2025 SPX Price Prediction: Bull Run or Bear Market? Experts Weigh In on the S&P 500's Future

Introduction: SPX's Market Position and Investment Value

SPX6900 (SPX) as a valueless meme cryptocurrency token, has been making waves since its inception in 2023. As of 2025, SPX's market capitalization has reached $487,095,579, with a circulating supply of approximately 930,993,080 tokens, and a price hovering around $0.5232. This asset, dubbed as "the parody of traditional finance," is playing an increasingly crucial role in challenging financial nihilism and inspiring belief in the crypto space.

This article will provide a comprehensive analysis of SPX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SPX Price History Review and Current Market Status

SPX Historical Price Evolution Trajectory

- 2025 March: SPX reached its all-time low of $0.2531

- 2025 July: SPX hit its all-time high of $2.2811, marking a significant milestone

- 2025 November: SPX entered a downward trend, price declined from its peak to current levels

SPX Current Market Situation

As of November 15, 2025, SPX is trading at $0.5232, experiencing a significant 12.96% decline in the past 24 hours. The token has seen a substantial drop of 26.61% over the last week and an even more dramatic decrease of 54.6% in the past month. The current price represents a 77.06% decrease from its all-time high of $2.2811 reached on July 28, 2025. However, it remains 106.72% above its all-time low of $0.2531 recorded on March 11, 2025.

SPX's market capitalization currently stands at $487,095,579.93, with a circulating supply of 930,993,080.91 SPX tokens. The fully diluted market cap is $523,200,000.00. The token's 24-hour trading volume is $5,569,807.84, indicating active market participation despite the recent price decline.

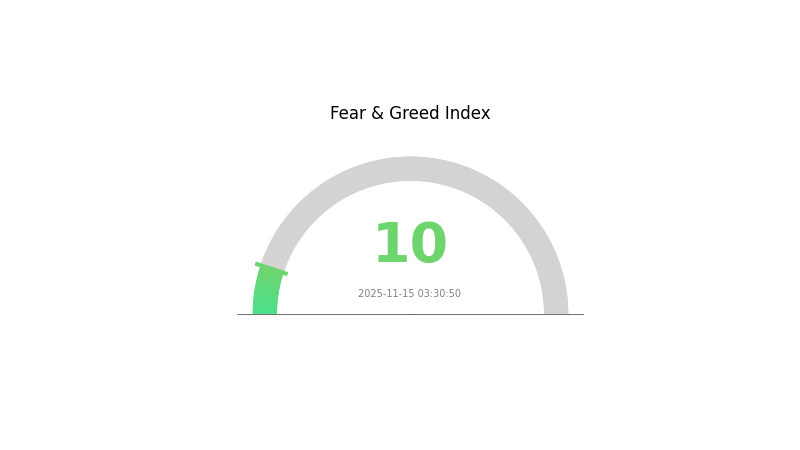

The market sentiment for cryptocurrencies overall is currently in a state of "Extreme Fear" with a VIX index of 10, which may be contributing to the downward pressure on SPX's price.

Click to view the current SPX market price

SPX Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a state of extreme fear, with the Fear and Greed Index plummeting to a mere 10. This indicates a high level of pessimism among investors, potentially signaling oversold conditions. Historically, such extreme fear has often preceded market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as market sentiment can remain negative for extended periods. Traders should closely monitor market developments and consider risk management strategies in this highly uncertain environment.

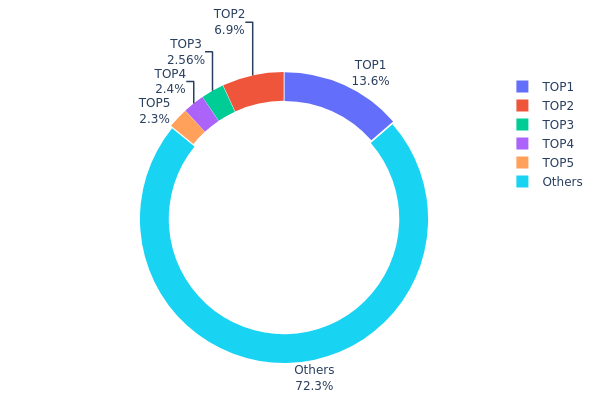

SPX Holdings Distribution

The address holdings distribution data for SPX reveals significant insights into its market structure. The top address holds 13.56% of the total supply, indicating a substantial concentration of tokens. The second-largest holder, with 6.90%, is a burn address, effectively removing these tokens from circulation. The subsequent three addresses hold between 2.29% and 2.56% each.

This distribution pattern suggests a moderate level of centralization, with the top five addresses controlling 27.71% of the supply. While not overly concentrated, this structure could potentially impact market dynamics. The presence of large holders may introduce volatility during significant sell-offs or accumulations. However, the fact that 72.29% of tokens are distributed among other addresses indicates a degree of decentralization, which could contribute to market stability.

