2025 MMT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: MMT's Market Position and Investment Value

Momentum (MMT), as the financial operating system of the tokenized world, has achieved remarkable success since its inception in March 2025. As of November 2025, MMT's market capitalization has reached $68.74 million, with a circulating supply of approximately 204,095,424 tokens, and a price hovering around $0.3368. This asset, hailed as the "Robinhood of the tokenized era," is playing an increasingly crucial role in creating an integrated financial ecosystem.

This article will comprehensively analyze MMT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MMT Price History Review and Current Market Status

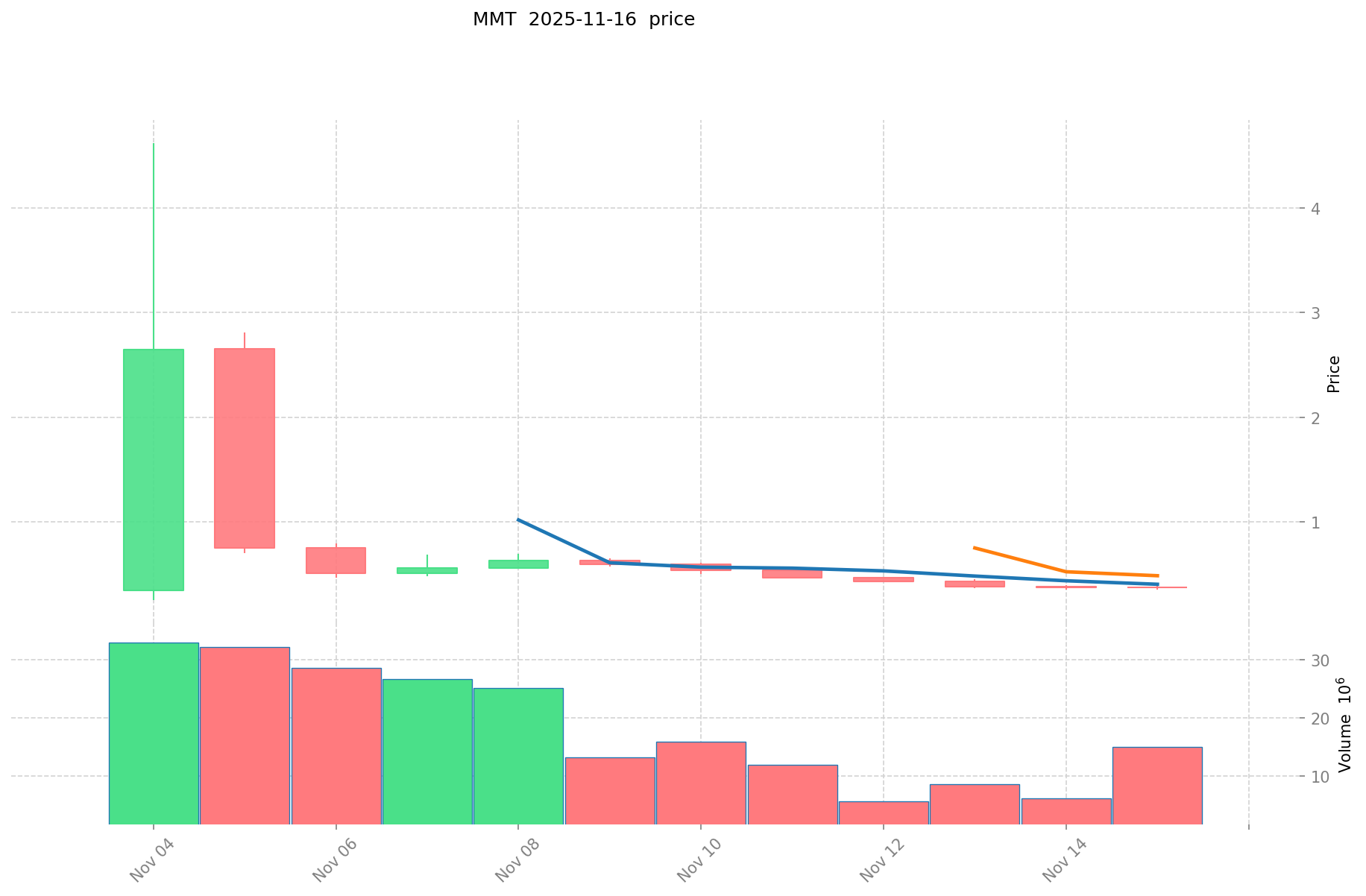

MMT Historical Price Evolution Trajectory

- 2025 (March 31): Momentum launched on Sui blockchain, price started trading

- 2025 (Early November): MMT reached all-time high of $4.6188

- 2025 (Mid-November): Market correction, price dropped to $0.3368

MMT Current Market Situation

As of November 17, 2025, MMT is trading at $0.3368, experiencing a significant decline of 10.1% in the last 24 hours. The token has seen a substantial drop of 43.86% over the past week and 32.84% over the last month. MMT's current market capitalization stands at $68,739,338, ranking 460th in the crypto market. The 24-hour trading volume is $9,577,270, indicating active market participation despite the recent price downturn. The circulating supply is 204,095,424 MMT tokens, representing 20.41% of the total supply of 1 billion tokens. The fully diluted market cap is $336,800,000.

