2025 RPL Price Prediction: Rocket Pool's Token Set to Soar in the DeFi Landscape

Introduction: RPL's Market Position and Investment Value

Rocket Pool (RPL) as a decentralized Ethereum staking protocol has made significant strides since its inception. As of 2025, Rocket Pool's market capitalization has reached $65,217,355, with a circulating supply of approximately 21,870,340 tokens, and a price hovering around $2.982. This asset, often referred to as the "democratizer of Ethereum staking," is playing an increasingly crucial role in the Ethereum 2.0 ecosystem and decentralized finance (DeFi) sector.

This article will provide a comprehensive analysis of Rocket Pool's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RPL Price History Review and Current Market Status

RPL Historical Price Evolution Trajectory

- 2018: Initial launch, price reached all-time low of $0.00884718 on August 28

- 2023: Market peak, price hit all-time high of $61.9 on April 17

- 2025: Market downturn, price declined from high to current $2.982

RPL Current Market Situation

As of November 17, 2025, RPL is trading at $2.982, experiencing a 3.15% decrease in the last 24 hours. The token's market capitalization stands at $65,217,355, ranking it 475th in the global cryptocurrency market. RPL has seen significant volatility over the past year, with a 71.02% decline in price. The 7-day and 30-day price changes show decreases of 13.42% and 12.17% respectively, indicating a bearish short-term trend. The current price is 95.18% below its all-time high, suggesting a prolonged bearish market phase. Trading volume in the past 24 hours is $15,112.92, reflecting moderate market activity.

Click to view the current RPL market price

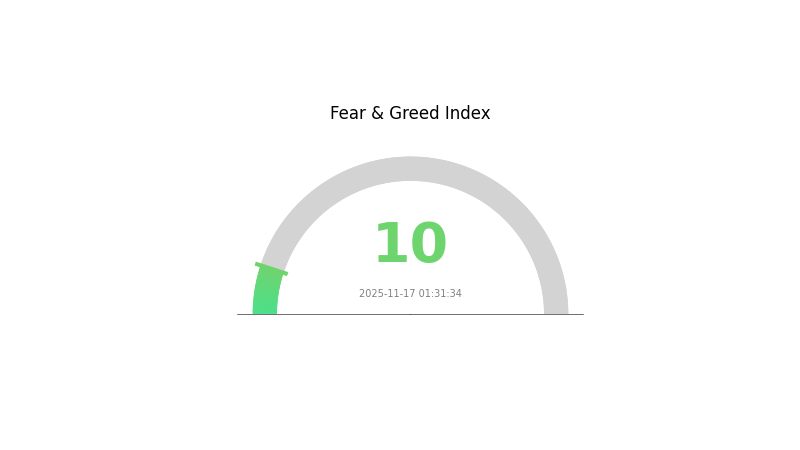

RPL Market Sentiment Indicator

2025-11-17 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 10. This indicates a highly pessimistic outlook among investors. During such periods, opportunities may arise for contrarian investors willing to buy when others are fearful. However, caution is advised as market volatility could persist. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly in the crypto space.

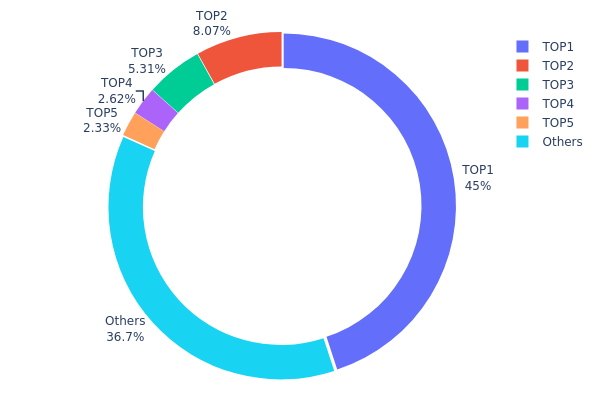

RPL Holdings Distribution

The address holdings distribution data for RPL reveals a highly concentrated ownership structure. The top address holds a staggering 44.97% of the total supply, with 9,835,690 RPL tokens. This is followed by four other significant holders, collectively accounting for an additional 18.31% of the supply. The remaining 36.72% is distributed among other addresses.

This concentration pattern raises concerns about the centralization of RPL ownership. With nearly half of the supply controlled by a single address, there is a potential for significant market influence. The top five addresses together hold 63.28% of all tokens, indicating a high degree of centralization. This concentration could lead to increased volatility and susceptibility to price manipulation, as large holders have the capacity to impact market dynamics substantially.

