2025 RARI Fiyat Tahmini: Rarible'ın yerel token'ının büyüme potansiyeli ve piyasa dinamiklerinin analizi

Giriş: RARI'nin Piyasadaki Konumu ve Yatırım Değeri

Rarible (RARI), blokzincir üzerinde ticaretin temel altyapısı olarak 2020 yılındaki kuruluşundan bu yana önemli gelişmeler kaydetmiştir. 2025 yılı itibarıyla RARI’nin piyasa değeri 15.601.128 dolar seviyesine ulaşırken, dolaşımdaki yaklaşık 18.121.882 token ile fiyatı 0,8609 dolar civarında seyretmektedir. Genellikle “NFT pazar yeri yönetim token’ı” olarak anılan bu varlık, merkeziyetsiz dijital varlık ekosisteminde giderek daha büyük bir rol üstlenmektedir.

Bu makalede, RARI’nin 2025-2030 dönemi fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde analiz edilmekte, yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulmaktadır.

I. RARI Fiyat Geçmişi ve Güncel Piyasa Durumu

RARI Tarihsel Fiyat Gelişimi

- 2020: RARI piyasaya sürüldü, açılış fiyatı 0,515277 dolar

- 2021: 30 Mart’ta tüm zamanların en yüksek seviyesi olan 46,7 dolara ulaştı

- 2022-2025: Piyasa döngüleri ile fiyat zirveden mevcut 0,8609 dolar seviyesine geriledi

RARI Güncel Piyasa Durumu

6 Ekim 2025 itibarıyla RARI 0,8609 dolardan işlem görmektedir. 24 saatlik işlem hacmi 10.385,63 dolar, günlük fiyat artışı %0,98’dir. Güncel piyasa değeri 15.601.128,44 dolar olup, RARI kripto piyasasında 1.206. sırada yer almaktadır. Dolaşımdaki arz 18.121.882,26 token olup, bu rakam maksimum arzın %72,46’sıdır (25.009.450,31 token). Token, tüm zamanların en yüksek seviyesinden bu yana ciddi değer kaybedip şu anda zirve fiyatının %98,16 altında işlem görmektedir. Son kazançlara rağmen, uzun vadeli kayıplar derinleşmiştir; son 30 günde %11,12 gerileme, son bir yılda ise %56,83 düşüş yaşanmıştır.

Güncel RARI piyasa fiyatını görüntülemek için tıklayın

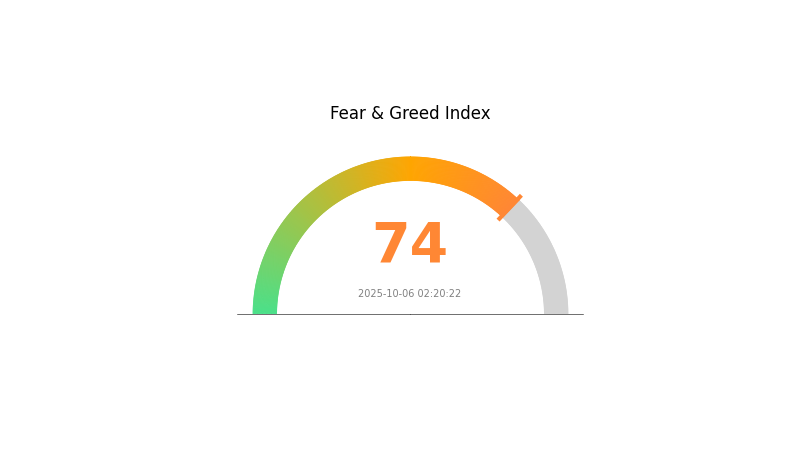

RARI Piyasa Duyarlılık Göstergesi

2025-10-06 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında açgözlülük göstergeleri güçleniyor; Korku ve Açgözlülük Endeksi 74 seviyesine ulaşmış durumda. Bu, yatırımcıların daha iyimser olduğunu ve fiyatlarda yükseliş beklentisinin arttığını gösteriyor. Ancak, aşırı açgözlülük genellikle piyasa düzeltmesine işaret eder. Yatırımcılar temkinli olmalı, kâr almayı veya risk yönetim stratejilerini devreye almayı değerlendirmelidir. Piyasa duyarlılığı hızla değişebileceğinden, güncel kalmak ve işlem stratejinizi dinamik tutmak önemlidir.

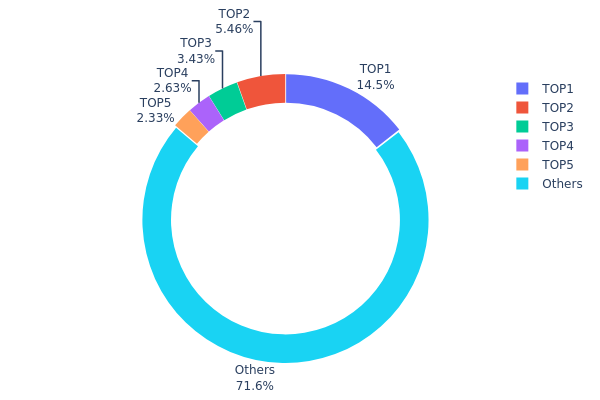

RARI Varlık Dağılımı

Adres bazlı varlık dağılımı, RARI token’larının farklı cüzdanlar arasında nasıl paylaştırıldığını gösterir. Analiz, ilk 5 adresin toplam arzın %28,34’ünü elinde bulundurduğunu ortaya koyuyor; en büyük sahip %14,51 paya sahip ve bu oran dikkate değer olsa da baskın değildir.

Bu dağılım, RARI için dengeli bir piyasa yapısını işaret ediyor. Üst sıralardaki sahiplerde belli bir yoğunlaşma olsa da token’ların %71,66’sı diğer adreslere yayılmış durumdadır; bu da makul bir merkeziyetsizlik seviyesi sunar. Yine de, büyük sahiplerin varlığı, işlemlerine bağlı olarak fiyat oynaklığına veya piyasa duyarlılığına etki edebilir.

Mevcut RARI adres dağılımı, zincir seviyesinde istikrarlı ve orta derecede merkeziyetsiz bir piyasayı yansıtmaktadır. Büyük sahipler etkili olsa da, geniş dağılım ekosistemin çeşitliliği ve dirençliliğine katkı sağlar.

Güncel RARI varlık dağılımı için tıklayın

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7e9c...42cbc5 | 3.628,27K | 14,51% |

| 2 | 0x47e3...7f139c | 1.364,22K | 5,45% |

| 3 | 0x453f...5cdcfd | 858,69K | 3,43% |

| 4 | 0x1cf0...39e18a | 657,99K | 2,63% |

| 5 | 0x8ce0...56fe78 | 582,13K | 2,32% |

| - | Diğerleri | 17.908,70K | 71,66% |

II. RARI'nin Gelecekteki Fiyatını Etkileyen Ana Unsurlar

Arz Mekanizması

- Piyasa Likidite Madenciliği: Kullanıcılar, Rarible platformunda NFT alıp satarak RARI token kazanabilir.

- Tarihsel Model: Başlangıçta likidite madenciliği kullanıcı çekip işlem hacmini artırırken, wash trading sorunlarını da doğurdu.

- Güncel Etki: Ekip, likidite madenciliği ödüllerini azaltmak ve wash trading’i önlemek için RARI staking uygulaması başlatabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Mayıs 2021’de ilk 100 adres, toplam RARI token’larının %91,76’sına sahipti.

Makroekonomik Ortam

- Enflasyon Korumalı Özellik: Bir NFT platform token’ı olarak RARI, enflasyon dönemlerinde dijital varlıklara olan ilgiyle birlikte avantaj sağlayabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- NFT+DeFi Entegrasyonu: Rarible, Yearn yInsure, Uniswap v3 LP token’ları ve Hegic opsiyon protokolleriyle entegrasyonlarda öncüdür.

- Ekosistem Uygulamaları: Rarible, çok çeşitli NFT varlıklarını destekler ve NFT sigortası ile opsiyon işlemleri gibi yenilikçi özellikler sunar.

III. 2025-2030 Dönemi RARI Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,56819 - 0,8609 dolar

- Tarafsız tahmin: 0,8609 - 1,00 dolar

- İyimser tahmin: 1,00 - 1,06752 dolar (güçlü piyasa momentumu gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Konsolidasyon sonrası kademeli büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,72287 - 1,20478 dolar

- 2028: 0,8115 - 1,21138 dolar

- Temel katalizörler: RARI token’ın benimsenmesinin artması, ekosistemin genişlemesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,19373 - 1,41457 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 1,41457 - 1,79651 dolar (güçlü yükseliş trendiyle)

- Dönüştürücü senaryo: 1,79651+ dolar (kripto piyasasında aşırı olumlu koşullar)

- 2030-12-31: RARI 1,41457 dolar (projeksiyon ortalaması)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1,06752 | 0,8609 | 0,56819 | 0 |

| 2026 | 1,33061 | 0,96421 | 0,82922 | 12 |

| 2027 | 1,20478 | 1,14741 | 0,72287 | 33 |

| 2028 | 1,21138 | 1,17609 | 0,8115 | 36 |

| 2029 | 1,63542 | 1,19373 | 0,63268 | 38 |

| 2030 | 1,79651 | 1,41457 | 0,82045 | 64 |

IV. RARI Profesyonel Yatırım Stratejisi ve Risk Yönetimi

RARI Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Uzun vadeli yatırımcılar ve NFT odaklı katılımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde RARI token’ı biriktirin

