2025 NIZA Price Prediction: Analyzing Market Trends and Future Growth Potential in the Digital Asset Ecosystem

Introduction: NIZA's Market Position and Investment Value

Niza Global (NIZA), as a digital asset designed to power a secure and user-friendly ecosystem, has made significant strides since its inception. As of 2025, NIZA's market capitalization has reached $12,144,000, with a circulating supply of approximately 150,000,000 tokens, and a price hovering around $0.08096. This asset, known for its "strong utility," is playing an increasingly crucial role in enabling seamless trading, staking, and participation across the Niza Global platform.

This article will comprehensively analyze NIZA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. NIZA Price History Review and Current Market Status

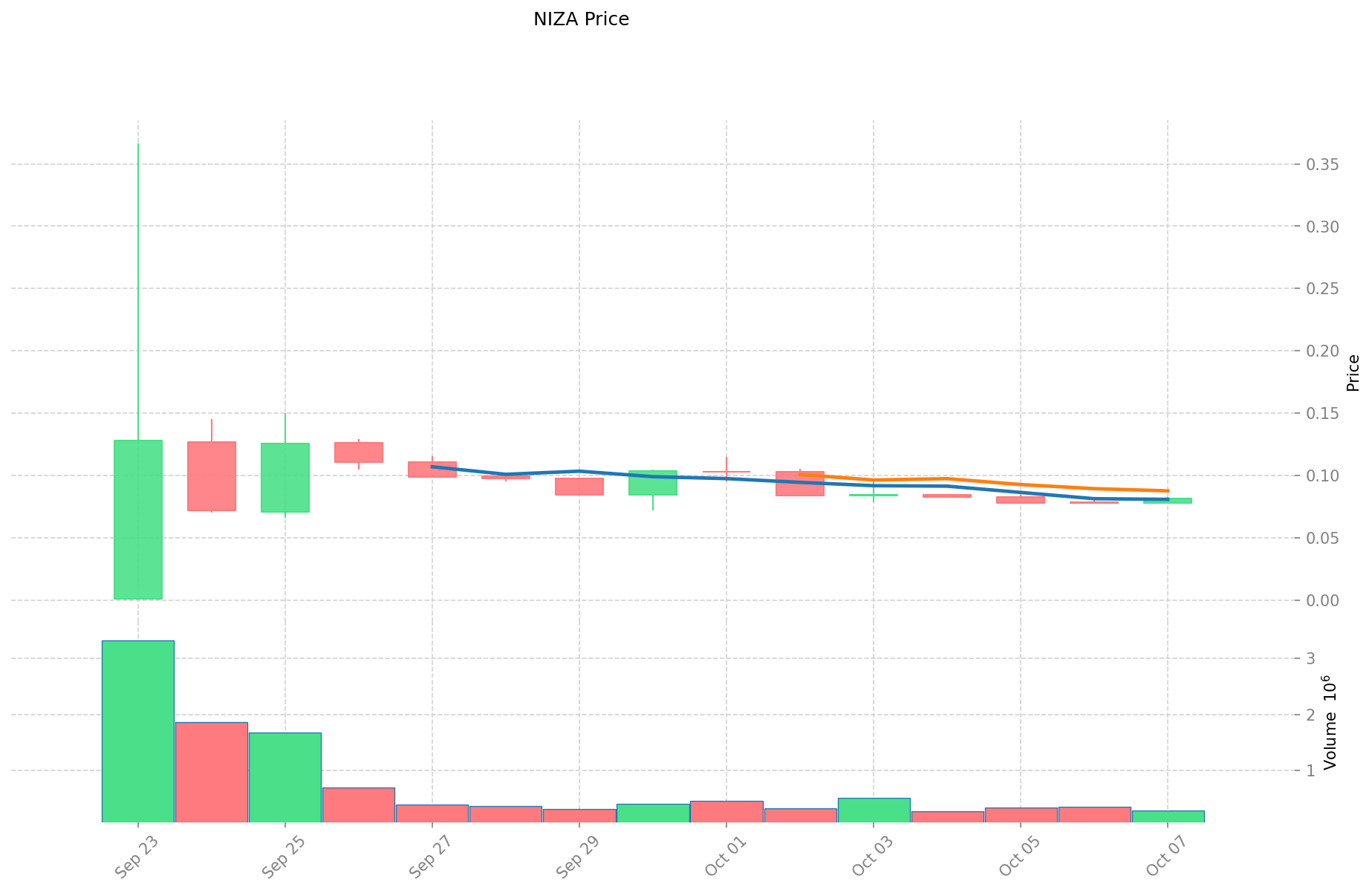

NIZA Historical Price Evolution

- 2025: NIZA launched, price reached all-time high of $0.366666

- 2025: Market correction, price dropped to all-time low of $0.001

- 2025: Recovery phase, price stabilized around $0.08

NIZA Current Market Situation

NIZA is currently trading at $0.08096, with a 24-hour trading volume of $23,579.85. The token has shown positive momentum in the short term, with a 4.06% increase in the last 24 hours and a 0.09% gain in the past hour. However, NIZA has experienced significant declines over longer periods, with a 22.05% drop in the past week, a 71.017% decrease over the last 30 days, and a 73.72% decline in the past year.

