2025 XTER Fiyat Tahmini: Değişen Kripto Ekosisteminde XTER Token’a Yönelik Piyasa Analizi ve Geleceğe Bakış

Giriş: XTER’in Piyasa Konumu ve Yatırım Değeri

Xterio (XTER), kuruluşundan bu yana küresel çapta, platformlar arası oynayarak kazan anlayışıyla faaliyet gösteren bir geliştirici ve yayıncı olarak kendini kanıtlamıştır. 2025 yılı itibarıyla XTER’in piyasa değeri 13.658.866 dolar seviyesine ulaşmış, yaklaşık 141.630.716 dolaşımdaki token ile fiyatı 0,09644 dolar civarında seyretmektedir. Web3 tabanlı evrenlere odaklanmasıyla öne çıkan bu varlık, dijital sahiplik avantajı sayesinde etkileşimi yüksek oyun dünyalarının oluşturulmasında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, XTER’in 2025’ten 2030’a kadar olan fiyat hareketleri kapsamlı biçimde ele alınacak; geçmiş eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik veriler birleştirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. XTER Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

XTER Tarihsel Fiyat Gelişimi

- 2025: XTER, 13 Eylül’de tüm zamanların en yüksek seviyesi olan 0,13862 doları gördü

- 2025: XTER, 25 Eylül’de tüm zamanların en düşük seviyesi olan 0,08078 dolara geriledi

- 2025: Piyasa dalgalanması; fiyat bir ayda 0,13862 ile 0,08078 dolar arasında hareket etti

XTER Güncel Piyasa Durumu

7 Ekim 2025 tarihi itibarıyla XTER, 0,09644 dolardan işlem görüyor. Token, son 24 saatte %3,43 değer kazanırken, işlem hacmi 28.733,62 dolar seviyesine ulaştı. XTER’in mevcut piyasa değeri 13.658.866 dolar olup, küresel kripto para piyasasında 1.282. sıradadır.

Token zaman dilimlerine göre karışık bir performans sergiledi. Son bir haftada %5,28, son bir ayda %4,25 artış yaşarken, son bir saatte %3,21 oranında gerilemiştir. Yıllık performansta ise geçen yıla göre %75,71’lik ciddi bir düşüş görülmektedir.

XTER’in dolaşımdaki arzı 141.630.716 token olup, toplam arzının %14,16’sını oluşturmaktadır (toplam arz: 1.000.000.000 token). Tam seyreltilmiş piyasa değeri ise şu anda 96.440.000 dolardır.

Piyasa eğilimi XTER için temkinli iyimser görünmektedir; kısa vadeli yükselişler uzun vadeli kayıpları bir miktar telafi etse de, token hâlâ en yüksek seviyesinin oldukça altında işlem görüyor ve piyasa koşulları iyileşirse toparlanma potansiyeli taşıyor.

