2025 JPrice Tahmini: Pandemi Sonrası Ekonomide Piyasa Trendleri ve J-Assets'in Gelecekteki Değerlemesi Analizi

Giriş: J'nin Piyasa Konumu ve Yatırım Potansiyeli

Jambo (J), dünyanın en büyük mobil odaklı kripto ağı olma hedefiyle yola çıkan bir proje olarak kuruluşundan bu yana önemli ilerleme kaydetti. 2025 yılı itibarıyla Jambo'nun piyasa değeri 13.666.900 $'a ulaşırken, yaklaşık 130.000.000 token dolaşımda ve fiyatı 0,10513 $ civarında seyrediyor. Mobil kripto çözümlerine odaklanan bu varlık, mobil öncelikli kripto ekosisteminde giderek daha belirleyici bir rol üstleniyor.

Bu makalede, Jambo'nun 2025-2030 dönemindeki fiyat hareketleri tarihsel veri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında incelenerek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. J Fiyat Geçmişi ve Mevcut Piyasa Durumu

J Fiyatının Tarihsel Gelişimi

- 2025 (Ocak): J, tüm zamanların en yüksek seviyesi olan 1,5 $'a ulaşarak fiyat tarihinde önemli bir dönüm noktası yaşadı.

- 2025 (Eylül): Fiyat, sert bir piyasa düzeltmesiyle tüm zamanların en düşük seviyesi olan 0,08655 $'a geriledi.

- 2025 (Ekim): J, toparlanma sinyalleri göstererek fiyatını yaklaşık 0,10513 $ seviyesinde istikrara kavuşturdu.

J Mevcut Piyasa Görünümü

7 Ekim 2025 tarihi itibarıyla J, 0,10513 $ seviyesinde işlem görüyor. Token, son 24 saatte %0,83 oranında hafif bir değer kaybı yaşarken, işlem hacmi 257.460,77 $ olarak gerçekleşti. Kısa vadeli düşüşe rağmen J, son bir haftada %12,22 artışla güçlü bir performans sergiledi. Piyasa değeri 13.666.900 $ olup, J kripto piyasasında 1280'inci sırada yer alıyor.

J'nin dolaşımdaki arzı 130.000.000 token ve bu miktar, toplam arzın (1.000.000.000) %13’ünü oluşturuyor. Düşük dolaşım oranı, ilerleyen dönemde daha fazla token piyasaya sürüldükçe büyüme potansiyelinin varlığına işaret ediyor.

J'nin farklı zaman dilimlerindeki fiyat performansı karmaşık bir seyir izliyor. Son bir haftada %12,22, son bir ayda %6,17 artış görülürken; yıl başından bu yana performansı %85,35 oranında ciddi bir düşüş gösteriyor. J, kısa vadede yükseliş yaşasa da genel piyasa gerilemesinden henüz tam anlamıyla toparlanmış değil.

Mevcut piyasa duyarlılığı temkinli bir iyimserliği yansıtıyor; son dönemdeki olumlu fiyat hareketi yeni yatırımcı ilgisini artırabilir. Ancak token fiyatı hâlâ tüm zamanların zirvesinin oldukça altında; piyasa koşulları iyileşirse büyüme için ciddi bir potansiyel söz konusu.

