Gate Ventures Weekly Crypto Recap (September 08, 2025)

TL;DR

- Nonfarm payrolls rose by only 22,000 in August with 4.3% unemployment rate, reinforced concerns on the slipping job market and boosted bets on a Fed rate cut.

- This week’s economic data includes the US CPI, PPI, UoM sentiment and monthly budget statement.

- U.S. BTC (-$160M) and ETH (-$447M) ETFs saw heavy Friday outflows; ETH marked a record -$788M weekly outflow, though validator inflows briefly outpaced exits.

- Top 30 recovery led by ENA (+20.9%) on StablecoinX’s $530M PIPE raise (~15% supply absorption), and HYPE (+10.3%) on USDH stablecoin proposals (Paxos, Frax, Agora) & Hyperliquid Strategies’ SEC S4 filing.

- New launches: WLFI listed Sep 1 (>$0.30 → $0.16 low) with controversy around Justin Sun wallets being blacklisted.

- OpenLedger an AI-focused blockchain, debuted via Binance HODLer airdrop, backed by Polychain, Borderless, and HashKey.

- Ondo Finance launches 100+ tokenized U.S. Stocks and ETF to expand RWA access.

- Fireblocks Network releases enterprise stablecoin payments network for trillions market sector.

- StablecoinX Secures $530M PIPE financing to expand ENA treasury.

Macro Overview

Nonfarm payrolls rose by only 22,000 in August with 4.3% unemployment rate, reinforced concerns on the slipping job market and boosted bets on a Fed rate cut.

Nonfarm payrolls rose by only 22,000 in August, the unemployment rate climbed to 4.3%, and the revised June data even showed the first negative print since 2020. These figures have reinforced concerns that the labor market is slipping, and quickly boosted bets on a Fed policy pivot. Investors have fully priced in a 25 bp cut in September and are further betting on a total of three cuts this year. Some observers even think the Fed might deliver a rare 50 bp cut this month to counter labor‑market weakness. Previously in his Jackson Hole remarks, Powell suggested the balance of risks has shifted from inflation toward unemployment, and New York Fed President John Williams also said that over time it will become appropriate to cut rates.

