2025 STEEM Price Prediction: Bullish Trends and Key Factors Driving Growth

Introduction: STEEM's Market Position and Investment Value

Steem (STEEM), as an open-source blockchain protocol for storing social information, has made significant strides since its inception in 2016. As of 2025, Steem's market capitalization has reached $40,579,270, with a circulating supply of approximately 532,183,561 coins, and a price hovering around $0.07625. This asset, often hailed as the "social blockchain pioneer," is playing an increasingly crucial role in decentralized social media and content creation platforms.

This article will provide a comprehensive analysis of Steem's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. STEEM Price History Review and Current Market Status

STEEM Historical Price Evolution

- 2016: STEEM launched, price fluctuated around $0.6429

- 2018: Bull market peak, price reached all-time high of $8.19 on January 3rd

- 2025: Bear market, price dropped to all-time low of $0.069888 on November 5th

STEEM Current Market Situation

As of November 18, 2025, STEEM is trading at $0.07625, with a 24-hour trading volume of $28,469.22811. The token has experienced a 1.66% decrease in the past 24 hours. STEEM's market cap currently stands at $40,578,996.54, ranking it 630th in the cryptocurrency market. The circulating supply is 532,183,561.192 STEEM tokens, with a total supply of 532,187,152.542 STEEM. The token has seen significant volatility, with a 10.37% decrease in the past week and a 16.73% drop over the last month. Year-to-date, STEEM has lost 61.92% of its value.

Click to view current STEEM market price

STEEM Market Sentiment Indicator

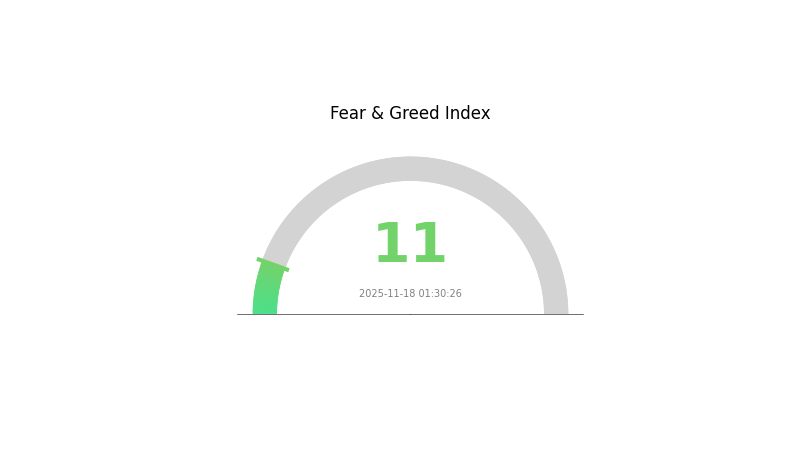

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to a mere 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com are closely monitoring STEEM's price action, looking for signs of a possible reversal. Remember, while fear can create opportunities, it's crucial to conduct thorough research and manage risk effectively in these uncertain times.

STEEM Holdings Distribution

The address holdings distribution data for STEEM is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Without specific data on top addresses and their holding quantities, it's challenging to assess the level of centralization or decentralization in STEEM's distribution.

In the absence of this crucial information, we cannot determine whether there's an excessive concentration of tokens in a few hands or if the distribution is relatively even across a broader range of addresses. This lack of data also prevents us from evaluating the potential impact on market structure, price volatility, or the possibility of market manipulation.

Given the importance of token distribution in understanding the overall health and stability of a cryptocurrency's ecosystem, the unavailability of this data for STEEM raises questions about transparency and may warrant further investigation. It's essential for investors and analysts to keep seeking updated information to make informed decisions about STEEM's market characteristics and on-chain structural stability.

Click to view the current STEEM holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting STEEM's Future Price

Supply Mechanism

- Inflation Rate: STEEM has an annual inflation rate that decreases over time.

