2025 GOAT Price Prediction: Analyzing Market Trends and Potential Growth for the Digital Asset

Introduction: GOAT's Market Position and Investment Value

Goatseus Maximus (GOAT), as a Solana-based memecoin, has gained attention since its inception. As of 2025, GOAT's market capitalization has reached $38,699,621, with a circulating supply of approximately 999,990,216 tokens, and a price hovering around $0.0387. This asset, endorsed by the AI bot Truth Terminal, is playing an increasingly significant role in the meme cryptocurrency space.

This article will comprehensively analyze GOAT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GOAT Price History Review and Current Market Status

GOAT Historical Price Evolution

- 2024: Project launch, price reached all-time high of $1.373 on November 17

- 2025: Market downturn, price hit all-time low of $0.02656 on October 10

GOAT Current Market Situation

As of November 18, 2025, GOAT is trading at $0.0387, experiencing a 6.02% decrease in the last 24 hours. The token has seen significant volatility, with a 24.7% decline over the past week and a 25.99% drop in the last 30 days. GOAT's market capitalization stands at $38,699,621, ranking it 645th in the overall cryptocurrency market. The circulating supply is 999,990,216.830403 GOAT, which is 99.999% of the total supply of 1,000,000,000 tokens. Despite the recent downtrend, GOAT has maintained a trading volume of $726,574 in the past 24 hours, indicating ongoing market interest and liquidity.

Click to view the current GOAT market price

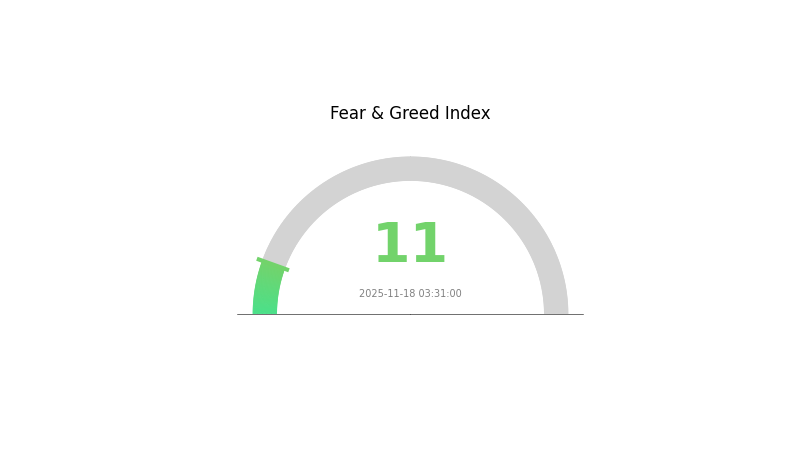

GOAT Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market conditions remain volatile. Savvy traders on Gate.com are closely monitoring key support levels and market indicators for signs of a potential trend reversal. Remember, while fear can present opportunities, it's crucial to conduct thorough research and manage risks carefully in such uncertain times.

GOAT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GOAT tokens among different wallet addresses. Analysis of this data reveals a relatively concentrated distribution pattern, with the top 5 addresses controlling approximately 39.51% of the total supply. The largest holder possesses 13.14% of GOAT tokens, followed by the second and third largest holders with 10.73% and 9.02%, respectively.

This level of concentration suggests a potential risk of market manipulation, as these large holders could significantly impact price movements if they decide to sell or accumulate more tokens. However, it's worth noting that 60.49% of GOAT tokens are distributed among other addresses, indicating a degree of decentralization beyond the top holders. This distribution pattern reflects a balance between concentration and dispersion, which could contribute to market stability while still allowing for price volatility based on the actions of major holders.

Overall, the current GOAT token distribution indicates a moderate level of centralization, which may impact market dynamics and liquidity. While not excessively concentrated, the significant holdings of the top addresses warrant careful monitoring for potential market movements and long-term token governance implications.

Click to view the current GOAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8Mm46C...zrMZQH | 131496.00K | 13.14% |

| 2 | EZ41Wc...ybxjsJ | 107369.20K | 10.73% |

| 3 | Am8MAE...i2B4hg | 90251.26K | 9.02% |

| 4 | Gem2VA...rPoTka | 33419.22K | 3.34% |

| 5 | JBQ1su...easyNe | 32829.67K | 3.28% |

| - | Others | 604624.87K | 60.49% |

II. Key Factors Affecting GOAT's Future Price

Institutional and Whale Dynamics

- Corporate Adoption: Notable companies like MicroStrategy have significantly increased their Bitcoin holdings, with MicroStrategy purchasing approximately 258,320 BTC for a total of $22.07 billion in 2024, achieving a 74.3% return on investment. This aggressive accumulation strategy may influence other companies to make similar allocations in 2025.