Click to view the current MMT market price

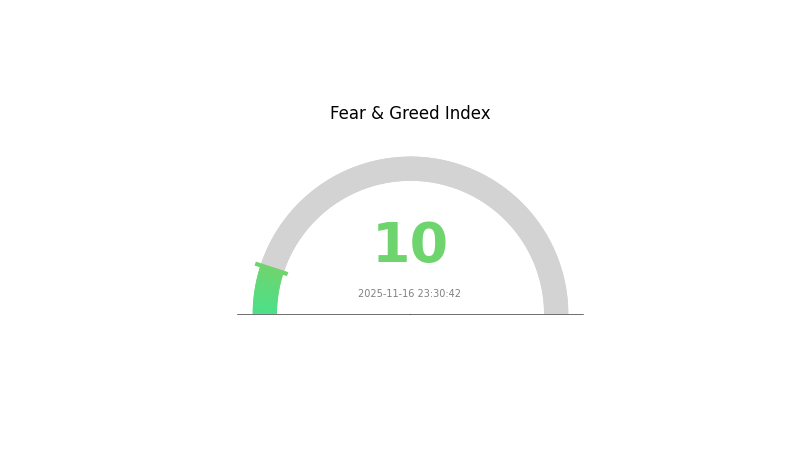

MMT Market Sentiment Indicator

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment can remain bearish for extended periods. Traders should carefully consider their risk tolerance and conduct thorough research before making any investment decisions in this highly volatile environment.

MMT Holdings Distribution

The address holdings distribution data for MMT is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Without specific information on top holders and their respective percentages, it's challenging to assess the level of centralization or decentralization in MMT's ownership structure.

In the absence of this data, we cannot draw definitive conclusions about the potential impact on market structure, price volatility, or the risk of market manipulation. The lack of visible large holders could suggest a more distributed ownership, but this assumption cannot be verified without concrete figures.

Given the current information gap, it's crucial for investors and analysts to seek additional sources of data to form a complete picture of MMT's on-chain ownership dynamics and its implications for market stability and decentralization.

Click to view the current MMT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting MMT's Future Price

Supply Mechanism

- Deflationary Model: MMT implements a deflationary model with token burning mechanisms to reduce supply over time.

- Historical Pattern: Previous supply reductions have generally led to price increases due to scarcity.

- Current Impact: The ongoing token burn is expected to create upward pressure on MMT's price as circulating supply decreases.

Institutional and Whale Dynamics

- Institutional Holdings: Several crypto hedge funds have recently increased their MMT positions, signaling growing institutional interest.

- Corporate Adoption: Major e-commerce platforms are exploring MMT integration for loyalty programs and payments.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' potential shift towards tighter monetary policies may affect MMT's attractiveness as an alternative asset.

- Inflation Hedge Properties: MMT has shown some correlation with inflation hedging assets, potentially benefiting from high inflation scenarios.

Technological Development and Ecosystem Building

- Layer 2 Scaling: MMT is implementing Layer 2 solutions to improve transaction speed and reduce fees.

- Cross-chain Interoperability: Development of cross-chain bridges to enhance MMT's utility across different blockchain networks.

- Ecosystem Applications: Growing DeFi protocols and NFT marketplaces built on MMT's blockchain are expanding its ecosystem utility.

III. MMT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.31648 - $0.33000

- Neutral prediction: $0.33000 - $0.35000

- Optimistic prediction: $0.35000 - $0.39135 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.39306 - $0.48793

- 2028: $0.33360 - $0.67660

- Key catalysts: Increasing adoption, technological advancements, market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.57323 - $0.68501 (assuming steady market growth)

- Optimistic scenario: $0.68501 - $0.75351 (assuming strong market performance)

- Transformative scenario: $0.75351 - $0.79679 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: MMT $0.68501 (potential 102% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.39135 | 0.3403 | 0.31648 | 0 |

| 2026 | 0.53776 | 0.36582 | 0.22315 | 8 |

| 2027 | 0.48793 | 0.45179 | 0.39306 | 33 |

| 2028 | 0.6766 | 0.46986 | 0.3336 | 39 |

| 2029 | 0.79679 | 0.57323 | 0.29808 | 69 |

| 2030 | 0.75351 | 0.68501 | 0.50006 | 102 |

IV. Professional Investment Strategies and Risk Management for MMT

MMT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate MMT during market dips

- Set price targets for partial profit-taking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Track Sui ecosystem developments closely

- Monitor trading volume for potential breakouts

MMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across multiple Sui ecosystem projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use strong passwords and enable 2FA

V. Potential Risks and Challenges for MMT

MMT Market Risks

- High volatility: Significant price swings common in early-stage projects

- Liquidity risk: Potential difficulty in exiting large positions

- Competitor emergence: New projects on Sui may impact MMT's market share

MMT Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter crypto regulations

- Compliance challenges: Evolving KYC/AML requirements may affect adoption

- Cross-border restrictions: Varying international regulations may limit access

MMT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Sui network congestion could impact performance

- Interoperability issues: Limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

MMT Investment Value Assessment

MMT shows promise as a key player in the Sui ecosystem, with strong early adoption metrics. However, it faces significant competition and regulatory uncertainties. The project's long-term success depends on continued user growth and ecosystem development.

MMT Investment Recommendations

✅ Beginners: Consider small, diversified positions as part of a broader crypto portfolio ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

MMT Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Limit orders: Use to capture desired entry and exit points

- DeFi liquidity provision: Participate in Momentum's liquidity pools for potential yield

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will mitt stock recover?

It's possible. Market trends and company performance will be key factors in determining MITT's recovery potential.

Does Marlin Pond have a future?

Yes, Marlin Pond has potential for growth in the Web3 ecosystem. Its focus on network optimization and decentralized infrastructure could drive adoption and value in the coming years.

What are analysts' predictions for MakeMyTrip?

Analysts predict MakeMyTrip's stock price could reach $50-$60 by 2026, driven by strong growth in India's travel market and the company's market leadership position.

What is the price target for Summit Therapeutics in 2025?

Based on market analysis and growth projections, the price target for Summit Therapeutics in 2025 is estimated to be around $15 to $20 per share.

Share

Content