- Historical Pattern: Past supply changes have influenced price movements, with reduced inflation generally supporting price stability.

- Current Impact: The ongoing reduction in inflation rate is expected to have a positive effect on STEEM's price in the long term.

Technical Development and Ecosystem Building

- Hive Fork: The Hive fork in 2020 significantly impacted STEEM's ecosystem and development direction.

- Ecosystem Applications: STEEM continues to support various decentralized applications (DApps) on its blockchain, including social media platforms and content creation tools.

III. STEEM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.06008 - $0.07605

- Neutral prediction: $0.07605 - $0.08632

- Optimistic prediction: $0.08632 - $0.09658 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.08287 - $0.13569

- 2028: $0.07596 - $0.14399

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.12868 - $0.15570 (assuming steady market growth)

- Optimistic scenario: $0.15570 - $0.18996 (assuming strong market performance)

- Transformative scenario: $0.18996 - $0.20000 (assuming breakthrough innovations)

- 2030-12-31: STEEM $0.18996 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09658 | 0.07605 | 0.06008 | 0 |

| 2026 | 0.09581 | 0.08632 | 0.06387 | 13 |

| 2027 | 0.13569 | 0.09106 | 0.08287 | 19 |

| 2028 | 0.14399 | 0.11337 | 0.07596 | 48 |

| 2029 | 0.18273 | 0.12868 | 0.10809 | 68 |

| 2030 | 0.18996 | 0.1557 | 0.14169 | 104 |

IV. STEEM Professional Investment Strategies and Risk Management

STEEM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate STEEM during market dips

- Stake STEEM to earn passive income

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- RSI (Relative Strength Index): Determine overbought/oversold conditions

- Key points for swing trading:

- Monitor social media sentiment and network activity

- Set strict stop-loss and take-profit levels

STEEM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Limit potential losses on STEEM positions

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for STEEM

STEEM Market Risks

- High volatility: STEEM price can experience significant fluctuations

- Competition: Other social media cryptocurrencies may gain market share

- Liquidity risk: Limited trading volume may affect price stability

STEEM Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter cryptocurrency regulations

- Tax implications: Evolving tax laws may impact STEEM transactions

- Platform content moderation: Regulatory pressure on social media content

STEEM Technical Risks

- Network security: Potential vulnerabilities in the blockchain infrastructure

- Scalability challenges: Handling increased transaction volume as the network grows

- Smart contract risks: Bugs or exploits in smart media tokens implementation

VI. Conclusion and Action Recommendations

STEEM Investment Value Assessment

STEEM offers long-term potential in the social media blockchain space but faces short-term volatility and competitive pressures. Its unique features and established community provide a solid foundation for growth, but investors should be prepared for significant price fluctuations.

STEEM Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the Steem ecosystem ✅ Experienced investors: Consider a balanced approach of staking and active trading ✅ Institutional investors: Evaluate STEEM as part of a diversified crypto portfolio

STEEM Trading Participation Methods

- Spot trading: Buy and sell STEEM on Gate.com

- Staking: Participate in the Steem network by powering up STEEM

- Content creation: Earn STEEM by contributing to Steem-based platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Steem in 2025?

Based on market analysis and current trends, Steem's price is predicted to reach around $2.50 to $3.00 by 2025, showing potential for significant growth in the coming years.

What will Stellar lumens be worth in 2025?

Based on market trends and adoption rates, Stellar Lumens (XLM) could potentially reach $1.50 to $2.00 by 2025, driven by increased blockchain integration and cross-border payment solutions.

Would hamster kombat coin reach $1?

It's unlikely for Hamster Kombat Coin to reach $1 in the near future, given its current market cap and circulating supply. However, with increased adoption and development, it could potentially reach higher price levels long-term.

How much is steem worth?

As of 2025-11-18, STEEM is worth approximately $2.50 per token. The price has shown steady growth over the past year, driven by increased adoption and platform developments.

Share

Content