GHO vs TRX: Comparing the Potential of Aave's Stablecoin and TRON's Native Token

Introduction: Investment Comparison between GHO and TRX

In the cryptocurrency market, the comparison between GHO vs TRX has always been a topic that investors cannot ignore. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

GHO (GHO): Launched in 2022, it has gained market recognition as a decentralized, over-collateralized stablecoin native to the Aave Protocol.

TRON (TRX): Since its inception in 2017, it has been hailed as a blockchain-based operating system, becoming one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between GHO vs TRX, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question that concerns investors the most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

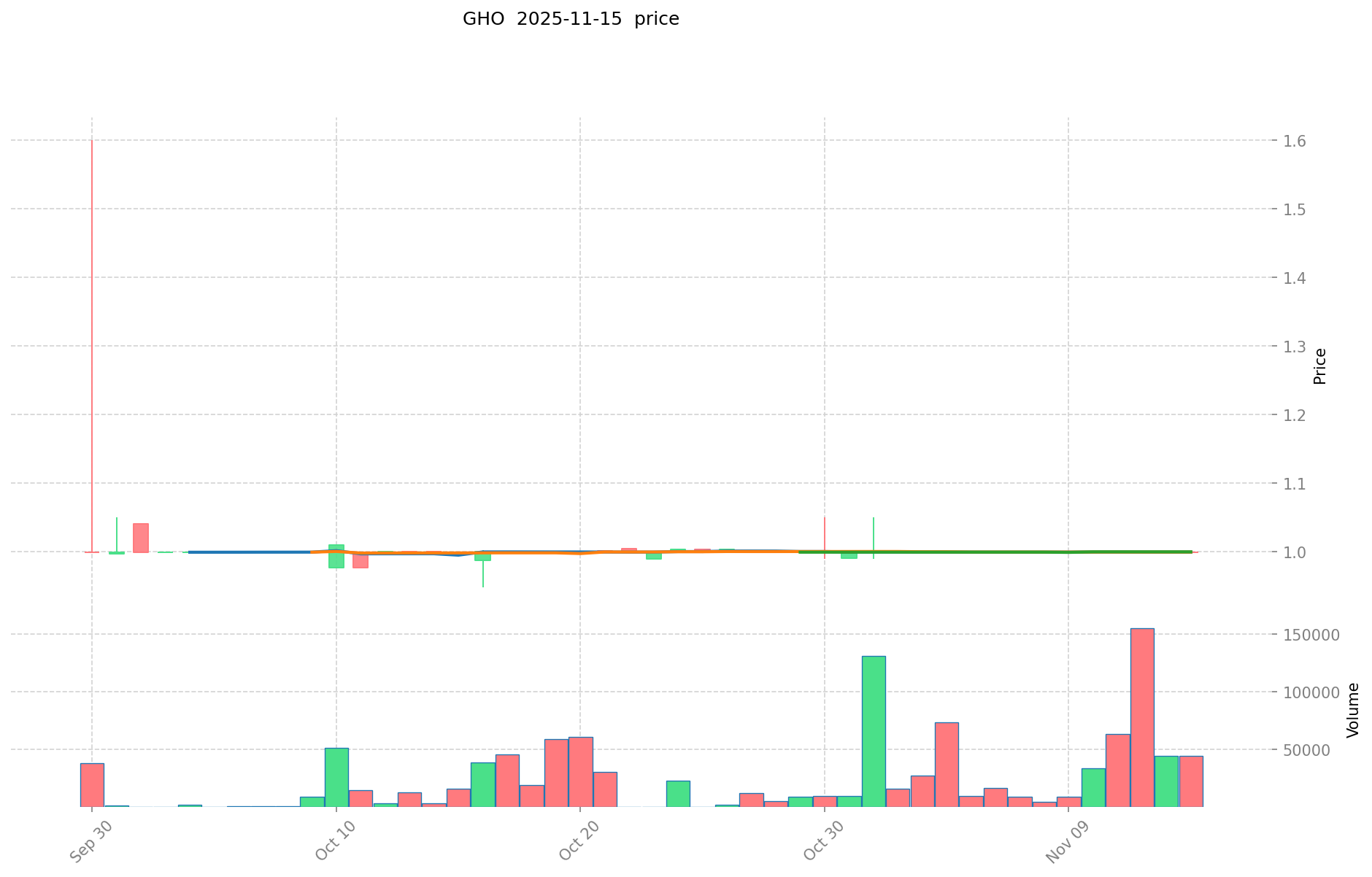

GHO and TRX Historical Price Trends

- 2025: GHO reached its all-time high of $1.6 on September 30, 2025, and its all-time low of $0.9478 on October 16, 2025.

- 2024: TRX reached its all-time high of $0.431288 on December 4, 2024.

- Comparative Analysis: In recent market cycles, GHO has shown relatively stable price movements, maintaining close to its $1 peg, while TRX has experienced more significant volatility, with a historical low of $0.00180434 in 2017.

Current Market Situation (2025-11-15)

- GHO current price: $0.9996

- TRX current price: $0.29239

- 24-hour trading volume: GHO $54,395.14494 vs TRX $11,138,903.6582298

- Market Sentiment Index (Fear & Greed Index): 10 (Extreme Fear)

Click to view real-time prices:

- View GHO current price Market Price

- View TRX current price Market Price

II. Core Factors Affecting Investment Value of GHO vs TRX

Supply Mechanism Comparison (Tokenomics)

- GHO: Decentralized stablecoin with dynamic supply based on user borrowing demand, pegged to USD ($1), with supply controlled through Aave's governance

- TRX: Fixed maximum supply of 100 billion tokens with deflationary mechanisms including token burns and staking rewards

- 📌 Historical pattern: GHO maintains price stability as a stablecoin while TRX experiences greater price volatility influenced by market conditions and periodic burn events.

Institutional Adoption and Market Applications

