2025 LINK Price Prediction: Bullish Trends and Key Factors Driving Chainlink's Future Value

Introduction: LINK's Market Position and Investment Value

ChainLink (LINK), as a leading decentralized oracle network, has achieved significant milestones since its inception in 2017. As of 2025, ChainLink's market capitalization has reached $10.02 billion, with a circulating supply of approximately 696,849,970 tokens, and a price hovering around $14.38. This asset, often referred to as the "Oracle of Blockchain," is playing an increasingly crucial role in connecting smart contracts with real-world data.

This article will provide a comprehensive analysis of ChainLink's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LINK Price History Review and Current Market Status

LINK Historical Price Evolution

- 2017: Initial launch, price started at $0.148183

- 2021: Bull market peak, price reached all-time high of $52.7 on May 10

- 2022-2023: Crypto winter, price declined significantly from its peak

LINK Current Market Situation

As of November 14, 2025, LINK is trading at $14.38. The token has experienced a 9.7% decrease in the last 24 hours, with a trading volume of $14,863,197. LINK's market capitalization stands at $10,020,702,575, ranking it 16th among all cryptocurrencies. The circulating supply is 696,849,970 LINK, which represents 69.68% of the total supply of 1 billion tokens.

In the short term, LINK has shown negative price trends across various timeframes. It has decreased by 0.03% in the past hour, 5.16% in the past week, and 23.77% in the past month. However, LINK has demonstrated a positive performance over the past year, with a 6.61% increase.

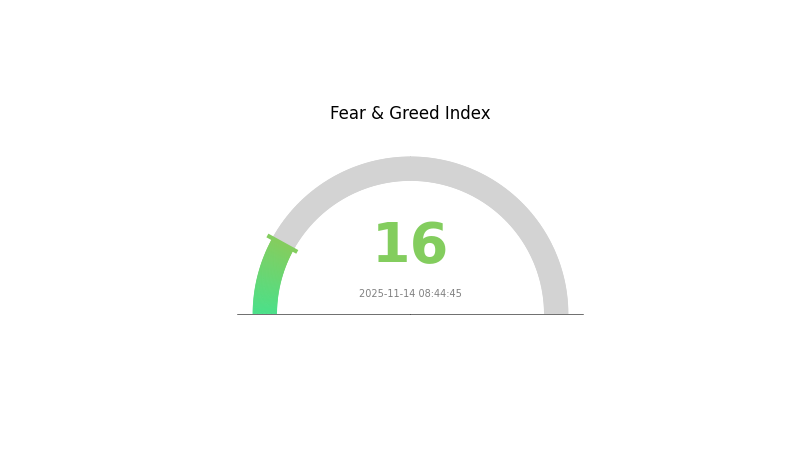

The market sentiment for LINK is currently in a state of "Extreme Fear" with a VIX index of 16, indicating significant investor anxiety in the broader crypto market.

Click to view the current LINK market price

LINK Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider diversifying their portfolios and implementing risk management strategies. Remember, market cycles are natural, and extreme fear doesn't last forever. Stay informed and make decisions based on thorough research and personal risk tolerance.

LINK Holdings Distribution

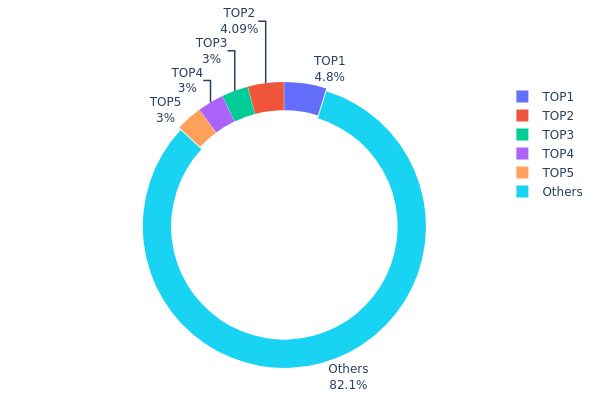

The address holdings distribution data provides insights into the concentration of LINK tokens among various wallet addresses. Analysis of this data reveals a moderate level of centralization in LINK's distribution. The top 5 addresses collectively hold 17.88% of the total LINK supply, with the largest holder possessing 4.80% of the tokens. This suggests a relatively balanced distribution, as no single address holds an overwhelmingly large portion of the supply.

However, the fact that 82.12% of LINK tokens are held by "Others" indicates a significant level of dispersion among smaller holders. This distribution pattern suggests a healthy balance between large stakeholders and a broader base of smaller investors. While the top holders have the potential to influence market dynamics, the wide distribution among other addresses mitigates the risk of market manipulation and contributes to overall market stability. This balance in LINK's token distribution reflects a moderate degree of decentralization, which is generally positive for the ecosystem's long-term sustainability and resilience against centralized control.

Click to view the current LINK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 48000.00K | 4.80% |

| 2 | 0xbc10...fcdb5e | 40875.54K | 4.08% |

| 3 | 0x9bbb...cc8db8 | 30000.00K | 3.00% |

| 4 | 0x35a5...3b5e45 | 30000.00K | 3.00% |

| 5 | 0x8652...4de081 | 30000.00K | 3.00% |

| - | Others | 821124.46K | 82.12% |

II. Key Factors Influencing LINK's Future Price

Supply Mechanism

- Inflationary Supply: LINK has an inflationary supply model with a maximum cap of 1 billion tokens.

