2025 GRINPrice Prediction: Analyzing Market Trends and Future Growth Potential in the Privacy-Focused Cryptocurrency Sector

Introduction: GRIN's Market Position and Investment Value

Grin (GRIN), as a privacy-focused cryptocurrency implementing the MimbleWimble protocol, has made significant strides since its inception in 2019. As of 2025, Grin's market capitalization has reached $9,227,203, with a circulating supply of approximately 211,778,820 coins, and a price hovering around $0.04357. This asset, often referred to as the "privacy-centric digital cash," is playing an increasingly crucial role in the realm of confidential transactions and scalable blockchain technology.

This article will comprehensively analyze Grin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GRIN Price History Review and Current Market Status

GRIN Historical Price Evolution

- 2019: GRIN launched, price reached all-time high of $25.09 on January 17

- 2020-2024: Gradual price decline amid overall crypto market cycles

- 2025: Price hit all-time low of $0.01332513 on April 7, followed by recent recovery

GRIN Current Market Situation

As of October 9, 2025, GRIN is trading at $0.04357, with a 24-hour trading volume of $29,331.33. The price has seen a 3.56% increase in the last 24 hours. GRIN's market cap stands at $9,227,203, ranking it at 1460th position in the crypto market. The circulating supply is 211,778,820 GRIN coins, with a total supply of 171,872,000 GRIN. The coin has shown significant growth over the past year, with a 79.19% price increase. In the short term, GRIN has experienced a 32.87% surge in the last 7 days and a 28.37% increase over the past 30 days, indicating a bullish trend. The current market sentiment for GRIN appears to be positive, with the overall crypto market in a state of "Greed" according to the Fear and Greed Index.

Click to view the current GRIN market price

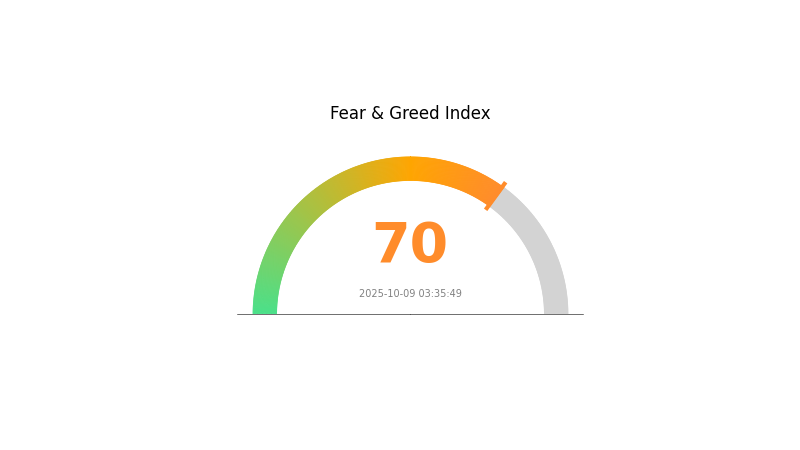

GRIN Market Sentiment Indicator

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index hitting 70. This suggests that investors are becoming increasingly optimistic and may be prone to making emotional decisions. While high sentiment can drive prices up in the short term, it's crucial to remain cautious. Experienced traders often view extreme greed as a potential signal for market corrections. As always, it's advisable to conduct thorough research and consider diversifying your portfolio to manage risk in these volatile market conditions.

GRIN Holdings Distribution

The address holdings distribution data for GRIN reveals a unique situation in the cryptocurrency market. Interestingly, there are no large holders or whales with significant GRIN holdings listed in the data provided. This absence of concentrated holdings is a distinctive feature of GRIN's on-chain structure.

This distribution pattern suggests a high level of decentralization in GRIN's ownership. The lack of dominant addresses holding large quantities of GRIN indicates that the token is likely widely distributed among numerous smaller holders. Such a dispersed ownership structure can potentially lead to a more stable market, as it reduces the risk of price manipulation by large individual players.

The current address distribution reflects positively on GRIN's market structure, potentially resulting in lower volatility and a reduced risk of market manipulation. This decentralized holding pattern aligns well with the principles of cryptocurrencies, promoting a fair and distributed ecosystem. However, it's important to note that this analysis is based on available on-chain data and may not capture the full picture of GRIN's ownership structure.

