2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

Introduction: MOVE's Market Position and Investment Value

Movement Network (MOVE), as a modular Move-based blockchain ecosystem, has been bridging the gap between Move and EVM ecosystems since its inception. As of 2025, MOVE's market capitalization has reached $353,237,500, with a circulating supply of approximately 2,750,000,000 tokens, and a price hovering around $0.12845. This asset, hailed as a "bridge between ecosystems," is playing an increasingly crucial role in developing secure, high-performance, and interoperable blockchain applications.

This article will comprehensively analyze MOVE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. MOVE Price History Review and Current Market Status

MOVE Historical Price Evolution

- 2024: MOVE reached its all-time high of $1.34 on December 9, 2024

- 2025: MOVE hit its all-time low of $0.11079 on June 22, 2025

- 2025: Market cycle fluctuation, price dropped from the high point to the current $0.12845

MOVE Current Market Situation

As of September 21, 2025, MOVE is trading at $0.12845, with a 24-hour trading volume of $274,421.18. The token has experienced a slight increase of 0.03% in the last 24 hours. MOVE's market cap currently stands at $353,237,500, ranking it 221st in the cryptocurrency market. The token has a circulating supply of 2,750,000,000 MOVE coins and a maximum supply of 10,000,000,000.

In terms of recent price trends, MOVE has shown mixed performance across different timeframes. It has gained 0.59% in the past hour and 1.52% over the last 30 days. However, it has experienced a decline of 2.83% in the past week. The most significant drop is observed in the yearly performance, with MOVE down by 80.65% compared to a year ago.

The current market sentiment for MOVE appears to be neutral, as indicated by the market emotion index. Despite the recent volatility, MOVE is trading above its all-time low, suggesting some level of price stability in the short term.

Click to view the current MOVE market price

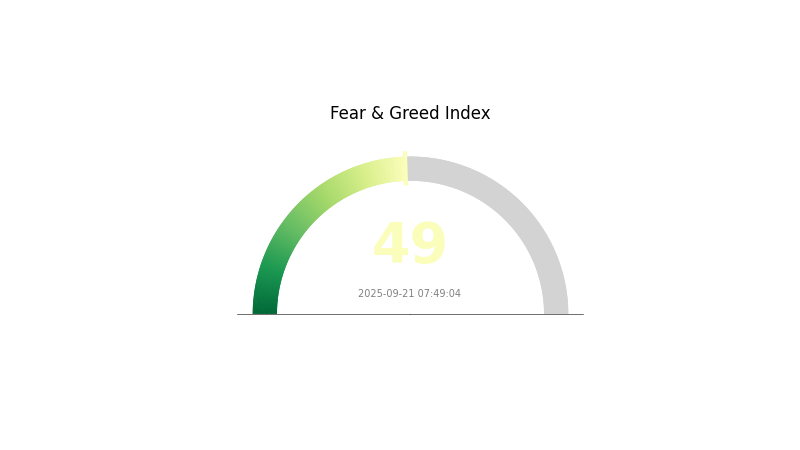

MOVE Market Sentiment Indicator

2025-09-21 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as the Fear and Greed Index stands at 49, indicating a neutral position. This suggests investors are neither overly fearful nor excessively greedy. While the market shows stability, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, the crypto landscape can shift rapidly, and staying informed is key to navigating potential opportunities and risks in this dynamic environment.

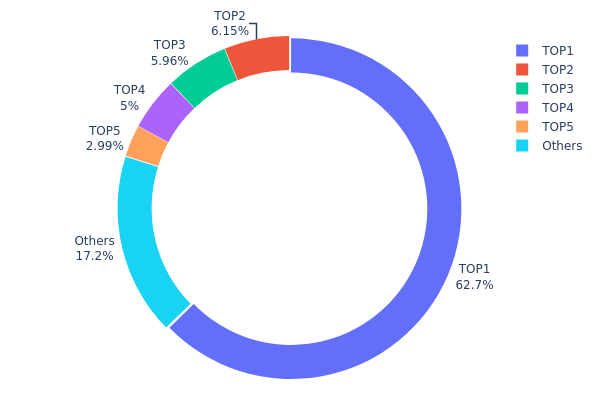

MOVE Holdings Distribution

The address holdings distribution data for MOVE reveals a highly concentrated ownership structure. The top address holds a staggering 62.66% of the total supply, indicating significant centralization. The next four largest holders collectively account for an additional 20.08%, bringing the total held by the top five addresses to 82.74%. This level of concentration raises concerns about potential market manipulation and volatility.

Such a concentrated distribution may lead to increased price volatility, as large holders have the ability to significantly impact the market with their trading activities. The high concentration also suggests a lower degree of decentralization, which could be problematic for a project aiming for widespread adoption and community governance. Furthermore, this distribution pattern may deter smaller investors due to perceived risks of large holders dominating the market.

