2025 SATS Price Prediction: Will Bitcoin's Smallest Unit Reach $0.01 Amid Growing Adoption?

Introduction: SATS Market Position and Investment Value

SATS (SATS), as a BRC-20 token, has been making waves in the cryptocurrency market since its inception. As of 2025, SATS has reached a market capitalization of $39,774,000, with a circulating supply of 2,100,000,000,000,000 tokens and a price hovering around $0.00000001894. This asset, often referred to as "the smallest unit of Bitcoin," is playing an increasingly crucial role in the Bitcoin ecosystem and micropayments.

This article will comprehensively analyze SATS price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SATS Price History Review and Current Market Status

SATS Historical Price Evolution

- 2023: SATS launched, reaching an all-time high of $0.000000941 on December 15, 2023

- 2024: Market volatility, price fluctuated between highs and lows

- 2025: Bearish trend, price dropped to an all-time low of $0.00000000638 on October 10, 2025

SATS Current Market Situation

As of November 18, 2025, SATS is trading at $0.00000001894, experiencing a 2.26% decrease in the last 24 hours. The token has a market capitalization of $39,774,000, ranking 634th in the cryptocurrency market. SATS has seen significant price declines across various timeframes, with a 17.69% drop in the past week and a 20.45% decrease over the last month. The most drastic decline is observed in the yearly performance, with a 92.11% decrease from the previous year.

The current trading volume for SATS stands at $292,159.27, indicating moderate market activity. The token's circulating supply matches its total and maximum supply at 2,100,000,000,000,000 SATS, suggesting no further token issuance is planned.

Despite the recent downtrend, SATS maintains a 100% circulating supply ratio, which could be seen as a positive aspect in terms of token distribution. However, the current price is significantly below its all-time high, reflecting the challenging market conditions faced by many cryptocurrencies in recent times.

Click to view the current SATS market price

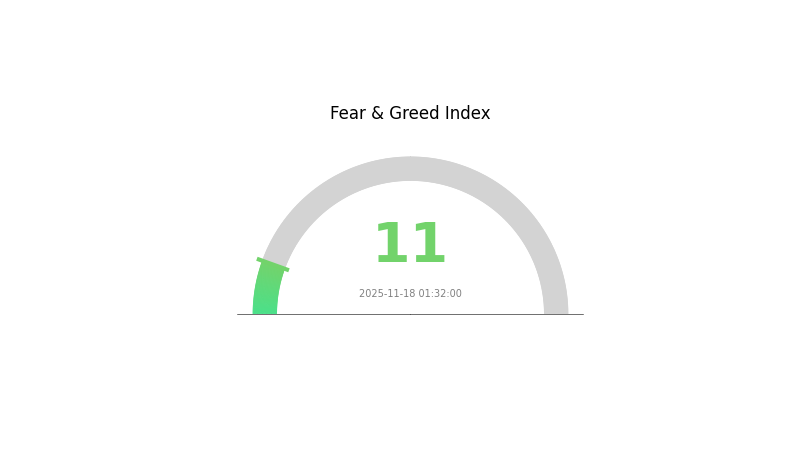

SATS Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 11. This indicates a high level of uncertainty and pessimism among investors. Such extreme fear often presents potential buying opportunities for contrarian investors, as assets may be undervalued. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to manage risk in these volatile times.

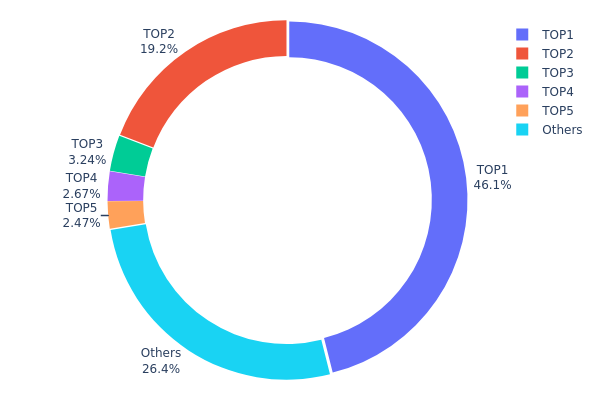

SATS Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for SATS. The top address holds a staggering 46.07% of the total supply, while the second-largest address controls 19.18%. Together, these two addresses account for over 65% of all SATS tokens, indicating an extremely centralized distribution.

This level of concentration raises concerns about market stability and potential price manipulation. With such a significant portion of tokens held by a few addresses, large sell-offs could lead to extreme volatility. Moreover, the top holders may have disproportionate influence over the token's governance and future development.

Despite the presence of numerous smaller holders, as evidenced by the 26.39% held by "Others," the current distribution suggests a low degree of decentralization. This concentration could impact SATS' long-term sustainability and may deter potential investors concerned about market fairness and resilience.

Click to view the current SATS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | bc1p8w...a8p0k6 | 967676769384.04K | 46.07% |

| 2 | bc1qgg...l9t85q | 402841653528.67K | 19.18% |

| 3 | bc1qn2...fmmrq2 | 68084860391.69K | 3.24% |

| 4 | 16G1xY...Vp9Wxh | 56027643353.03K | 2.66% |

| 5 | bc1qm6...nmyzcx | 51813398915.94K | 2.46% |

| - | Others | 553555674426.63K | 26.39% |

II. Key Factors Affecting SATS Future Price

Supply Mechanism

- Halving: Bitcoin's supply issuance halves approximately every four years, reducing the rate of new coin creation.