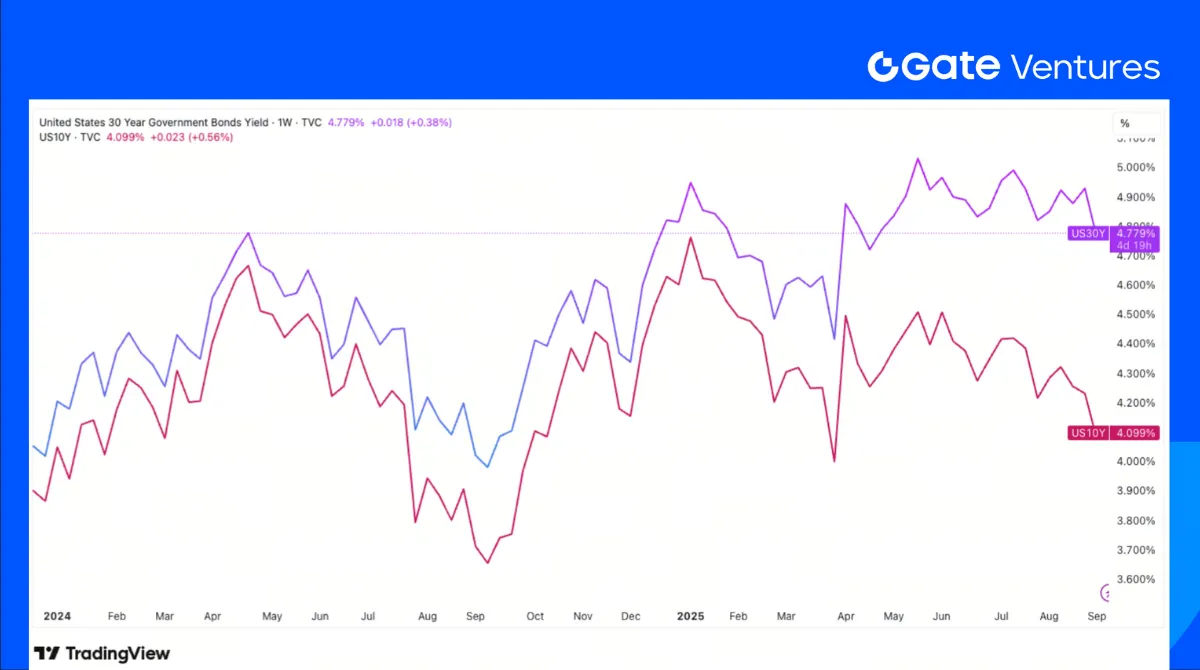

However, the rate structure across the curve is notably out of sync. While front‑end yields have fallen sharply, the 30‑year Treasury yield remains elevated. The 10-year bond yield is approaching the 4% level, while the 30-year bond yield still remains high, and this is showing doubts about long‑term inflation. This configuration sends a split message that the market believes the Fed will cut rates, but doesn’t believe inflation will fall accordingly. Some Fed officials have also warned that tariff policy could reignite price pressures, inflation remains above the 2% target, and could even rise further.

Following the release of the August labour market report last Friday, the final key piece of US economic data release ahead of the September Federal Open Market Committee (FOMC) meeting will be the US CPI and PPI data for August. CPI and PPI data will be released on Thursday and Wednesday. Meanwhile, the preliminary September University of Michigan sentiment survey will be published this Friday. (1, 2)

US 30 Year Bond & 10 Year Bond Yield

DXY

As the labor market report showed the nonfarm payrolls increased by only 22k last month, far shorter than the 75k estimation by economists, the US dollar fell sharply against other major currencies, reaffirmed the weak labor market, and likely guarantees a Fed rate cut. (3)

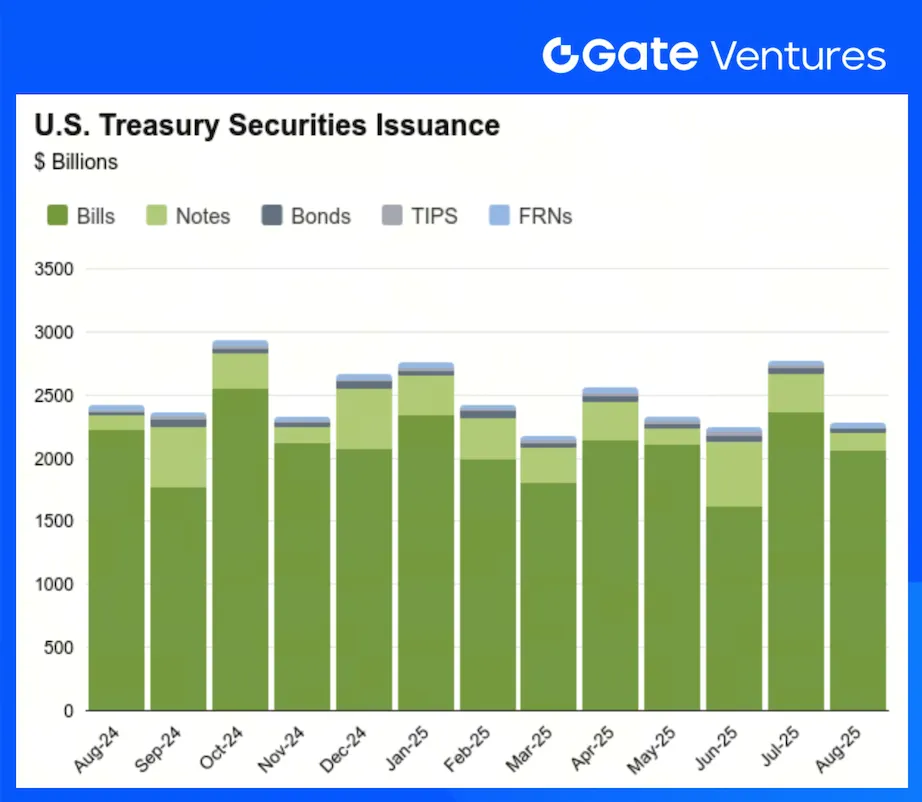

US Treasury Securities Issuance

The newly uploaded Aug US security issuance data showed that after the large-scale debt issuance in July, the US Treasury has slowed its pace in August and kept the notes, bonds and other financial instruments size steady. (4)

Gold

Gold prices surged to new highs last week as weak US labor market data fuels rate cut bets. The market has been assuming a major upside surprise before the data was released, and the gold price rally has started throughout the week. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

On Friday (5/9), both U.S. Bitcoin and Ethereum ETFs recorded notable outflows, with BTC seeing -$160.18M and ETH facing a sharper withdrawal of -$446.71M. For the week, U.S. ETH ETFs registered the largest single-week outflow, totaling -$787.74M.