Mevcut J piyasa fiyatını incelemek için tıklayın

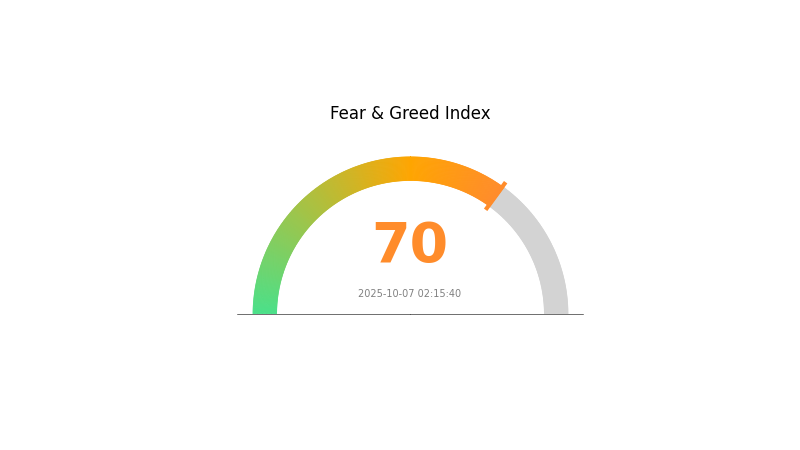

J Piyasa Duyarlılığı Endeksi

2025-10-07 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Mevcut Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu an güçlü bir iyimserlik hakim; Korku ve Açgözlülük Endeksi 70'e ulaşarak açgözlülük sinyali veriyor. Bu tür bir duyarlılık genellikle yükseliş trendinin göstergesi olup yatırımcıların kazanç beklentisini artırıyor. Ancak aşırı açgözlülük dönemlerinde dikkatli olmak gerekir; çünkü aşırı değerlenme ve volatilite riski yükselir. Gate.com üzerindeki deneyimli yatırımcılar, bu endeksi izleyerek hem olumlu ivmeden yararlanıyor hem de olası düzeltmelere karşı stratejilerini güçlendiriyor.

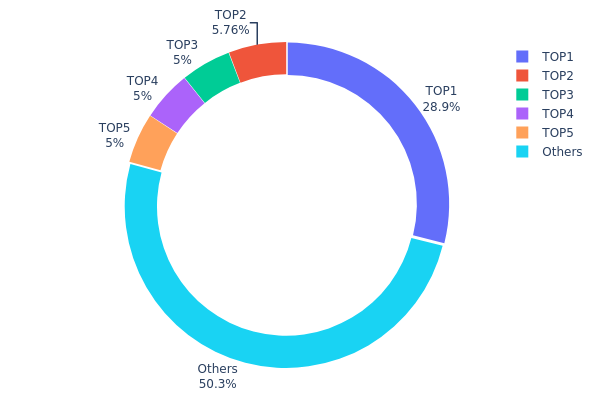

J Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, J token sahipliğinde yüksek bir yoğunlaşma olduğunu gösteriyor. En büyük adres, toplam arzın %28,89'unu elinde bulunduruyor ve bu ciddi bir merkezileşmeye işaret ediyor. Sonraki dört adresin her biri %5 veya biraz fazlasına sahip ve toplamda arzın %20,76’sını kontrol ediyor. Buna göre, ilk 5 adres J tokenlarının neredeyse yarısını (%49,65) elinde tutarken, geri kalan %50,35 diğer yatırımcılar arasında dağılmış durumda.

Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı açısından risk oluşturuyor. Tokenların büyük bir kısmı az sayıda adreste toplanınca, bu yatırımcıların satış veya transfer işlemleri fiyatlarda sert dalgalanmalara neden olabilir. Ayrıca bu seviyede merkezileşme, J’nin piyasa dinamiklerini etkileyerek büyük yatırımcıların fiyatlar üzerinde daha kolay etkili olmasına yol açabilir.

Genel olarak bakıldığında, bu dağılım J'nin merkeziyetsizlik düzeyinin düşük olduğunu ve bunun hem yatırımcı algısına hem de piyasa istikrarına olumsuz yansıyabileceğini gösteriyor. Kripto paraların çoğunda yoğunlaşma olağan olsa da, bu derecedeki konsolidasyon büyük sahiplerin aktivitelerinin ve piyasa etkilerinin yakından izlenmesini gerektiriyor.

