2025 TRACAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: TRACAI's Market Position and Investment Value

OriginTrail (TRACAI) has established itself as a pioneering ecosystem for building a Verifiable Internet for AI since its inception. As of 2025, OriginTrail's market capitalization has reached $274,501,052, with a circulating supply of approximately 499,546,955 TRACAI tokens, and a price hovering around $0.5495. This asset, hailed as the "trust layer for AI-driven knowledge," is playing an increasingly crucial role in combating misinformation and ensuring data integrity across various sectors.

This article will provide a comprehensive analysis of OriginTrail's price trends from 2025 to 2030, considering historical patterns, market dynamics, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. TRACAI Price History Review and Current Market Status

TRACAI Historical Price Evolution

- 2018: Initial launch, price started at $0.1

- 2024: Reached all-time high of $1.2354 on December 9

- 2025: Market cycle downturn, price dropped to all-time low of $0.2834 on June 22

TRACAI Current Market Situation

As of November 15, 2025, TRACAI is trading at $0.5495, experiencing a 4.93% decrease in the last 24 hours. The current price represents a significant recovery from its all-time low but remains well below its peak. TRACAI has shown volatility in recent periods, with a 14.49% decrease over the past week and a more substantial 28.1% decline over the last month. The yearly performance indicates a 26.93% decrease. Despite these short-term downtrends, TRACAI maintains a market cap of $274,501,052, ranking it 206th in the cryptocurrency market. The trading volume in the last 24 hours stands at $96,208, suggesting moderate market activity.

Click to view current TRACAI market price

TRACAI Market Sentiment Indicator

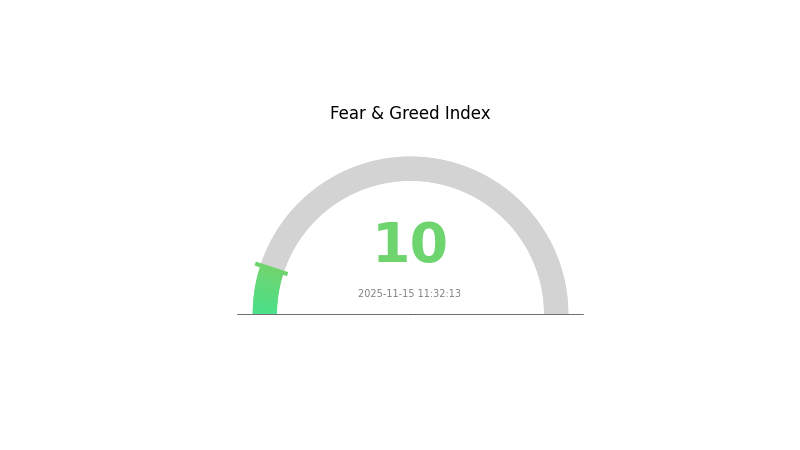

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiments can shift rapidly. For those considering entering the market, Gate.com offers a secure platform with a wide range of trading options. Always practice responsible investing and never risk more than you can afford to lose.

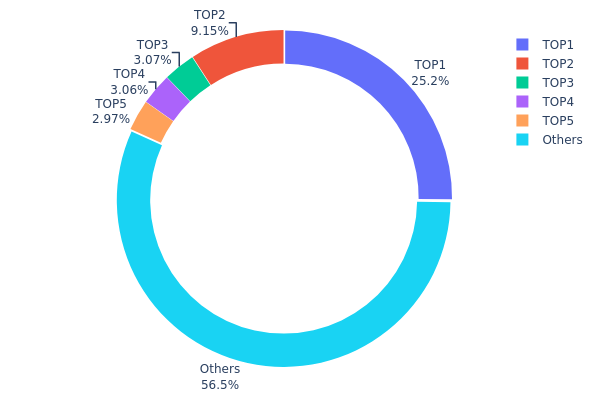

TRACAI Holdings Distribution

The address holdings distribution data for TRACAI reveals significant concentration among top holders. The largest address holds 25.19% of the total supply, while the top five addresses collectively control 43.44% of TRACAI tokens. This concentration level indicates a relatively centralized distribution pattern, which could have implications for market dynamics.

Such a concentration of holdings may potentially impact price volatility and liquidity. The presence of large holders, often referred to as "whales," can lead to sudden market movements if they decide to buy or sell substantial amounts. However, it's worth noting that 56.56% of the tokens are distributed among other addresses, suggesting a degree of wider participation in the TRACAI ecosystem.

