2025 VNO Fiyat Tahmini: Gelecek Yıl VNO’nun Piyasa Trendleri ve Büyüme Potansiyeli Üzerine Analiz

Giriş: VNO’nun Piyasa Konumu ve Yatırım Potansiyeli

VenoFinance (VNO), Cronos blokzinciri üzerinde geliştirilen bir likit staking protokolü olarak, CRO staking işlemleri için tek noktadan kapsamlı bir çözüm sunmaktadır. 2025 yılı itibarıyla VNO’nun piyasa değeri 8.353.850 $’a ulaşmış, dolaşımdaki arz yaklaşık 517.747.189 token seviyesindedir ve fiyatı 0,016135 $ civarında seyretmektedir. “Likit CRO Çözümü” olarak bilinen bu varlık, Cronos ekosistemi ve DeFi sektöründe giderek daha belirleyici bir rol üstlenmektedir.

Bu makale, VNO’nun 2025-2030 dönemi fiyat hareketlerini; geçmiş verilere, arz-talep dengelerine, ekosistem gelişimine ve makroekonomik etkenlere dayanarak kapsamlı şekilde analiz edecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. VNO Fiyat Geçmişi ve Güncel Piyasa Durumu

VNO Fiyat Geçmişinin Evrimi

- 2023: 26 Ağustos’ta 2,999 $ ile tüm zamanların en yüksek seviyesine ulaşarak VNO için önemli bir dönüm noktası oluşturdu

- 2025: Piyasa gerilemesi ile fiyat, 1 Temmuz’da 0,01104 $ ile tarihinin en düşük seviyesini gördü

- 2025: Kademeli toparlanma sürecinin ardından, 9 Ekim itibarıyla fiyat 0,016135 $ seviyesinde istikrara kavuştu

VNO Güncel Piyasa Görünümü

VNO şu anda 0,016135 $ seviyesinden işlem görüyor; son 24 saatteki işlem hacmi ise 20.811,35 $ olarak kaydedildi. Token, son 24 saatte %6,37 değer kaybetti. VNO’nun piyasa değeri 8.353.850 $ ve küresel kripto para sıralamasında 1513. sırada bulunuyor. Dolaşımdaki arz 517.747.189,11 VNO olup, toplam arzın (1.885.837.051,28 VNO) %25,89’una karşılık geliyor. Token’ın fiyatı son 1 saatte %1,13, son 7 günde %8,57, son 30 günde ise %34,56 oranında geriledi. Kısa vadeli düşüşlere rağmen VNO, piyasadaki varlığını sürdürürken fiyatı hâlâ en düşük seviyesinin üzerinde bulunuyor.

Güncel VNO piyasa fiyatını görmek için tıklayın

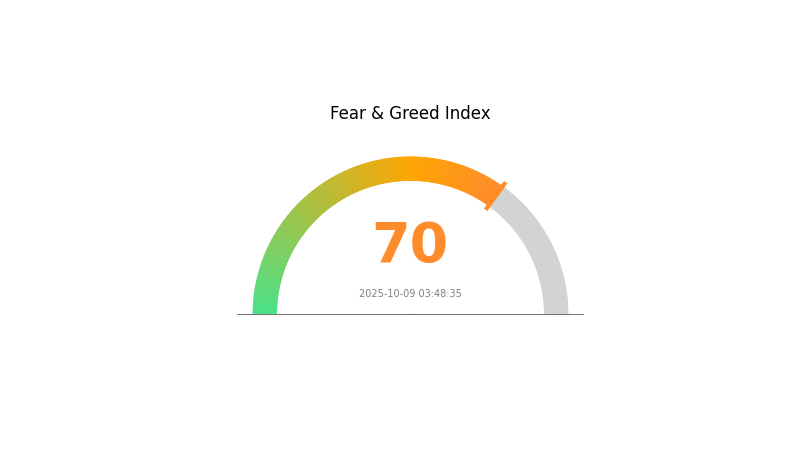

VNO Piyasa Duyarlılık Endeksi

09 Ekim 2025 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında aşırı iyimserlik gözleniyor; Korku ve Açgözlülük Endeksi 70’e ulaşarak açgözlü bir atmosferi işaret ediyor. Yatırımcılar daha iyimser davranmaya başlamış ve bu, fiyatların yükselmesini tetikleyebilir. Ancak, aşırı açgözlülük piyasa düzeltmelerini beraberinde getirebilir. Yatırımcıların temkinli hareket etmesi, portföylerini çeşitlendirmesi ve gerektiğinde kâr realizasyonu yapması önemlidir. Her zaman olduğu gibi, detaylı araştırma ve etkin risk yönetimi, bu dalgalı piyasa koşullarında temel gerekliliktir.