In parallel, Ethereum’s validator dynamics have shown a shift. For the first time in roughly 20 days, the number of new validators entering the network outpaced exits (5/9: 959k vs. 821k). However, given that official withdrawals typically take around two weeks to finalize, ETH remains exposed to selling pressure from exiting validator whales in the near term.

Despite these flows, relative performance metrics such as the ETH/BTC and SOL/ETH ratios have remained stable, suggesting the market is consolidating rather than showing a decisive tilt in allocation preferences.

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total cryptocurrency market capitalization continues to hover around $3.79T, with the market cap excluding BTC and ETH steady at approximately $1.06T. Altcoin market performance has shown little deviation over the period.

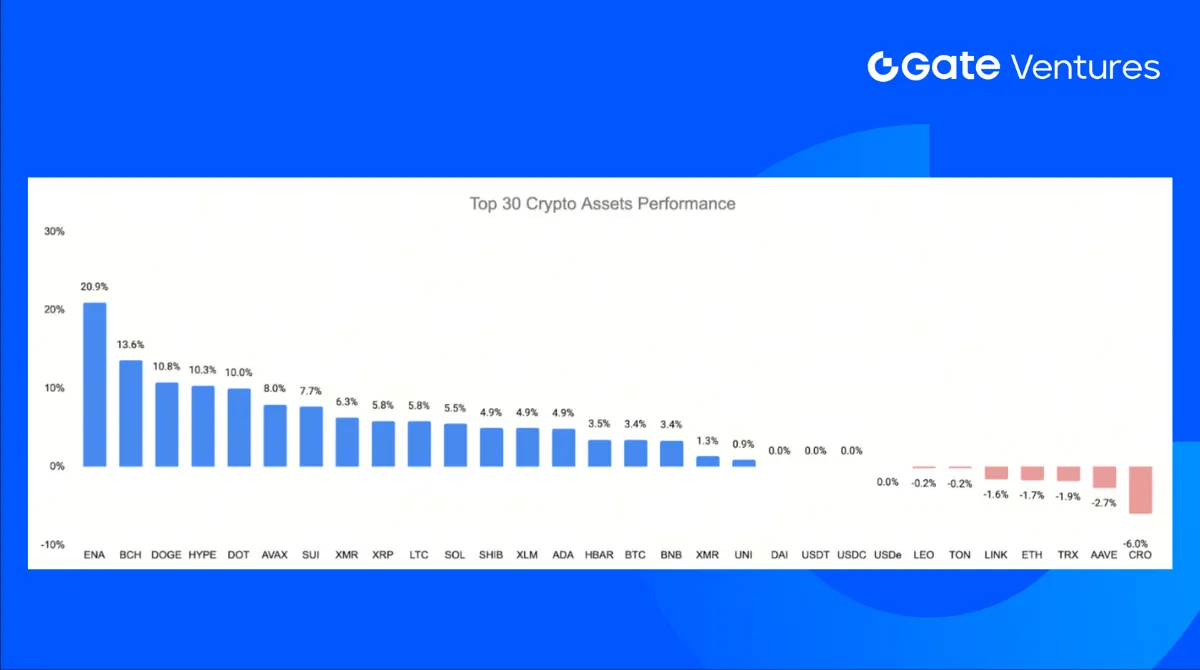

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Sept 1st 2025

The top 30 cryptocurrencies are showing signs of recovery from last week’s dip, led by ENA with a 20.9% gain.

The rally was driven by news that StablecoinX secured an additional $530M in PIPE financing, bringing a total of ~$895M for $ENA accumulation. Proceeds will fund token acquisitions from an Ethena Foundation subsidiary, which will conduct a ~$310M buyback over 6–8 weeks. Together with prior PIPE activity, these programs account for roughly 15% of circulating ENA, tightening supply and reinforcing alignment between StablecoinX and the Foundation.

Besides, HYPE surged 10.3% last week, driven largely by news that Hyperliquid is preparing to launch its native stablecoin, USDH, with issuance rights currently subject to a validator vote.