Mevcut J Varlık Dağılımını görüntülemek için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | A5gsRX...Qky4N5 | 288.991,99K | 28,89% |

| 2 | 3LzmBq...Bwq3b1 | 57.617,86K | 5,76% |

| 3 | 9nESh7...x5smmn | 50.000,01K | 5,00% |

| 4 | 3ukaaH...q6QZu1 | 50.000,01K | 5,00% |

| 5 | Ftrnwk...wxWori | 50.000,01K | 5,00% |

| - | Diğerleri | 503.389,87K | 50,35% |

II. Gelecekteki J Fiyatlarını Belirleyen Temel Etkenler

Arz Mekanizması

- Tarihsel eğilimler: Geçmişteki arz değişimleri fiyatlar üzerinde önemli etki yaratmıştır. Arzın azalması ve talebin artması fiyatları yükseltirken, arz bolluğunda ve talebin zayıflamasında fiyatlar gerileyebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Ulusal politikalar: Ülke bazında hükümet uygulamaları J fiyatlarını ciddi biçimde etkileyebilir.

Makroekonomik Ortam

- Para politikalarının etkisi: Merkez bankalarının ve özellikle büyük ekonomilerdeki para politikalarının J fiyatlarına belirgin yansımaları bekleniyor.

- Enflasyona karşı koruma: J, performansı enflasyonist ortamlara paralel olarak enflasyona karşı koruma aracı özellikleri göstermektedir.

- Jeopolitik etkenler: Uluslararası gerilim ve çatışmalar, yatırımcıları J’ye güvenli liman olarak yönlendirebilir.

Teknik Gelişim ve Ekosistem İnşası

- Ekosistem uygulamaları: J ile ilişkili büyük DApp’ler ve ekosistem projelerinin gelişimi, varlığın değerini ve benimsenmesini artırabilir.

III. 2025-2030 Arası J Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,0602 $ - 0,10561 $

- Tarafsız tahmin: 0,10561 $ - 0,11089 $

- İyimser tahmin: 0,11089 $ - 0,12665 $ (güçlü piyasa ivmesi gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa fazı: Olası büyüme dönemi

- Fiyat aralığı öngörüleri:

- 2027: 0,07869 $ - 0,15739 $

- 2028: 0,1278 $ - 0,18964 $

- Temel katalizörler: Artan benimsenme ve teknolojik gelişmeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,17185 $ - 0,18479 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,18479 $ - 0,24577 $ (olumlu piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,24577 $ - 0,30000 $ (çığır açan yenilikler ve yaygın benimseme varsayımıyla)

- 31 Aralık 2030: J 0,24577 $ (yılın muhtemel zirvesi)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,11089 | 0,10561 | 0,0602 | 0 |

| 2026 | 0,12665 | 0,10825 | 0,07036 | 2 |

| 2027 | 0,15739 | 0,11745 | 0,07869 | 11 |

| 2028 | 0,18964 | 0,13742 | 0,1278 | 30 |

| 2029 | 0,20604 | 0,16353 | 0,0834 | 55 |

| 2030 | 0,24577 | 0,18479 | 0,17185 | 75 |

IV. J için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

J Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli kripto yatırımcıları ve blokzincir teknolojisi meraklıları

- Uygulama önerileri:

- Piyasa düşüşlerinde J token biriktirmek

- Önemli fiyat hareketleri için fiyat alarmı kurmak

- Tokenları güvenli donanım cüzdanında saklamak

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip etmek

- RSI: Aşırı alım veya aşırı satım bölgelerini tespit etmek

- Dalgalı alım-satımda temel noktalar:

- Jambo ile ilgili piyasa duyarlılığını ve haberleri izlemek

- Risk yönetimi için zarar-durdur emirleri uygulamak

J Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklarına yaymak

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanmak

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için kağıt cüzdan kullanmak

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü parola kullanmak

V. J için Potansiyel Riskler ve Zorluklar

J Piyasa Riskleri

- Yüksek volatilite: Kripto piyasası ani fiyat dalgalanmalarına açıktır

- Sınırlı benimseme: Jambo’nun başarısı geniş kullanıcı kabulüne bağlıdır

- Rekabet: Mobil odaklı rakip kripto ağlar ortaya çıkabilir

J Mevzuat Riskleri

- Belirsiz düzenlemeler: Kripto regülasyonları ülkeden ülkeye değişir ve güncellenebilir

