2025 METAL Price Prediction: Bullish Outlook as Global Demand Surges and Supply Tightens

Introduction: METAL's Market Position and Investment Value

Metal Blockchain Token (METAL), as a zero-layer blockchain (L0) platform, has made significant strides since its inception. As of 2025, METAL's market capitalization has reached $39,227,441, with a circulating supply of approximately 187,055,653 tokens, and a price hovering around $0.20971. This asset, known as the "extensible zero layer blockchain," is playing an increasingly crucial role in the fields of decentralized finance (DeFi) and enterprise blockchain solutions.

This article will provide a comprehensive analysis of METAL's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. METAL Price History Review and Current Market Status

METAL Historical Price Evolution Trajectory

- 2022: All-time high reached, price peaked at $1.6464 on September 12

- 2024: Market downturn, price hit all-time low of $0.03528 on August 5

- 2025: Recovery phase, price rebounded significantly by 309.030% over the past year

METAL Current Market Situation

As of November 18, 2025, METAL is trading at $0.20971, with a market cap of $39,227,441. The token has experienced mixed performance across different timeframes. In the past 24 hours, METAL has seen a slight decline of 0.29%, with the price ranging between $0.20599 and $0.22141. Over the past week, there has been a more substantial decrease of 14.7%, indicating short-term bearish sentiment.

However, looking at the longer-term perspective, METAL has shown remarkable growth, with a 309.030% increase over the past year. This suggests strong overall bullish momentum despite recent pullbacks. The token's current price is still significantly below its all-time high, potentially indicating room for further growth.

METAL's market dominance stands at 0.0021%, reflecting its relatively small but growing position in the overall cryptocurrency market. The circulating supply of 187,055,653 METAL represents 28.06% of the total supply, which could impact future price movements as more tokens potentially enter circulation.

Click to view the current METAL market price

METAL Market Sentiment Index

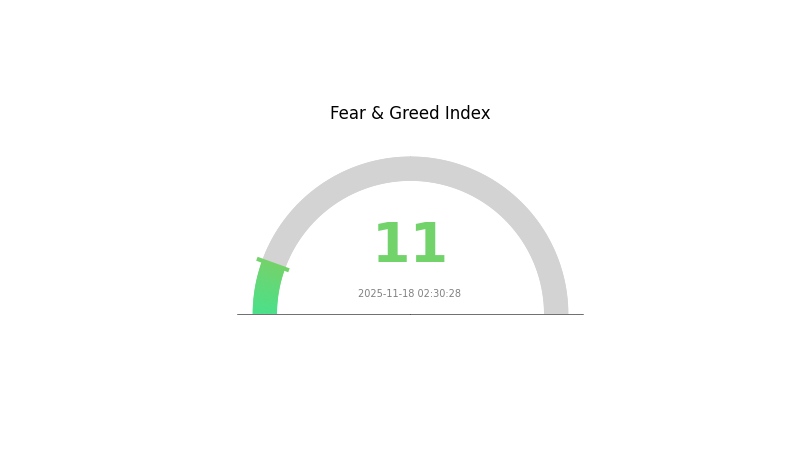

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This signals a potential buying opportunity for savvy investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider dollar-cost averaging strategies and focus on projects with strong fundamentals. Remember, market cycles are natural, and extreme fear often precedes significant recoveries. Stay informed, manage risks wisely, and be prepared for potential market shifts in the coming days.

METAL Holdings Distribution

The address holdings distribution data for METAL reveals a highly decentralized ownership structure. With no significant concentrations of tokens in any single address, the distribution suggests a diverse and widespread holder base. This pattern indicates a relatively low risk of market manipulation or price volatility stemming from large individual holders.

The absence of dominant addresses holding a substantial percentage of METAL tokens points to a healthy distribution among participants. Such a dispersed ownership structure typically contributes to market stability and resilience against sudden price swings caused by large sell-offs. Furthermore, it aligns well with the principles of decentralization, potentially fostering a more democratic and participatory ecosystem for METAL.

This distributed ownership pattern may also indicate a strong grassroots interest in the project, with a broad base of smaller holders rather than a few institutional or whale investors dominating the supply. Overall, the current address distribution reflects positively on METAL's market structure, suggesting a robust foundation for organic growth and price discovery.

