2025 UOS Fiyat Tahmini: Gelişen Blockchain Ekosisteminde Büyüme Potansiyeli ile Piyasa Dinamiklerinin Analizi

Giriş: UOS'un Piyasa Konumu ve Yatırım Potansiyeli

Ultra (UOS), 140 milyar dolarlık oyun sektörünü kökten değiştirmek üzere tasarlanmış bir blockchain platformu olarak 2019'daki çıkışından bu yana önemli ilerleme kaydetti. 2025 yılı itibarıyla Ultra'nın piyasa değeri 15.025.566 dolar, dolaşımdaki arzı yaklaşık 472.205.109 token ve fiyatı 0,03182 dolar civarında. "Oyun sektörü bozucusu" olarak anılan bu varlık, oyun dağıtımı ile dijital ürün ticaretinin dönüşümünde giderek daha kritik bir rol üstleniyor.

Bu makalede, Ultra'nın 2025-2030 dönemindeki fiyat hareketleri; tarihsel trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde analiz edilecek, profesyonel fiyat tahminleri ile yatırımcılar için uygulanabilir stratejiler sunulacaktır.

I. UOS Fiyat Geçmişi ve Mevcut Piyasa Durumu

UOS Tarihsel Fiyat Gelişimi

- 2019: UOS 0,05 dolardan piyasaya sürüldü, fiyat bu seviyede dalgalandı

- 2021: 25 Kasım'da tüm zamanların zirvesi olan 2,49 dolara ulaştı

- 2022-2024: Piyasa gerilemesiyle fiyat alt seviyelere indi

UOS Güncel Piyasa Durumu

7 Ekim 2025 itibarıyla UOS, 0,03182 dolardan işlem görüyor. Son 24 saatte %1,69 artış kaydeden tokenin işlem hacmi 20.936,07 dolar. UOS, piyasa değerine göre #1238. sırada yer alıyor ve toplam piyasa değeri 31.820.000 dolar. Dolaşımdaki arz 472.205.109,5661 UOS olup, bu rakam 1 milyar tokenlik toplam arzın %47,22'sini oluşturuyor.

Son bir haftada UOS hafif bir yükselişle %1,67 artarken; uzun vadede, son 30 günde %13,48 ve son bir yılda %62,71 oranında ciddi düşüş yaşadı.

Mevcut fiyat, 25 Kasım 2021'de kaydedilen 2,49 dolarlık zirvenin oldukça altında, ancak 2 Eylül 2019'daki 0,02137354 dolarlık dip seviyenin üzerinde seyrediyor.

Güncel UOS piyasa fiyatını görmek için tıklayın

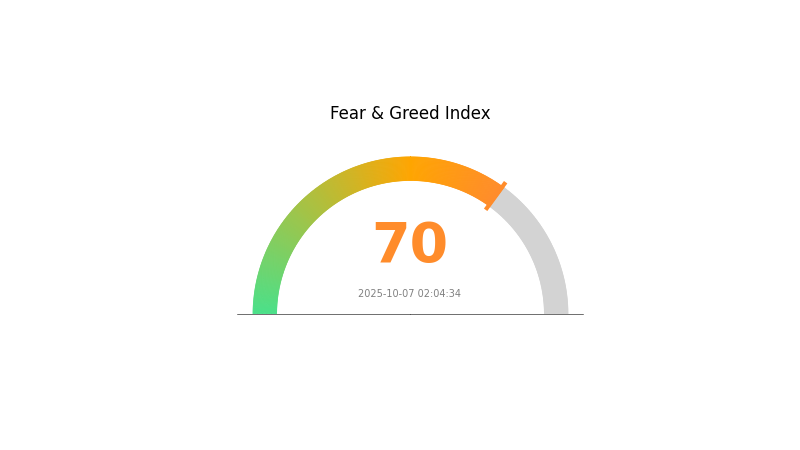

UOS Piyasa Duyarlılık Göstergesi

07 Ekim 2025 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim ve endeks 70 seviyesine ulaştı. Bu, yatırımcıların iyimserliğinin arttığını ve aşırı alım riskinin doğabileceğini gösteriyor. Yüksek piyasa hissiyatı kısa vadede fiyatları yükseltebilir, ancak ihtiyatlı olmak gerekir. Tecrübeli yatırımcılar genellikle aşırı açgözlülüğü, kâr alma veya pozisyon azaltma sinyali olarak yorumlar. Her zaman olduğu gibi, bu oynak ortamda kapsamlı araştırma yapmak ve risk yönetimine dikkat etmek şarttır.

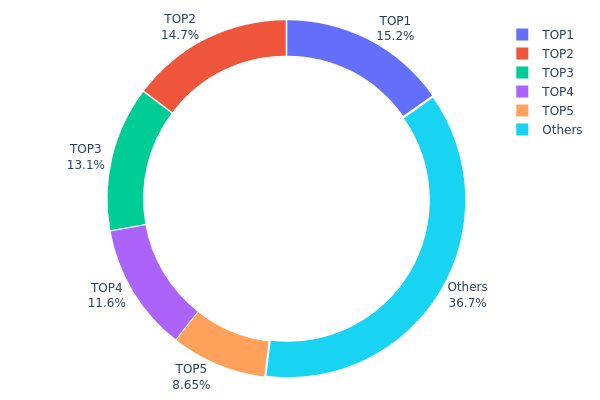

UOS Varlık Dağılımı

UOS adres varlık dağılımı, tokenlerin büyük kısmının az sayıda adreste yoğunlaştığını gösteriyor. İlk 5 adres toplam arzın %63,28’ini, en büyük tek adres ise %15,23’ünü elinde bulunduruyor. Bu yapı, piyasa dinamikleri ve fiyat istikrarı açısından merkeziyetçi bir dağılıma işaret ediyor.

Bu yoğunlaşma, piyasa manipülasyonu ve volatilite riskini artırıyor. "Balina" olarak bilinen büyük sahipler, büyük alım ya da satış işlemleriyle fiyatları etkileyebiliyor. Bu, UOS ekosisteminin yeterince merkeziyetsiz olmadığını ve az sayıda varlık sahibinin dolaşıma ve yönetime ciddi etki ettiğini gösteriyor.

Yine de, tokenlerin %36,72’si diğer adreslere dağılmış durumda ve bu bir çeşitlilik sağlıyor. Bu tablo, büyük adres hareketlerinin izlenmesinin önemini ve UOS ekosisteminde token dağılımını artırmanın piyasa dayanıklılığını güçlendirmek ve manipülasyon riskini azaltmak için elzem olduğunu ortaya koyuyor.

Güncel UOS Varlık Dağılımı için tıklayın

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xa353...e1ecf1 | 152.348,13K | 15,23% |

| 2 | 0x7b5d...2cf8b1 | 147.300,00K | 14,73% |

| 3 | 0xd13c...ab5c8c | 131.301,19K | 13,13% |

| 4 | 0xca5f...fbbc26 | 115.506,31K | 11,55% |

| 5 | 0xc9e8...5e87ca | 86.465,00K | 8,64% |

| - | Diğerleri | 367.079,37K | 36,72% |

II. UOS'un Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Halving Olayları: Bitcoin’in periyodik halving süreçleri, yeni arzı azaltarak UOS fiyatını dolaylı olarak etkileyebilir.

- Tarihsel Trendler: Geçmiş halvingler, arz şoku nedeniyle fiyatları yukarı taşımıştır.

- Mevcut Etki: Bir sonraki halvingin enflasyonu düşürmesi ve fiyatları yukarı çekmesi bekleniyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Merkez bankalarının altın alımları, UOS'un dijital altın alternatifi algısını güçlendirebilir.

- Kurumsal Benimseme: Bazı şirketler, UOS'u hazine rezervlerinde tutuyor.

- Ulusal Politikalar: Bazı ülkeler, UOS'u uluslararası ödemeler ve rezervlerde değerlendirmeye alıyor.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası faiz kararları, UOS'un alternatif yatırım olarak fiyatını etkiliyor.

- Enflasyon Koruma Özelliği: UOS, tıpkı altın gibi, enflasyona karşı korunma aracı olarak görülüyor.

- Jeopolitik Faktörler: Küresel gerginlikler ve belirsizlikler, UOS'a güvenli liman talebini artırıyor.

Teknik Gelişim ve Ekosistem Büyümesi

- Ağ Güncellemeleri: Sürekli ölçeklenebilirlik ve işlevsellik iyileştirmeleri, UOS kullanımını artırıyor.

- DeFi Entegrasyonu: UOS ağında DeFi uygulamalarının yaygınlaşması benimsemeyi hızlandırıyor.

- Ekosistem Uygulamaları: UOS blockchain üzerinde geliştirilen dApp ve projeler talepleri artırıyor.

III. 2025-2030 Dönemi UOS Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01907 - 0,02500 ABD doları

- Tarafsız tahmin: 0,02500 - 0,03500 ABD doları

- İyimser tahmin: 0,03500 - 0,04417 ABD doları (güçlü piyasa iyileşmesi ve UOS benimsenmesi gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimseme ile potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,02566 - 0,04429 ABD doları

- 2028: 0,03085 - 0,04456 ABD doları

- Başlıca katalizörler: Ekosistem genişlemesi, teknolojik yenilikler ve genel piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,03000 - 0,04500 ABD doları (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,04500 - 0,05234 ABD doları (hızlanan benimseme ve olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,05234 - 0,06000 ABD doları (çığır açan kullanım alanları ve ana akım entegrasyonla)

- 31 Aralık 2030: UOS 0,04436 ABD doları (2030 yılı için öngörülen ortalama fiyat)

| Yıl | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,04417 | 0,03178 | 0,01907 | 0 |

| 2026 | 0,04481 | 0,03798 | 0,02127 | 19 |

| 2027 | 0,04429 | 0,0414 | 0,02566 | 30 |

| 2028 | 0,04456 | 0,04284 | 0,03085 | 35 |

| 2029 | 0,04501 | 0,0437 | 0,02928 | 37 |

| 2030 | 0,05234 | 0,04436 | 0,03149 | 39 |

IV. UOS Yatırımında Profesyonel Stratejiler ve Risk Yönetimi

UOS Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde UOS biriktirin

- Fiyat hedefleri belirleyip düzenli gözden geçirin

- Tokenleri güvenli, saklama hakkı sizde olan cüzdanda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için

- RSI: Aşırı alım/aşırı satım bölgelerini izlemek için

- Dalgalı alım-satım için dikkat edilmesi gerekenler:

- Açık giriş ve çıkış noktaları belirleyin

- Risk yönetimi için zarar durdur emirleri kullanın

UOS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto paralar arasında dağılım yapın

- Zarar durdur emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama kullanın, güçlü parolalar oluşturun

V. UOS İçin Potansiyel Riskler ve Zorluklar

UOS Piyasa Riskleri

- Yüksek volatilite: Fiyat dalgalanmaları sık görülür

- Sınırlı benimseme: Başarı, Ultra platformunun yaygınlığına bağlıdır

- Rekabet: Oyun sektöründe güçlü rakipler bulunuyor

UOS Regülasyon Riskleri

- Belirsiz düzenlemeler: Kripto para regülasyonları küresel ölçekte değişiyor

- Olası kısıtlamalar: Bazı ülkeler kripto kullanımını sınırlayabilir veya yasaklayabilir

- Uyum sorunları: Regülasyonlardaki değişiklikler Ultra'nın faaliyetlerini etkileyebilir

UOS Teknik Riskler

- Akıllı kontrat açıkları: Sömürü veya hata oluşabilir

- Ölçeklenebilirlik sorunları: Platform büyüdükçe sıkıntı yaşanabilir

- Teknolojik eskime: Blockchain teknolojisinde hızlı yenilikler

VI. Sonuç ve Eylem Önerileri

UOS Yatırım Potansiyeli Değerlendirmesi

UOS oyun sektöründe özgün bir konum sunar; fakat büyük rekabet ve regülasyon belirsizliğiyle karşı karşıyadır. Ultra başarılı olursa uzun vadeli potansiyel vardır, ancak kısa vadede volatilite ve riskler yüksektir.

UOS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Detaylı araştırma sonrası küçük ve deneme amaçlı pozisyonlar açılabilir ✅ Tecrübeli yatırımcılar: Katı risk yönetimiyle maliyet ortalaması yöntemi tercih edilmeli ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapılmalı ve çeşitlendirilmiş kripto portföyüne dahil edilmelidir

UOS Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com üzerinden UOS işlemleri yapabilirsiniz

- Stake etme: Uygun programlar varsa katılım sağlanabilir

- DeFi: UOS token ile merkeziyetsiz finans çözümlerini değerlendirin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre vermelidir. Profesyonel finansal danışmana başvurmanız önerilir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Uniswap 100 dolara ulaşabilir mi?

Mevcut tahminler, Uniswap'ın 100 dolara ulaşmasını öngörmüyor. Piyasa trendleri ve tahminlere göre 2049 yılına kadar en yüksek fiyat yaklaşık 49 dolar olabilir.

2025'te hangi kripto paralar yükseliş gösterecek?

2025 yılında Bitcoin, Ethereum, Solana, XRP ve Binance Coin’in önemli büyüme göstermesi ve bu büyük kripto paralar ile altcoinlerde kayda değer fiyat artışları yaşanması beklenmektedir.

Uniswap 2025'te ne kadar olur?

Uniswap (UNI) için 2025'te 7,99 ile 17,03 dolar arasında, ortalama 12,54 dolar fiyat öngörülmektedir; bu rakamlar güncel piyasa trendlerine dayanmaktadır.

Nvidia'nın 2025 fiyat tahmini nedir?

Nvidia hissesi, yapay zeka ve veri merkezi talebinde beklenen güçlü büyüme ile 2025 yılında hisse başına 1.000 dolara ulaşabilir.

Vanar (VANRY) iyi bir yatırım mı?: Risk ve Potansiyel Getirilerin Detaylı Analizi

UOS ve ICP: Kurumsal güvenlik ve uyumluluk için işletim sistemlerinin karşılaştırmalı analizi

PIXEL ve ZIL: Yükselen dijital varlık protokollerinin rekabeti

Gunz (GUN) iyi bir yatırım mı?: Kripto yatırımcıları açısından piyasa potansiyeli ve risk faktörlerinin değerlendirilmesi

2025 GUN Fiyat Tahmini: Ateşli Silahlar Sektörü İçin Piyasa Analizi ve Yatırım Perspektifi

GUN ve THETA: Yazılım geliştirmede açık kaynak lisanslama modellerinin karşılaştırmalı analizi

Kripto Cüzdanınızı Oluşturun: Kolay Kayıt Rehberi

Kripto para dünyasında EVM’yi anlamak

NFT Değerini Keşfetmek: Nadirlik Puanlama Sistemlerine Kapsamlı Bir Rehber

Avalanche Ağı’na Bağlanma: Varlıklarınızı Kesintisiz Aktarmanın Kılavuzu

Web3 alanında ENS Domainlerini verimli biçimde kullanmak