2025 DXCT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of DXCT

DNAxCAT (DXCT) is the governance token of the DNAxCAT Metaverse, serving as both the governance mechanism and in-game transaction currency within a digital cat pet world where players can raise, breed, and battle various virtual cats. Since its launch in 2021, DXCT has established itself within the gaming and metaverse ecosystem. As of January 2026, DXCT maintains a market capitalization of approximately $59,013.6, with a circulating supply of 3,670,000 tokens out of a total supply of 100,000,000, currently trading at around $0.01608. This emerging digital asset is playing an increasingly important role in the play-to-earn gaming and metaverse sectors.

This article will comprehensively analyze DXCT's price trends from 2026 to 2031, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

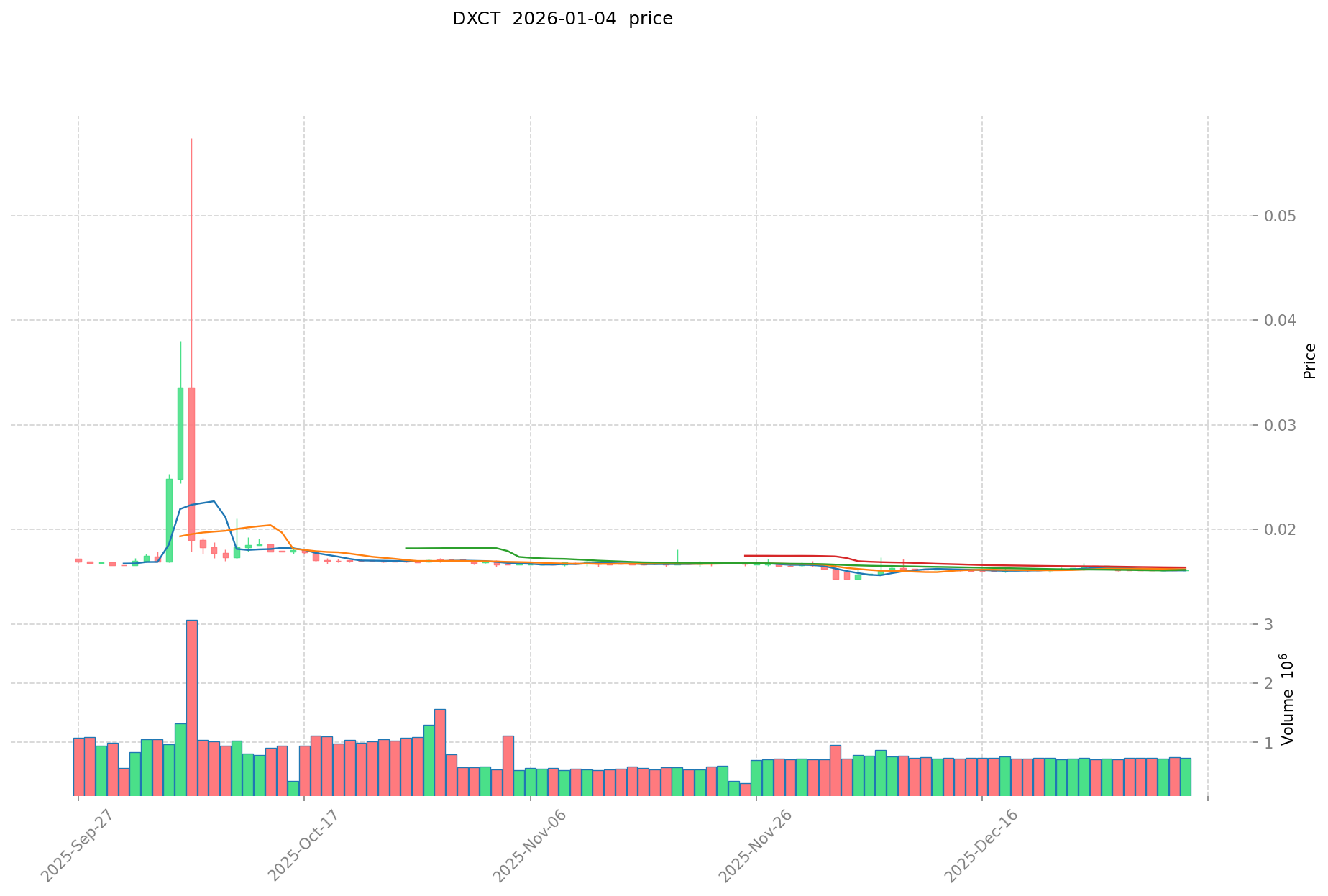

I. DXCT Price History Review and Current Market Status

DXCT Historical Price Evolution

-

2021: Project launch with initial price of $0.7143. The token reached its all-time high of $10.8 on December 1st, 2021, marking the peak of early market enthusiasm for the DNAxCAT metaverse project.

-

2025: Extended bear market period. The token declined significantly from its peak, reaching an all-time low of $0.01522901 on December 5th, 2025.

-

2026: Recovery phase beginning. As of January 5th, 2026, DXCT is trading at $0.01608, showing modest upward movement from recent lows.

