2025 LTC Price Prediction: Analyzing Key Factors Driving Litecoin's Future Value

Introduction: LTC's Market Position and Investment Value

Litecoin (LTC), as a pioneering cryptocurrency based on the Scrypt algorithm, has achieved significant milestones since its inception in 2011. As of 2025, Litecoin's market capitalization has reached $7.39 billion, with a circulating supply of approximately 76.51 million coins, and a price hovering around $96.58. This asset, often referred to as "digital silver," is playing an increasingly crucial role in fast and efficient digital transactions.

This article will comprehensively analyze Litecoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. LTC Price History Review and Current Market Status

LTC Historical Price Evolution

- 2015: LTC reached its all-time low of $1.15 on January 14

- 2021: LTC hit its all-time high of $410.26 on May 10

- 2025: Current price at $96.58, showing a 28.18% increase over the past year

LTC Current Market Situation

As of November 14, 2025, Litecoin (LTC) is trading at $96.58, ranking 25th in the cryptocurrency market. The coin has experienced a 3.15% decrease in the last 24 hours, with a trading volume of $17,120,395.69. LTC's market capitalization stands at $7,389,215,870, representing a 0.21% market share in the overall crypto market.

In the short term, LTC has shown mixed performance across different timeframes. While it has declined by 1.05% in the past hour and 3.15% in the last 24 hours, it has gained 6.93% over the past week. However, looking at the 30-day performance, LTC has experienced a slight decrease of 2.19%.

The circulating supply of LTC is 76,508,758.23, which is 91.08% of its maximum supply of 84,000,000 coins. This high circulation ratio indicates that a significant portion of LTC is already in the market.

Despite recent price fluctuations, LTC has demonstrated strong long-term growth, with a 28.18% increase in value over the past year. This suggests a positive sentiment among investors and growing adoption of the cryptocurrency.

Click to view the current LTC market price

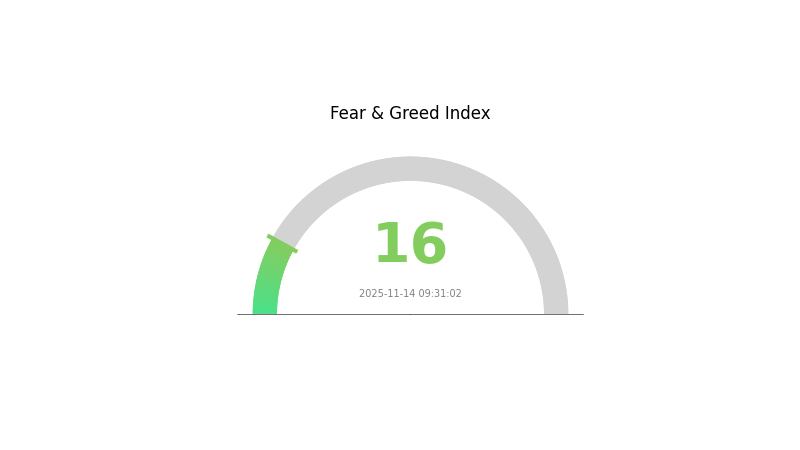

LTC Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 16. This indicates a high level of uncertainty and pessimism among investors. Such extreme fear often presents potential buying opportunities for contrarian investors, as markets may be oversold. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Keep a close eye on market trends and fundamental factors affecting LTC's price movement.

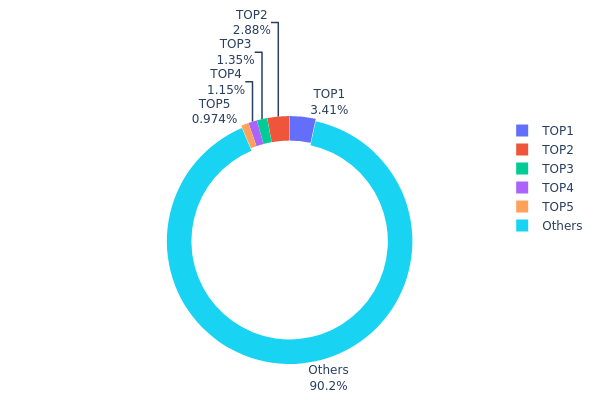

LTC Holdings Distribution

The address holdings distribution data provides insight into the concentration of Litecoin (LTC) ownership across different wallet addresses. Analysis of the current data reveals a relatively decentralized distribution pattern. The top 5 addresses collectively hold only 9.75% of the total LTC supply, with the largest individual address containing 3.41%. This distribution suggests a healthy level of decentralization, as no single entity or small group appears to have overwhelming control over the LTC supply.

The fact that 90.25% of LTC is held by addresses outside the top 5 indicates a broad distribution among a large number of participants. This wide dispersion of holdings contributes to market stability and reduces the risk of price manipulation by large holders. It also reflects a mature ecosystem with diverse participation, enhancing Litecoin's resilience to sudden market shocks that could arise from the actions of a few major players.

