2025 GIZA Fiyat Tahmini: Kripto para ekosisteminde piyasa trendlerinin ve potansiyel büyüme faktörlerinin analizi

Giriş: GIZA'nın Pazar Konumu ve Yatırım Potansiyeli

Giza (GIZA), ajan tabanlı finansal piyasaları yönlendiren bir protokol olarak, kuruluşundan bu yana insanın bilişsel sınırlarını aşmaktadır. 2025 itibarıyla GIZA'nın piyasa değeri 9.270.575 ABD doları seviyesine ulaşmış, yaklaşık 67.300.000 dolaşımdaki token ile fiyatı 0,13775 ABD doları civarında seyretmektedir. "Bilişsel gelişim aracı" olarak öne çıkan bu varlık, merkeziyetsiz finans ve yapay zeka alanlarında giderek daha belirleyici bir rol üstlenmektedir.

Bu makalede, GIZA'nın 2025-2030 dönemindeki fiyat hareketleri; tarihsel fiyat örüntüleri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. GIZA Fiyat Geçmişi ve Güncel Piyasa Durumu

GIZA Fiyatının Tarihsel Seyri

- Mayıs 2025: GIZA, 0,03639 ABD doları ile en düşük seviyesine ulaştı

- Haziran 2025: GIZA, 0,50471 ABD doları ile tüm zamanların en yüksek seviyesini gördü ve güçlü bir fiyat sıçraması yaşadı

- Ekim 2025: Fiyat düzeltme sürecinde GIZA 0,13775 ABD dolarından işlem gördü

GIZA Güncel Piyasa Görünümü

9 Ekim 2025 tarihinde GIZA, 0,13775 ABD dolarından işlem görmektedir. Token, son 24 saatte %1,4 değer kaybetmiş olup işlem hacmi 128.643 ABD dolarıdır. GIZA'nın piyasa değeri 9.270.575 ABD doları ile kripto para piyasasında 1.457. sırada yer almaktadır.

Token fiyatı, 8 Haziran 2025'te kaydedilen 0,50471 ABD doları zirvesinin %72,7 altında; 23 Mayıs 2025'te görülen 0,03639 ABD doları taban değerinin ise %278,5 üzerindedir.

GIZA kısa vadede dalgalı bir performans sergilemiştir. Son bir saatte %0,09 artış kaydederken, son bir haftada %8,23 ve son 30 günde %44,12 düşüş yaşanmıştır. Bu kısa vadeli gerilemelere rağmen, GIZA uzun vadede güçlü bir büyüme göstermiş ve son bir yılda %89,57 değer kazanmıştır.

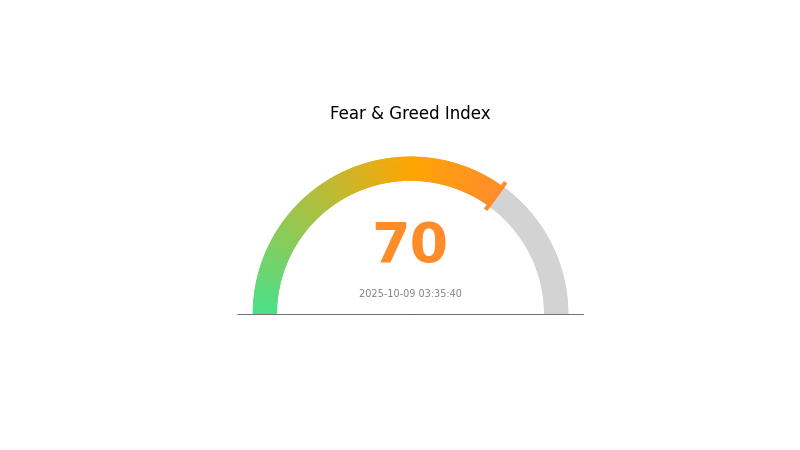

Mevcut piyasa hissiyatı "Açgözlülük" düzeyinde olup, VIX endeksi 70'tedir; bu da piyasanın aşırı ısınmış olabileceğine işaret etmektedir.

Güncel GIZA piyasa fiyatını görüntülemek için tıklayın

GIZA Piyasa Hissiyatı Göstergesi

2025-10-09 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında aşırı iyimserlik hakim; Korku ve Açgözlülük Endeksi 70 seviyesinde ve "açgözlülük" durumunu gösteriyor. Yatırımcılar aşırı özgüvenle hareket ediyor ve bu fiyatları daha da yukarı taşıyabilir. Ancak bu tür aşırılıklar genellikle piyasa düzeltmelerinin öncesinde görülür. Yatırımcılar temkinli olmalı, kâr almayı ya da pozisyonlarını koruma altına almayı göz önünde bulundurmalıdır. Unutmayın, piyasalar mantıksız davrandığında, ödeme gücünüzden daha uzun süre bu şekilde kalabilir. Gate.com'da güncel kalın ve riskinizi kontrollü yönetin.

