2025 HNT Price Prediction: Analyzing Helium's Potential in the IoT Revolution

Introduction: HNT's Market Position and Investment Value

Helium (HNT), as a pioneering decentralized wireless network, has made significant strides since its inception in 2013. By 2025, Helium's market capitalization has reached $459,654,987, with a circulating supply of approximately 186,321,438 tokens, and a price hovering around $2.467. This asset, often referred to as the "People's Network," is playing an increasingly crucial role in the Internet of Things (IoT) and wireless connectivity sectors.

This article will provide a comprehensive analysis of Helium's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. HNT Price History Review and Current Market Status

HNT Historical Price Evolution

- 2020: Initial launch, price started at $0.257

- 2021: Bull market peak, price reached all-time high of $54.88 on November 13

- 2022-2024: Bearish trend, price declined to $0.113248 on April 18, 2020

HNT Current Market Situation

As of November 15, 2025, HNT is trading at $2.467. The token has seen a 6.58% increase in the last 24 hours, with a trading volume of $2,944,806. HNT's market cap stands at $459,654,987, ranking it 150th among all cryptocurrencies. The circulating supply is 186,321,438 HNT, which represents 83.55% of the total supply of 223,000,000 HNT.

In the short term, HNT has shown positive momentum with a 0.82% increase in the past hour and a 6.58% gain in the last 24 hours. However, the 7-day performance shows a slight decline of 1.40%. The 30-day trend is bullish with a 15.2% increase, indicating growing interest in the token. Despite these recent gains, HNT is still down 57.21% compared to its price one year ago, reflecting the overall bearish sentiment in the broader crypto market.

The current price of $2.467 is significantly below the all-time high of $54.88, suggesting potential room for growth if market conditions improve and the Helium project continues to develop successfully.

Click to view the current HNT market price

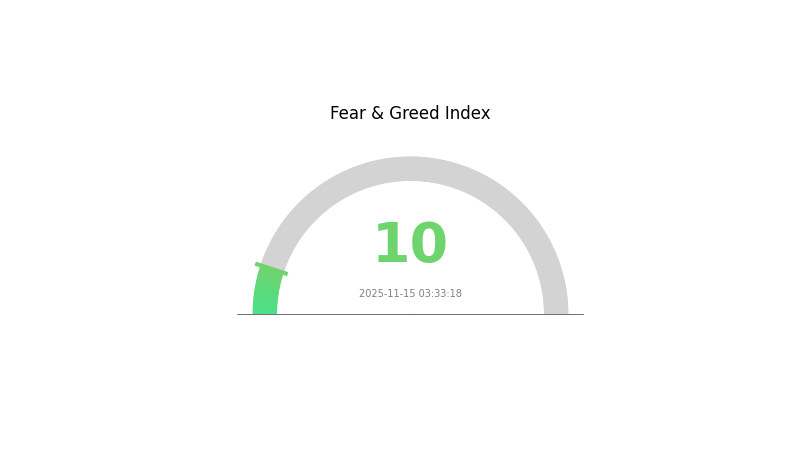

HNT Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment can remain negative for extended periods. Traders on Gate.com should consider this indicator alongside other technical and fundamental analyses before making investment decisions. Remember, while fear can present opportunities, it's crucial to manage risk carefully in such volatile conditions.

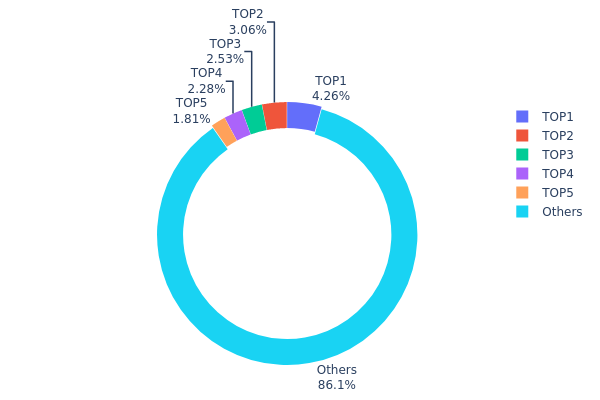

HNT Holdings Distribution

The address holdings distribution data provides insights into the concentration of HNT tokens among different addresses. According to the data, the top 5 addresses hold approximately 13.92% of the total HNT supply, with the largest holder possessing 4.26%. This distribution suggests a moderate level of concentration, as no single address controls an overwhelmingly large portion of the supply.

The relatively dispersed nature of HNT holdings indicates a fair degree of decentralization. With 86.08% of tokens held by addresses outside the top 5, it suggests a broad base of smaller holders. This distribution pattern may contribute to market stability, as it reduces the potential for large-scale price manipulation by individual whales. However, it's worth noting that the top holders still have significant influence and their actions could impact short-term price movements.