- Institutional holdings: TRX has more established institutional presence with the TRON DAO Reserve managing significant assets, while GHO is newer but backed by Aave's institutional credibility

- Enterprise adoption: GHO serves as a capital-efficient stablecoin within DeFi lending protocols, while TRX powers a broader ecosystem including USDD stablecoin and applications in content distribution

- Regulatory attitudes: Both face varying regulatory scrutiny, with TRX experiencing more regulatory challenges in certain jurisdictions due to its association with Justin Sun

Technical Development and Ecosystem Building

- GHO technical upgrades: Integration with Aave V3, multichain expansion strategy, and facilitation of cross-chain liquidity

- TRX technical development: TRON DAO's focus on enhancing transaction throughput, expanding cross-chain interoperability, and improving smart contract functionality

- Ecosystem comparison: TRX has a more mature ecosystem with established DeFi protocols, NFT marketplaces, and payment solutions, while GHO is building its presence within Aave's ecosystem and expanding partnerships

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: GHO designed specifically as an inflation hedge through its USD peg, while TRX offers inflation resistance through its deflationary mechanisms

- Macroeconomic monetary policy: Interest rates and USD index fluctuations affect GHO's stablecoin premium/discount, while TRX price tends to move with broader crypto market in response to monetary conditions

- Geopolitical factors: GHO potentially benefits from global DeFi adoption and stablecoin demand, while TRX has established stronger presence in Asian markets with cross-border settlement use cases

III. 2025-2030 Price Prediction: GHO vs TRX

Short-term Prediction (2025)

- GHO: Conservative $0.72 - $1.00 | Optimistic $1.00 - $1.24

- TRX: Conservative $0.28 - $0.29 | Optimistic $0.29 - $0.37

Mid-term Prediction (2027)

- GHO may enter a growth phase, with expected prices $0.61 - $1.26

- TRX may enter a growth phase, with expected prices $0.22 - $0.51

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- GHO: Base scenario $0.94 - $1.54 | Optimistic scenario $1.54 - $2.22

