2025 ZCX Fiyat Tahmini: ZCX Token’a Yönelik Piyasa Analizi ve Olası Büyüme Etkenleri

Giriş: ZCX'nin Piyasa Konumu ve Yatırım Potansiyeli

Unizen (ZCX), Ethereum blokzinciri üzerinde çalışan bir borsa platform tokenı olarak 2021'de piyasaya sürüldüğünden beri dikkat çekici bir ilerleme kaydetti. 2025 itibarıyla Unizen'in piyasa değeri 11.155.046 ABD doları, dolaşımdaki arzı yaklaşık 650.819.503 token ve fiyatı da 0,01714 ABD doları civarında seyrediyor. “Ethereum tabanlı borsa tokenı” olarak anılan bu varlık, merkeziyetsiz finans (DeFi) ekosisteminde giderek daha önemli bir rol üstleniyor.

Bu makalede, Unizen'in 2025-2030 dönemindeki fiyat hareketleri, geçmiş veriler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler ışığında incelenerek, yatırımcılar için profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacak.

I. ZCX Fiyat Geçmişi ve Güncel Piyasa Durumu

ZCX Tarihsel Fiyat Seyri

- 2021: Lansman, 14 Eylül'de 7,03 ABD doları ile zirve yaptı

- 2023: Piyasa düşüşü, fiyat ciddi oranda geriledi

- 2025: Kademeli toparlanma, 29 Eylül'de 0,01461762 ABD doları ile dipten yükselmeye başladı

ZCX Güncel Piyasa Görünümü

8 Ekim 2025 itibarıyla ZCX, 0,01714 ABD doları seviyesinden işlem görüyor; son 24 saatteki işlem hacmi 12.806,35 ABD doları. Token fiyatı son 24 saatte %1,72 geriledi. ZCX'nin piyasa değeri şu anda 11.155.046 ABD doları ve kripto piyasasında 1362'nci sırada yer alıyor.

Dolaşımdaki arz 650.819.503,357031 token ve bu, toplam arzın %68,73'üne karşılık geliyor (toplam arz: 946.938.568,2935846 token). Tam seyreltilmiş piyasa değeri ise 16.230.527,06 ABD doları.

ZCX'nin fiyat performansı, farklı zaman aralıklarında şu şekilde:

- 1 saat: +%0,65

- 24 saat: -%1,72

- 7 gün: +%0,65

- 30 gün: +%4,26

- 1 yıl: -%80,63

Token şu anda tüm zamanların en yüksek seviyesinden %99,76 daha düşük ve en düşük seviyesinden %17,26 yukarıda işlem görüyor. ZCX için piyasa duyarlılığı “Açgözlülük” bölgesinde, bu da olası bir yükseliş eğilimi işaret ediyor.

Güncel ZCX piyasa fiyatını görmek için tıklayın

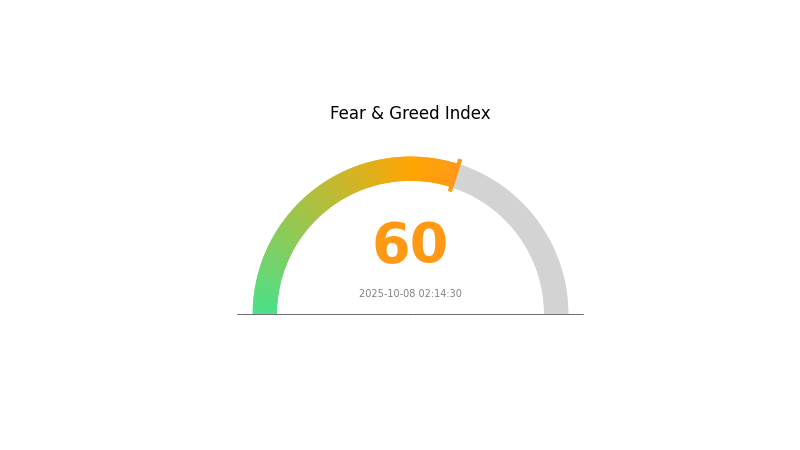

ZCX Piyasa Duyarlılık Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Bugün kripto piyasasında açgözlülük hakim ve Korku ve Açgözlülük Endeksi 60 seviyesinde. Yatırımcılar son olumlu gelişmeler veya fiyat hareketlerinin etkisiyle daha iyimser görünüyor. Ancak, yüksek açgözlülük seviyeleri bazen piyasa düzeltmesinin habercisi olabileceğinden dikkatli olunmalı. Portföy dengesi ve FOMO'ya kapılmamak önemli; her zaman detaylı araştırma ve risk yönetimi, kripto piyasasının oynak yapısında kritik önemdedir.

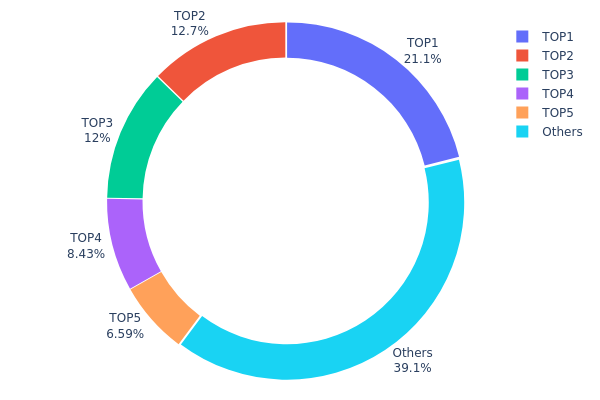

ZCX Varlık Dağılımı

ZCX adres varlık dağılımı incelendiğinde, tokenlerin büyük bölümü az sayıda adreste yoğunlaşmış durumda. En büyük adres toplam arzın %21,12'sini tutarken, ilk 5 adres ZCX tokenlarının %60,87'sini elinde bulunduruyor. Bu yüksek yoğunlaşma, piyasa dinamikleri açısından merkeziyetçi bir sahiplik yapısı yaratıyor.

Böyle bir dağılım, piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor. Arzın büyük kısmı birkaç büyük yatırımcıda olursa, bu yatırımcıların alım veya satış yapması fiyatlarda ciddi dalgalanma yaratabilir. Ayrıca, bu yoğunlaşma token likiditesini ve piyasa istikrarını da etkileyebilir.

Bununla birlikte, tokenların %39,13'ü diğer adresler arasında dağılmış durumda; bu da kısmi bir yaygınlık olduğunu gösteriyor. Ancak mevcut yapı, ZCX'nin zincir üzerindeki merkeziyetsizliğinin sınırlı olduğunu, piyasa şoklarına karşı dayanıklılığını ve paydaş çeşitliliğini etkilediğini gösteriyor.

Güncel ZCX Varlık Dağılımı'nı görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x277c...9ba6d9 | 200.000,00K | 21,12% |

| 2 | 0xda51...0d4cca | 120.726,62K | 12,74% |

| 3 | 0xac4c...5ee8fd | 113.820,60K | 12,01% |

| 4 | 0x7e81...34f621 | 79.800,00K | 8,42% |

| 5 | 0x0000...00dead | 62.393,60K | 6,58% |

| - | Diğerleri | 370.197,74K | 39,13% |

II. ZCX'nin Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Cüzdan Çeşitlendirmesi: Farklı kripto paralar için farklı cüzdanlar kullanma stratejisi, işlem geçmişinin tek tipleşmesini önlerken adres yönetim maliyetlerini minimumda tutmayı hedefler.

- Güncel Etki: Bu yaklaşım, ZCX tokenlarının farklı cüzdanlara ve piyasa dolaşımına etkisiyle fiyat üzerinde oynaklık yaratabilir.

Kurumsal ve Balina Etkileri

- Kurumsal Varlıklar: Token sahiplerinin farklı aşamalarda değişimi, elde tutma maliyetlerini artırır ve büyük yatırımcıların gelecekte fiyat yükseltme baskısını azaltır.

- Güncel Etki: Tekrarlanan piyasa hareketleriyle ortalama elde tutma maliyeti artar; büyük yatırımcılar yüksekten çıkış yaparken ani fiyat düşüşleri engellenir.

Makroekonomik Faktörler

- Jeopolitik Unsurlar: Ukrayna krizi gibi uluslararası gelişmeler, enerji fiyatlarını ve genel ekonomik ortamı etkileyerek ZCX dahil kripto piyasalarına yön verebilir.

- Enflasyona Karşı Koruma: Enflasyonist koşullarda ZCX gibi kripto paralar, değer koruma aracı olarak talep görebilir ve fiyatları üzerinde olumlu etki yaratabilir.

Teknolojik Gelişmeler ve Ekosistem İnşası

- Fiyat Koruma Mekanizması: NovaEx gibi borsalar, emir koruyucu ve sigorta fonu destekli fiyat garantisi sunar. Bu tür mekanizmalar ZCX'nin fiyat istikrarına ve işlem davranışına doğrudan etki eder.

- Ekosistem Uygulamaları: ZCX’nin ekosistemdeki merkezi rolü, tokenın kullanım alanı ve piyasa değerini doğrudan etkiler.

III. ZCX 2025-2030 Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 0,00891 - 0,01714 ABD doları

- Tarafsız tahmin: 0,01714 - 0,01834 ABD doları

- İyimser tahmin: 0,01834 - 0,02000 ABD doları (güçlü piyasa toparlanması ve yüksek benimseme ile)

2027 Orta Vadeli Beklenti

- Piyasa fazı: Konsolidasyon ve yukarı yönlü ivme olasılığı

- Fiyat tahmini:

- 2026: 0,01561 - 0,01916 ABD doları

- 2027: 0,01144 - 0,02417 ABD doları

- Temel katalizörler: Teknolojik ilerlemeler, yeni kullanım alanları ve piyasa farkındalığının artışı

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,02610 - 0,02747 ABD doları (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,02747 - 0,03599 ABD doları (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,03599 - 0,04000 ABD doları (yenilikçi gelişmeler ve ana akım entegrasyon ile)