Competing proposals highlight different strategic directions: Paxos has put forward a fully compliant, Treasury-backed model that would channel 95% of reserve yields into HYPE buybacks; Frax is offering a frxUSD-backed design with zero fees, 100% yield to users, and multichain redemption; while Agora proposes an institutional framework with State Street as custodian, VanEck as asset manager, $10m in day-one liquidity, and 100% of net revenues reinvested into HYPE and ecosystem funds.

Another key driver is the news that Hyperliquid Strategies just filed the SEC’s S-4 registration statement, indicating it’s officially moving ahead with its merger to become a publicly traded crypto treasury company, backed by significant HYPE holdings and cash. The paperwork provides legal and financial clarity ahead of the Nasdaq listing.

4. New Token Launched

WLFI began trading on September 1, opening above $0.30 before sliding ~12% to around $0.246 by the end of day one. The decline continued over the following days, reaching a low of ~$0.16 on September 4. On-chain data later flagged transactions tied to Justin Sun, showing roughly $9–10M worth of WLFI being moved to centralized exchanges such as HTX, which fueled allegations of selling. In response, the WLFI team blacklisted and froze wallets linked to Sun.

OpenLedger (token: $OPEN), an AI-focused EVM blockchain designed to monetize data, models, and AI agents was featured as Binance latest HODLer Airdrop project, distributing 10m tokens (1% of supply) to BNB stakers with an additional 15m set to unlock in six months. The project is backed by leading investors such as Polychain Capital, Borderless Capital, and HashKey Capital.

The Key Crypto Highlights

1. Ondo Finance launches 100+ tokenized U.S. Stocks and ETF to expand RWA access

Ondo Finance and the Ondo Foundation have launched Ondo Global Markets, offering onchain access to more than 100 tokenized U.S. stocks and ETFs on Ethereum, with support for BNB Chain and Solana to follow. The platform, open to eligible investors in Asia-Pacific, Europe, Africa, and Latin America, plans to scale to over 1,000 assets by year-end. The launch addresses the liquidity and transferability gaps of earlier tokenized stock offerings.

Ondo’s solution allows users to mint and redeem tokenized securities 24/5, while enabling peer-to-peer transfers 24/7. Assets are fully backed by stocks and ETFs held at U.S.-registered broker-dealers, providing exposure to the total economic return of underlying securities such as Apple and Tesla. Ondo is also working with Block Street, a new unified liquidity layer backed by Point72 and Jane Street, to bring borrowing, shorting, and hedging to tokenized equities. Competing projects such as Kraken’s xStocks and Robinhood’s EU onchain equities highlight the growing race to tokenize securities, with McKinsey estimating the broader tokenized asset market could reach $2 trillion by 2030 (excluding stablecoins). The expansion of tokenized securities underscores Ondo’s ambition to bridge traditional financial markets and DeFi at scale.(6)

2. Fireblocks Network releases enterprise stablecoin payments network for trillions market sector

Fireblocks has launched an enterprise-grade stablecoin payments network to help crypto and financial firms move USD-pegged tokens and build products around them. Already live with 40+ participants, including Circle, Bridge, Zerohash, and Yellow Card, the network provides unified APIs and workflows for secure, compliant stablecoin transfers across providers, blockchains, and fiat rails. CEO Michael Shaulov positioned Fireblocks as the “backbone of stablecoin payments”, enabling institutions to scale products in line with an industry projected to reach the trillions of dollars. The move reflects growing interest from both crypto-native firms and traditional players like Bank of America, which are exploring USD-pegged token issuance.

Fireblocks, last valued at $8B following a $550M raise in 2022, counts Sequoia Capital, Coatue, Ribbit, BNY Mellon, Paradigm, and SCB10x among its investors. By positioning itself as the middleware layer of stablecoin adoption, Fireblocks is targeting the infrastructure revenue opportunity behind the next phase of stablecoin-driven global payments.(7)

3. StablecoinX Secures $530M PIPE financing to expand ENA treasury

StablecoinX, a treasury firm tied to Ethena, has raised $530M in PIPE financing.. Backers include YZi Labs, Brevan Howard, Susquehanna Crypto, IMC Trading, and other repeat investors. StablecoinX also announced a Strategic Advisory Board, chaired by Dragonfly GP Rob Hadick, to guide alignment, governance, and long-term value creation

