Is Ethena USDe (USDE) a good investment?: Analyzing the Potential and Risks of This Emerging Stablecoin

Introduction: Investment Status and Market Outlook of Ethena USDe (USDE)

USDE is a significant asset in the cryptocurrency realm, having achieved notable success in the stablecoin sector since its launch. As of 2025, USDE has a market capitalization of $8,143,820,132, with a circulating supply of approximately 8,151,156,173 tokens, and a current price hovering around $0.9991. With its positioning as the "first censorship-resistant, scalable, and stable crypto-native solution for money," USDE has gradually become a focal point for investors discussing "Is Ethena USDe (USDE) a good investment?" This article will comprehensively analyze USDE's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. Ethena USDe (USDE) Price History Review and Current Investment Value

USDE Historical Price Trends and Investment Returns (Ethena USDe(USDE) investment performance)

- 2024: Launch of USDe → Initial price stability around $1

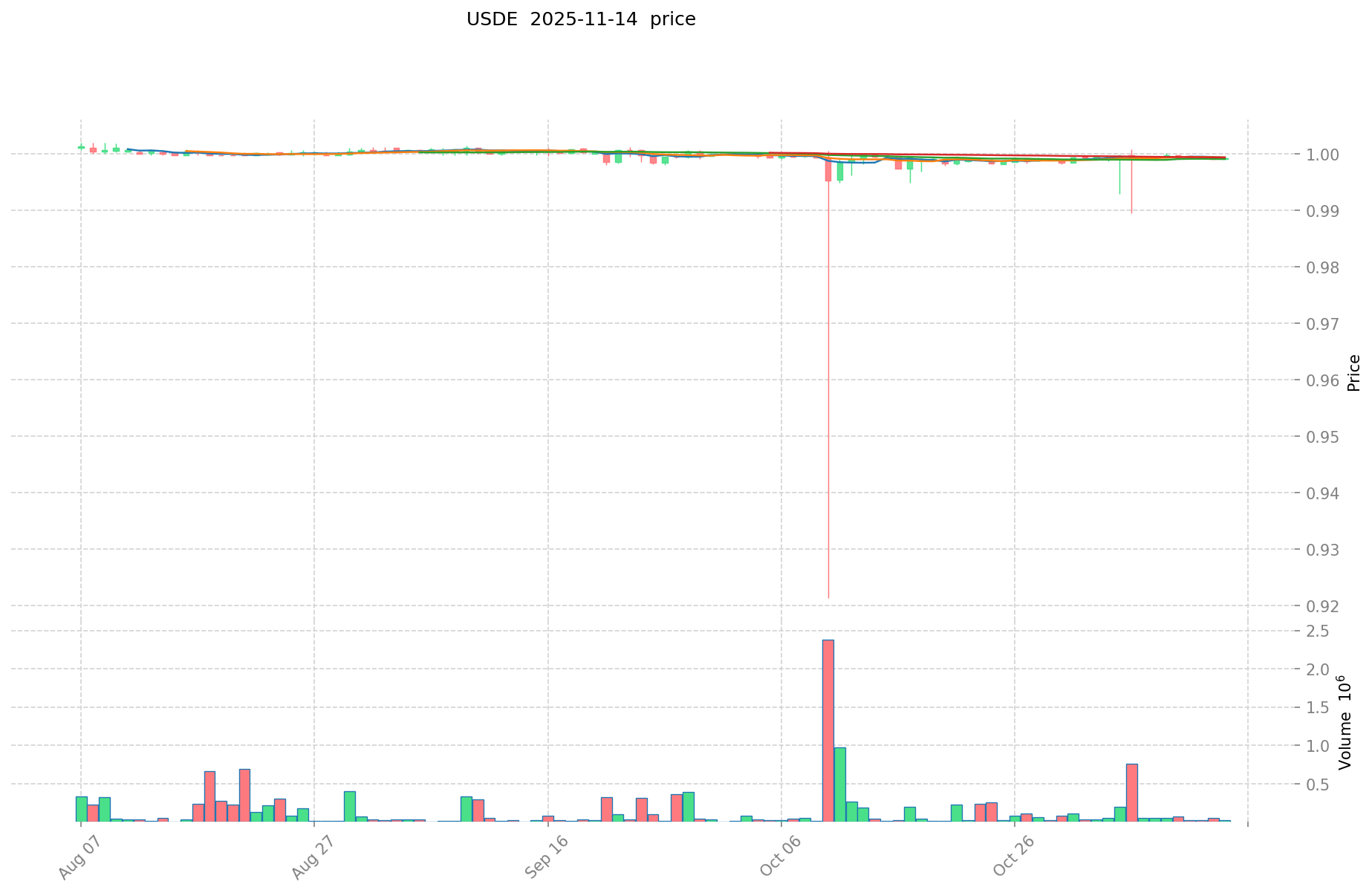

- 2025: Market fluctuations → Price reached all-time high of $1.5 on November 14, 2024, and all-time low of $0.9213 on October 10, 2025

Current USDE Investment Market Status (November 2025)

- USDE current price: $0.9991

- Market sentiment: Neutral (based on price stability)

- 24-hour trading volume: $33,737.685405

- Circulating supply: 8,151,156,173.098487 USDE

Click to view real-time USDE market price

II. Key Factors Influencing Whether Ethena USDe(USDE) is a Good Investment

USDE investment scarcity

- Infinite maximum supply → Impact on price and investment value

- Historical pattern: Supply changes have driven USDE price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional investment in USDE

