2025 HOLDSTATION Price Prediction: Analyzing Growth Factors and Market Potential in the Evolving DeFi Ecosystem

Introduction: HOLDSTATION's Market Position and Investment Value

Holdstation (HOLDSTATION), as an innovative Smart Contract Wallet for Futures Trading built on the zkSync Era, has made significant strides since its inception. As of 2025, Holdstation's market capitalization has reached $13,498,729.23, with a circulating supply of approximately 7,903,700 tokens, and a price hovering around $1.7079. This asset, often referred to as a "product-community fit" platform, is playing an increasingly crucial role in seamless trading and asset management.

This article will comprehensively analyze Holdstation's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. HOLDSTATION Price History Review and Current Market Status

HOLDSTATION Historical Price Evolution

- 2024: Launch on zkSync Era, price reached ATH of $16.445 on December 27

- 2025: Market correction, price dropped to ATL of $0.647 on March 9

- 2025: Recovery phase, price rebounded to current level of $1.7079

HOLDSTATION Current Market Situation

HOLDSTATION is currently trading at $1.7079, with a market capitalization of $13,498,729.23. The token has experienced a 1.7% decrease in the last 24 hours, but shows a significant 15.04% increase over the past 30 days. The trading volume in the last 24 hours stands at $228,179.94. Despite the recent dip, HOLDSTATION has demonstrated strong performance over the past year, with a 100.072% price increase. The current circulating supply is 7,903,700 HOLDSTATION tokens, representing 26.35% of the total supply of 30,000,000 tokens.

Click to view the current HOLDSTATION market price

HOLDSTATION Market Sentiment Indicator

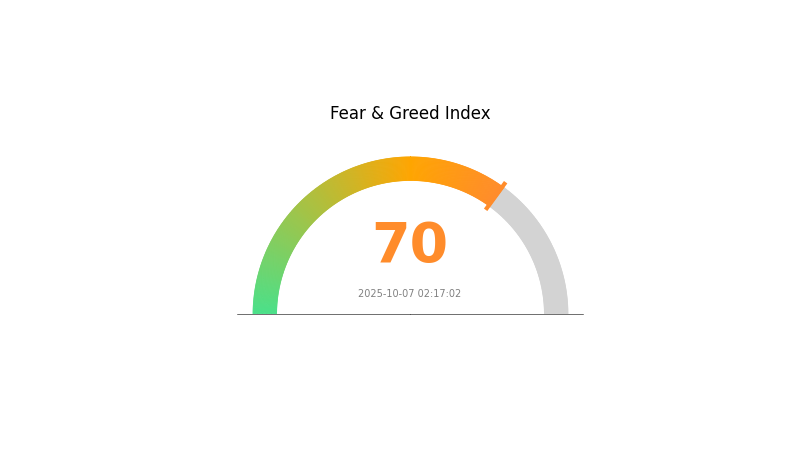

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of excessive optimism, with the Fear and Greed Index reaching 70, indicating a state of greed. This suggests investors are becoming overly confident, potentially driving prices to unsustainable levels. While bullish sentiment can fuel short-term gains, it's crucial to remain cautious and consider taking some profits. Remember, markets often correct when euphoria peaks. Stay vigilant and manage your risk wisely in this exuberant climate.

HOLDSTATION Holdings Distribution

The address holdings distribution data for HOLDSTATION reveals an interesting picture of token concentration. This metric provides insights into how tokens are distributed among different addresses, which can be indicative of ownership patterns and potential market influences.

Upon analysis, the data suggests a relatively dispersed distribution of HOLDSTATION tokens. There doesn't appear to be a significant concentration of tokens in a small number of addresses, which is generally considered a positive sign for decentralization. This distribution pattern may contribute to a more stable market structure, as it reduces the likelihood of large holders exerting outsized influence on price movements.

The current address distribution pattern potentially reflects a healthy ecosystem for HOLDSTATION, with a diverse set of stakeholders. This could be interpreted as a sign of organic growth and adoption, rather than speculative accumulation by a few large players. Such a distribution may lead to more gradual and sustainable price movements, as opposed to sharp volatility often associated with highly concentrated token ownership.

Click to view the current HOLDSTATION Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting HOLDSTATION's Future Price

Market Sentiment

- Investor Confidence: The sentiment and confidence of investors have a direct impact on the HOLD/USD price trend. Positive news about HOLD's widespread adoption or major technological breakthroughs can significantly influence the price.