The current distribution suggests a relatively low level of decentralization for RPL, which may affect its on-chain stability and resistance to market shocks. While a certain degree of concentration is not uncommon in cryptocurrency markets, the extent observed here warrants careful consideration by market participants and analysts when assessing RPL's market structure and potential future movements.

Click to view the current RPL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3bdc...b469d6 | 9835.69K | 44.97% |

| 2 | 0xd335...21a51f | 1764.47K | 8.06% |

| 3 | 0x5775...647806 | 1161.82K | 5.31% |

| 4 | 0x07a9...51daaa | 573.91K | 2.62% |

| 5 | 0xfce7...b24a96 | 509.54K | 2.32% |

| - | Others | 8024.91K | 36.72% |

II. Key Factors Affecting RPL's Future Price

Technical Development and Ecosystem Building

- Rocket Pool v2: Upgrade aimed at improving scalability and efficiency of the Rocket Pool network.

- Ecosystem applications: Continued development of DApps and projects within the Rocket Pool ecosystem, enhancing utility and adoption of RPL.

III. RPL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $2.61 - $2.80

- Neutral prediction: $2.80 - $3.00

- Optimistic prediction: $3.00 - $3.21 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $2.27 - $4.02

- 2028: $3.04 - $4.51

- Key catalysts: Increased adoption of RPL in DeFi ecosystems, overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $4.13 - $4.81 (assuming steady market growth)

- Optimistic scenario: $4.81 - $5.49 (assuming strong RPL ecosystem expansion)

- Transformative scenario: $5.49 - $6.00 (extreme favorable conditions such as mass adoption)

- 2030-12-31: RPL $4.8132 (61% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.21084 | 2.973 | 2.61624 | 0 |

| 2026 | 3.89582 | 3.09192 | 2.34986 | 3 |

| 2027 | 4.01795 | 3.49387 | 2.27102 | 17 |

| 2028 | 4.50709 | 3.75591 | 3.04229 | 25 |

| 2029 | 5.4949 | 4.1315 | 2.85074 | 38 |

| 2030 | 5.15012 | 4.8132 | 2.50286 | 61 |

IV. RPL Professional Investment Strategies and Risk Management

RPL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and Ethereum ecosystem supporters

- Operational suggestions:

- Accumulate RPL during market dips

- Stake RPL to participate in network security and earn rewards

- Store in non-custodial wallets for enhanced security

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor Ethereum network upgrades and their impact on RPL

- Pay attention to overall crypto market sentiment

RPL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for RPL

RPL Market Risks

- High volatility: Cryptocurrency markets can experience extreme price swings

- Correlation with Ethereum: RPL's performance is closely tied to Ethereum's success

- Competition: Other staking solutions may impact RPL's market share

RPL Regulatory Risks

- Uncertain regulatory landscape: Crypto regulations are evolving globally

- Staking classification: Potential regulatory scrutiny on staking rewards

- Cross-border compliance: Varying regulations across different jurisdictions

RPL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scaling challenges: Ethereum network congestion may affect RPL's performance

- Validator slashing: Risk of losing staked assets due to protocol violations

VI. Conclusion and Action Recommendations

RPL Investment Value Assessment

RPL offers long-term potential as an integral part of Ethereum's staking ecosystem. However, short-term volatility and regulatory uncertainties pose significant risks.

RPL Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider a balanced approach with regular DCA ✅ Institutional investors: Conduct thorough due diligence and implement robust risk management

RPL Participation Methods

- Direct purchase: Buy RPL on Gate.com

- Staking: Participate in the Rocket Pool network to earn rewards

- Node operation: Run a Rocket Pool node for more active involvement

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for RPL coin in 2030?

Based on market trends and potential growth, RPL coin could reach $500-$600 by 2030, driven by increased adoption of the Rocket Pool network and overall crypto market expansion.

Does Rocket Pool have a future?

Yes, Rocket Pool has a promising future. As Ethereum's staking ecosystem grows, Rocket Pool's decentralized staking solution is likely to gain more adoption, potentially increasing RPL's value and utility in the coming years.

Will XRP reach $500 by end of 2025?

It's highly unlikely for XRP to reach $500 by the end of 2025. While XRP has potential for growth, such a massive price increase would require unprecedented market conditions and adoption.

Will pi coin reach $100?

It's highly unlikely for Pi coin to reach $100. Given its large supply and current market trends, a more realistic long-term price target might be in the range of $0.01 to $1.

Share

Content