- Olası kısıtlamalar: Hükümetler kripto kullanımı üzerinde kısıtlamalar getirebilir

- Vergi etkileri: Gelişen vergi yasaları J token sahiplerini etkileyebilir

J Teknik Riskler

- Akıllı sözleşme açıkları: Token kodunda açıklar ve istismar riski olabilir

- Ağ yoğunluğu: Solana blokzincirinde dönemsel trafik sıkışıklıkları yaşanabilir

- Entegrasyon zorlukları: JamboPhone uygulamasında teknik sorunlar çıkabilir

VI. Sonuç ve Eylem Önerileri

J Yatırım Değeri Analizi

Jambo (J), mobil odaklı kripto ağı vizyonuyla dijital ekonomide uzun vadeli potansiyel sunuyor. Ancak yatırımcıların kısa vadeli oynaklık ve benimseme engellerini göz önünde bulundurması gerekir.

J Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp teknolojiyi öğrenmeye odaklanmalı ✅ Deneyimli yatırımcılar: Kripto portföylerinin bir bölümünü J’ye ayırmayı değerlendirmeli ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak J’yi çeşitlendirilmiş portföye dahil etmeli

J Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com’da J token alıp satmak

- Staking: Uygun staking programlarına katılım

- DeFi entegrasyonu: J token ile ilişkili merkeziyetsiz finans fırsatlarını değerlendirmek

Kripto para yatırımları oldukça yüksek risk içerir ve bu içerik yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve uzman finans danışmanlarına danışmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

2025’te hangi meme coin sıçrama yapacak, fiyat tahmini nedir?

Pepe Coin’in deflasyonist yapısı ve artan popülaritesi sayesinde 2025’te değerini zirveye taşıması bekleniyor.

Johnson and Johnson hissesi yükselir mi?

Evet, Johnson and Johnson hissesi için yükseliş öngörülüyor. Tahminlere göre 4 Kasım 2025’te hisse başı fiyatı 191,04 $’a ulaşacak ve mevcut seviyeye göre %1,27 artış gösterecek.

Jacobs hissesi alınmalı mı satılmalı mı?

Jacobs hissesi şu anda Orta Düzey Al notuna sahip. Analistlerin hem al hem de tut tavsiyeleri, bu hisseyi cazip bir yatırım seçeneği hâline getiriyor.

J hissesi ne kadar oynak?

J hissesi, haftalık yaklaşık %3 oynaklık ile düşük volatilite sergilemektedir. Son üç ayda piyasa geneline kıyasla fiyatı oldukça istikrarlıdır.

NEON ve THETA: Yapay zekâ uygulamalarında yeni nesil sinir ağı mimarilerinin karşılaştırmalı analizi

ROOT ve SOL: Zincirler Arası Birlikte Çalışabilirlikte Blockchain Üstünlüğü Yarışı

WEN ve XLM: Büyük Dil Modellerinde Performans ile Tokenizasyon Verimliliğinin Karşılaştırılması

PUSH ve SOL: Blockchain Ölçeklenebilirlik Çözümlerinin Rekabeti

2025’te Solana (SOL) fiyatındaki dalgalanma nasıl bir seyir izleyecek?

XYRO ve SOL: Merkeziyetsiz Finans Platformlarının Geleceği Karşılaştırılıyor

Baby Doge Coin'un Geleceğine Dair Beklentiler: Uzmanların 2024-2030 Tahminleri

Polkadot (DOT) nedir ve çoklu zincir mimarisi, token'ın 2026 değerini nasıl etkiler?

MEMEFI nedir: Merkeziyetsiz Meme Token Platformu ve Devrim Yaratan Özellikleri Hakkında Kapsamlı Rehber