Güncel XTER piyasa fiyatını görmek için tıklayın

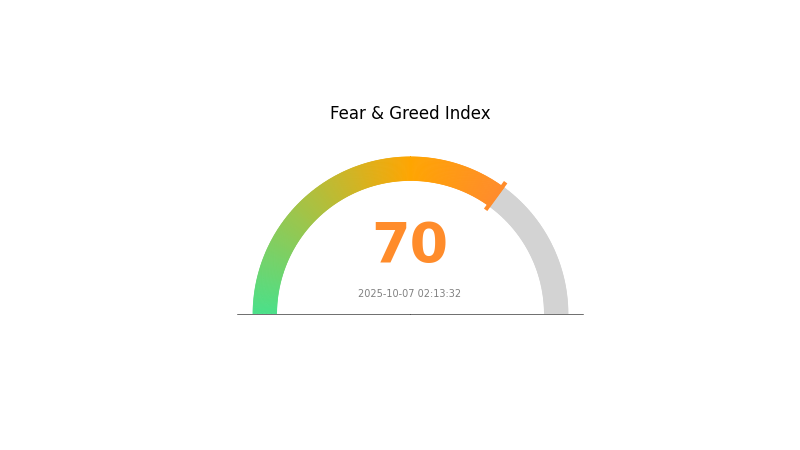

XTER Piyasa Duyarlılık Göstergesi

2025-10-07 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim; Korku ve Açgözlülük Endeksi 70 seviyesinde. Bu durum, yatırımcıların iyimserliğinin arttığını gösteriyor; olumlu piyasa hareketleri veya sektördeki gelişmeler bu eğilimi besliyor olabilir. Ancak bu tür yüksek coşku dönemlerinde dikkatli olmak gerekir. Olası fırsatlar söz konusu olsa da, yatırım öncesinde kapsamlı araştırma yapmak ve risk yönetimi stratejilerini uygulamak akıllıca olur. Unutmayın, kripto piyasasında duyarlılık son derece hızlı değişebilir.

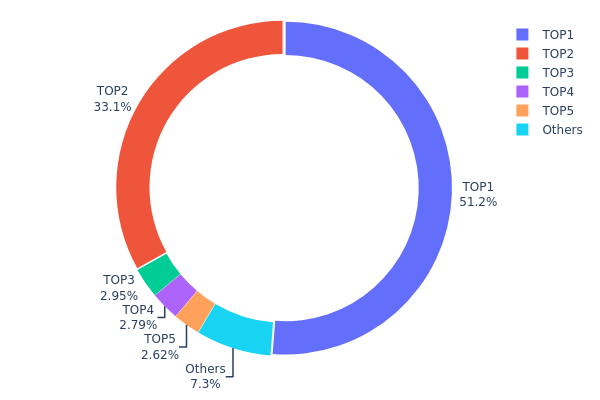

XTER Varlık Dağılımı

Adres bazlı varlık dağılımı, XTER tokenlarının cüzdanlar arasında nasıl dağıldığına dair önemli bilgiler sunar. Bu analiz, XTER’in oldukça merkezileşmiş bir dağılım yapısına sahip olduğunu göstermektedir. İlk iki adres toplam arzın %84,35’ini elinde bulunduruyor; en büyük sahip %51,25, ikinci büyük sahip ise %33,10 oranında paya sahip. Bu yüksek yoğunlaşma, XTER’in merkeziyetsizliği ve piyasa yapısı açısından ciddi bir risk oluşturmaktadır.

Böylesine yoğun bir dağılım, fiyat oynaklığını artırabilir ve piyasa manipülasyonuna açık hale getirebilir. Az sayıda adres çoğunluğu kontrol ettiğinde, bu büyük sahiplerin yapacağı büyük işlemler XTER’in piyasa dinamiklerinde belirleyici olabilir. Ayrıca, bu durum fiyat istikrarı ve adil piyasa koşulları konusunda küçük yatırımcıları tedirgin edebilir.

Blockchain açısından bu dağılım, XTER’in düşük merkeziyetsizlik düzeyine ve zincir üzerindeki yapısal istikrarın zayıflayabileceğine işaret etmektedir. Büyük sahiplerin hakimiyeti, yönetim kararlarını ve ekosistem gelişimini etkileyebilir ve kripto projelerinde aranan merkeziyetsizlik ilkesine ters düşebilir.

Güncel XTER Varlık Dağılımı için tıklayın

| En İyi | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0876...c6199f | 512.500,00K | 51,25% |

| 2 | 0x8dab...0d4690 | 331.000,00K | 33,10% |

| 3 | 0xc851...bcbaf2 | 29.493,61K | 2,94% |

| 4 | 0x0fb8...9e2fd8 | 27.889,71K | 2,78% |

| 5 | 0x93de...85d976 | 26.151,24K | 2,61% |

| - | Diğerleri | 72.965,44K | 7,32% |

II. XTER’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: ARK Invest gibi büyük kurumlar XTER ile ilişkili yatırımlara ilgi gösteriyor. Temmuz 2025’te ARK Invest, ATM (Piyasa Üzerinden) arzına katılarak XTER ilişkili 182 milyon dolarlık hisse aldı.

