2025 KSM Price Prediction: Bullish Outlook as Kusama Network Expands Its Ecosystem

Introduction: KSM's Market Position and Investment Value

Kusama (KSM), as a canary network for Polkadot, has made significant strides since its inception in 2019, establishing itself as a crucial testbed for blockchain innovation. As of 2025, Kusama's market capitalization has reached $179,002,337, with a circulating supply of approximately 17,331,743 KSM tokens, and a price hovering around $10.328. This asset, often referred to as "Polkadot's wild cousin," is playing an increasingly vital role in blockchain experimentation and rapid iteration.

This article will provide a comprehensive analysis of Kusama's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. KSM Price History Review and Current Market Status

KSM Historical Price Evolution

- 2020: Kusama network launched, price started around $1.70

- 2021: Bull market peak, KSM reached all-time high of $621.71 on May 18

- 2022-2023: Crypto winter, price declined to low double digits

KSM Current Market Situation

As of November 16, 2025, KSM is trading at $10.328. The token has experienced a slight decline of 0.4% in the past 24 hours, with a trading volume of $25,410.01337. KSM's market capitalization stands at $179,002,245.55, ranking it 271st in the overall cryptocurrency market. The current price represents a significant drop from its all-time high, reflecting the broader market conditions. Short-term price trends show mixed signals, with a 0.09% increase in the last hour but a 22.81% decrease over the past week.

Click to view the current KSM market price

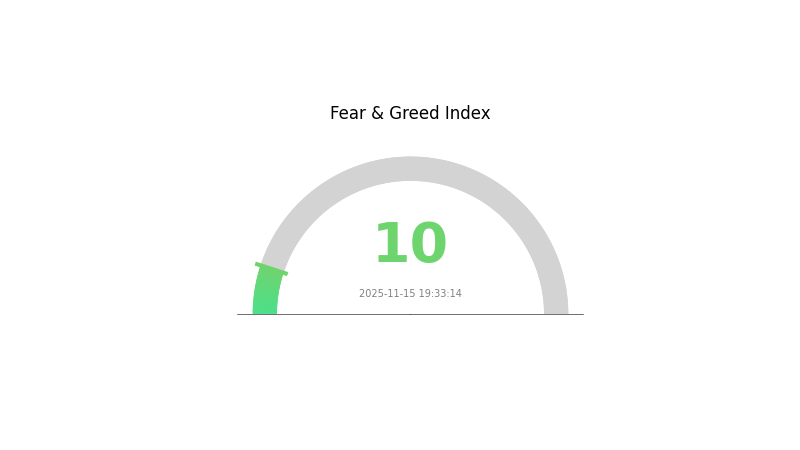

KSM Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to remember that market bottoms can be prolonged. While some may see this as a chance to accumulate KSM at lower prices, others might prefer to wait for signs of sentiment improvement before entering the market. As always, thorough research and risk management are essential in these volatile conditions.

KSM Holdings Distribution

The address holdings distribution data for KSM is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration and market structure. Without specific data on top addresses and their holdings, we cannot accurately assess the degree of centralization or decentralization in the KSM network.

In general, address holdings distribution is a crucial metric for understanding the distribution of wealth and power within a cryptocurrency network. It provides insights into the level of decentralization and the potential for market manipulation. A healthy distribution typically shows a balanced spread of holdings across numerous addresses, reducing the risk of market dominance by a few large holders.

For KSM, the lack of available data makes it challenging to evaluate its on-chain structural stability or the potential impact of large holders on price volatility. Investors and analysts should seek updated information to make informed decisions about the network's current state and its implications for market dynamics.

Click to view the current KSM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting KSM's Future Price

Supply Mechanism

- Inflationary Model: KSM has an inflationary supply model with no fixed cap.

- Historical Pattern: The increasing supply has generally put downward pressure on the price over time.

- Current Impact: Continued inflation may create selling pressure, potentially impacting the price negatively.

Technical Development and Ecosystem Building

- Parachain Auctions: Ongoing parachain auctions lock up KSM tokens, potentially reducing circulating supply.

- Ecosystem Growth: The expansion of projects building on Kusama may increase demand for KSM tokens.

- Ecosystem Applications: Various DApps and projects are being developed on Kusama, enhancing its utility and potential value.

III. KSM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $9.09 - $10.33

- Neutral prediction: $10.33 - $12.08

- Optimistic prediction: $12.08 - $13.84 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation phase with gradual upward trend

- Price range forecast:

- 2027: $9.92 - $14.95

- 2028: $13.70 - $16.13

- Key catalysts: Network upgrades, increased parachain activity, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $15.20 - $17.33 (assuming steady growth and adoption)

- Optimistic scenario: $17.33 - $19.46 (assuming strong ecosystem expansion and favorable market conditions)

- Transformative scenario: $19.46 - $23.92 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: KSM $23.92 (potentially reaching new all-time highs)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 13.83952 | 10.328 | 9.08864 | 0 |

| 2026 | 15.1047 | 12.08376 | 10.87538 | 17 |

| 2027 | 14.95365 | 13.59423 | 9.92379 | 31 |

| 2028 | 16.12955 | 14.27394 | 13.70298 | 38 |

| 2029 | 19.45824 | 15.20175 | 12.46543 | 47 |

| 2030 | 23.91539 | 17.32999 | 12.13099 | 67 |

IV. KSM Professional Investment Strategies and Risk Management

KSM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors, believers in Polkadot ecosystem

- Operational suggestions:

- Accumulate KSM during market dips

- Participate in network governance and staking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Polkadot ecosystem developments

- Track parachain auction cycles

KSM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Allocate across multiple crypto assets

- Stop-loss orders: Limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Use two-factor authentication, regularly update software

V. Potential Risks and Challenges for KSM

KSM Market Risks

- High volatility: Significant price fluctuations

- Correlation with broader crypto market: Susceptible to overall market trends

- Competition from other blockchain platforms

KSM Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny

- Cross-border compliance issues: Varying regulations across jurisdictions

- Taxation complexities: Evolving tax treatment of crypto assets

KSM Technical Risks

- Smart contract vulnerabilities: Potential for exploits

- Scalability challenges: Ability to handle increased network load

- Interoperability issues: Smooth integration with other blockchains

VI. Conclusion and Action Recommendations

KSM Investment Value Assessment

Kusama offers long-term potential as a testbed for Polkadot innovations, but faces short-term volatility and ecosystem-specific risks.

KSM Investment Recommendations

✅ Beginners: Start with small positions, focus on learning ecosystem ✅ Experienced investors: Consider allocating as part of a diversified crypto portfolio ✅ Institutional investors: Explore staking and governance participation opportunities

KSM Trading Participation Methods

- Spot trading: Buy and sell KSM on Gate.com

- Staking: Participate in network security and earn rewards

- Parachain auctions: Support projects building on Kusama

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is Kusama worth in 2025?

Based on market trends and expert predictions, Kusama (KSM) could be worth around $250 to $300 per token by 2025, potentially reaching new all-time highs due to increased adoption and ecosystem growth.

What is the future of the KSM coin?

KSM's future looks promising, with potential for significant growth. As Kusama's native token, it's likely to benefit from increased adoption of parachains and DeFi projects on the network.

Can Kusama reach 1000?

While ambitious, Kusama reaching $1000 is possible in the long term, given its potential for growth in the Web3 ecosystem and increasing adoption of parachains.

Will Kusama ever recover?

Yes, Kusama is likely to recover. As a key player in the Polkadot ecosystem, it has strong fundamentals and ongoing development. Market cycles suggest a potential rebound in the coming years.

Share

Content