- Historical Pattern: Past supply increases have generally led to short-term price pressures.

- Current Impact: The continued token release is expected to exert mild downward pressure on price in the short term.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms have increased their LINK holdings in recent months.

- Enterprise Adoption: Companies like Google Cloud and Swift have partnered with Chainlink for oracle services.

Macroeconomic Environment

- Monetary Policy Impact: Expected central bank easing could potentially boost risk asset demand, including cryptocurrencies like LINK.

- Inflation Hedging Properties: LINK has shown some correlation with inflation hedges, though not as strong as Bitcoin.

Technological Development and Ecosystem Building

- Chainlink 2.0: The upgrade aims to enhance scalability and introduce staking, potentially increasing network security and token demand.

- Cross-Chain Interoperability: Ongoing developments in cross-chain communication could expand Chainlink's utility across multiple blockchains.

- Ecosystem Applications: Decentralized insurance platforms and prediction markets are leveraging Chainlink oracles, expanding its use cases.

III. LINK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $8.03 - $12.00

- Neutral prediction: $12.00 - $16.00

- Optimistic prediction: $16.00 - $18.80 (requires strong market recovery and increased adoption of Chainlink services)

2027-2028 Outlook

- Market stage expectation: Potential consolidation phase followed by gradual growth

- Price range forecast:

- 2027: $14.00 - $25.44

- 2028: $12.97 - $31.47

- Key catalysts: Expansion of Chainlink's oracle services, integration with more blockchain networks, and increased demand for decentralized data feeds

2030 Long-term Outlook

- Base scenario: $25.00 - $35.00 (assuming steady growth in the blockchain and DeFi sectors)

- Optimistic scenario: $35.00 - $43.39 (assuming widespread adoption of Chainlink technology across multiple industries)

- Transformative scenario: $45.00 - $55.00 (assuming Chainlink becomes the dominant oracle solution for most blockchain networks and real-world data integration)

- 2030-12-31: LINK $29.92 (potential average price based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 18.80767 | 14.357 | 8.03992 | 0 |

| 2026 | 17.57728 | 16.58234 | 14.42663 | 15 |

| 2027 | 25.44891 | 17.07981 | 14.00544 | 18 |

| 2028 | 31.47125 | 21.26436 | 12.97126 | 47 |

| 2029 | 33.48711 | 26.3678 | 22.14895 | 83 |

| 2030 | 43.39481 | 29.92746 | 15.263 | 108 |

IV. LINK Professional Investment Strategy and Risk Management

LINK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in oracle technology

- Operation suggestions:

- Accumulate LINK during market dips

- Set price targets and rebalance portfolio periodically

- Store in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor oracle adoption news and partnership announcements

- Pay attention to overall crypto market sentiment

LINK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple oracle projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, and be cautious of phishing attempts

V. Potential Risks and Challenges for LINK

LINK Market Risks

- Volatility: Crypto market fluctuations can lead to significant price swings

- Competition: Emerging oracle solutions may challenge Chainlink's market position

- Adoption rate: Slower than expected integration by DeFi projects could impact growth

LINK Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory decisions in key markets

- Securities classification: Risk of LINK being classified as a security in some jurisdictions

- Cross-border restrictions: Possible limitations on LINK's use in certain countries

LINK Technical Risks

- Smart contract vulnerabilities: Potential for exploits in Chainlink's code

- Network congestion: Ethereum network issues could affect Chainlink's performance

- Oracle manipulation: Theoretical risk of data feed tampering

VI. Conclusion and Action Recommendations

LINK Investment Value Assessment

Chainlink (LINK) presents a strong long-term value proposition as a leading oracle solution in the blockchain space. However, short-term volatility and regulatory uncertainties pose significant risks.

LINK Investment Recommendations

✅ Beginners: Consider small, regular investments to build a position over time ✅ Experienced investors: Implement a balanced approach with strategic entry and exit points ✅ Institutional investors: Conduct thorough due diligence and consider LINK as part of a diversified crypto portfolio

LINK Trading Participation Methods

- Spot trading: Buy and hold LINK on reputable exchanges like Gate.com

- DeFi staking: Explore LINK staking opportunities in DeFi protocols

- Futures trading: For experienced traders, LINK futures contracts offer leveraged exposure

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will Chainlink be worth in 2025?

Based on market trends and adoption, Chainlink could potentially reach $50-$60 per LINK token by 2025, driven by increased demand for decentralized oracle services in the expanding Web3 ecosystem.

Can Chainlink reach $100?

Yes, Chainlink could potentially reach $100 in the future, given its strong fundamentals, growing adoption, and the overall expansion of the crypto market. However, precise price predictions are challenging and depend on various factors.

How high will link coin go?

LINK could potentially reach $100 by 2025, driven by increased adoption of Chainlink's oracle services and overall crypto market growth.

Is link a buy or sell?

Based on market trends and potential growth, LINK appears to be a buy. Its utility in smart contracts and oracle networks suggests long-term value.

Share

Content