Click to view the current GRIN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing GRIN's Future Price

Supply Mechanism

- Emission schedule: GRIN has a linear emission schedule with no cap on total supply

- Historical pattern: The continuous increase in supply has historically put downward pressure on price

- Current impact: The ongoing emission may continue to create selling pressure on GRIN's price

Institutional and Whale Dynamics

- Institutional holdings: No significant institutional holdings of GRIN have been reported

Macroeconomic Environment

- Inflation hedging properties: GRIN has not demonstrated strong inflation hedging characteristics

Technological Development and Ecosystem Building

- MimbleWimble protocol: GRIN's core privacy technology continues to be developed and improved

- Ecosystem applications: GRIN's ecosystem remains limited, with few major DApps or projects built on it

III. GRIN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0231 - $0.04359

- Neutral prediction: $0.04359 - $0.05231

- Optimistic prediction: $0.05231 - $0.06 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.03932 - $0.05926

- 2028: $0.05503 - $0.08025

- Key catalysts: Technological advancements, wider cryptocurrency market trends, and potential partnerships

2030 Long-term Outlook

- Base scenario: $0.07972 - $0.08392 (assuming steady market growth)

- Optimistic scenario: $0.08392 - $0.12 (assuming strong adoption and favorable market conditions)

- Transformative scenario: $0.12 - $0.15 (assuming breakthrough use cases and mainstream acceptance)

- 2030-12-31: GRIN $0.12 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05231 | 0.04359 | 0.0231 | 0 |

| 2026 | 0.06281 | 0.04795 | 0.03596 | 10 |

| 2027 | 0.05926 | 0.05538 | 0.03932 | 27 |

| 2028 | 0.08025 | 0.05732 | 0.05503 | 31 |

| 2029 | 0.09905 | 0.06878 | 0.05159 | 57 |

| 2030 | 0.12 | 0.08392 | 0.07972 | 92 |

IV. GRIN Professional Investment Strategies and Risk Management

GRIN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking privacy-focused cryptocurrencies

- Operation suggestions:

- Accumulate GRIN during price dips

- Hold for at least 1-2 years to ride out market volatility

- Store in a secure wallet supporting GRIN

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend shifts

- RSI: Use overbought/oversold levels for entry and exit points

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

GRIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting GRIN

- Security precautions: Use strong passwords, enable 2FA, and keep private keys offline

V. GRIN Potential Risks and Challenges

GRIN Market Risks

- High volatility: GRIN price can experience significant fluctuations

- Limited adoption: Lack of widespread use may impact long-term value

- Competition: Other privacy coins may outperform GRIN

GRIN Regulatory Risks

- Privacy coin scrutiny: Increased regulatory focus on anonymous transactions

- Exchange delistings: Potential removal from trading platforms due to compliance issues

- Cross-border restrictions: Some countries may ban or limit GRIN transactions

GRIN Technical Risks

- Network attacks: Potential vulnerabilities in the MimbleWimble protocol

- Scalability issues: Challenges in handling increased transaction volumes

- Development delays: Slow progress in implementing new features or upgrades

VI. Conclusion and Action Recommendations

GRIN Investment Value Assessment

GRIN offers strong privacy features and potential long-term value, but faces significant short-term risks due to market volatility and regulatory uncertainties.

GRIN Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging with strict risk management ✅ Institutional investors: Allocate a small portion of high-risk portfolio, monitor regulatory developments closely

GRIN Trading Participation Methods

- Spot trading: Buy and hold GRIN on Gate.com

- Staking: Participate in GRIN staking programs if available

- Mining: Consider mining GRIN to support the network and earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Grin a good investment?

Yes, Grin shows promise as an investment. With a projected value of $0.04423201 by 2028, it offers potential for growth. Current market trends suggest it could be a favorable choice for investors.

What crypto will 1000x prediction?

While no guarantee, emerging projects like AI-powered tokens or metaverse coins have high growth potential and could potentially 1000x in the next bull run.

What meme coin will explode in 2025 price prediction?

Popcat is predicted to explode in 2025. It's expected to be listed on major exchanges like Binance and has a strong community backing, suggesting significant price growth potential.

Does gravity crypto have a future?

Yes, Gravity crypto has potential. Forecasts suggest it could reach $0.01578 by 2030, with future success depending on market trends and user adoption.

Share

Content