2025 PAL Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: PAL's Market Position and Investment Value

Palio (PAL) is the first token launched on the Xterio platform, built with a "Community First" mindset that emphasizes fairness and inclusivity for every user. As of December 2025, PAL has established itself as a community-driven digital asset within the gaming and AI ecosystem. The token's market capitalization currently stands at $420,659.99, with a circulating supply of 190 million tokens out of a total supply of 1 billion, trading at $0.002214. This asset, designed to power an innovative ecosystem combining AI and friendship through "AI Agent" pets and engaging games, is gaining traction as a bridge between gaming communities and blockchain technology.

This article will provide a comprehensive analysis of PAL's price trajectory and market performance, examining historical price movements, market dynamics, and ecosystem development to offer investors professional price insights and practical investment strategies for informed decision-making in the crypto markets.

Palio (PAL) Market Analysis Report

I. PAL Price History Review and Current Market Status

PAL Historical Price Evolution

- July 2025: Token launch on the Xterio platform with initial price of $0.05, reaching an all-time high (ATH) of $0.0314 on July 7, 2025.

- December 2025: Significant price decline, with the token reaching a new all-time low (ATL) of $0.00217 on December 30, 2025, representing a year-to-date decline of 95.53%.

PAL Current Market Conditions

As of December 30, 2025, PAL is trading at $0.002214, reflecting a volatile market environment for the token. The token has experienced substantial losses across multiple timeframes:

- 1-hour change: -0.58%

- 24-hour change: -2.02%

- 7-day change: -16.86%

- 30-day change: -37.99%

- 1-year change: -95.53%

The current market capitalization stands at approximately $420,660, with a fully diluted valuation (FDV) of $2,214,000. The circulating supply comprises 190 million PAL tokens out of a total maximum supply of 1 billion tokens, representing 19% circulation. Daily trading volume is recorded at $17,851.71, with the token listed on 5 exchanges and held by approximately 3,390 token holders.

Click to view current PAL market price

PAL Market Sentiment Index

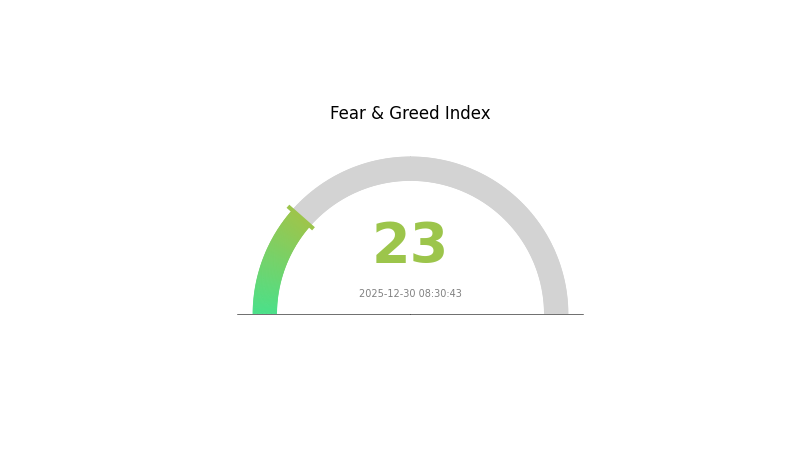

2025-12-30 Fear and Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 23. This indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, assets are typically oversold, presenting potential opportunities for contrarian investors. However, caution remains essential as market volatility may persist. Monitor key support levels and risk management strategies closely. Consider dollar-cost averaging or staggered entries on Gate.com to navigate this uncertain environment effectively.

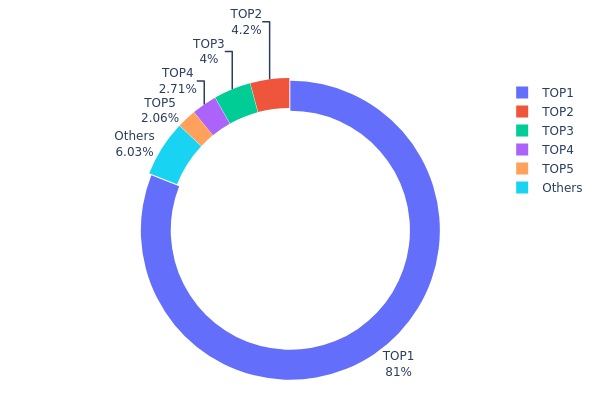

PAL Holdings Distribution

The address holdings distribution map illustrates the concentration of PAL token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure vulnerabilities. This metric tracks the top token holders and their respective percentages of total supply, providing crucial insights into token concentration risk and market sentiment dynamics.

PAL exhibits significant concentration characteristics, with the top holder commanding 81.00% of the total supply through address 0x3d2a...19a373. This extreme concentration substantially exceeds healthy decentralization thresholds, indicating a highly centralized token structure. The subsequent four addresses collectively hold only 13.03% of tokens, while the remaining addresses account for merely 6.03% of the total supply. Such distribution patterns suggest that market movements are predominantly influenced by a single dominant stakeholder, creating asymmetric risk conditions for other participants.