Overall, the current HNT address distribution reflects a balanced market structure with a mix of large stakeholders and a diverse group of smaller holders. This equilibrium may foster a more resilient ecosystem, potentially leading to more organic price discovery and reduced volatility in the long term.

Click to view the current HNT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | AguTdj...ma9i98 | 7927.77K | 4.26% |

| 2 | 9DSMdy...kZfZGg | 5700.00K | 3.06% |

| 3 | 7KDues...1bSurS | 4705.96K | 2.52% |

| 4 | 6JgtYN...D33Y6T | 4235.94K | 2.27% |

| 5 | 9TwDYX...vYHmWH | 3374.53K | 1.81% |

| - | Others | 160127.96K | 86.08% |

II. Key Factors Affecting HNT's Future Price

Supply Mechanism

- Halving: HNT undergoes regular halving events, reducing the rate of new token issuance.

- Historical Pattern: Previous halvings have historically led to increased scarcity and potential price appreciation.

- Current Impact: The upcoming halving is expected to reduce supply inflation, potentially supporting price growth.

Institutional and Whale Dynamics

- Enterprise Adoption: Major telecom companies and IoT manufacturers are exploring Helium network integration.

Macroeconomic Environment

- Inflation Hedging Properties: HNT may serve as a hedge against inflation due to its limited supply and utility in the growing IoT sector.

Technological Development and Ecosystem Building

- 5G Network Expansion: Helium is expanding its network to include 5G coverage, broadening its use case and potential market.

- IoT Integration: Continued development of IoT devices compatible with the Helium network could drive demand for HNT.

- Ecosystem Applications: Helium's ecosystem is growing with various IoT and data transfer applications being built on the network.

III. HNT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.67 - $2.00

- Neutral prediction: $2.00 - $2.50

- Optimistic prediction: $2.50 - $2.84 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $1.85 - $4.04

- 2028: $2.48 - $4.71

- Key catalysts: Expansion of the Helium network, technological advancements, and broader IoT industry growth

2030 Long-term Outlook

- Base scenario: $4.23 - $4.65 (assuming steady network growth and market stability)

- Optimistic scenario: $4.65 - $5.50 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $5.50 - $6.60 (with breakthrough innovations and mainstream IoT integration)

- 2030-12-31: HNT $6.60 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.83705 | 2.467 | 1.67756 | 0 |

| 2026 | 3.20895 | 2.65203 | 1.53817 | 7 |

| 2027 | 4.04407 | 2.93049 | 1.84621 | 19 |

| 2028 | 4.70783 | 3.48728 | 2.47597 | 41 |

| 2029 | 5.20389 | 4.09755 | 3.89268 | 66 |

| 2030 | 6.60403 | 4.65072 | 4.23216 | 89 |

IV. HNT Professional Investment Strategies and Risk Management

HNT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate HNT during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

HNT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Helium wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HNT

HNT Market Risks

- High volatility: Cryptocurrency markets are known for extreme price swings

- Competition: Other IoT-focused blockchain projects may emerge

- Adoption challenges: Slow uptake of Helium network could impact token value

HNT Regulatory Risks

- Regulatory uncertainty: Evolving cryptocurrency regulations may impact HNT

- Compliance issues: Potential challenges in adhering to global regulatory standards

- Tax implications: Changing tax laws may affect HNT holders

HNT Technical Risks

- Network security: Potential vulnerabilities in the Helium blockchain

- Scalability concerns: Ability to handle increased network demand

- Technological obsolescence: Rapid advancements in IoT technology may challenge Helium's relevance

VI. Conclusion and Action Recommendations

HNT Investment Value Assessment

HNT presents a unique value proposition in the IoT space, but faces significant short-term volatility and long-term adoption challenges. The project's success depends on widespread network growth and continued technological relevance.

HNT Investment Recommendations

✅ Beginners: Start with small, affordable investments to learn about the project

✅ Experienced investors: Consider a moderate allocation as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence and consider HNT as a high-risk, high-reward component of a broader investment strategy

HNT Trading Participation Methods

- Spot trading: Buy and sell HNT on Gate.com

- Staking: Participate in HNT staking programs for potential rewards

- Mining: Set up a Helium hotspot to earn HNT by providing network coverage

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will HNT be worth in 2025?

Based on market trends and network growth, HNT could potentially reach $50-$75 by 2025, driven by increased IoT adoption and Helium ecosystem expansion.

Can Helium reach $100?

While ambitious, reaching $100 is possible for Helium in the long term, given its potential in IoT and 5G networks. However, it would require significant adoption and market growth.

Is Helium a good coin to buy?

Yes, Helium (HNT) shows promise as a long-term investment. Its unique IoT network and growing adoption make it an attractive option for crypto investors seeking potential growth in the Web3 space.

What will the price of Helium be in 2025?

Based on market trends and adoption rates, Helium (HNT) could reach $20-$25 by 2025, driven by increased IoT network usage and ecosystem growth.

Share

Content