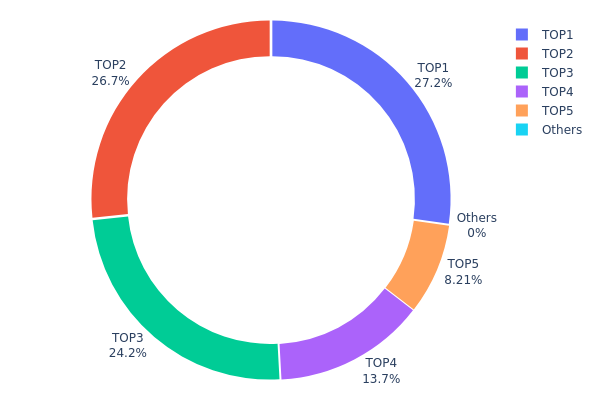

VNO Varlık Dağılımı

VNO’nun adres bazında varlık dağılımı, yoğunlaşmış bir sahiplik yapısına işaret ediyor. İlk beş adres, toplam arzın %77,47’sini elinde bulunduruyor ve en büyük sahip %21,10 paya sahip. Bu denli yoğunlaşmış bir yapı, merkeziyetsizlik ve piyasa manipülasyonu risklerini gündeme getiriyor.

Yoğun sahiplik, fiyat oynaklığını artırabilir ve büyük ölçekli satış veya birikimlerin fiyat üzerinde ciddi etkiler yaratmasına yol açabilir. Büyük sahiplerin hakimiyeti, VNO zincir üstü yönetim mekanizmaları hayata geçirilirse karar süreçlerini de etkileyebilir. Yeni projelerde yoğunlaşma olağan olsa da, bu düzeydeki merkeziyet piyasa istikrarı ve adil dağılım açısından daha geniş bir yayılım gerektirmektedir.

Özetle, VNO’nun mevcut varlık dağılımı, merkeziyetsizliğin sınırlı olduğu erken aşama bir piyasa yapısına işaret etmektedir. Proje olgunlaştıkça, bu dağılımdaki değişimleri izlemek, token yayılımı ve ekosistem sağlığı açısından kritik olacaktır.

| İlk | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xa1f4...9c79d9 | 398.005,06K | 21,10% |

| 2 | 0xa438...d3dfec | 390.000,00K | 20,68% |

| 3 | 0xebaf...279433 | 353.208,74K | 18,73% |

| 4 | 0xea01...564057 | 200.000,00K | 10,60% |

| 5 | 0x26a7...d7fe0a | 120.000,00K | 6,36% |

| - | Diğerleri | 0 | 22,53% |

II. VNO’nun Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Tarihsel Seyir: Geçmişteki arz değişimleri fiyat üzerinde belirleyici rol oynadı

- Mevcut Etki: Güncel arz değişiminin beklenen yansımaları

Kurumsal ve Balina Etkisi

- Ulusal Politikalar: Ülke düzeyinde uygulanan ilgili düzenlemeler

Makroekonomik Koşullar

- Para Politikası Etkisi: Önemli merkez bankalarının para politikalarına ilişkin beklentiler

- Enflasyon Korumalı Özellikler: Enflasyonist ortamlarda performans

- Jeopolitik Faktörler: Uluslararası gelişmelerin piyasa üzerindeki etkisi

Teknolojik İlerleme ve Ekosistem Gelişimi

- Ekosistem Uygulamaları: Önde gelen DApp’ler ve ekosistem projeleri

III. 2025-2030 VNO Fiyat Öngörüleri

2025 Görünümü

- Temkinli senaryo: 0,01049 $ - 0,01613 $

- Tarafsız senaryo: 0,01613 $ - 0,02000 $

- İyimser senaryo: 0,02000 $ - 0,02355 $ (güçlü piyasa toparlanması ve artan benimseme ile)

2027-2028 Görünümü

- Piyasa aşaması: Konsolidasyon ve büyüme potansiyeli

- Fiyat aralığı öngörüleri:

- 2027: 0,01877 $ - 0,02544 $

- 2028: 0,02181 $ - 0,02633 $

- Önemli katalizörler: Teknolojik ilerleme, piyasa kabulünün genişlemesi ve regülasyon netliği

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,02382 $ - 0,02724 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,02724 $ - 0,03309 $ (hızlanan benimsenme ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: 0,03309 $+ (çığır açan kullanım alanları ve ana akım entegrasyon ile)

- 31 Aralık 2030: VNO 0,03309 $ (iyimser projeksiyonlara göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,02355 | 0,01613 | 0,01049 | 0 |

| 2026 | 0,02956 | 0,01984 | 0,01528 | 22 |

| 2027 | 0,02544 | 0,0247 | 0,01877 | 52 |

| 2028 | 0,02633 | 0,02507 | 0,02181 | 54 |

| 2029 | 0,02724 | 0,0257 | 0,01413 | 58 |

| 2030 | 0,03309 | 0,02647 | 0,02382 | 63 |

IV. VNO İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

VNO Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde VNO biriktirin

- Kısmi kâr alımı için hedef fiyatlar belirleyin

- Token’ları güvenli, saklama dışı cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend tespiti için kullanılır

- RSI: Aşırı alım/aşırı satım durumunu takip edin

- Dalgalı ticaret için temel noktalar:

