2025 REI Price Prediction: Analyzing Growth Potential and Market Trends for Real Estate Investment Trust Assets

Introduction: REI's Market Position and Investment Value

REI Network (REI), as a new application-level public chain compatible with Ethereum EVM, has achieved significant progress since its inception in 2022. As of 2025, REI's market capitalization has reached $15.68 million, with a circulating supply of approximately 980,801,696 tokens, and a price hovering around $0.015983. This asset, known as a "lightweight and free blockchain solution," is playing an increasingly crucial role in supporting enterprises and developers in the blockchain space.

This article will provide a comprehensive analysis of REI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. REI Price History Review and Current Market Status

REI Historical Price Evolution

- 2024: REI reached its all-time high of $0.354607 on March 29, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with REI hitting its all-time low of $0.01341598 on June 23.

- 2025: As of October, REI has shown signs of recovery, with the price stabilizing around $0.015983.

REI Current Market Situation

REI is currently trading at $0.015983, with a 24-hour trading volume of $18,757.96. The token has seen a 2.37% increase in the last 24 hours, indicating a short-term positive momentum. However, looking at the broader picture, REI has experienced a significant decline of 71.54% over the past year.

The current market capitalization of REI stands at $15,676,153.51, ranking it 1223rd in the cryptocurrency market. With a circulating supply of 980,801,696 REI tokens and a maximum supply of 1,000,000,000, the project has a circulating ratio of 98.08%.

Despite the recent positive 24-hour performance, REI has shown mixed results across different timeframes. While it has gained 6.11% in the past week, it has declined by 1.08% over the last 30 days. This suggests that the token is experiencing some volatility and may be in a period of price discovery.

Click to view the current REI market price

REI Market Sentiment Indicator

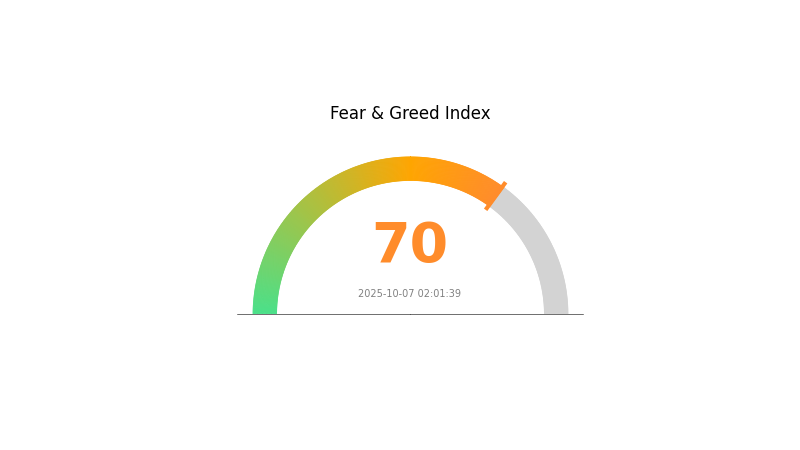

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance, with the Fear and Greed Index hitting 70, indicating a state of greed. This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, it's crucial to remain cautious as extreme greed often precedes market corrections. Savvy traders might consider taking profits or hedging positions. Remember, market sentiment can shift rapidly, so stay informed and manage your risk wisely on Gate.com.

REI Holdings Distribution

The address holdings distribution for REI reveals an interesting pattern in token concentration. Based on the provided data, there appears to be no significant concentration of tokens in a small number of addresses, suggesting a relatively decentralized distribution.

This distribution pattern indicates a healthy market structure for REI, with a lower risk of price manipulation by large token holders. The absence of dominant addresses holding a disproportionate amount of tokens suggests that the market is less susceptible to sudden price swings caused by the actions of a few major players. This distributed ownership structure may contribute to greater price stability and more organic market movements driven by a broader base of participants.

Overall, the current address distribution reflects a positive aspect of REI's market characteristics, indicating a good level of decentralization and on-chain structural stability. This distribution pattern aligns well with the principles of decentralized finance and may be viewed favorably by investors and market analysts.