- Historical Pattern: Previous halvings have historically been followed by significant price increases in the months and years after the event.

- Current Impact: The next halving is expected to occur in 2024, which could potentially lead to increased scarcity and upward price pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and corporations have been increasing their Bitcoin holdings, viewing it as a digital store of value.

- Corporate Adoption: Companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, setting a precedent for corporate treasury management.

- National Policies: El Salvador's adoption of Bitcoin as legal tender has set a precedent, while other countries are exploring various regulatory approaches.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' monetary policies, especially those of the Federal Reserve, can influence Bitcoin's attractiveness as an alternative asset.

- Inflation Hedge Properties: Bitcoin is often viewed as a hedge against inflation, potentially benefiting from periods of high inflation or currency devaluation.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions can drive interest in Bitcoin as a non-sovereign store of value.

Technical Development and Ecosystem Building

- Lightning Network: The continued development and adoption of the Lightning Network could improve Bitcoin's scalability and transaction speed.

- Taproot Upgrade: This upgrade enhances Bitcoin's privacy and smart contract capabilities, potentially expanding its use cases.

- Ecosystem Applications: The growth of Bitcoin-native DeFi protocols and layer-2 solutions are expanding the utility of the Bitcoin network.

III. SATS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00028 - $0.00030

- Neutral prediction: $0.00030 - $0.00032

- Optimistic prediction: $0.00032 - $0.00034 (requires continued Bitcoin adoption and favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase with increasing institutional adoption

- Price range forecast:

- 2027: $0.00039 - $0.00042

- 2028: $0.00044 - $0.00047

- Key catalysts: Halving event, increased regulatory clarity, and mainstream acceptance of Bitcoin

2029-2030 Long-term Outlook

- Base scenario: $0.00047 - $0.00051 (assuming steady growth in Bitcoin ecosystem)

- Optimistic scenario: $0.00051 - $0.00055 (with accelerated global adoption and favorable regulatory environment)

- Transformative scenario: $0.00055 - $0.00060 (with major institutional investment and widespread use as a global reserve asset)

- 2030-12-31: SATS $0.00060 (potential peak if extremely favorable conditions persist)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 12 |

| 2027 | 0 | 0 | 0 | 32 |

| 2028 | 0 | 0 | 0 | 46 |

| 2029 | 0 | 0 | 0 | 49 |

| 2030 | 0 | 0 | 0 | 60 |

IV. Professional Investment Strategies and Risk Management for SATS

SATS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term Bitcoin believers and BRC-20 enthusiasts

- Operation suggestions:

- Accumulate SATS during market dips

- Hold for potential long-term appreciation

- Store in secure Bitcoin-compatible wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor Bitcoin price movements closely

- Pay attention to BRC-20 market sentiment

SATS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance SATS with other crypto assets

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets supporting BRC-20 tokens

- Security precautions: Always verify transactions and use strong passwords

V. Potential Risks and Challenges for SATS

SATS Market Risks

- High volatility: Price can fluctuate dramatically

- Liquidity risk: Limited trading volume may affect price stability

- Correlation with Bitcoin: SATS price heavily influenced by BTC movements

SATS Regulatory Risks

- Uncertain regulatory status: BRC-20 tokens may face regulatory scrutiny

- Potential trading restrictions: Some jurisdictions may limit BRC-20 trading

- Tax implications: Unclear tax treatment in many countries

SATS Technical Risks

- Smart contract vulnerabilities: Potential issues with the BRC-20 standard

- Scalability concerns: Bitcoin network congestion may affect SATS transfers

- Wallet compatibility: Not all Bitcoin wallets support BRC-20 tokens

VI. Conclusion and Action Recommendations

SATS Investment Value Assessment

SATS represents a speculative investment in the BRC-20 ecosystem on Bitcoin. While it offers potential for high returns, it also carries significant risks due to its experimental nature and dependence on Bitcoin's performance.

SATS Investment Recommendations

✅ Beginners: Limit exposure, focus on education about BRC-20 tokens ✅ Experienced investors: Consider small allocations as part of a diversified crypto portfolio ✅ Institutional investors: Approach with caution, conduct thorough due diligence

SATS Trading Participation Methods

- Spot trading: Buy and sell SATS on supported exchanges

- DeFi platforms: Explore emerging BRC-20 DeFi protocols (with caution)

- OTC markets: Consider for large volume trades

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can sats coin reach $1 dollar?

It's highly unlikely for sats to reach $1. As sats are fractions of Bitcoin, for 1 sat to equal $1, Bitcoin's price would need to be around $100 million, which is unrealistic in the foreseeable future.

Are SATs a good investment?

Yes, SATs are considered a promising investment in 2025. As Bitcoin's smallest unit, they offer affordable exposure to the leading cryptocurrency, with potential for significant growth as adoption increases.

What is the target price for sats in 2025?

Based on current market trends and expert predictions, the target price for sats in 2025 is expected to be around $0.01 to $0.015 per sat.

How much is satoshi worth in 2030?

Based on current trends and expert predictions, a satoshi could be worth around $0.01 to $0.05 by 2030, assuming Bitcoin reaches $1 million to $5 million per coin.

Share

Content