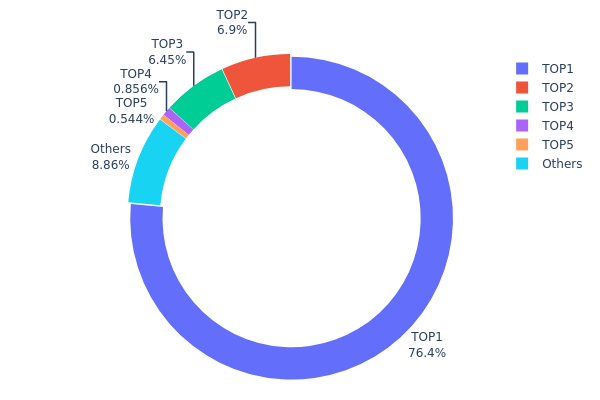

GIZA Varlık Dağılımı

GIZA'nın adres varlık dağılımı son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres, toplam arzın %76,39'unu, yani 674.995.950 GIZA tokenı elinde tutuyor. Bunu %6,89 ve %6,44 oranlarıyla iki adres izlerken, diğer adresler çok küçük paylara sahip.

Böyle bir yoğunlaşmış dağılım, token'ın merkeziyetsizliği ile piyasa istikrarı konusunda endişe yaratıyor. Arzın %90'ından fazlasının üç adreste toplanması, piyasada ciddi manipülasyon ve fiyat oynaklığı potansiyeli doğuruyor. En büyük sahip, fiyat hareketleri ve yönetim kararları üzerinde önemli etki sahibi olabilir.

Bu yoğunlaşma, token'ın genel kullanıcı tabanına düşük oranda dağıldığını ve bu durumun likidite ile işlem dinamiklerini olumsuz etkileyebileceğini gösteriyor. GIZA ekosistemi henüz erken gelişim aşamasında olabilir veya daha geniş katılım ve dengeli dağıtım konusunda zorluklarla karşı karşıya olabilir.

Güncel GIZA Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xb5d7...e0fe3b | 674.995,95K | 76,39% |

| 2 | 0xa87d...f86ae0 | 60.948,82K | 6,89% |

| 3 | 0xe576...6d8e18 | 56.962,48K | 6,44% |

| 4 | 0x6d10...fbc742 | 7.560,00K | 0,85% |

| 5 | 0xe077...7ee399 | 4.810,78K | 0,54% |

| - | Diğerleri | 78.318,76K | 8,89% |

II. GIZA'nın Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Yapısı

- Airdrop Programı: "Megaphone x Giza Points" programı, test kullanıcılarına ödül sunar; bu puanlar gelecekte GIZA tokenına dönüştürülebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Yapay Zeka ile Optimize Edilmiş DeFi Stratejileri: GIZA, DeFi stratejilerini yapay zeka ile optimize ederek gelecekteki fiyat performansını olumlu etkileyebilir.

- Ekosistem Uygulamaları: GIZA, ekosistemin temelini oluşturan yapay zeka tabanlı DeFi uygulamalarına odaklanır.

III. 2025-2030 GIZA Fiyat Tahminleri

2025 Tahmini

- Temkinli öngörü: 0,12408 - 0,13787 ABD doları

- Tarafsız öngörü: 0,13787 - 0,16338 ABD doları

- İyimser öngörü: 0,16338 - 0,18888 ABD doları (olumlu piyasa koşulları gerektirir)

2027-2028 Tahmini

- Piyasa dönemi: Artan oynaklık ile potansiyel büyüme fazı

- Fiyat aralığı:

- 2027: 0,10484 - 0,23673 ABD doları

- 2028: 0,18871 - 0,22726 ABD doları

- Kilit katalizörler: Proje gelişmeleri, piyasa benimsenmesi ve genel kripto trendleri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,21509 - 0,23660 ABD doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,25811 - 0,30521 ABD doları (güçlü proje başarısı ve yaygın benimsenme ile)

- Dönüştürücü senaryo: 0,30521+ ABD doları (çok elverişli piyasa ve yaygın benimsenmede)

- 2030-12-31: GIZA 0,30521 ABD doları (dönem için öngörülen zirve fiyat)

| Yıl | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,18888 | 0,13787 | 0,12408 | 0 |

| 2026 | 0,17481 | 0,16338 | 0,08659 | 18 |

| 2027 | 0,23673 | 0,16909 | 0,10484 | 22 |

| 2028 | 0,22726 | 0,20291 | 0,18871 | 47 |

| 2029 | 0,25811 | 0,21509 | 0,14841 | 56 |

| 2030 | 0,30521 | 0,2366 | 0,12066 | 71 |

IV. GIZA için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GIZA Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Sabırlı, yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde GIZA biriktirin

- Proje gelişimine göre uzun vadeli hedefler belirleyin

- Tokenları donanım cüzdanında saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trendleri ve dönüş noktalarını belirler