Click to view the current REI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing REI's Future Price

Supply Mechanism

- Circulating Supply: The circulating supply is a crucial indicator that helps understand the current availability of REI tokens in the market. This, combined with demand, can significantly influence the price.

- Historical Pattern: The circulating supply has historically been an important factor in assessing REI Network's market capitalization.

- Current Impact: Investors are closely monitoring the circulating supply as it directly affects the market capitalization and, consequently, the price of REI.

Institutional and Whale Dynamics

- Institutional Holdings: While specific information about institutional holdings is not provided, the growing interest in ESG factors among investors suggests that institutional investors may be considering REI as part of their portfolios.

Macroeconomic Environment

- Inflation Hedging Properties: As with many cryptocurrencies, REI may be viewed as a potential hedge against inflation, although specific performance data in inflationary environments is not provided.

Technical Development and Ecosystem Building

- Partnership with Infini Card: REI Network has announced a collaboration with Infini Card to launch a co-branded payment product. This partnership could potentially expand REI's use cases and adoption.

- Ecosystem Applications: The development of decentralized applications (DApps) and other ecosystem projects could play a significant role in REI's future value, although specific details are not provided in the given context.

III. REI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0152 - $0.016

- Neutral prediction: $0.016 - $0.017

- Optimistic prediction: $0.017 - $0.01712 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01433 - $0.02336

- 2028: $0.01475 - $0.02566

- Key catalysts: Increased adoption and market expansion

2030 Long-term Outlook

- Base scenario: $0.02351 - $0.02738 (assuming steady market growth)

- Optimistic scenario: $0.02738 - $0.03127 (assuming strong market performance)

- Transformative scenario: $0.03127 - $0.03500 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: REI $0.03127 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01712 | 0.016 | 0.0152 | 0 |

| 2026 | 0.01755 | 0.01656 | 0.01474 | 3 |

| 2027 | 0.02336 | 0.01705 | 0.01433 | 6 |

| 2028 | 0.02566 | 0.02021 | 0.01475 | 26 |

| 2029 | 0.02408 | 0.02294 | 0.01537 | 43 |

| 2030 | 0.03127 | 0.02351 | 0.01716 | 47 |

IV. Professional Investment Strategies and Risk Management for REI

REI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operational suggestions:

- Dollar-cost average into REI over time

- Hold for at least 3-5 years to ride out market volatility

- Store REI in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50 and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take partial profits on significant price surges

REI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for REI

REI Market Risks

- High volatility: REI price can experience significant swings

- Limited liquidity: May face challenges in executing large trades

- Competition: Other blockchain platforms may outperform REI

REI Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations

- Cross-border compliance: Varying regulations across jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrencies

REI Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues with network congestion

- Technological obsolescence: Rapid advancements in blockchain tech

VI. Conclusion and Action Recommendations

REI Investment Value Assessment

REI offers potential long-term value as an innovative blockchain platform, but faces short-term risks due to market volatility and technological uncertainties.

REI Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider a moderate allocation with active risk management ✅ Institutional investors: Conduct thorough due diligence and consider REI as part of a diversified crypto portfolio

REI Trading Participation Methods

- Spot trading: Buy and sell REI on Gate.com's spot market

- staking: Participate in REI staking programs if available

- DeFi: Explore decentralized finance opportunities within the REI ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is REI stock a good buy now?

Yes, REI stock appears to be a good buy now. It's trading slightly above forecast but may still be undervalued, aligning with current market trends.

What is the future of REI coin?

REI coin's future looks promising, with potential for significant growth. Market trends indicate continued interest and predictions suggest substantial gains in value.

What is the stock price prediction for Repare Therapeutics in 2025?

Repare Therapeutics' stock price is predicted to average $11.19 in 2025, with a potential range from $0.2699 to $22.12.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $139,045 by 2025. The current price is around $124,798.

Share

Content