This pronounced concentration poses considerable implications for market stability and price discovery mechanisms. The dominant holder's decision to accumulate or liquidate positions could trigger substantial price volatility, while the limited liquidity dispersal among other addresses constrains organic trading volume and market resilience. The current distribution reflects a market structure where centralized decision-making capacity supersedes collective price formation, thereby compromising the decentralization objectives typically associated with blockchain-based assets. Investors should carefully evaluate whether this concentration level aligns with their risk tolerance and long-term investment thesis.

Click to view current PAL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3d2a...19a373 | 810000.00K | 81.00% |

| 2 | 0x8441...30bf7c | 42000.00K | 4.20% |

| 3 | 0x93de...85d976 | 40000.00K | 4.00% |

| 4 | 0x4982...6e89cb | 27110.31K | 2.71% |

| 5 | 0xcb90...bb3530 | 20629.12K | 2.06% |

| - | Others | 60260.57K | 6.03% |

II. Core Factors Affecting PAL's Future Price

Macroeconomic Environment

-

Currency Depreciation Impact: Long-term price movements are primarily driven by two core factors: the speed of technology adoption and currency depreciation. As global debt levels remain elevated since 2008, continuous monetary stimulus through debt refinancing cycles maintains economic operations, creating sustained depreciation pressures on fiat currencies.

-

Liquidity and Economic Cycles: Cryptocurrency markets and the broader economy exhibit four-year cyclical patterns rooted in debt refinancing cycles. Market liquidity fluctuations and capital rotation dynamics significantly influence price trajectories. Interest rate changes represent only one factor affecting currency value; capital flows and M&A activities play equally important roles in determining asset prices.

-

Market Cycle Dynamics: Short-term market volatility is often driven by noise and temporary factors, while long-term trends are determined by structural macroeconomic drivers. The 2025 global economic landscape continues to present evolving influences on cryptocurrency valuations.

III. 2025-2030 PAL Price Forecast

2025 Outlook

- Conservative Forecast: $0.00165 - $0.00200

- Neutral Forecast: $0.00200 - $0.00230

- Optimistic Forecast: $0.00230 - $0.00236 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation patterns, characterized by incremental adoption growth and stabilization of market sentiment

- Price Range Forecast:

- 2026: $0.00141 - $0.00251

- 2027: $0.00153 - $0.00261

- 2028: $0.00208 - $0.00265

- Key Catalysts: Expansion of platform utility, increased institutional interest, ecosystem partnership announcements, and technical infrastructure improvements

2029-2030 Long-term Outlook

- Base Case: $0.00157 - $0.00291 (assumes moderate adoption acceleration and stable market conditions)

- Optimistic Case: $0.00209 - $0.00362 (assumes successful ecosystem scaling and broader market acceptance by 2030)

- Transformative Case: Above $0.00362 (contingent on breakthrough technological innovations, significant enterprise adoption, and exceptional macroeconomic tailwinds)

- 2030-12-31: PAL reaching $0.00362 (represents 54% increase from 2025 baseline, reflecting cumulative growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00236 | 0.0022 | 0.00165 | 0 |

| 2026 | 0.00251 | 0.00228 | 0.00141 | 2 |

| 2027 | 0.00261 | 0.00239 | 0.00153 | 8 |

| 2028 | 0.00265 | 0.0025 | 0.00208 | 13 |

| 2029 | 0.00291 | 0.00258 | 0.00157 | 16 |

| 2030 | 0.00362 | 0.00274 | 0.00209 | 23 |

Palio (PAL) Investment Strategy and Risk Management Report

IV. PAL Professional Investment Strategy and Risk Management

PAL Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Community-oriented investors who believe in the AI companion pet ecosystem and gaming innovation potential

- Operational recommendations:

- Accumulate during market downturns to dollar-cost average your entry position

- Hold through ecosystem development phases as Xterio platform matures

- Reinvest any staking or gaming rewards to compound your position

(2) Active Trading Strategy

- Market dynamics considerations:

- Volume analysis: Current 24-hour volume of $17,851.71 indicates relatively low liquidity; traders should use limit orders to minimize slippage

- Price action monitoring: Track support levels around the all-time low ($0.00217) and resistance at previous highs ($0.0314)

- Swing trading focus points:

- Monitor ecosystem announcements and gaming feature launches for positive catalysts

- Pay attention to community sentiment shifts given the "Community First" tokenomics structure

PAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of digital asset portfolio

- Active investors: 2-5% of digital asset portfolio

- Specialized investors: 5-10% of digital asset portfolio

(2) Risk Hedging Solutions

- Portfolio diversification: Combine PAL holdings with established Layer-1 blockchain assets to reduce concentration risk

- Position sizing: Given the -95.53% one-year decline, limit individual trade sizes to defined percentages of total capital