- 31 Aralık 2030: ZCX 0,03599 ABD doları (iyimser tahmine göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,01834 | 0,01714 | 0,00891 | 0 |

| 2026 | 0,01916 | 0,01774 | 0,01561 | 3 |

| 2027 | 0,02417 | 0,01845 | 0,01144 | 7 |

| 2028 | 0,03005 | 0,02131 | 0,01129 | 24 |

| 2029 | 0,02927 | 0,02568 | 0,0131 | 49 |

| 2030 | 0,03599 | 0,02747 | 0,0261 | 60 |

IV. ZCX Yatırım Stratejileri ve Risk Yönetimi

ZCX Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Risk toleransı yüksek, uzun vadeli bakış açısı olan yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde ZCX biriktirin

- Önemli fiyat hareketleri için fiyat alarmı kurun

- ZCX’leri donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için kullanılır

- RSI: Aşırı alım ve aşırı satım bölgelerini izler

- Dalgalı işlem için ana noktalar:

- Destek ve direnç seviyelerini takip edin

- Fiyat hareketlerini doğrulamak için işlem hacmini izleyin

ZCX Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: %1-3

- Saldırgan yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Stop-loss emirleri: Zararları sınırlamak için önceden çıkış noktası belirleyin

- Çeşitlendirme: Yatırımı birden fazla kripto para ve varlık grubuna yayın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı seçeneği: Gate.com dahili cüzdan

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifreler ve düzenli güvenlik güncellemeleri

V. ZCX için Potansiyel Riskler ve Zorluklar

ZCX Piyasa Riskleri

- Yüksek volatilite: ZCX fiyatında ani dalgalanmalar görülebilir

- Düşük likidite: İşlem hacminin düşük olması giriş-çıkışta zorluk yaratabilir

- Piyasa duyarlılığı: Genel kripto piyasası trendleri ZCX performansını etkiler

ZCX Düzenleyici Riskler

- Belirsiz regülasyon ortamı: ZCX'nin faaliyetini etkileyebilecek yeni düzenlemeler çıkabilir

- Sınır ötesi uyumluluk: Ülkeler arası farklı regülasyonlar

- Vergi etkileri: Kripto para işlemlerine dair değişen vergi mevzuatı

ZCX Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda güvenlik zafiyeti riski

- Ağ tıkanıklığı: Ethereum blokzinciri sınırlamaları işlem hızını etkileyebilir

- Teknolojik eskime: Blokzincir teknolojisinin hızlı gelişimi ZCX'nin güncelliğini etkileyebilir

VI. Sonuç ve Eylem Önerileri

ZCX Yatırım Potansiyeli Değerlendirmesi

ZCX, kripto borsa tokenı alanında yüksek riskli ama yüksek getiri potansiyeline sahip bir yatırım olanağı sunuyor. Yüksek kazanç imkanı olsa da aşırı oynaklık ve projenin erken aşamada oluşu yatırımcılar tarafından dikkate alınmalı.

ZCX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini tanımak için küçük, deneme yatırımları

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması uygulayın

✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın ve ZCX'yi çeşitlendirilmiş portföyde değerlendirin

ZCX İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden doğrudan ZCX alım-satımı

- Stake etme: Var ise Gate.com'da stake programlarına katılım

- Limit emirleri: Belirli fiyatlarda pozisyon açıp kapamak için gelişmiş emir türleri kullanımı

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırım kararlarınızı kendi risk toleransınıza göre almalı ve profesyonel finans danışmanlarına danışmalısınız. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

ZCX coin şu an ne kadar?

8 Ekim 2025 itibarıyla ZCX coin fiyatı 0,01736 ABD doları. Son 24 saatte %0,14 artış gösterirken, işlem hacmi 153.236 ABD doları oldu.

2030'da LCX için fiyat tahmini nedir?

LCX'nin 2030 yılı tahmini fiyatı, güncel piyasa trendi ve analizlere göre 0,171446 ABD dolarıdır.

ZCX kripto nedir?

ZCX, Unizen platformunun yerel ERC-20 fayda tokenı olup, Ethereum ve Polygon üzerinde kullanılabilir. Unizen ekosisteminde işlem ve yönetim mekanizmasında rol oynar.

2025 Zoo Token fiyat tahmini nedir?

Piyasa analizine göre Zoo Token'ın 2025'te 0,000256 ile 0,000259 ABD doları arasında işlem görmesi bekleniyor. Ortalama fiyat ise yaklaşık 0,000257 ABD doları olabilir.

Ethereum'dan AUD'ya: Avustralyalı Tüccarların 2025'te Bilmesi Gerekenler

2030'da AAVE Fiyatı Ne Seviyelere Ulaşabilir?

2025 ETC Fiyat Tahmini: Ethereum Classic, DeFi alanında ivme kazanırken yükseliş yönünde öngörüler güçleniyor

2025 OMG Fiyat Tahmini: DeFi Benimsenmesi Artarken Yükseliş Beklentisi

CELL vs ETH: DeFi Ekosisteminde Blockchain Liderliği İçin Mücadele

2025 DPY Fiyat Tahmini: Merkeziyetsiz Platformlara İlgi Artarken Yükseliş Eğilimi Öne Çıkıyor

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025