- Kurumsal Benimseme: Bazı şirketler, PIPE (Halka Açık Şirkete Özel Sermaye Yatırımı) anlaşmaları ve dönüştürülebilir tahvil ihracı gibi yenilikçi finansman yöntemleriyle XTER elde etmektedir.

- Ulusal Politikalar: Regülasyon değişiklikleri ve devlet politikaları XTER piyasasının şekillenmesinde belirleyici rol oynamaktadır.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası’nın (Federal Reserve) adımları ve bağımsızlığı, ekonomik istikrar için kritik olup XTER fiyatını dolaylı olarak etkiler.

- Enflasyona Karşı Koruma: XTER’in enflasyonist ortamlardaki performansı yatırımcılar tarafından yakından izlenmektedir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: Oyun sektörü, Web3’ün kitlesel benimsenmesi için anahtar alan olarak görülmekte ve bu durum XTER’in ekosistemi ile fiyatı üzerinde önemli etki yaratabilir.

III. XTER 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,0704 - 0,09644 dolar

- Tarafsız tahmin: 0,09644 - 0,11525 dolar

- İyimser tahmin: 0,11525 - 0,13405 dolar (olumlu piyasa şartlarında)

2026-2028 Görünümü

- Piyasa aşaması beklentisi: Kademeli büyüme ve potansiyel dalgalanma

- Fiyat aralığı tahminleri:

- 2026: 0,08874 - 0,14521 dolar

- 2027: 0,07553 - 0,14586 dolar

- 2028: 0,08421 - 0,19602 dolar

- Ana katalizörler: Benimsenme artışı, teknolojik gelişmeler ve piyasa duyarlılığı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,15534 - 0,17455 dolar (istikrarlı piyasa büyümesi öngörüsüyle)

- İyimser senaryo: 0,17455 - 0,18327 dolar (güçlü boğa trendiyle)

- Dönüştürücü senaryo: 0,18327 - 0,19602 dolar (son derece olumlu piyasa koşulları)

- 2030-12-31: XTER 0,18327 dolar (olası zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,13405 | 0,09644 | 0,0704 | 0 |

| 2026 | 0,14521 | 0,11525 | 0,08874 | 19 |

| 2027 | 0,14586 | 0,13023 | 0,07553 | 35 |

| 2028 | 0,19602 | 0,13804 | 0,08421 | 43 |

| 2029 | 0,18206 | 0,16703 | 0,15534 | 73 |

| 2030 | 0,18327 | 0,17455 | 0,13091 | 80 |

IV. XTER Profesyonel Yatırım Stratejisi ve Risk Yönetimi

XTER Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açısına sahip ve risk toleransı yüksek olanlar

- İşlem önerileri:

- Piyasa geri çekilmelerinde XTER biriktirin

- Kısmi kâr için fiyat hedefleri belirleyin

- Tokenları güvenli cüzdanlarda ve yedekli saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI: Aşırı alım ve aşırı satım bölgelerini tespit edin

- Dalgalı alım-satım için ana noktalar:

- Kayıpları sınırlamak için zarar durdur emirleri kullanın

- Belirlenen dirençlerde kâr alın

XTER Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Aggresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün en fazla %15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla kripto para arasında dağıtın

- Zarar durdur emirleri: Kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama kullanın, güçlü şifreler tercih edin

