2025 VELO Price Prediction: Analyzing Growth Potential and Market Factors Shaping Its Future Value

Introduction: VELO's Market Position and Investment Value

Velo (VELO), as a blockchain-based financial protocol, has established itself as a significant player in the cryptocurrency market since its inception. As of 2025, Velo's market capitalization has reached $233,318,530, with a circulating supply of approximately 17,563,876,115 tokens and a price hovering around $0.013284. This asset, often referred to as a "bridge asset" connecting the real world and the digital currency world, is playing an increasingly crucial role in areas such as cross-border remittances, loans, payments, and loyalty programs.

This article will provide a comprehensive analysis of Velo's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. VELO Price History Review and Current Market Status

VELO Historical Price Evolution

- 2021: VELO reached its all-time high of $2.29 on March 8, 2021

- 2022: Market downturn, price dropped to its all-time low of $0.00103046 on December 20, 2022

- 2025: Current price at $0.013284, showing recovery from the 2022 low

VELO Current Market Situation

As of September 24, 2025, VELO is trading at $0.013284, with a market capitalization of $233,318,530. The token has experienced a 1.32% decrease in the last 24 hours, but shows a 0.98% increase in the past hour. The 7-day and 30-day trends indicate declines of 11.39% and 12.72% respectively. VELO's current price is significantly below its all-time high, suggesting potential for growth if market conditions improve. The circulating supply stands at 17,563,876,115 VELO, which is 73.18% of the total supply. The fully diluted market cap is $318,816,000.

Click to view the current VELO market price

VELO Market Sentiment Indicator

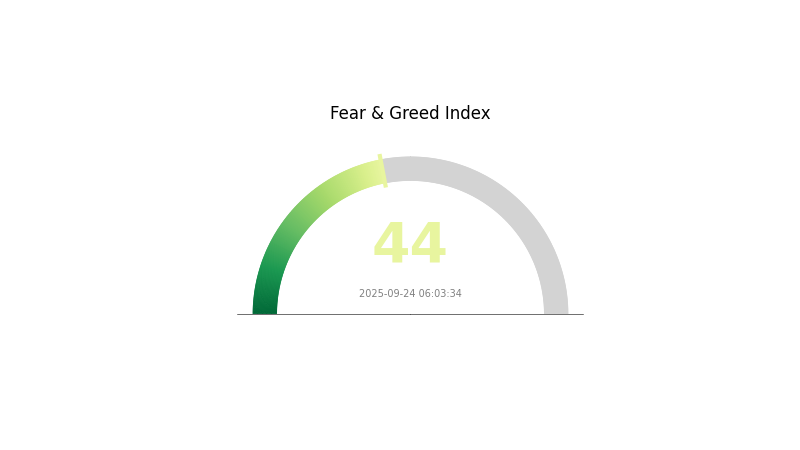

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 44. This indicates a cautious sentiment among investors, suggesting potential undervaluation of assets. During such times, experienced traders often view fear as an opportunity to accumulate, following the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and exercise caution before making any investment decisions in this volatile market.

VELO Holdings Distribution

The address holdings distribution data for VELO is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration and market structure. This lack of information prevents us from assessing the degree of decentralization, potential market manipulation risks, and overall stability of VELO's on-chain structure.

In a typical scenario, address holdings distribution would provide valuable insights into the token's ownership pattern and its implications for market dynamics. Without this data, it's challenging to determine whether VELO's holdings are widely distributed among many addresses or concentrated in the hands of a few large holders.

This information gap underscores the importance of transparency in the cryptocurrency market. As the market matures, it's crucial for projects to provide clear and accessible data to enable informed decision-making by investors and analysts alike.

Click to view the current VELO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting VELO's Future Price

Supply Mechanism

- Transaction Fees: VELO allows users to exchange digital assets with low fees and low slippage, with transaction fees ranging from 0.02% to 0.05%.

- Historical Pattern: After VELO introduced OP token incentives in August 2024, the Total Value Locked (TVL) surged significantly.

- Current Impact: The low transaction fees and incentive measures continue to attract users and increase liquidity, potentially impacting VELO's price positively.

Institutional and Whale Dynamics

- Enterprise Adoption: The core function of VELO in allowing low-cost digital asset exchanges has attracted attention from various enterprises.

Technical Development and Ecosystem Building

-

TVL Growth: The Total Value Locked in VELO has shown significant growth since the introduction of OP token incentives.

-

Staking Rate Changes: VELO staking rate has seen fluctuations, with a peak followed by a decline. The reasons for this change may include:

- A sustained price increase for VELO tokens starting from late January 2023.

- Changes in market conditions or competitive landscape.

- Shifts in user behavior or preferences.

- Potential adjustments to the staking mechanism or rewards structure.

-

Ecosystem Applications: VELO's ecosystem focuses on providing efficient decentralized exchange services with low fees and slippage.

III. VELO Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.01231 - $0.01338

- Neutral estimate: $0.01338 - $0.01525

- Optimistic estimate: $0.01525 - $0.01712 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00875 - $0.02162

- 2028: $0.01047 - $0.02889

- Key catalysts: Technological advancements, partnerships, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.02414 - $0.02884 (assuming steady growth and adoption)

- Optimistic scenario: $0.02884 - $0.03355 (with favorable market conditions and project success)

- Transformative scenario: $0.03355 - $0.03576 (with breakthrough innovations and mass adoption)

- 2030-12-31: VELO $0.03576 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01712 | 0.01338 | 0.01231 | 0 |

| 2026 | 0.01906 | 0.01525 | 0.00869 | 14 |

| 2027 | 0.02162 | 0.01716 | 0.00875 | 29 |

| 2028 | 0.02889 | 0.01939 | 0.01047 | 45 |

| 2029 | 0.03355 | 0.02414 | 0.01907 | 81 |

| 2030 | 0.03576 | 0.02884 | 0.02394 | 117 |

IV. Professional Investment Strategies and Risk Management for VELO

VELO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the Velo protocol

- Operational suggestions:

- Accumulate VELO tokens during market dips

- Stake VELO tokens to earn rewards and participate in governance

- Store tokens in a secure wallet, preferably a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor VELO's correlation with broader crypto market trends

- Set clear entry and exit points based on technical indicators

VELO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for VELO

VELO Market Risks

- Volatility: Cryptocurrency markets are known for high volatility

- Liquidity: Lower trading volumes may lead to slippage during large trades

- Competition: Other blockchain-based financial protocols may impact VELO's market share

VELO Regulatory Risks

- Regulatory uncertainty: Evolving global regulations may impact VELO's operations

- Compliance requirements: Potential need for additional compliance measures

- Cross-border transaction limitations: Regulatory changes may affect VELO's use in international transfers

VELO Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Scalability challenges: Possible network congestion during high demand periods

- Interoperability issues: Challenges in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

VELO Investment Value Assessment

VELO presents a unique value proposition in the blockchain-based financial protocol space. While it offers potential for long-term growth, investors should be aware of short-term volatility and regulatory uncertainties.

VELO Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the Velo protocol ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider VELO as part of a diversified crypto portfolio

VELO Trading Participation Methods

- Spot trading: Buy and sell VELO tokens on reputable exchanges like Gate.com

- Staking: Participate in VELO staking programs to earn rewards

- DeFi integration: Explore opportunities within the Velo ecosystem for additional yield

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Velo a good crypto to buy?

Yes, Velo shows promise as a crypto investment. Its innovative technology and growing adoption in the DeFi space make it an attractive option for 2025 and beyond.

What is Velo all time high?

Velo's all-time high is $0.05355, reached 7 days ago. The current price is slightly below this peak.

Will Velodrome go up?

Based on current data, Velodrome's future is uncertain. Its price is $0.05154 with a $52.83M market cap, but predicting exact movements is challenging.

What is the prediction for Vela token?

Based on current market trends, the Vela token price is predicted to reach between $0.002485 and $0.00486 by 2025, showing potential for growth.

Share

Content