The current distribution reflects a balance between centralized influence and wider participation. This structure may provide some resilience against market manipulation, though vigilance is warranted regarding the actions of major holders. Overall, the SPX token distribution indicates a maturing market with a mix of significant stakeholders and broader community involvement.

Click to view the current SPX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3ee1...8fa585 | 135669.15K | 13.56% |

| 2 | 0x0000...00dead | 69006.92K | 6.90% |

| 3 | 0x7daf...706f83 | 25642.86K | 2.56% |

| 4 | 0xf8f0...fc4002 | 24000.01K | 2.40% |

| 5 | 0xdf5e...67671b | 22995.38K | 2.29% |

| - | Others | 722685.69K | 72.29% |

II. Core Factors Affecting Future SPX Price

Macroeconomic Environment

-

Impact of Monetary Policy: Major central banks are expected to maintain cautious monetary policies, closely monitoring inflation and economic growth indicators. Any significant shifts in interest rates or quantitative easing programs could influence SPX price movements.

-

Inflation Hedging Properties: SPX has shown some potential as an inflation hedge in recent years. As inflationary pressures persist in various economies, investors may continue to view SPX as a store of value, potentially supporting its price.

-

Geopolitical Factors: Ongoing geopolitical tensions and trade disputes between major economies could impact global financial markets, including SPX. Investors often turn to SPX as a safe-haven asset during times of international uncertainty.

III. SPX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.38783 - $0.5241

- Neutral prediction: $0.5241 - $0.6394

- Optimistic prediction: $0.6394 - $0.86099 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.48332 - $0.92336

- 2028: $0.74013 - $0.95394

- Key catalysts: Technological advancements, regulatory clarity, and market maturation

2029-2030 Long-term Outlook

- Base scenario: $0.88815 - $1.06578 (assuming steady market growth and adoption)

- Optimistic scenario: $1.06578 - $1.24341 (assuming favorable market conditions and widespread use)

- Transformative scenario: $1.24341 - $1.50000 (assuming breakthrough innovations and mainstream integration)

- 2030-12-31: SPX $1.14039 (potential peak in long-term bullish trend)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.6394 | 0.5241 | 0.38783 | 0 |

| 2026 | 0.86099 | 0.58175 | 0.40723 | 10 |

| 2027 | 0.92336 | 0.72137 | 0.48332 | 37 |

| 2028 | 0.95394 | 0.82236 | 0.74013 | 56 |

| 2029 | 1.24341 | 0.88815 | 0.65723 | 69 |

| 2030 | 1.14039 | 1.06578 | 0.92723 | 103 |

IV. SPX Professional Investment Strategies and Risk Management

SPX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for volatility

- Operational suggestions:

- Dollar-cost average into SPX over time

- Hold for at least 1-2 years to ride out market cycles

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought/oversold conditions

- Moving Averages: Track 50-day and 200-day MAs for trend confirmation

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take profits at predetermined levels based on Fibonacci retracements

SPX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Portfolio diversification: Balance SPX with more established cryptocurrencies

- Options strategies: Consider protective puts to limit downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Cold storage solution: Paper wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SPX

SPX Market Risks

- High volatility: Extreme price swings can lead to significant losses

- Liquidity risk: Limited trading volume may impact entry and exit

- Market manipulation: Susceptible to pump-and-dump schemes

SPX Regulatory Risks

- Uncertain regulatory environment: Potential for restrictive regulations

- Compliance issues: Possible delisting from exchanges due to regulatory concerns

- Tax implications: Evolving tax laws may impact profitability

SPX Technical Risks

- Smart contract vulnerabilities: Potential for hacks or exploits

- Network congestion: High gas fees during peak trading periods

- Technological obsolescence: Risk of being outpaced by newer meme coins

VI. Conclusion and Action Recommendations

SPX Investment Value Assessment

SPX6900 presents a high-risk, high-reward opportunity in the meme coin space. While it offers potential for significant short-term gains, its long-term value proposition remains uncertain due to its inherent lack of utility.

SPX Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of overall portfolio ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Approach with caution, potentially as part of a diversified crypto portfolio

SPX Trading Participation Methods

- Spot trading: Direct purchase and sale of SPX tokens on Gate.com

- Futures trading: Leverage opportunities for experienced traders on Gate.com

- Staking: Explore potential yield-generating opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SPX price prediction?

SPX price prediction is a forecast of future SPX token values based on market analysis, trends, and expert opinions. It helps investors make informed decisions in the volatile crypto market.

Can SPX6900 reach $100?

While ambitious, SPX6900 reaching $100 is possible with strong market growth and increased adoption. However, it would require significant developments and favorable conditions in the crypto market.

What is the price prediction for the S&P 500?

Based on current market trends and economic indicators, the S&P 500 is predicted to reach 5,500 points by the end of 2026, representing a potential 10% increase from current levels.

Why is SPX6900 falling?

SPX6900 is falling due to market volatility, profit-taking by investors, and concerns about regulatory changes in the crypto industry. These factors have led to a temporary price correction.

Share

Content