The current market capitalization of NIZA stands at $12,144,000, ranking it at 1328th in the overall cryptocurrency market. With a circulating supply of 150,000,000 NIZA tokens, which is also the total and maximum supply, the project has reached full circulation.

Despite recent short-term gains, the overall market sentiment for NIZA appears cautious, given the substantial losses over longer timeframes. The token's price is currently far from its all-time high of $0.366666, indicating potential for recovery if market conditions improve and project developments gain traction.

Click to view the current NIZA market price

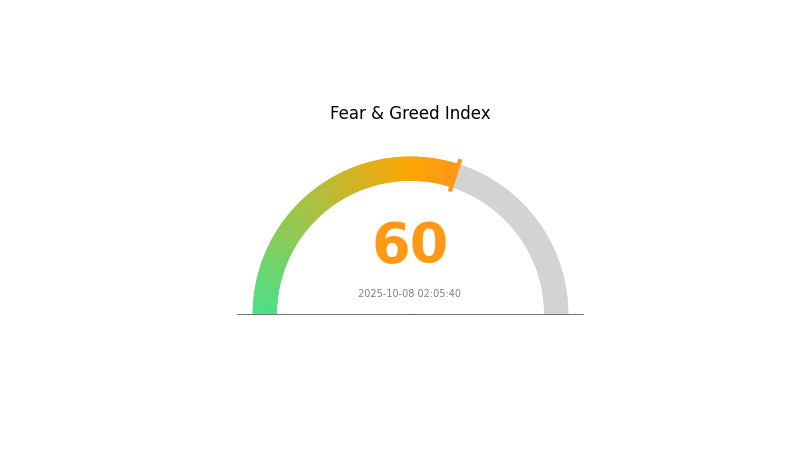

NIZA Market Sentiment Indicator

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of greed, with the Fear and Greed Index at 60. This suggests investors are becoming optimistic, potentially driving prices higher. However, it's crucial to remain cautious as excessive greed can lead to market corrections. Traders should consider taking profits or hedging positions. Remember, markets often reverse when sentiment reaches extremes. Stay informed and manage your risk wisely in this greedy market environment.

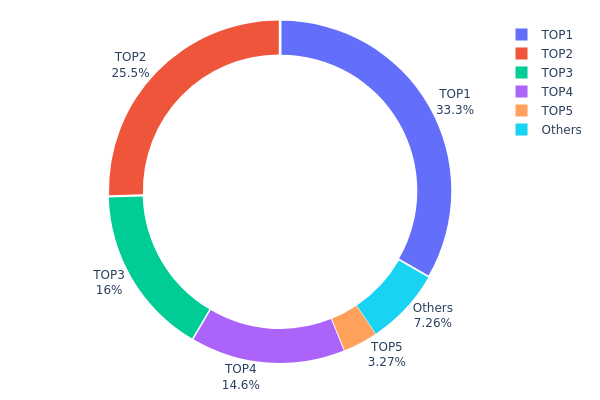

NIZA Holdings Distribution

The address holdings distribution chart provides insight into the concentration of NIZA tokens among different wallet addresses. Analysis of the data reveals a highly centralized distribution pattern. The top address holds 33.33% of the total supply, while the top five addresses collectively control 92.72% of all NIZA tokens.

This level of concentration raises concerns about market stability and potential price manipulation. With such a significant portion of tokens held by a small number of addresses, large-scale transactions by these holders could lead to substantial price volatility. Furthermore, the concentrated ownership structure may impact the token's liquidity and overall market dynamics.

The current distribution suggests a low level of decentralization for NIZA, which could be a point of consideration for potential investors. While centralization can sometimes lead to more efficient decision-making, it may also pose risks to the long-term sustainability and widespread adoption of the project. Monitoring changes in this distribution over time will be crucial for assessing the evolving market structure and potential shifts in the token's ecosystem.

Click to view the current NIZA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc200...0dfb68 | 50000.00K | 33.33% |

| 2 | 0x472e...65d989 | 38209.61K | 25.47% |

| 3 | 0x8ff9...6944a5 | 24040.00K | 16.02% |

| 4 | 0x377c...69be0f | 21960.00K | 14.64% |

| 5 | 0x986a...2d1181 | 4900.00K | 3.26% |

| - | Others | 10890.39K | 7.28% |

II. Key Factors Affecting NIZA's Future Price

Supply Mechanism

-

Market Dynamics: The value of NIZA is determined by the interaction of supply and demand. When demand is high and supply is limited, its price tends to increase, and vice versa.

-

Current Impact: In the short term, NIZA price is expected to fluctuate between $0.10 and $0.40 as the market stabilizes after the initial listing enthusiasm.

Institutional and Whale Movements

- Corporate Adoption: The adoption of NIZA by well-known enterprises could significantly impact its price and market perception.

Macroeconomic Environment

-

Inflation Hedging Properties: As a cryptocurrency, NIZA's performance in inflationary environments may be a factor in its price movements.

-

Geopolitical Factors: International situations and conflicts can influence the global cryptocurrency market, including NIZA.

Technological Development and Ecosystem Building

-

Community Engagement: The level of community participation and social sentiment surrounding NIZA plays a crucial role in its price trajectory, especially considering its position as a meme coin in a highly volatile market segment.

-

Token Economics: The distribution and supply allocation of NIZA tokens can influence its market value and price stability.

III. NIZA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04212 - $0.07000

- Neutral prediction: $0.07000 - $0.08100

- Optimistic prediction: $0.08100 - $0.08343 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.08295 - $0.10704

- 2028: $0.09518 - $0.1354

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.11676 - $0.12552 (assuming steady market growth and project development)

- Optimistic scenario: $0.13428 - $0.16443 (assuming strong market performance and significant project milestones)

- Transformative scenario: $0.16443 - $0.18000 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: NIZA $0.16443 (potential peak price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08343 | 0.081 | 0.04212 | 0 |

| 2026 | 0.09619 | 0.08221 | 0.05673 | 1 |

| 2027 | 0.10704 | 0.0892 | 0.08295 | 10 |

| 2028 | 0.1354 | 0.09812 | 0.09518 | 21 |

| 2029 | 0.13428 | 0.11676 | 0.09925 | 44 |

| 2030 | 0.16443 | 0.12552 | 0.1092 | 55 |

IV. NIZA Professional Investment Strategy and Risk Management

NIZA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the Niza Global ecosystem

- Operation suggestions:

- Accumulate NIZA tokens during market dips

- Participate in staking programs to earn passive income

- Store tokens securely in Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in determining overbought or oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set stop-loss orders to manage downside risk

NIZA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update security settings

V. NIZA Potential Risks and Challenges

NIZA Market Risks

- High volatility: NIZA price can experience significant fluctuations

- Limited trading history: As a relatively new token, historical data for analysis is limited

- Market sentiment: Susceptible to broader cryptocurrency market trends

NIZA Regulatory Risks

- Regulatory uncertainty: Evolving global cryptocurrency regulations may impact NIZA's adoption

- Compliance challenges: Potential difficulties in meeting varying international regulatory requirements

- Tax implications: Unclear or changing tax laws related to cryptocurrency transactions

NIZA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: High transaction volumes could lead to slower processing times

- Technological obsolescence: Rapid advancements in blockchain technology may require frequent updates

VI. Conclusion and Action Recommendations

NIZA Investment Value Assessment

NIZA offers potential long-term value within the Niza Global ecosystem but faces short-term risks due to market volatility and regulatory uncertainties. Its utility within the platform provides a foundation for growth, but investors should approach with caution given the nascent stage of the project.

NIZA Investment Recommendations

✅ Beginners: Start with small, affordable investments and focus on learning about the Niza Global ecosystem ✅ Experienced investors: Consider allocating a portion of your crypto portfolio to NIZA, balancing risk with potential rewards ✅ Institutional investors: Conduct thorough due diligence and consider NIZA as part of a diversified cryptocurrency portfolio

NIZA Trading Participation Methods

- Spot trading: Buy and sell NIZA tokens on Gate.com

- Staking: Participate in NIZA staking programs for passive income

- DeFi integration: Explore decentralized finance options as they become available on the Niza Global platform

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin (BTC) is predicted to have the highest price in 2025. It remains a top choice for investors, supported by its consistent trend.

What is the price prediction for NIO in 2030?

Based on current trends, NIO's price is predicted to range between $1.50 and $5.17 by 2030, assuming moderate market fluctuations.

What is the price prediction for crypto in 2025?

Bitcoin is expected to reach over $118,000, Ethereum over $3,000, and popular altcoins are also predicted to rise significantly in 2025.

Which coin will reach 1 rupee prediction?

PEPE is predicted to reach 1 rupee by 2030, based on market trends and economic factors.

Share

Content