- Rarible ekosistem yönetimine katılım sağlayın

- Token’ları güvenli, saklama hizmeti sunmayan cüzdanlarda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI: Aşırı alım veya aşırı satım bölgelerini tespit edin

- Dalgalı işlemde temel noktalar:

- RARI fiyatını etkileyen NFT piyasa trendlerini izleyin

- Rarible platformundaki güncellemeleri ve kullanıcı büyümesini takip edin

RARI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları birden fazla NFT odaklı token’a yaymak

- Stop-loss emirleri: Potansiyel zararları sınırlamak için önceden belirlenen çıkış noktaları

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Büyük tutarlar için donanım cüzdanları kullanmak

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. RARI Olası Riskler ve Zorluklar

RARI Piyasa Riskleri

- Yüksek oynaklık: NFT piyasasındaki dalgalanmalar RARI fiyatını etkileyebilir

- Rekabet: Yeni NFT platformları Rarible’ın piyasa payını zayıflatabilir

- Likidite riski: Düşük işlem hacmi fiyat istikrarını bozabilir

RARI Düzenleyici Riskler

- Belirsiz düzenleyici ortam: NFT alanındaki olası düzenlemeler RARI’yi etkileyebilir

- Vergisel etkiler: NFT işlemleri ve token varlıklarıyla ilgili değişen vergi mevzuatı

- Sınır ötesi uyum: Kripto varlıklar için farklı uluslararası düzenlemelere uyum gerekliliği

RARI Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmelerinde potansiyel güvenlik zafiyetleri

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklık Rarible platformunu etkileyebilir

- İşbirliği problemleri: Zincirler arası uyumluluk ve entegrasyon riskleri

VI. Sonuç ve Eylem Önerileri

RARI Yatırım Değeri Değerlendirmesi

RARI, NFT piyasasının büyümesine bağlı olarak uzun vadeli potansiyel sunarken kısa vadede oynaklık ve rekabet baskısı altındadır. Değer önerisi, Rarible ekosisteminin gelişimi ve NFT benimsenmesiyle doğrudan bağlantılıdır.

RARI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük tutarla başlayın, NFT piyasasını öğrenmeye öncelik verin ✅ Tecrübeli yatırımcılar: RARI’yi çeşitlendirilmiş bir kripto portföyünde değerlendirin ✅ Kurumsal yatırımcılar: Rarible’ın teknolojisi ve piyasa konumunu detaylı inceleyin

RARI İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden RARI token alımı

- Staking: RARI staking programına katılarak ödül elde etme imkânı

- Yönetim: Rarible ekosistem yönetiminde RARI token ile katılım sağlama

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatlice vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Rari iyi bir yatırım mı?

Rari, yoğun rekabet ve belirsiz piyasa eğilimleri nedeniyle iyi bir yatırım olarak değerlendirilmemektedir. Geleceği öngörülemezliğini koruyor.

RARI kripto için 2030 fiyat tahmini nedir?

Mevcut piyasa analizine göre, RARI kripto 2030’da 0,84 ile 1,12 dolar arasında değerlenebilir.

RARI hissesi için tahmin nedir?

RARI’nin teknik analizine göre, 28 Ekim 2025’e kadar 0,8444 dolara gerilemesi beklenmekte olup, bu düşüş eğilimine işaret etmektedir.

Rarible iyi bir kripto mu?

Rarible (RARI), NFT meraklıları için gelecek vaat eden bir kripto varlıktır. Önde gelen bir NFT pazar yerini güçlendirir ve yönetim hakları sunar; dijital sanat alanında büyüyen bir değer potansiyeli taşır.

2025 RARE Fiyat Tahmini: Büyüme Potansiyeli ve Token Değerini Etkileyen Piyasa Faktörlerinin Analizi

Faith Tribe (FTRB) Yatırım İçin Uygun mu?: Moda NFT Platformunun Potansiyeli ve Riskleri Üzerine Analiz

Alt.town (TOWN) iyi bir yatırım mı?: Bu gelişmekte olan kripto paranın potansiyeli ve riskleri üzerine analiz

Pudgy Penguins NFT Değer Tahmini 2025-2031: 1 Dolar Seviyesi Gerçekçi mi?

Hedera (HBAR) 2025 Fiyat Analizi ve Yatırım Olanakları

Sui Fiyat Pazar Analizi ve 2025'te Uzun Vadeli Yatırım Potansiyeli

Sui’yi Keşfedin: Web3 Blockchain Tutkunları İçin Vazgeçilmez Bir Rehber

2025 FAIR3 Fiyat Tahmini: Uzman Analizi ve Gelecek Yıl İçin Piyasa Öngörüsü

Jambo Token: Web3 Ekosistemindeki Rolü Üzerine İnceleme