With USDe position: the stablecoin is now the third-largest by supply, trailing Tether and Circle, the funds will be used to purchase locked ENA tokens from an Ethena Foundation subsidiary, which in turn will buy $310M worth of ENA on the spot market over the next 6–8 weeks. Using prior financing, the subsidiary has already acquired 7.3% of ENA’s circulating supply, with plans to reach 13% after this round. Any resale of locked ENA after the SPAC deal will require Ethena Foundation veto approval, a structure aimed at limiting market overhang. The raise, part of StablecoinX’s plan to list on Nasdaq under ticker USDE in Q4 2025, brings its total PIPE commitments to $895M(8)

Key Ventures Deals

1. Plural Secures $7.13M to scale tokenized infrastructure marketplace for Energy assets

Plural, a tokenized asset management platform for the electron economy, has raised $7.13M in an oversubscribed Seed round led by Paradigm, with participation from Maven11, Volt Capital, and Neoclassic Capital. The raise nearly doubled its initial target, bringing total funding close to $10M. Plural provides investors access to high-yield distributed energy assets: solar, storage, and data centers, that have historically been too small or administratively burdensome for traditional infrastructure financing. With global data center electricity demand expected to more than double by 2030 and overall consumption projected to rise 50%.

This makes distributed energy projects scalable, programmable, and portfolio-ready while reducing capital costs for developers by an estimated 2%. The company already lists over $300M in solar and battery assets and recently acquired a registered broker-dealer, now Plural Brokerage LLC, to embed securities compliance into its platform. Plural aims to bridge the multi-trillion-dollar financing gap in future energy systems: electron economy will be one of the most compelling capital market opportunities of the next decade, driven by AI adoption and electrification. The capital will accelerate growth in compliance, deal flow, and product development.(9)

2. Robot Ventures leads $3.5M round valuing Wildcat Labs at $35M for DeFi Credit Growth

Wildcat Labs has raised $3.5M Seed extension round, which structured as a SAFE, gives investors a 10% stake, bringing Wildcat’s total fundraising to $5.3M. The round is led by Robot Ventures, valuing the firm at $35M post-money. Other investors included Triton Capital, Polygon Ventures, Safe Foundation, Hyperithm, Hermeneutic Investments, Kronos Research, and angels such as Fei founder Joey Santoro and Vyper contributor Charles Cooper.

Founded in 2023, Wildcat targets one of DeFi’s toughest challenges: undercollateralized lending. The protocol allows borrowers to customize loan parameters, from reserve ratios to lender whitelists, while letting credit lines remain undercollateralized. It generates revenue through a 5% protocol fee on borrower APR. Wildcat currently manages $150M in outstanding credit and has originated $368M since launch, serving clients such as Wintermute, Hyperithm, Selini Capital, Amber Group, and Keyrock. Use cases include bridge financing after hacks and pre-market token speculation, with growth accelerating after the V2 release on Ethereum mainnet in February

Positioned as a response to opaque credit practices that fueled collapses like Terra and FTX, Wildcat aims to bring transparent, programmable private credit onchain for institutional borrowers. With a two-year runway secured, the firm is focusing on building new market types and yield mechanisms.(10)

3. Pointsville Raises Series A with backing from Tether and global finance leaders to scale RWA and loyalty Infrastructure

Pointsville, a platform for digital asset infrastructure and loyalty programs, has completed its Series A funding round led by Valor Capital Group, with backing from Tether, Itaú Unibanco’s founding family, Nubank’s co-founder, Temasek-backed Superscrypt, Credit Saison, K2 Integrity, Citrino, Dynamo, and SNZ. The round brings together a coalition spanning global stablecoin operators, major Latin American banks, Asian financial institutions, and leading risk and intelligence firms. Pointsville builds tokenization infrastructure that enables real-world assets (RWAs) such as bonds and securities to move seamlessly into digital markets, while also powering loyalty ecosystems across sports, entertainment, and fintech.