Click to view the current MOVE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe3e8...5f4f25 | 6266721.36K | 62.66% |

| 2 | 0xecb4...d57630 | 614798.98K | 6.14% |

| 3 | 0x5098...4295eb | 596333.92K | 5.96% |

| 4 | 0x360f...44df31 | 500000.00K | 5.00% |

| 5 | 0xf1df...2cbe0f | 298625.27K | 2.98% |

| - | Others | 1723520.46K | 17.26% |

II. Key Factors Influencing Future MOVE Price

Supply Mechanism

- Total Supply Cap: The maximum supply of MOVE is capped at 10 billion tokens.

- Historical Pattern: As a relatively new token launched in 2024, MOVE has limited historical data to establish clear patterns.

- Current Impact: With only 27.5% of the total supply in circulation, future token releases may create selling pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Several venture capital firms, including YZi Labs and World Liberty Financial, have invested in MOVE.

- Corporate Adoption: Movement Network is gaining traction as an Ethereum Layer 2 scaling solution.

- Government Policies: Being a "Made in America" project may provide favorable regulatory treatment in the U.S.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies on interest rates and inflation will affect risk asset demand, including cryptocurrencies like MOVE.

- Inflation Hedging Properties: As a blockchain asset, MOVE may be viewed as an inflation hedge during periods of high inflation.

Technical Development and Ecosystem Growth

- MoveVM Integration: The integration of MoveVM (Move Virtual Machine) enhances the network's smart contract capabilities.

- Layer 2 Scaling: Movement Network's focus on Layer 2 scaling solutions for Ethereum addresses a critical need in the blockchain space.

- Ecosystem Applications: The growth of decentralized applications (dApps) built on Movement Network will be crucial for MOVE's value proposition.

III. MOVE Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.10407 - $0.12848

- Neutral estimate: $0.12848 - $0.14647

- Optimistic estimate: $0.14647 - $0.16445 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $0.08034 - $0.15614

- 2028: $0.13386 - $0.17079

- Key catalysts: Technological advancements, wider acceptance of cryptocurrency, and potential regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.16233 - $0.19398 (assuming steady market growth and adoption)

- Optimistic scenario: $0.19398 - $0.22564 (with favorable market conditions and increased utility)

- Transformative scenario: $0.22564 - $0.25000 (with breakthrough applications and mainstream acceptance)

- 2030-12-31: MOVE $0.19980 (potential peak within a bullish trend)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16445 | 0.12848 | 0.10407 | 0 |

| 2026 | 0.15672 | 0.14647 | 0.0747 | 13 |

| 2027 | 0.15614 | 0.15159 | 0.08034 | 17 |

| 2028 | 0.17079 | 0.15387 | 0.13386 | 19 |

| 2029 | 0.22564 | 0.16233 | 0.1461 | 26 |

| 2030 | 0.1998 | 0.19398 | 0.17653 | 50 |

IV. MOVE Professional Investment Strategies and Risk Management

MOVE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate MOVE tokens during market dips

- Set price targets and regularly rebalance portfolio

- Store tokens in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor MOVE's correlation with major cryptocurrencies

- Pay attention to project developments and ecosystem growth

MOVE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Stop-loss orders: Set appropriate stop-loss levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MOVE

MOVE Market Risks

- High volatility: MOVE's price may experience significant fluctuations

- Limited adoption: Slow uptake of Move-based technologies could impact growth

- Competition: Other blockchain ecosystems may outpace MOVE's development

MOVE Regulatory Risks

- Uncertain regulatory landscape: Changing regulations may affect MOVE's operations

- Cross-border compliance: Varying international regulations could limit expansion

- Securities classification: Risk of being classified as a security in some jurisdictions

MOVE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible limitations in handling increased network load

- Interoperability issues: Difficulties in achieving seamless integration with other blockchains

VI. Conclusion and Action Recommendations

MOVE Investment Value Assessment

MOVE presents a unique value proposition in bridging Move and EVM ecosystems, offering long-term potential for growth. However, short-term volatility and adoption challenges pose significant risks.

MOVE Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider MOVE as part of a diversified crypto portfolio

MOVE Trading Participation Methods

- Spot trading: Purchase MOVE tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance opportunities within the Movement Network ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can a move coin go?

MOVE could potentially reach $0.55 or higher if it breaks above $0.52, based on recent bullish trends and market analysis.

What is the future of move coin?

By 2035, MOVE is projected to reach $40.50-$100.00, driven by mature blockchain adoption and increased investor confidence. Current trends suggest strong growth potential.

What crypto has the highest price prediction?

Ethereum (ETH) has the highest price prediction, with a forecast of up to $4,495 by 2025 based on market analysis.

What is the price prediction for XRP in 2030?

XRP could range between $4.67 and $26.97 in 2030, based on adoption and regulatory factors. Higher prices require strong institutional uptake and favorable market conditions.

Share

Content