DXCT Current Market Status

As of January 5th, 2026, DXCT is trading at $0.01608 with a 24-hour trading volume of $11,985.05. The token shows a 1-hour price change of +0.059%, while maintaining flat performance over the last 24 hours. Over a 7-day period, DXCT has declined by -0.37%, though it demonstrates positive momentum on a 30-day basis with a +2.29% gain. On an annual basis, the token is down -4.74% from its previous year levels.

The token's current market capitalization stands at $59,013.6, with a fully diluted valuation of $1,608,000. There are currently 9,063 token holders, indicating a distributed holder base. The circulating supply is 3,670,000 DXCT out of a total supply of 100,000,000 tokens, representing a circulation ratio of 3.67%.

Click to view current DXCT market price

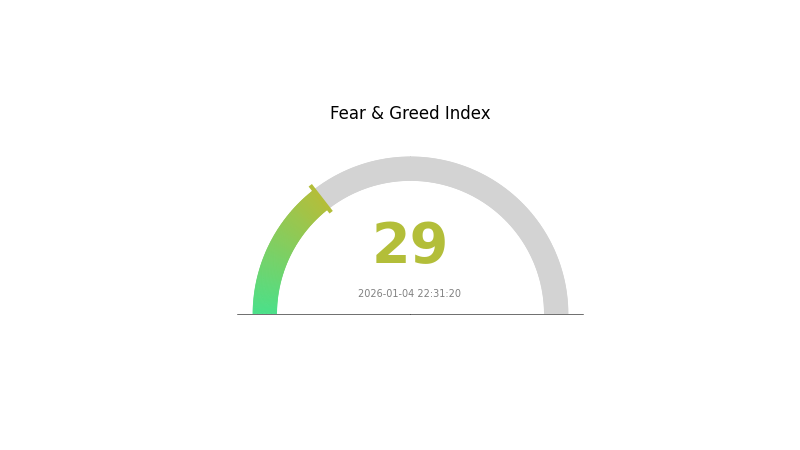

DXCT Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened investor anxiety and risk-averse behavior across digital asset markets. During such periods, market participants tend to reduce exposure and adopt defensive positioning. The fear environment often presents contrarian opportunities for long-term investors, as excessive pessimism can create attractive entry points. However, traders should exercise caution and conduct thorough due diligence before making investment decisions. Market conditions may remain volatile, and it's recommended to stay informed through reliable market data sources on Gate.com.

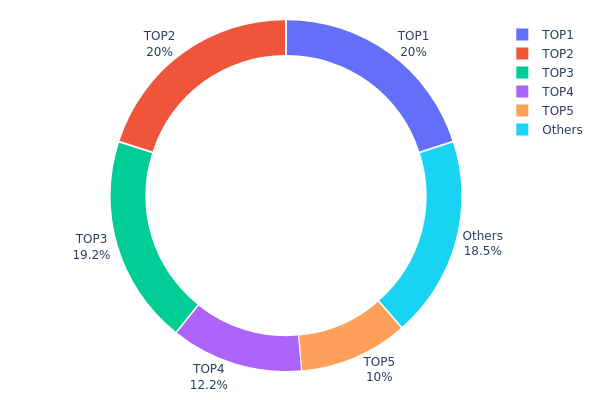

DXCT Holdings Distribution

The address holdings distribution chart illustrates the concentration of DXCT tokens across the top wallet addresses on the blockchain. This metric is critical for assessing the decentralization level and potential market manipulation risks, as it reveals how token supply is distributed among major stakeholders.

Current analysis of DXCT's address concentration reveals a moderately elevated level of centralization. The top five addresses collectively control approximately 81.46% of the token supply, with the leading three addresses alone accounting for 59.29%. Specifically, the top two addresses each hold exactly 20,000K tokens (20.03% each), suggesting these may represent institutional reserves or exchange custodial wallets. The third-largest holder maintains 19,200K tokens (19.23%), while the fourth and fifth positions hold 12,141K and 10,000K tokens respectively. The remaining addresses account for 18.54% of the total supply, indicating a fragmented distribution among smaller stakeholders.

This concentration pattern presents notable implications for market dynamics. The significant wealth concentration among the top five addresses creates potential vulnerability to coordinated selling pressure or market manipulation through large-scale transactions. However, the presence of "Others" category holding over 18% suggests the project maintains a certain degree of distributed participation. The relatively balanced holdings among the top three addresses—each near the 20% threshold—may indicate strategic allocation by project founders, early investors, or institutional participants, rather than extreme dominance by a single entity. This structure warrants continued monitoring to evaluate whether ongoing token distribution mechanisms effectively improve decentralization or if concentration levels persist as a structural characteristic.

For real-time DXCT holdings data and detailed address information, visit Gate.com's crypto market data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd069...63beb0 | 20000.00K | 20.03% |

| 2 | 0xb522...77c670 | 20000.00K | 20.03% |

| 3 | 0x764b...a1e16b | 19200.00K | 19.23% |

| 4 | 0x237e...c2959e | 12141.00K | 12.16% |

| 5 | 0x6838...f44d2c | 10000.00K | 10.01% |

| - | Others | 18498.88K | 18.54% |

II. Core Factors Affecting DXCT's Future Price

Market Sentiment and Regulatory Environment

-

Market Volatility Impact: The cryptocurrency market itself exhibits high volatility, and DXCT's price is susceptible to market sentiment fluctuations. Token price volatility can extend investment return cycles and reduce new market entrants, leading to decreased demand and diminished reward pools, which negatively impacts token value.