V. XTER Olası Riskler ve Zorluklar

XTER Piyasa Riskleri

- Oynaklık: Kripto para piyasalarında aşırı fiyat dalgalanmaları görülür

- Likidite: Büyük miktarları hızlıca satmakta güçlük yaşanabilir

- Piyasa duyarlılığı: Haber ve trendlerle hızla değişebilir

XTER Düzenleyici Riskler

- Regülasyon belirsizliği: Yeni düzenlemeler XTER’in operasyonunu etkileyebilir

- Uyum zorlukları: Farklı ülkelerdeki yasal gerekliliklere uyum sağlama

- Vergilendirme sorunları: Kripto kazançlarının belirsiz veya değişen vergisel durumu

XTER Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda istismar edilebilecek zafiyetler olabilir

- Ölçeklenebilirlik sorunları: Talebin arttığı dönemlerde ağ tıkanıklığı yaşanabilir

- Birlikte çalışabilirlik: Diğer blockchain ağlarıyla uyum problemleri çıkabilir

VI. Sonuç ve Eylem Önerileri

XTER Yatırım Değeri Değerlendirmesi

XTER, oyun ve Web3 projesi olarak potansiyel sunuyor; ancak önemli piyasa ve regülasyon riskleri mevcut. Uzun vadeli değeri, platformun benimsenmesi ve regülasyon netliğine bağlıdır.

XTER Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, teknolojiyi ve sistemi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: XTER’i çeşitlendirilmiş kripto portföyünde değerlendirin, piyasa trendlerini yakından izleyin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, oyun ve Web3 sektörlerinde XTER’i değerlendirin

XTER Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden XTER token alıp satabilirsiniz

- Staking: Uygun program bulunuyorsa pasif gelir için staking’e katılın

- DeFi entegrasyonu: XTER token içeren merkeziyetsiz finans seçeneklerini keşfedin

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular (SSS)

Tezos 2025’te ne kadar değerli?

Mevcut piyasa eğilimlerine göre, Tezos’un 2025 yılında yaklaşık 0,73 dolar değerinde olması bekleniyor. Ancak kripto para fiyatları yüksek oynaklık gösterebilir.

XRP 100 dolara ulaşır mı?

Mevcut piyasa eğilimleri ve analist tahminlerine göre, XRP 2030’a kadar 100 dolara ulaşabilir. Piyasa iyimserliği ve güncel veriler bu iddialı fiyat hedefini desteklemektedir.

XTER coin bugün ne kadar?

2025-10-07 tarihi itibarıyla XTER coin’in fiyatı 0,096231 dolar. Son 24 saatte %2,75 artış gösterdi ve işlem hacmi 10.177.834 dolara ulaştı.

Tezos iyi bir kripto para mı?

Evet, Tezos güçlü blockchain teknolojisi ve akıllı kontrat özellikleriyle iyi bir kripto para olarak görülüyor. Analistler, fiyatının 2033’te 15,80 dolara ulaşabileceğini öngörüyor ve 2025 için umut vadeden bir yatırım alternatifi olarak değerlendiriyor.

PixelVerse (PIXEL) İyi Bir Yatırım mı?: Dijital Sanat Sektöründe Büyüme Potansiyeli ve Piyasa Risklerinin Değerlendirilmesi

2025 MLC Fiyat Tahmini: Gelecekteki Piyasa Trendleri ve Yatırım Fırsatları

2025 A8 Fiyat Tahmini: Audi'nin lüks sedan modeli için piyasa analizi ve beklenen değer öngörüsü

Open Loot (OL) iyi bir yatırım mı?: Bu yeni kripto oyun platformunun potansiyeli ve riskleri üzerine analiz

Echelon Prime (PRIME) iyi bir yatırım mı?: Bu yeni nesil kripto paranın potansiyeli ve taşıdığı risklerin detaylı analizi

Pomerium (PMG) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyeli ve riskleri üzerine analiz

iExec RLC’yi Anlamak: Merkeziyetsiz Bulut Bilişimde Temel Bir Oyuncu

Helium Ağı’nı Anlamak: HNT Token’ları ve Merkeziyetsiz Sistemlere Kapsamlı Bir Bakış