- TRX: Base scenario $0.50 - $0.65 | Optimistic scenario $0.65 - $0.84

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

GHO:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.239504 | 0.9996 | 0.719712 | 0 |

| 2026 | 1.1755296 | 1.119552 | 0.94042368 | 11 |

| 2027 | 1.26229488 | 1.1475408 | 0.608196624 | 14 |

| 2028 | 1.6748357976 | 1.20491784 | 0.9277867368 | 20 |

| 2029 | 1.641459573432 | 1.4398768188 | 1.166300223228 | 44 |

| 2030 | 2.21856220240704 | 1.540668196116 | 0.93980759963076 | 54 |

TRX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.3671388 | 0.29138 | 0.2826386 | 0 |

| 2026 | 0.388526092 | 0.3292594 | 0.23048158 | 12 |

| 2027 | 0.51321662678 | 0.358892746 | 0.21892457506 | 22 |

| 2028 | 0.6061160140821 | 0.43605468639 | 0.3270410147925 | 49 |

| 2029 | 0.771206318349354 | 0.52108535023605 | 0.463765961710084 | 78 |

| 2030 | 0.839989584580512 | 0.646145834292702 | 0.49753229240538 | 120 |

IV. Investment Strategy Comparison: GHO vs TRX

Long-term vs Short-term Investment Strategies

- GHO: Suitable for investors seeking stable value and DeFi ecosystem exposure

- TRX: Suitable for investors looking for potential growth and blockchain ecosystem development

Risk Management and Asset Allocation

- Conservative investors: GHO: 70% vs TRX: 30%

- Aggressive investors: GHO: 40% vs TRX: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- GHO: Risk of depegging from USD, liquidity constraints in extreme market conditions

- TRX: High volatility, susceptibility to market sentiment shifts

Technical Risk

- GHO: Smart contract vulnerabilities, scalability challenges within Aave ecosystem

- TRX: Network congestion, potential centralization concerns

Regulatory Risk

- Global regulatory policies may have different impacts on both assets, with stablecoins like GHO potentially facing increased scrutiny

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- GHO advantages: Stability as a stablecoin, integration with Aave's established DeFi ecosystem

- TRX advantages: Broader ecosystem, higher potential for price appreciation, established market presence

✅ Investment Advice:

- New investors: Consider a higher allocation to GHO for stability, with a small TRX position for growth potential

- Experienced investors: Balanced approach with both assets, adjusting based on risk tolerance and market conditions

- Institutional investors: Strategic allocation to both, leveraging GHO for stable DeFi yields and TRX for ecosystem exposure

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between GHO and TRX? A: GHO is a decentralized stablecoin pegged to USD, while TRX is a cryptocurrency powering the TRON blockchain ecosystem. GHO aims for price stability, whereas TRX has more price volatility and potential for growth.

Q2: Which asset is considered more stable? A: GHO is generally considered more stable as it's designed to maintain a $1 peg. TRX, being a traditional cryptocurrency, experiences more significant price fluctuations.

Q3: How do their supply mechanisms differ? A: GHO has a dynamic supply based on user borrowing demand within the Aave protocol. TRX has a fixed maximum supply of 100 billion tokens with deflationary mechanisms like token burns.

Q4: Which asset might be better for long-term investment? A: This depends on individual investment goals. GHO may be better for those seeking stability and DeFi exposure, while TRX might suit investors looking for potential growth and broader blockchain ecosystem development.

Q5: What are the main risks associated with each asset? A: GHO risks include potential depegging from USD and liquidity constraints. TRX faces risks such as high volatility, regulatory challenges, and potential centralization concerns.

Q6: How do institutional adoptions compare between GHO and TRX? A: TRX has a more established institutional presence with the TRON DAO Reserve, while GHO is newer but backed by Aave's institutional credibility in the DeFi space.

Q7: What factors should be considered when allocating investments between GHO and TRX? A: Factors to consider include risk tolerance, investment timeline, market conditions, regulatory developments, and the overall crypto market sentiment. Conservative investors might lean towards a higher GHO allocation, while more aggressive investors might prefer a larger TRX position.

Share

Content