- RSI: Aşırı alım/aşırı satım durumlarını izler

- Dalgalı işlem için öncelikler:

- Kayıpları sınırlamak için zararı durdur emirleri kullanın

- Belirlenen direnç noktalarında kâr alımı yapın

GIZA Risk Yönetimi Çerçevesi

(1) Varlık Dağıtımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3'ü

- Agresif yatırımcı: %5-10'u

- Profesyonel yatırımcı: %15'e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla kripto varlığına yatırım yapın

- Zarar durdur: Olası kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk cüzdan: Uzun vadeli tutum için donanım cüzdanı kullanın

- Güvenlik: İki faktörlü doğrulamayı açın, güçlü şifreler kullanın

V. GIZA'nın Potansiyel Riskleri ve Zorlukları

GIZA Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sık görülen ani fiyat dalgalanmaları

- Düşük likidite: Büyük işlem hacimlerinde zorluk yaşanabilir

- Piyasa hissiyatı: Yatırımcı psikolojisindeki ani değişimlere duyarlı

GIZA Düzenleme Riskleri

- Belirsiz mevzuat: DeFi projelerine yönelik olası daha sıkı kurallar

- Uluslararası uyum: Farklı ülke düzenlemelerine uyum zorlukları

- Vergi etkisi: Değişen vergi yasaları GIZA sahiplerini etkileyebilir

GIZA Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde hata veya suistimal riski

- Ölçeklenebilirlik sorunları: Yoğun talepte ağ tıkanıklığı

- Uyumluluk problemleri: Diğer blokzincirlerle entegrasyonda zorluk

VI. Sonuç ve Eylem Önerileri

GIZA Yatırım Potansiyeli Değerlendirmesi

GIZA, gelişen DeFi sektöründe yüksek risk-yüksek getiri fırsatı sunar. Uzun vadeli potansiyeli bulunsa da, kısa vadede ciddi oynaklık ve düzenleyici belirsizlikler mevcuttur.

GIZA Yatırım Önerileri

✅ Yeni başlayanlar: Portföyün küçük bir kısmını (%1-3) ayırın, öncelikle bilgi edinin ✅ Deneyimli yatırımcılar: Taktiksel pozisyonlar alın, zarar durdur kullanın ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, çeşitlendirilmiş DeFi stratejisine dahil edin

GIZA İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden GIZA işlemi yapın

- DeFi staking: Likidite sağlama imkanı varsa katılın

- Ortalama maliyet yöntemi: Oynaklık riskini azaltmak için düzenli küçük tutarlarda yatırım yapın

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk profilinize göre dikkatle verin ve profesyonel finansal danışmanlarla görüşün. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Giza kripto ne kadar değerli?

9 Ekim 2025 itibarıyla Giza kripto değeri yaklaşık 23,8 milyon ABD dolarıdır ve piyasa değeri açısından #1280. sıradadır.

2030 için XRP fiyat tahmini nedir?

Mevcut eğilimler doğrultusunda, XRP'nin 2030'da 10-15 ABD doları aralığına ulaşması bekleniyor. Sınır ötesi ödemelerde ve büyük finans kurumlarıyla ortaklıklarda artan benimsenme bu öngörüyü destekliyor.

En yüksek fiyat tahminine sahip kripto hangisi?

2025 itibarıyla Solana (SOL) en yüksek fiyat tahminine sahip kripto olarak öne çıkıyor. Kurumsal benimseme ve teknolojik gelişmeler büyümesini hızlandırıyor. Tahminler güncel piyasa trendleri ve analizlere dayanıyor.

Giza kripto nedir?

Giza, makine öğrenimi çıkarımlarını merkeziyetsizleştirerek blokzincir ortamında yapay zeka uygulamalarını geliştiren güven gerektirmeyen bir protokoldür.

Hey Anon (ANON) Yatırım İçin Uygun mu?: Bu Gelişmekte Olan Kripto Paranın Olası Getirileri ve Risklerinin Değerlendirilmesi

Hive AI (BUZZ) iyi bir yatırım mı?: Bu Yükselen Kriptoparanın Potansiyelini ve Risklerini Analiz Etmek

2025 ALCH Fiyat Öngörüsü: DeFi Benimsenmesindeki Hızlı Artışla Yükseliş Eğilimi

Velvet (VELVET) yatırım için uygun mu? : Bu yeni kripto paranın potansiyeli ve riskleri üzerine analiz

2025 UNO Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 FYDE Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Baby Doge Coin'un Geleceğine Dair Beklentiler: Uzmanların 2024-2030 Tahminleri

Polkadot (DOT) nedir ve çoklu zincir mimarisi, token'ın 2026 değerini nasıl etkiler?

MEMEFI nedir: Merkeziyetsiz Meme Token Platformu ve Devrim Yaratan Özellikleri Hakkında Kapsamlı Rehber