The raise coincides with Pointsville’s role as core technology provider for Hadron by Tether, and partnerships such as Fanatics FanCash in loyalty experiences, alongside projects with governments and leading institutions. Proceeds will accelerate product development, infrastructure scaling, and global partnerships. By combining institutional-grade compliance, multi-chain support, and tokenization tools, Pointsville aims to become a key infrastructure layer for both financial assets and loyalty programs, shaping how traditional and digital finance converge worldwide.(11)

Ventures Market Metrics

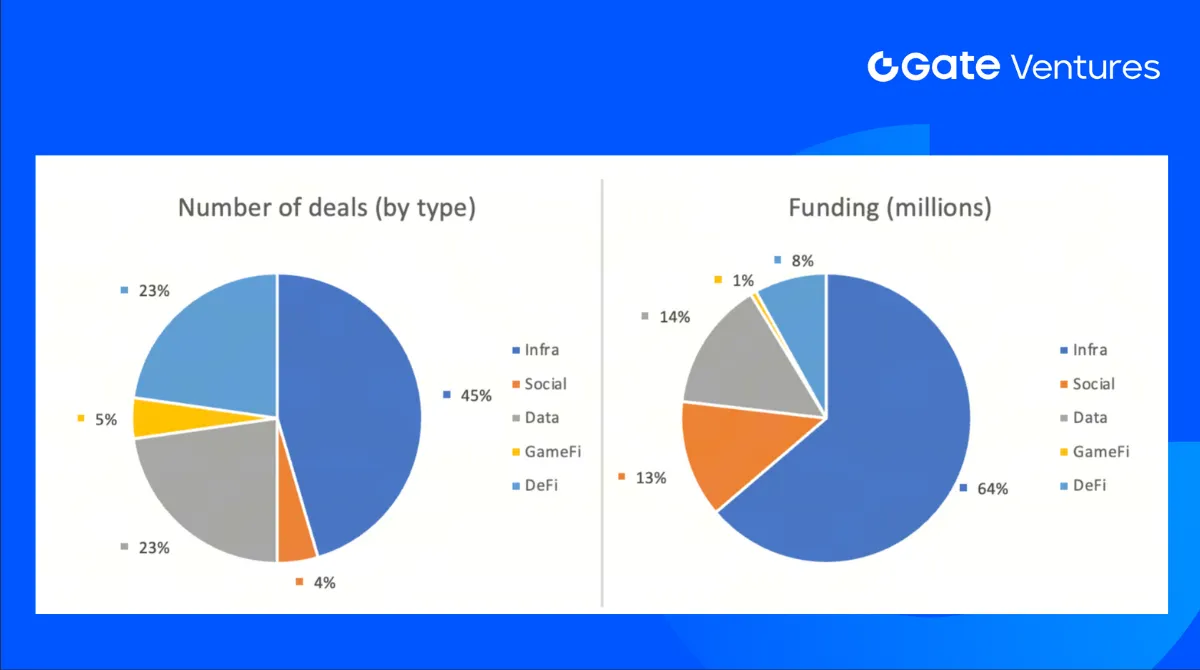

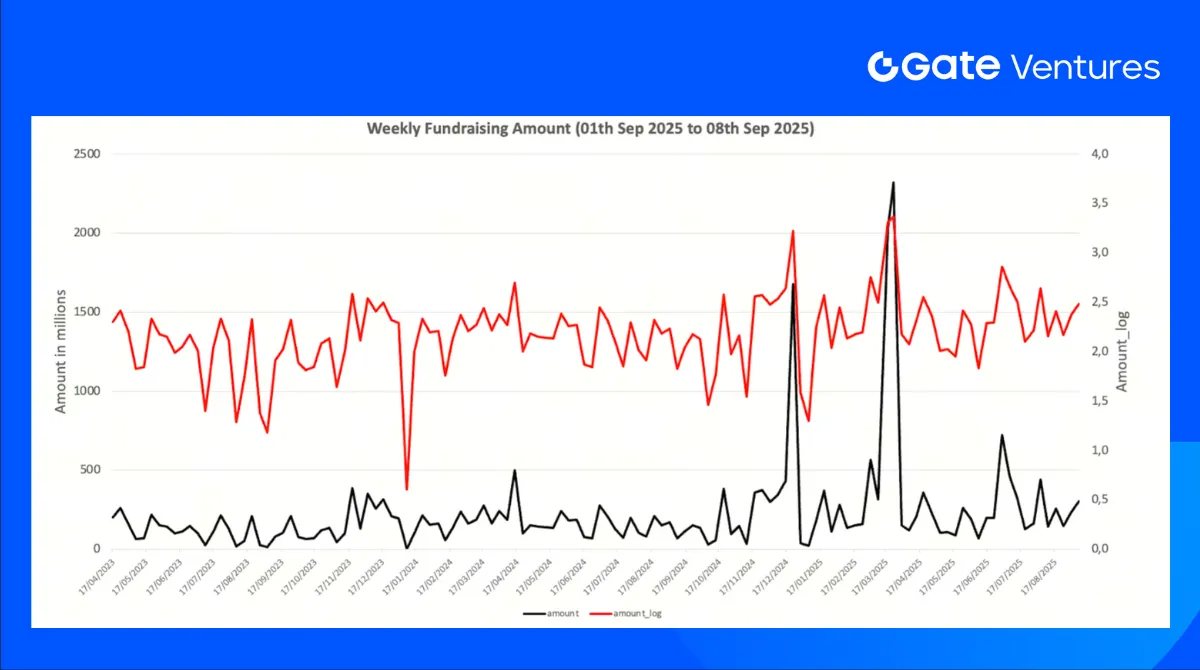

The number of deals closed in the previous week was 22, with Infra having 10 deals, representing 45% for each sector of the total number of deals. Meanwhile, Social had 1 (5%), Data had 5 (23%), Gamefi had 1(5%) and DeFi had 5 (23%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 8th Sep 2025

The total amount of disclosed funding raised in the previous week was $305M, 33% deals (6/22) in previous week didn’t public the raised amount. The top funding came from Infra sector with $195M. Most funded deals: Etherealize $40M, SonicStrategy $40M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 08th Sep 2025

Total weekly fundraising rose to $305M for the 1st week of Sep-2025, an increase of +29% compared to the week prior. Weekly fundraising in the previous week was up 78% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Sources

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-8-september-2025.html

- TradingView on US 30-Year Bond Yield and US 10-Year Bond Yield, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS30Y

- TradingView on DXY Index, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- Securities Industry and Financial Markets Association on US Securities Satistics, https://www.sifma.org/resources/research/statistics/us-treasury-securities-statistics/