- Institutional holding trend: Data not available

- Adoption by well-known companies → Enhances investment value

- Impact of national policies on USDE investment prospects

Macroeconomic environment's impact on USDE investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital gold" positioning

- Geopolitical uncertainties → Enhance demand for USDE investment

Technology & Ecosystem for USDE investment

- USDe is fully backed and transparently maintained on-chain: Improves network performance → Enhances investment attractiveness

- Free composability: Expands ecosystem applications → Supports long-term value

- DeFi, NFT, and payment applications driving investment value

III. USDE Future Investment Forecast and Price Outlook (Is Ethena USDe(USDE) worth investing in 2025-2030)

Short-term USDE investment outlook (2025)

- Conservative forecast: $0.66933 - $0.999

- Neutral forecast: $0.999 - $1.14885

- Optimistic forecast: $1.14885 - $1.2987

Mid-term Ethena USDe(USDE) investment forecast (2027-2028)

- Market stage expectation: Steady growth phase

- Investment return forecast:

- 2027: $1.0021992975 - $1.839653505

- 2028: $1.493826103575 - $2.0560187232

- Key catalysts: Increased adoption and market stability

Long-term investment outlook (Is USDE a good long-term investment?)

- Base scenario: $1.743796217435805 - $2.11606732003446 (Assuming continued market adoption)

- Optimistic scenario: $2.11606732003446 - $2.5 (Assuming significant ecosystem growth)

- Risk scenario: $0.66933 - $1.0 (Extreme market conditions or regulatory challenges)

Click to view USDE long-term investment and price prediction: Price Prediction

2025-11-14 - 2030 Long-term Outlook

- Base scenario: $1.743796217435805 - $2.11606732003446 (Corresponding to steady progress and gradual mainstream application)

- Optimistic scenario: $2.11606732003446 - $2.5 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $2.5 (In case of breakthrough developments in the ecosystem and mainstream adoption)

- 2030-12-31 Predicted high: $2.11606732003446 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.2987 | 0.999 | 0.66933 | 0 |

| 2026 | 1.5969015 | 1.14885 | 0.7237755 | 14 |

| 2027 | 1.839653505 | 1.37287575 | 1.0021992975 | 37 |

| 2028 | 2.0560187232 | 1.6062646275 | 1.493826103575 | 60 |

| 2029 | 2.087501509899 | 1.83114167535 | 1.611404674308 | 83 |

| 2030 | 2.11606732003446 | 1.9593215926245 | 1.743796217435805 | 96 |

IV. How to invest in USDe

USDe investment strategy

- HODL USDe: Suitable for conservative investors looking for stable value preservation

- Active trading: Relies on technical analysis and short-term arbitrage opportunities

Risk management for USDe investment

- Asset allocation ratio: Conservative: 5-10% of portfolio Aggressive: 15-20% of portfolio Professional: Up to 30% of portfolio

- Risk hedging plan: Diversify across multiple stablecoins and fiat currencies

- Secure storage: Hardware wallets like Ledger or Trezor recommended for large holdings

V. Risks of investing in stablecoins

- Market risk: De-pegging events, liquidity crunches

- Regulatory risk: Uncertain policies across different jurisdictions

- Technical risk: Smart contract vulnerabilities, hacks

VI. Conclusion: Is USDe a Good Investment?

- Investment value summary: USDe offers a potentially stable store of value, but carries unique risks as a synthetic stablecoin.

- Investor recommendations: ✅ Beginners: Dollar-cost average into small positions, use reputable exchanges ✅ Experienced investors: Monitor peg stability, diversify stablecoin holdings ✅ Institutional investors: Assess counterparty and smart contract risks thoroughly

⚠️ Disclaimer: Cryptocurrency investments carry high risk. This report is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is USDe and how does it differ from other stablecoins? A: USDe is a synthetic stablecoin created by Ethena Labs, designed to be censorship-resistant, scalable, and stable. It differs from traditional stablecoins by being fully backed and transparently maintained on-chain, offering free composability within the DeFi ecosystem.

Q2: Is USDe a good investment in 2025? A: As of 2025, USDe is considered a potentially stable investment with a current price of $0.9991. However, like all cryptocurrencies, it carries risks. The short-term outlook for 2025 ranges from $0.66933 to $1.2987, depending on market conditions.

Q3: What are the main risks of investing in USDe? A: The main risks include market risk (potential de-pegging events), regulatory risk (uncertain policies across jurisdictions), and technical risk (smart contract vulnerabilities or hacks).

Q4: How can I invest in USDe? A: You can invest in USDe through two main strategies: HODL (buy and hold) for stable value preservation, or active trading based on technical analysis. It's recommended to use reputable exchanges and secure storage methods like hardware wallets for large holdings.

Q5: What is the long-term price prediction for USDe? A: The long-term outlook for USDe by 2030 ranges from $1.743796217435805 to $2.11606732003446 in the base scenario, with a potential high of $2.5 in optimistic conditions. However, these predictions are speculative and subject to market dynamics.

Q6: How much of my portfolio should I allocate to USDe? A: The recommended allocation depends on your risk tolerance. Conservative investors might allocate 5-10% of their portfolio, while more aggressive investors might go up to 15-20%. Professional investors might allocate up to 30%, but always diversify and manage risks accordingly.

Share

Content