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for active trading and gaming ecosystem participation

- Cold storage approach: For long-term holdings exceeding 6 months, transfer to air-gapped hardware solutions

- Security considerations: Enable multi-signature authentication, never share private keys, verify contract addresses before transfers (0xb7e548c4f133adbb910914d7529d5cb00c2e9051 on BSC)

V. PAL Potential Risks and Challenges

PAL Market Risk

- Extreme price volatility: PAL has experienced a -95.53% decline over one year, indicating severe market pressure and potential loss of investor confidence

- Low trading liquidity: With only 5 exchange listings and $17,851.71 daily volume, large transactions may face significant slippage

- Market capitalization concentration: Current market cap of $420,659.99 with only 3,390 token holders suggests high concentration risk among early participants

PAL Regulatory Risk

- Gaming regulation uncertainty: AI companion pet games face evolving regulatory scrutiny across different jurisdictions regarding digital asset rewards

- Blockchain compliance: BSC token operations must navigate varying regulatory frameworks for crypto asset classification globally

- Token classification ambiguity: Regulatory bodies may reclassify PAL based on gaming mechanisms and reward distribution methods

PAL Technology Risk

- Platform dependency: PAL's value is intrinsically tied to Xterio platform adoption and technical stability

- Smart contract vulnerabilities: Although using standard BEP-20 protocol, ongoing audits are necessary for AI agent integration features

- Ecosystem execution risk: Team must successfully deliver on promised "AI Agent" pet features and gaming experiences to maintain user engagement

VI. Conclusion and Action Recommendations

PAL Investment Value Assessment

Palio represents an experimental venture in merging AI technology with gaming and blockchain ecosystems. The "Community First" tokenomics model and experienced development team from Tencent, Happy Elements, and FunPlus provide credibility for long-term vision. However, the dramatic -95.53% one-year decline and minimal market capitalization ($420,659.99) indicate the project is in early and highly volatile stages. Success depends entirely on widespread adoption of the Xterio platform's AI companion pet games and substantial user growth. This is a high-risk, speculative investment suitable only for experienced investors with significant risk tolerance.

PAL Investment Recommendations

✅ Beginners: Avoid direct PAL investment; instead, wait for platform maturation signals and ecosystem adoption metrics before considering entry ✅ Experienced investors: Consider small-position accumulation (1-2% portfolio allocation) only during major downturns if you believe in long-term gaming+AI narrative ✅ Institutional investors: Conduct extensive due diligence on Xterio platform development roadmap and user acquisition metrics before any significant allocation

PAL Trading Participation Methods

- Direct acquisition: Purchase PAL on Gate.com exchange where it is listed as a supported trading pair

- Gaming ecosystem participation: Earn PAL tokens through active participation in Xterio platform games and AI agent interactions

- Community engagement: Join Discord and X (Twitter) communities for ecosystem updates, airdrops, and early feature access

Cryptocurrency investment carries extreme risk of total capital loss. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Is PAL a good stock to buy?

PAL shows strong potential with analyst consensus rating of "Buy" and a 12-month price target of $12.0, indicating positive growth prospects for investors interested in this asset.

Will Palantir hit $150?

Based on current consensus price targets, Palantir is unlikely to reach $150 in 2025. The stock would need significant growth beyond analyst expectations to achieve this milestone.

What factors influence Palantir (PAL) stock price?

Palantir's stock price is driven by revenue growth, profitability metrics, AI demand, technological advancements, government contracts, and overall market sentiment towards data analytics and artificial intelligence sectors.

What is Palantir's business model and revenue sources?

Palantir generates revenue through public and private sector contracts for data analytics and software solutions. Revenue is structured through advance payments, partial payments, or installments from government and commercial clients.

How does PAL stock compare to competitors like Booz Allen Hamilton?

PAL offers higher growth potential compared to Booz Allen Hamilton. While BAH trades at lower valuations around 21x earnings, PAL commands premium pricing due to superior market positioning and technology capabilities in the defense and intelligence sectors.

What are the risks associated with investing in Palantir?

Palantir investments face macroeconomic risks, market volatility, and dependency on government contracts. Regulatory changes and shifting investor sentiment toward high-growth stocks may impact performance.

XCX vs FLOW: The Battle for Music Streaming Supremacy in the Digital Age

AIV vs LRC: The Battle for Automated Video Captioning Supremacy

Is Akedo (AKE) a good investment?: A Comprehensive Analysis of Market Performance, Risk Factors, and Future Prospects

Is Palio (PAL) a good investment?: A Comprehensive Analysis of Price Potential, Market Fundamentals, and Risk Factors for 2024

Is StarryNift (SNIFT) a good investment?: A Comprehensive Analysis of the Token's Potential, Risks, and Market Outlook

Is Alchemist AI (ALCH) a Good Investment? Analyzing Potential Returns and Risks in the Emerging AI Token Market

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange