2025 NIM Price Prediction: Analyzing Market Trends and Potential Growth Factors for Nimiq Cryptocurrency

Introduction: NIM's Market Position and Investment Value

Nimiq (NIM), as the world's first browser-centric blockchain payment protocol, has maximized availability and scalability without compromising decentralization since its inception in 2017. As of 2025, Nimiq's market capitalization has reached $9,359,000, with a circulating supply of approximately 13,505,050,909 coins, and a price hovering around $0.000693. This asset, hailed as the "cryptocurrency of humanity," is playing an increasingly crucial role in online and point-of-sale payments.

This article will comprehensively analyze Nimiq's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. NIM Price History Review and Current Market Status

NIM Historical Price Evolution

- 2020: Market low point, price reached $0.00028326 on January 3rd

- 2021: Bull market peak, price hit all-time high of $0.01501821 on April 12th

- 2025: Current market cycle, price declined from ATH to $0.000693

NIM Current Market Situation

As of October 9, 2025, NIM is trading at $0.000693, ranking 1451st in the cryptocurrency market. The token has experienced a 0.88% decrease in the past 24 hours, with a trading volume of $24,132.98. NIM's market capitalization stands at $9,359,000, representing a 0.00021% market share. The circulating supply is 13,505,050,908.8491 NIM, which is 64.31% of the maximum supply of 21,000,000,000 NIM. Despite the recent 24-hour decline, NIM has shown positive growth over the past week and month, with increases of 1.97% and 0.86% respectively. However, the token has faced a significant 48.87% decrease over the past year, reflecting the broader market challenges in the cryptocurrency sector.

Click to view the current NIM market price

NIM Market Sentiment Indicator

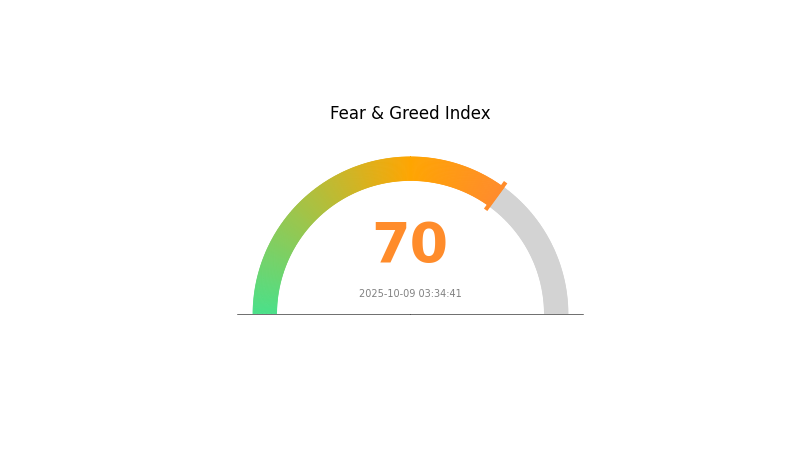

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a surge of greed, with the Fear and Greed Index reaching 70. This high level of greed suggests that investors are becoming increasingly optimistic about the market's potential. However, it's crucial to approach such sentiment with caution. While the market may continue to rise in the short term, historically, extreme greed often precedes market corrections. Traders should remain vigilant and consider implementing risk management strategies to protect their investments during this potentially volatile period.

NIM Holdings Distribution

The address holdings distribution data for NIM reveals a unique pattern in its token distribution. This metric provides insights into the concentration of token ownership across different addresses, offering a glimpse into the project's decentralization and potential market dynamics.

Based on the provided data, NIM appears to have a relatively dispersed ownership structure. The absence of large individual holdings suggests a lack of significant whale accounts that could exert undue influence on the market. This distribution pattern indicates a healthier market structure, potentially reducing the risk of price manipulation by single large holders.

The current address distribution reflects positively on NIM's market characteristics. It suggests a higher degree of decentralization, which aligns with blockchain ethos and potentially contributes to greater price stability. The absence of dominant addresses also implies a more resilient on-chain structure, reducing systemic risks associated with concentrated token ownership.

Click to view the current NIM holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing NIM's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have impacted price movements

- Current impact: Expected influence of the current supply changes

Institutional and Whale Dynamics

- Corporate adoption: Notable companies adopting NIM

Macroeconomic Environment

- Monetary policy impact: Major central bank policy expectations

- Inflation hedging properties: Performance in inflationary environments

- Geopolitical factors: Impact of international situations

Technical Development and Ecosystem Building

- Ecosystem applications: Major DApps/ecosystem projects

III. NIM Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00039 - $0.00050

- Neutral forecast: $0.00069 - $0.00080

- Optimistic forecast: $0.00080 - $0.00091 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00057 - $0.00097

- 2028: $0.00059 - $0.00125

- Key catalysts: Technological advancements, expanding use cases, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.00111 - $0.00123 (assuming steady market growth)

- Optimistic scenario: $0.00135 - $0.00162 (assuming strong adoption and favorable market conditions)

- Transformative scenario: $0.00170 - $0.00200 (assuming breakthrough applications and mainstream integration)

- 2030-12-31: NIM $0.00162 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00091 | 0.00069 | 0.00039 | 0 |

| 2026 | 0.00109 | 0.0008 | 0.0005 | 15 |

| 2027 | 0.00097 | 0.00094 | 0.00057 | 36 |

| 2028 | 0.00125 | 0.00096 | 0.00059 | 38 |

| 2029 | 0.00135 | 0.00111 | 0.00091 | 59 |

| 2030 | 0.00162 | 0.00123 | 0.00093 | 77 |

IV. NIM Professional Investment Strategies and Risk Management

NIM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a high risk tolerance

- Operation suggestions:

- Accumulate NIM during market dips

- Hold for at least 3-5 years to ride out market volatility

- Store NIM in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor NIM's price action in relation to overall crypto market trends

- Set stop-loss orders to manage downside risk

NIM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term storage

- Security precautions: Never share private keys, use two-factor authentication

V. Potential Risks and Challenges for NIM

NIM Market Risks

- High volatility: NIM's price can experience significant fluctuations

- Limited liquidity: May face challenges in buying or selling large amounts

- Competition: Other blockchain payment protocols may gain market share

NIM Regulatory Risks

- Uncertain regulatory environment: Cryptocurrency regulations are evolving globally

- Potential restrictions: Some countries may impose limitations on crypto use

- Tax implications: Changing tax laws may impact NIM transactions

NIM Technical Risks

- Network security: Potential vulnerabilities in the Nimiq blockchain

- Scalability challenges: May face issues as transaction volume increases

- Development delays: Updates or improvements to the protocol may take longer than expected

VI. Conclusion and Action Recommendations

NIM Investment Value Assessment

NIM offers potential as a browser-centric blockchain payment solution, but faces significant competition and market volatility. Long-term value depends on widespread adoption and technological advancements, while short-term risks include regulatory uncertainty and market fluctuations.

NIM Investment Recommendations

✅ Beginners: Start with small investments, focus on learning about NIM's technology ✅ Experienced investors: Consider NIM as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and monitor NIM's development progress

NIM Trading Participation Methods

- Spot trading: Buy and sell NIM on Gate.com

- Dollar-cost averaging: Regularly invest small amounts to mitigate price volatility

- Staking: Participate in NIM staking if available to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While no guarantee, emerging DeFi tokens or AI-powered cryptos could potentially see 1000x growth in the next bull run.

Does Ecomi have a future?

Yes, Ecomi shows strong potential for future growth. Its technical analysis and robust fundamentals indicate a promising outlook for the cryptocurrency.

What meme coin will explode in 2025 price prediction?

Shiba Inu is predicted to explode in price in 2025. It remains a popular meme coin driven by strong community support and viral trends.

How much is nim worth?

As of 2025-10-09, Nimiq (NIM) is worth $0.0006817, with a 2.28% price decline in the last 24 hours.

Share

Content