This distribution structure reflects a moderate level of decentralization, though there is room for improvement. The significant holdings by top addresses could pose risks to market stability if not managed carefully. Investors and stakeholders should monitor these large holders' activities as they may have outsized influence on TRACAI's market behavior and future development.

Click to view the current TRACAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd803...b846a8 | 125969.50K | 25.19% |

| 2 | 0x88ad...655671 | 45771.96K | 9.15% |

| 3 | 0x3154...0f2c35 | 15364.58K | 3.07% |

| 4 | 0x5624...509283 | 15300.00K | 3.06% |

| 5 | 0xa8d8...9fe54a | 14856.14K | 2.97% |

| - | Others | 282737.82K | 56.56% |

II. Key Factors Affecting TRACAI's Future Price

Supply Mechanism

- Fixed Supply: TRACAI has a fixed total supply, which creates scarcity and potential upward pressure on price as demand increases.

- Historical Pattern: Limited supply has historically led to price appreciation during periods of increased adoption and demand.

- Current Impact: The fixed supply is expected to continue supporting price stability and potential growth as the project develops.

Macroeconomic Environment

- Inflation Hedging Properties: As a digital asset, TRACAI may be viewed as a potential hedge against inflation, similar to other cryptocurrencies.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could drive interest in alternative assets like TRACAI.

Technical Development and Ecosystem Building

- Ecosystem Applications: TRACAI is likely developing decentralized applications (DApps) and ecosystem projects to increase utility and adoption.

III. TRACAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.3888 - $0.5476

- Neutral prediction: $0.5476 - $0.6000

- Optimistic prediction: $0.6000 - $0.69545 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.55154 - $0.71003

- 2028: $0.63167 - $0.88031

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.77615 - $0.84989 (assuming steady market growth and adoption)

- Optimistic scenario: $0.92362 - $1.13885 (assuming strong market performance and widespread use)

- Transformative scenario: $1.13885+ (extreme favorable conditions such as major institutional adoption)

- 2030-12-31: TRACAI $1.13885 (potentially reaching new all-time high)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.69545 | 0.5476 | 0.3888 | 0 |

| 2026 | 0.64639 | 0.62153 | 0.59045 | 13 |

| 2027 | 0.71003 | 0.63396 | 0.55154 | 15 |

| 2028 | 0.88031 | 0.67199 | 0.63167 | 22 |

| 2029 | 0.92362 | 0.77615 | 0.71406 | 41 |

| 2030 | 1.13885 | 0.84989 | 0.46744 | 54 |

IV. TRACAI Professional Investment Strategies and Risk Management

TRACAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in AI and blockchain technology

- Operation suggestions:

- Accumulate TRACAI tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor AI industry news and OriginTrail partnerships

- Set stop-loss orders to manage downside risk

TRACAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TRACAI

TRACAI Market Risks

- Volatility: Cryptocurrency market is highly volatile

- Competition: Emerging AI projects may affect TRACAI's market position

- Adoption: Slow adoption of blockchain technology in AI industry

TRACAI Regulatory Risks

- Uncertain regulations: Evolving cryptocurrency regulations globally

- Data privacy concerns: Potential conflicts with data protection laws

- Cross-border restrictions: Limitations on international use of TRACAI

TRACAI Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Challenges in handling increased network load

- Interoperability: Integration difficulties with existing AI systems

VI. Conclusion and Action Recommendations

TRACAI Investment Value Assessment

TRACAI presents a unique value proposition in the AI-blockchain intersection, with long-term potential for growth. However, short-term volatility and regulatory uncertainties pose significant risks.

TRACAI Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market

✅ Experienced investors: Consider a balanced approach with strategic entry points

✅ Institutional investors: Conduct thorough due diligence and allocate based on risk tolerance

TRACAI Trading Participation Methods

- Spot trading: Buy and hold TRACAI tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi: Explore decentralized finance options involving TRACAI

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Trac Crypto have a future?

Yes, Trac Crypto has a promising future. With its innovative blockchain solutions and growing adoption in supply chain management, it's poised for significant growth and value appreciation in the coming years.

What is the price prediction for Trac in 2040?

Based on current trends and potential growth, Trac could reach $50-$100 by 2040, driven by increased adoption and technological advancements in the blockchain space.

How much will fetch AI cost in 2030?

Based on current trends and potential growth, Fetch AI could reach $5 to $10 per token by 2030, driven by increased adoption and advancements in AI technology.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

Share

Content