of $0.05867. LUCIC, being newer, reached its all-time high of $0.735 in November 2025 and is currently trading at $0.458. While LRC has a longer price history, LUCIC has shown more recent stability.

Q3: What are the key factors affecting the investment value of these tokens? A: Key factors include supply mechanisms (both implement deflationary models), institutional adoption, technical development and ecosystem building, macroeconomic factors, and market cycles. LRC has more institutional interest due to its longer market presence, while LUCIC is positioning itself in the growing cross-chain interoperability space.

Q4: What are the price predictions for LUCIC and LRC by 2030? A: For LUCIC, the base scenario predicts a range of $1.01-$1.45, with an optimistic scenario of $1.45-$1.80 by 2030. For LRC, the base scenario predicts $0.080-$0.13, with an optimistic scenario of $0.13-$0.16 by 2030. However, these predictions are subject to market volatility and should not be considered financial advice.

Q5: How should investors allocate their assets between LUCIC and LRC? A: Conservative investors might consider allocating 30% to LUCIC and 70% to LRC, while aggressive investors might allocate 60% to LUCIC and 40% to LRC. New investors may lean towards LRC for its established presence, while experienced investors might explore LUCIC's potential in cross-chain ecosystems.

Q6: What are the main risks associated with investing in LUCIC and LRC? A: For LUCIC, risks include limited historical data and potential volatility due to its newer market entry. For LRC, risks include significant price decline from its all-time high and market saturation in Layer 2 solutions. Both face technical risks related to their respective technologies and regulatory risks from global policies.

Share

Content