2025 IRONPrice Prediction: Market Analysis and Future Outlook for Steel Industry Commodities

Introduction: IRON's Market Position and Investment Value

Iron Fish (IRON), as a decentralized blockchain project focused on privacy, has made significant strides since its inception. As of 2025, IRON's market capitalization has reached $11,499,951, with a circulating supply of approximately 67,055,111 tokens, and a price hovering around $0.1715. This asset, often referred to as a "privacy-centric blockchain," is playing an increasingly crucial role in the field of secure and private transactions.

This article will comprehensively analyze IRON's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. IRON Price History Review and Current Market Status

IRON Historical Price Evolution

- 2023: IRON reached its all-time high of $23.5 on April 25, marking a significant milestone for the project.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.0784 on March 27.

IRON Current Market Situation

As of October 8, 2025, IRON is trading at $0.1715, representing a 24-hour decrease of 12.72%. The token's market capitalization stands at $11,499,951.69, ranking it 1349th in the global cryptocurrency market. IRON has seen a significant recovery from its all-time low, with a 7-day increase of 28.08%. However, it remains 99.27% below its all-time high. The 24-hour trading volume is $54,099.50, indicating moderate market activity. The circulating supply is 67,055,111.875 IRON, which is 99.99% of the total supply of 67,064,047.5 tokens. The fully diluted market cap is $11,501,484.15, closely matching the current market cap due to the high circulation ratio.

Click to view the current IRON market price

IRON Market Sentiment Indicator

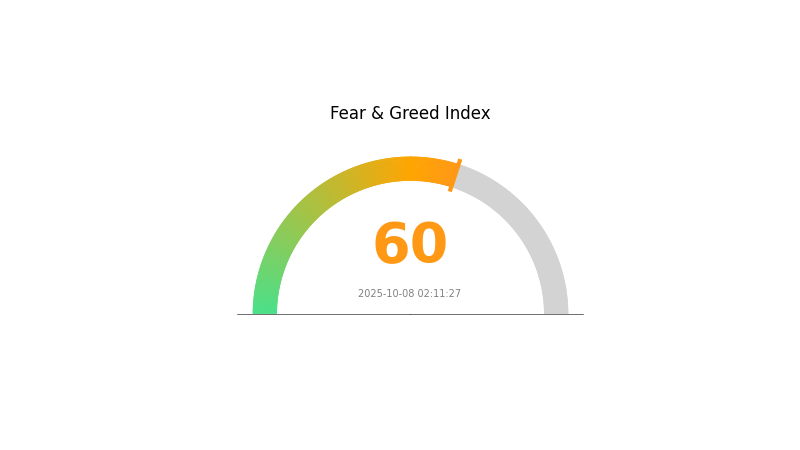

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of greed, with the Fear and Greed Index at 60. This indicates growing investor confidence and potentially bullish sentiment. However, it's crucial to remain cautious as excessive greed can lead to market corrections. Traders should consider diversifying their portfolios and setting stop-loss orders to protect gains. As always, thorough research and risk management are essential in this volatile market environment. Stay informed and trade wisely on Gate.com.

IRON Holdings Distribution

The address holdings distribution data for IRON reveals a notably decentralized ownership structure. With no single address holding a significant percentage of the total supply, the token's distribution appears to be spread across a wide range of holders. This lack of concentration suggests a reduced risk of market manipulation by large individual stakeholders.

The absence of dominant addresses in the distribution indicates a potentially healthy market structure for IRON. Such a dispersed ownership pattern may contribute to more stable price movements, as no single entity has the power to significantly impact the market through large-scale buying or selling actions. This decentralized structure aligns well with the principles of blockchain technology, potentially fostering a more resilient and fair trading environment.

Overall, the current address distribution of IRON reflects a high degree of decentralization and on-chain structural stability. This characteristic may be viewed positively by investors and analysts, as it suggests a reduced risk of market manipulation and potentially more organic price discovery mechanisms.

Click to view the current IRON holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting Future IRON Prices

Supply Mechanism

- Market Structure Changes: Changes in market structure, including supply-demand relationships and industry concentration, significantly impact iron ore price formation.

- Historical Patterns: In the past, supply disruptions have led to price increases, while oversupply has resulted in price declines.

- Current Impact: As supply-side disruptions gradually stabilize, the recovery of steel mill profits is expected to be the main driver of iron ore price increases.

Institutional and Major Player Dynamics

- Corporate Adoption: The implementation of the "Belt and Road" initiative and new rural construction projects in China may influence iron ore demand and prices.