- CRO fiyat hareketlerini izleyin; VNO’ya etkisi olabilir

- Cronos ekosistemi gelişmelerini takip edin

VNO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Varlıkları çoklu kripto paralara yaymak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlandırmak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı tercih edin

- Güvenlik önlemleri: 2FA etkinleştirin, güçlü şifre kullanın ve özel anahtarları çevrimdışı saklayın

V. VNO İçin Potansiyel Riskler ve Zorluklar

VNO Piyasa Riskleri

- Yüksek oynaklık: VNO fiyatı önemli dalgalanmalara açık

- Likidite riski: Düşük işlem hacmi fiyat istikrarını etkileyebilir

- CRO ile korelasyon: VNO’nun performansı Cronos ekosistemine doğrudan bağlı

VNO Düzenleyici Riskleri

- Belirsiz regülasyon ortamı: Kripto sektörüne yönelik daha sıkı düzenlemeler olasılığı

- Uyumluluk zorlukları: DeFi protokolleri için değişen yasal gereklilikler

- Sınır ötesi kısıtlamalar: Uluslararası kullanımda potansiyel sınırlamalar

VNO Teknik Riskleri

- Akıllı kontrat açıkları: Sömürü veya hata riski

- Ölçeklenebilirlik sorunları: Ağ üzerindeki yükün artmasıyla ortaya çıkabilecek zorluklar

- İşbirliği kısıtları: Zincirler arası uyumlulukta sınırlamalar

VI. Sonuç ve Eylem Önerileri

VNO Yatırım Potansiyeli Değerlendirmesi

VNO, Cronos ekosistemi içinde büyüme potansiyeline sahip olsa da, piyasa oynaklığı ve regülasyon belirsizlikleri nedeniyle kısa vadede önemli riskler barındırmaktadır. Uzun vadede değer, Veno Finance’ın yol haritasını başarıyla uygulamasına ve Cronos ağının benimsenme düzeyine bağlıdır.

VNO Yatırım Önerileri

✅ Yeni başlayanlar: Küçük hacimli pozisyonlarla başlayın, bilgi ve risk yönetimine odaklanın ✅ Deneyimli yatırımcılar: VNO’yu çeşitlendirilmiş portföyün bir parçası olarak değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve Cronos ekosistemi gelişimini yakın takip edin

VNO İşlem Katılım Yöntemleri

- Spot ticaret: Gate.com üzerinden VNO alıp satabilirsiniz

- Staking: VNO staking programlarına katılarak ödül elde edin

- DeFi entegrasyonu: Veno Finance protokolü ile ek fırsatları değerlendirin

Kripto para yatırımları oldukça yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profiline göre dikkatli karar almalı ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alamayacağınız tutarda yatırım yapmayın.

SSS

VeChain 1 $’a ulaşabilir mi?

Evet, piyasa koşulları uygun olursa ve proje büyümesini sürdürürse VeChain 1 $’a ulaşabilir. Bunun için VeChain teknolojisinin sektörlerde yaygınlaşması ve piyasa hacminin ciddi şekilde büyümesi gerekir.

VNO hissesi için hedef fiyat nedir?

VNO hissesi için hedef fiyat, Ekim 2025 itibarıyla analistlerin ortalama tahminine göre 40,38 $’dır.

NVAX için 2025 fiyat hedefi nedir?

NVAX için 2025 yılı fiyat hedefi 10,00 $’dır; analistler, 12 aylık ortalama tahmine göre %26,58 yukarı potansiyel öngörmektedir.

VeChain 2 $’a ulaşabilir mi?

VeChain’in kısa vadede 2 $’a ulaşma potansiyeli yüksektir. Analistler güçlü bir yükseliş öngörüyor ve mevcut piyasa eğilimleri bu fiyatın yakında gerçekleşebileceğini gösteriyor.

2025 FIS Fiyat Tahmini: Gelişen DeFi Ekosisteminde FIS Token’in Piyasa Trendleri ve Gelecek Potansiyeli Analizi

HAEDAL vs GMX: DeFi Ekosisteminde Yeni Nesil Alım Satım Protokollerinin Karşılaştırılması

pSTAKE Finance (PSTAKE) yatırım yapmak için uygun mu?: Likit staking alanında olası getiriler ve riskler üzerine detaylı analiz

FST ve SNX: İki Lider Merkeziyetsiz Finans Protokolünün Karşılaştırmalı Analizi

2025 FIS Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 MILK Fiyat Tahmini: Süt Ürünleri Emtiasının Geleceğini Belirleyen Piyasa Trendleri ve Etkenlerin Analizi

Solana mobil cihazlarında blockchain entegrasyonunu incelemek

StakeStone Dolaşımdaki Arzı Hakkında Bilgi Edinmek: Detaylı Bir Kılavuz

2025 yılında Bitcoin fiyatındaki oynaklık, işlem fırsatlarını ne şekilde etkiler?

Merkeziyetsiz İnternetin Anlaşılması: Detaylı Bir Kılavuz