Click to view the current METAL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting METAL's Future Price

Supply Mechanism

- Supply and Demand: This is the core factor affecting metal prices. On the demand side, when the global economy recovers, rapid development in industries such as industrial production, construction, and automobile manufacturing will significantly increase the demand for metals.

Institutional and Whale Dynamics

- National Policies: The accelerated decline of US dollar credit has become a core driving factor for metal price increases since 2025, promoting a strong rebound in non-ferrous metal prices.

Macroeconomic Environment

- Monetary Policy Impact: With the Federal Reserve's rate cut cycle beginning, manufacturing demand previously suppressed by the high-interest rate environment may gradually be released.

- Geopolitical Factors: Changes in the fiscal orientation of major Western countries, shifting towards encouraging corporate investment or direct government support for military and infrastructure construction.

Technological Development and Ecosystem Building

- Technological Innovation: Technological innovation and ecosystem construction are mentioned as major factors affecting MTL's future price.

- Ecosystem Applications: The article analyzes MTL's price trend predictions for different development scenarios and proposes professional investment strategies.

III. METAL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.11324 - $0.20971

- Neutral prediction: $0.20971 - $0.22229

- Optimistic prediction: $0.22229 - $0.23328 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.17747 - $0.28754

- 2028: $0.15878 - $0.32780

- Key catalysts: Increasing adoption and market expansion

2030 Long-term Outlook

- Base scenario: $0.31858 - $0.32844 (assuming steady market growth)

- Optimistic scenario: $0.32844 - $0.35471 (assuming favorable market conditions)

- Transformative scenario: $0.35471 - $0.36493 (assuming breakthrough developments in METAL ecosystem)

- 2030-12-31: METAL $0.35471 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.22229 | 0.20971 | 0.11324 | 0 |

| 2026 | 0.23328 | 0.216 | 0.1296 | 3 |

| 2027 | 0.28754 | 0.22464 | 0.17747 | 7 |

| 2028 | 0.3278 | 0.25609 | 0.15878 | 22 |

| 2029 | 0.36493 | 0.29194 | 0.18392 | 39 |

| 2030 | 0.35471 | 0.32844 | 0.31858 | 56 |

IV. METAL Professional Investment Strategies and Risk Management

METAL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Layer 0 blockchain technology

- Operation suggestions:

- Accumulate METAL tokens during market dips

- Stay updated with project developments and ecosystem growth

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor trading volume for confirmation of price movements

METAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate investments across multiple Layer 0 and Layer 1 projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet option: Official Metal Blockchain wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for METAL

METAL Market Risks

- High volatility: Price fluctuations common in early-stage blockchain projects

- Competition: Other Layer 0 solutions may gain market share

- Adoption risk: Slow uptake by developers and enterprises could impact growth

METAL Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of Layer 0 projects

- Cross-border compliance: Challenges in adhering to diverse international regulations

- Token classification: Risk of being classified as a security in some jurisdictions

METAL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the blockchain's code

- Scalability challenges: Possible limitations in handling high transaction volumes

- Interoperability issues: Difficulties in seamless integration with other blockchains

VI. Conclusion and Action Recommendations

METAL Investment Value Assessment

METAL shows promise as a Layer 0 blockchain solution, offering potential long-term value through its innovative approach to consensus and interoperability. However, short-term risks include high volatility, regulatory uncertainty, and competition in the rapidly evolving blockchain space.

METAL Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Evaluate for inclusion in diversified blockchain technology portfolios

METAL Trading Participation Methods

- Spot trading: Purchase and hold METAL tokens on reputable exchanges

- Staking: Participate in network validation if staking options become available

- DeFi integration: Explore potential yield farming or liquidity provision opportunities as the ecosystem develops

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Are metal prices expected to rise?

Metal prices are expected to rise due to stimulus packages, but may be tempered by a sluggish real estate sector. Recent trends show mixed signals, with aluminum prices increasing in 2024 due to raw material shortages.

What is the price prediction for metal One in 2030?

Based on long-term forecasts, the price prediction for Metal One in 2030 is approximately 35.796 GBX.

What will 1 oz of gold be worth in 5 years?

Based on current trends, 1 oz of gold is projected to be worth approximately $3,441 in 5 years, assuming an annual growth rate of 11.2%.

What is the metal outlook for 2025?

Metal prices in 2025 show stability for stainless steel, while carbon metals have decreased. High demand for red metals leads to extended lead times. Reshoring trends are boosting demand for domestic suppliers.

Share

Content