Overall, the current address distribution pattern of LTC demonstrates a robust on-chain structure and a high degree of decentralization. This characteristic aligns well with the principles of cryptocurrencies and suggests a reduced likelihood of market distortions caused by concentrated ownership.

Click to view the current LTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | MQd1fJ...qDbPQS | 2611.45K | 3.41% |

| 2 | ltc1qr...h5pp4t | 2205.01K | 2.88% |

| 3 | MLj1bg...nXXV3E | 1033.08K | 1.35% |

| 4 | MS56eJ...pTzZ5V | 878.22K | 1.14% |

| 5 | MQSs17...K5iCB6 | 745.00K | 0.97% |

| - | Others | 69045.88K | 90.25% |

II. Key Factors Influencing LTC's Future Price

Supply Mechanism

- Halving: Litecoin undergoes halving events, where block rewards are reduced by half.

- Historical Pattern: Previous halvings have typically led to price increases due to reduced supply inflation.

- Current Impact: The next halving is expected to potentially drive up LTC's price by reducing new coin issuance.

Institutional and Whale Dynamics

- Institutional Holdings: Some institutional investors have shown interest in LTC as part of their crypto portfolios.

- Corporate Adoption: A few companies have begun accepting LTC as a payment method, expanding its real-world use cases.

Macroeconomic Environment

- Inflation Hedging Properties: LTC, like other cryptocurrencies, is sometimes viewed as a potential hedge against inflation.

Technical Development and Ecosystem Building

- MimbleWimble: The implementation of MimbleWimble technology enhances Litecoin's privacy and scalability features.

- Ecosystem Applications: Litecoin is being integrated into various DeFi platforms and payment systems, expanding its utility.

III. LTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $86.69 - $96.32

- Neutral prediction: $96.32 - $110.00

- Optimistic prediction: $110.00 - $127.14 (requires strong market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range forecast:

- 2027: $106.34 - $164.11

- 2028: $138.83 - $192.00

- Key catalysts: Halving event, increased institutional adoption, and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $169.85 - $194.48 (assuming steady growth and adoption)

- Optimistic scenario: $194.48 - $219.11 (assuming widespread adoption and favorable regulatory environment)

- Transformative scenario: $219.11 - $250.00 (assuming major technological breakthroughs and mainstream integration)

- 2030-12-31: LTC $213.92 (potential peak before market correction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 127.14 | 96.32 | 86.688 | 0 |

| 2026 | 150.84 | 111.73 | 80.44646 | 15 |

| 2027 | 164.11 | 131.28 | 106.34 | 35 |

| 2028 | 192 | 147.69 | 138.83 | 52 |

| 2029 | 219.11 | 169.85 | 140.97 | 75 |

| 2030 | 213.92 | 194.48 | 101.13 | 101 |

IV. LTC Professional Investment Strategies and Risk Management

LTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operational suggestions:

- Accumulate LTC during market dips

- Set up regular purchase plans to average costs

- Store LTC in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key Points for Swing Trading:

- Follow the overall market trend

- Set clear entry and exit points based on technical indicators

LTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: 10-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Litecoin Core wallet

- Security precautions: Use two-factor authentication, backup private keys securely

V. LTC Potential Risks and Challenges

LTC Market Risks

- High volatility: LTC price can fluctuate dramatically in short periods

- Market sentiment: Influenced by overall cryptocurrency market trends

- Competition: Emerging cryptocurrencies may challenge LTC's market position

LTC Regulatory Risks

- Government regulations: Potential restrictions or bans in certain jurisdictions

- Tax implications: Evolving tax laws may impact LTC transactions and holdings

- AML/KYC requirements: Increasing compliance demands from exchanges

LTC Technical Risks

- Network security: Potential vulnerabilities to 51% attacks

- Scalability challenges: Handling increased transaction volumes

- Development pace: Keeping up with technological advancements in the crypto space

VI. Conclusion and Action Recommendations

LTC Investment Value Assessment

Litecoin offers long-term potential as an established cryptocurrency with fast transaction speeds and low fees. However, short-term volatility and regulatory uncertainties pose significant risks.

LTC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider LTC as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate LTC for potential hedging and diversification benefits

LTC Trading Participation Methods

- Spot trading: Buy and sell LTC directly on Gate.com

- Futures trading: Engage in leveraged trading with caution on Gate.com

- Staking: Explore LTC Staking options for passive income, if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will LTC be worth in 2025?

Based on market trends and expert predictions, LTC could potentially reach $250-$300 by 2025, driven by increased adoption and technological advancements in the crypto space.

Can Litecoin reach $1000?

Yes, Litecoin could potentially reach $1000 in the future. With increasing adoption and market growth, LTC may achieve this milestone, especially if crypto markets experience significant bullish trends.

How much will LTC be worth in 2030?

Based on current trends and market analysis, LTC could potentially reach $500 to $800 by 2030, driven by increased adoption and technological advancements in the crypto space.

Is LTC worth buying?

Yes, LTC is worth buying. Its strong network, low fees, and potential for growth make it an attractive investment in the crypto market.

Share

Content