- Current Impact: Market sentiment remains a crucial factor in determining HOLDSTATION's price volatility. Investors should closely monitor market dynamics and capital flows.

Technological Developments and Ecosystem Building

- Technical Breakthroughs: Any significant technological advancements in the HOLDSTATION project could potentially drive price movements.

- Ecosystem Applications: The development and adoption of DApps or ecosystem projects within the HOLDSTATION network may impact its future value.

Macroeconomic Environment

- Market Conditions: The overall cryptocurrency market conditions, including general trends and trading volumes, play a role in HOLDSTATION's price movements.

- Risk Factors: The price of HOLDSTATION can be vulnerable to sudden changes in market conditions, especially during periods of overall market instability.

III. HOLDSTATION Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $1.36 - $1.50

- Neutral forecast: $1.70 - $1.85

- Optimistic forecast: $2.00 - $2.12 (requires sustained market recovery)

2027 Mid-term Outlook

- Market phase expectation: Potential consolidation phase

- Price range prediction:

- 2026: $1.43 - $2.72

- 2027: $1.67 - $2.52

- Key catalysts: Broader crypto market trends, HOLDSTATION ecosystem development

2030 Long-term Outlook

- Base scenario: $3.00 - $3.50 (assuming steady growth in adoption)

- Optimistic scenario: $3.50 - $4.20 (with significant ecosystem expansion)

- Transformative scenario: $4.20 - $4.68 (with major breakthroughs in technology and partnerships)

- 2030-12-31: HOLDSTATION $3.23 (potential year-end valuation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.11879 | 1.7087 | 1.36696 | 0 |

| 2026 | 2.71752 | 1.91374 | 1.43531 | 12 |

| 2027 | 2.52404 | 2.31563 | 1.66725 | 35 |

| 2028 | 3.09739 | 2.41983 | 1.25831 | 41 |

| 2029 | 3.69654 | 2.75861 | 1.48965 | 61 |

| 2030 | 4.67998 | 3.22757 | 2.61433 | 89 |

IV. Professional Investment Strategies and Risk Management for HOLDSTATION

HOLDSTATION Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate HOLDSTATION tokens during market dips

- Set price targets and regularly review investment thesis

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend direction and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set strict stop-loss orders to manage downside risk

HOLDSTATION Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable multi-signature wallets

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for HOLDSTATION

HOLDSTATION Market Risks

- High volatility: Significant price fluctuations can lead to substantial gains or losses

- Limited liquidity: May affect ability to enter or exit positions at desired prices

- Competition: Other projects in the zkSync ecosystem may impact HOLDSTATION's market share

HOLDSTATION Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting DeFi platforms

- Cross-border compliance: Challenges in adhering to varying international regulations

- AML/KYC requirements: Possible implementation of stricter identity verification measures

HOLDSTATION Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the platform's code

- Scalability issues: Possible network congestion on zkSync affecting transaction speed

- Interoperability challenges: Risks associated with cross-chain interactions and bridges

VI. Conclusion and Action Recommendations

HOLDSTATION Investment Value Assessment

HOLDSTATION offers innovative features in the zkSync ecosystem but faces significant competition and regulatory uncertainties. Long-term potential exists, but short-term volatility and technical risks should be carefully considered.

HOLDSTATION Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the technology

✅ Experienced investors: Consider as part of a diversified DeFi portfolio

✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments

HOLDSTATION Trading Participation Methods

- Gate.com: Trade HOLDSTATION tokens on a reputable centralized exchange

- DeFi platforms: Engage directly with HOLDSTATION's DeFi features (e.g., futures trading)

- Yield farming: Explore liquidity provision opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

Unlikely. Predictions suggest a price target of $0.05 to $0.10 in the coming months. Current trends don't support a $1 valuation.

What is the price of Holdstation?

As of 2025-10-07, the price of Holdstation (HOLD) is $1.74, with a 24-hour trading volume of $823,656. The price has decreased by 0.58% in the past day.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $139,045 by 2025. The current price is around $124,798.

Which coin will reach 1 rupee prediction?

Shiba Inu (SHIB) is predicted to reach 1 rupee by the end of 2030, based on current market trends and analysis.

Share

Content