Macroeconomic Environment

- Inflation Hedging Properties: Bitcoin has shown potential as a hedge against inflation. Over the past seven years, Bitcoin has achieved an annualized return of 60%, significantly outperforming bonds and other major assets which averaged 7% returns. Bitcoin investors have consistently profited over five-year holding periods, while bonds, gold, and short-term U.S. Treasuries have lost 99% of their purchasing power over the past decade.

Technological Developments and Ecosystem Building

-

AI Integration: AI-themed meme coins, such as Terminal of Truths and $GOAT, have successfully merged humor with advanced AI functionalities. This trend is expected to continue gaining momentum in 2025, attracting attention from investors and crypto enthusiasts.

-

Ethereum Blob Fee Market: The implementation of EIP-4844 has improved Ethereum's scalability by introducing a new transaction type called "Blob" data. Since November 2024, validators have been publishing over 20,000 Blob data on Ethereum daily. If this trend continues or accelerates, Blob fees could potentially burn over $1 billion worth of ETH in 2025, further solidifying Ethereum's evolving security and economic model.

III. GOAT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03045 - $0.03854

- Neutral prediction: $0.03854 - $0.04721

- Optimistic prediction: $0.04721 - $0.05588 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.03871 - $0.06468

- 2027: $0.03245 - $0.07161

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.07154 - $0.09414 (assuming steady market growth)

- Optimistic scenario: $0.09414 - $0.1139 (assuming strong market performance)

- Transformative scenario: $0.1139+ (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: GOAT $0.1139 (potential peak based on projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05588 | 0.03854 | 0.03045 | 0 |

| 2026 | 0.06468 | 0.04721 | 0.03871 | 21 |

| 2027 | 0.07161 | 0.05595 | 0.03245 | 44 |

| 2028 | 0.08929 | 0.06378 | 0.0574 | 64 |

| 2029 | 0.11174 | 0.07653 | 0.05204 | 97 |

| 2030 | 0.1139 | 0.09414 | 0.07154 | 143 |

IV. Professional Investment Strategies and Risk Management for GOAT

GOAT Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Risk-tolerant investors with a high appetite for volatility

- Operation suggestions:

- Accumulate GOAT tokens during market dips

- Set long-term price targets and stick to them

- Store tokens in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage risk

- Take profits at predetermined levels

GOAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: Up to 10% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting Solana tokens

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for GOAT

GOAT Market Risks

- High volatility: Memecoins are subject to extreme price swings

- Limited utility: Lack of real-world use cases may impact long-term value

- Market sentiment: Heavily influenced by social media trends and celebrity endorsements

GOAT Regulatory Risks

- Regulatory scrutiny: Increased oversight of memecoins by financial authorities

- Trading restrictions: Potential limitations on memecoin trading platforms

- Tax implications: Unclear or changing tax regulations for memecoin transactions

GOAT Technical Risks

- Smart contract vulnerabilities: Potential exploits in the token's underlying code

- Solana network issues: Dependence on Solana blockchain performance and stability

- Limited development team: Uncertainty about ongoing technical support and upgrades

VI. Conclusion and Action Recommendations

GOAT Investment Value Assessment

GOAT presents a high-risk, high-reward opportunity within the memecoin space. While it offers potential for significant short-term gains, its long-term value proposition remains uncertain due to limited utility and regulatory concerns.

GOAT Investment Recommendations

✅ Beginners: Limit exposure to a small portion of your portfolio, if any ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Approach with caution, potentially as part of a diversified crypto portfolio

GOAT Trading Participation Methods

- Spot trading: Buy and sell GOAT tokens on Gate.com

- Limit orders: Set buy and sell orders at specific price points to automate trading strategy

- Dollar-cost averaging: Regularly invest small amounts to mitigate the impact of volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does goat coin have a future?

GOAT Coin's future is promising, driven by strong community support and market trends. It has potential for growth in the evolving crypto landscape.

Will Doge hit $10?

It's highly unlikely. Doge's current market cap and supply make a $10 price unrealistic in the near future.

How much is GOATS crypto worth?

As of November 2025, GOATS crypto is worth $0.00004446. Prices fluctuate, so check for latest updates.

Can Solana reach $1000 in 2025?

Yes, Solana could potentially reach $1000 in 2025. Market trends and growing adoption suggest this price target is achievable, though predictions remain speculative.

Share

Content