- TradingView on Gold, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- Ondo Finance launches 100+ tokenized U.S. Stocks and ETF to expand RWA access

https://www.theblock.co/post/369284/ondo-tokenized-stocks-etfs-ethereum-bnb-chain-solana

https://www.coindesk.com/business/2025/09/03/ondo-finance-rolls-out-tokenized-u-s-stocks-etfs-as-equity-tokenization-ramps-up

https://finance.yahoo.com/news/defi-protocol-ondo-finance-puts-191807701.html - Fireblocks Network releases enterprise stablecoin payments network for trillions market sector

https://www.theblock.co/post/369489/fireblocks-launches-stablecoin-payments-network-amid-expected-growth-boom

https://blockworks.co/news/fireblocks-launches-payments-network-for-stablecoins - StablecoinX Secures $530M PIPE financing to expand ENA treasury

https://www.theblock.co/post/369709/ethena-jumps-12-after-treasury-firm-stablecoinx-secures-530-million-investment

https://cointelegraph.com/news/tlgy-and-stablecoinx-secure-530m-pipe-as-ethena-s-usde-becomes-fastest-stablecoin-to-10b-supply

https://www.coindesk.com/business/2025/09/06/stablecoinx-secures-usd530m-investment-to-back-ethena-linked-treasury - Plural Secures $7.13M to scale tokenized infrastructure marketplace for Energy assets

https://x.com/PluralEnergy/status/1963650516501893472

https://www.prnewswire.com/news-releases/plural-closes-7m-seed-led-by-paradigm-to-power-the-electron-economy-302546425.html - Robot Ventures leads $3.5M round valuing Wildcat Labs at $35M for DeFi Credit Growth

https://x.com/WildcatFi/status/1963950251120976180

https://www.theblock.co/post/369453/wildcat-labs-3-5-million-usd-round-robot-ventures - Pointsville Raises Series A with backing from Tether and global finance leaders to scale RWA and loyalty Infrastructure

https://x.com/PointsVilleApp/status/1963584264848466177

https://www.prnewswire.com/news-releases/pointsville-secures-series-a-funding-led-by-valor-capital-group-with-global-strategic-partners-to-accelerate-asset-digitization--rwa-growth-302545980.html

Thanks for your attention.

Share