- National Policies: The full implementation of resource tax in 2016 has been a significant factor affecting iron ore prices. Environmental protection measures, such as production restrictions in certain Chinese cities, have also impacted steel production and iron ore demand.

Macroeconomic Environment

- Monetary Policy Impact: Global economic recovery trends play a role in shaping iron ore prices.

- Inflation Hedging Properties: As a commodity, iron ore prices may be influenced by inflationary pressures and used as a potential hedge.

- Geopolitical Factors: International situations, such as the implementation of the EU Carbon Border Adjustment Mechanism (CBAM), may affect iron ore demand and prices, particularly in the context of the steel industry.

Technical Developments and Ecosystem Building

- Environmental Regulations: The implementation of environmental laws has been identified as one of the key factors influencing iron ore prices, potentially affecting production and demand dynamics.

- Industry Applications: The steel industry's profitability and production levels directly impact iron ore demand and prices. Future technological developments in steel production may influence iron ore consumption patterns.

III. IRON Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.09256 - $0.1714

- Neutral prediction: $0.1714 - $0.19368

- Optimistic prediction: $0.19368 - $0.21596 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.16237 - $0.24709

- 2028: $0.15196 - $0.31839

- Key catalysts: Technological advancements, wider adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.27980 - $0.31477 (assuming steady market growth)

- Optimistic scenario: $0.31477 - $0.34975 (assuming strong market performance)

- Transformative scenario: $0.34975 - $0.40000 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: IRON $0.33681 (potential peak within the forecast period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.21596 | 0.1714 | 0.09256 | 0 |

| 2026 | 0.27697 | 0.19368 | 0.14526 | 12 |

| 2027 | 0.24709 | 0.23532 | 0.16237 | 37 |

| 2028 | 0.31839 | 0.24121 | 0.15196 | 40 |

| 2029 | 0.34975 | 0.2798 | 0.25182 | 63 |

| 2030 | 0.33681 | 0.31477 | 0.30218 | 83 |

IV. IRON Professional Investment Strategies and Risk Management

IRON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors focused on privacy-centric blockchain projects

- Operation suggestions:

- Accumulate IRON during market dips

- Set price targets for partial profit-taking

- Store in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Use stop-loss orders to manage risk

- Take profits at predetermined resistance levels

IRON Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. IRON Potential Risks and Challenges

IRON Market Risks

- High volatility: Significant price fluctuations common in cryptocurrency markets

- Limited liquidity: Potential challenges in executing large trades

- Competitive landscape: Emergence of new privacy-focused blockchain projects

IRON Regulatory Risks

- Increased scrutiny: Potential regulatory challenges for privacy coins

- Compliance requirements: Possible restrictions on exchanges listing IRON

- Legal uncertainties: Evolving regulatory framework for cryptocurrencies

IRON Technical Risks

- Network security: Potential vulnerabilities in the blockchain infrastructure

- Scalability challenges: Possible limitations in transaction processing capacity

- Development delays: Risk of setbacks in implementing planned upgrades

VI. Conclusion and Action Recommendations

IRON Investment Value Assessment

Iron Fish offers strong privacy features in a decentralized blockchain, presenting long-term potential for privacy-focused investors. However, short-term risks include high volatility and regulatory uncertainties.

IRON Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about privacy coins ✅ Experienced investors: Consider allocating a portion of portfolio to IRON, maintain strict risk management ✅ Institutional investors: Evaluate IRON as part of a diversified crypto portfolio, monitor regulatory developments closely

IRON Trading Participation Methods

- Spot trading: Buy and sell IRON on Gate.com

- DCA strategy: Set up regular small purchases to average out price volatility

- Staking: Participate in staking programs if available to earn additional rewards

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will the price of iron be in 2025?

Based on current market trends, the price of iron is expected to reach 908 USD/MT in 2025.

What is the projection for iron prices?

Iron prices are projected to gradually increase due to industrial demand. Market trends suggest potential growth, with prices expected to remain stable with slight fluctuations based on global supply and demand dynamics.

Is iron ore expected to rise?

No, iron ore prices are not expected to rise. Analysts predict a decline due to reduced steel production in China, indicating a potential decrease in demand.

Why are iron prices falling?

Iron prices are falling due to oversupply and reduced demand from slowing global economies. Market pressure is particularly strong on mid-tier producers. Prices have dropped to $85-90 per ton.

Share

Content