-

Regulatory Pressure: Regulatory constraints represent a key factor influencing future growth prospects for DXCT and the broader market.

Platform Performance Correlation

- Platform Dependency: DXCT's price performance is closely linked to the underlying platform's operational performance. Market competition within the ecosystem directly influences the token's valuation trajectory.

Macroeconomic Factors

- Economic Relationship: DXCT's price exhibits stronger correlation with macroeconomic conditions. Broader economic trends and monetary policies play an important role in determining token price movements.

III. 2026-2031 DXCT Price Forecast

2026 Outlook

- Conservative forecast: $0.01109 - $0.01477

- Neutral forecast: $0.01477 - $0.01792

- Optimistic forecast: $0.01792 - $0.01977 (requires sustained market momentum and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market stage expectations: Gradual recovery and consolidation phase with increasing institutional interest

- Price range forecasts:

- 2027: $0.01272 - $0.02491

- 2028: $0.01370 - $0.03126

- 2029: $0.02476 - $0.03845

- Key catalysts: Protocol upgrades, increased adoption rates, macro market sentiment improvement, and strengthening of fundamental use cases

2030-2031 Long-term Outlook

- Base case: $0.02883 - $0.03725 (assumes steady ecosystem growth and moderate market conditions)

- Optimistic scenario: $0.03239 - $0.04353 (assumes accelerated adoption, strategic partnerships, and favorable regulatory environment)

- Transformational scenario: $0.03482 - $0.04353 (assumes breakthrough technological innovations, mainstream adoption, and significant macro tailwinds)

- 2031-01-05: DXCT potentially reaching $0.04353 (peak scenario with sustained positive momentum and market expansion)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.01977 | 0.01607 | 0.01109 | 0 |

| 2027 | 0.02491 | 0.01792 | 0.01272 | 11 |

| 2028 | 0.03126 | 0.02141 | 0.0137 | 33 |

| 2029 | 0.03845 | 0.02634 | 0.02476 | 63 |

| 2030 | 0.03725 | 0.03239 | 0.02883 | 101 |

| 2031 | 0.04353 | 0.03482 | 0.0202 | 116 |

DNAxCAT (DXCT) Professional Investment Strategy and Risk Management Report

IV. DXCT Professional Investment Strategy and Risk Management

DXCT Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Metaverse gaming enthusiasts, long-term crypto portfolio holders, and players seeking exposure to the play-to-earn gaming ecosystem.

- Operational Recommendations:

- Accumulate DXCT tokens during market consolidation phases when prices remain stable near support levels.

- Participate actively in the DNAxCAT Metaverse ecosystem to generate rewards through breeding, battling, and trading digital cats.

- Store accumulated tokens securely for extended holding periods to benefit from potential ecosystem growth.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.01608 (current resistance) and $0.01523 (historical low support) to identify potential entry and exit points.

- Volume Analysis: Track the 24-hour trading volume of approximately $11,985 to assess market liquidity and confirm price movements.

- Wave Trading Key Points:

- Execute buy positions when price approaches the $0.01523 support level with increasing trading volume.

- Set profit targets near the historical high of $10.8, recognizing this represents significant long-term upside potential despite current distance.

DXCT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, treating DXCT as a speculative high-risk diversification component.

- Active Investors: 3-5% portfolio allocation, allowing for meaningful exposure while maintaining balanced portfolio management.

- Professional Investors: 5-10% allocation, with hedging strategies and regular rebalancing protocols in place.

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance DXCT holdings with established cryptocurrencies and traditional assets to reduce concentration risk.

- Position Sizing: Implement strict position limits and avoid overexposure to a single gaming token, especially given its small market cap of $59,013.6.

(3) Secure Storage Solutions

- Hardware Wallet Integration: Store DXCT tokens on secure hardware solutions that support BNB Smart Chain (BSC) assets.

- Exchange Custody: Maintain trading positions on Gate.com with proper account security measures including two-factor authentication and API whitelisting.

- Security Considerations: Protect private keys vigilantly, verify all wallet addresses on BSCscan before transactions, and never share recovery phrases or sensitive credentials.

V. DXCT Potential Risks and Challenges

DXCT Market Risks

- Extreme Volatility: DXCT exhibits significant price fluctuation with a historical decline of 99.86% from its all-time high of $10.8 (December 2021) to current levels, indicating substantial downside risk for investors entering at higher valuations.

- Low Liquidity: With only 24-hour trading volume of $11,985 and limited exchange availability (trading on only 1 exchange), the token faces liquidity constraints that can result in slippage and difficulty executing large orders.

- Market Cap Decline: The current market capitalization of $59,013.6 represents a dramatic contraction, suggesting reduced investor confidence and potential further depreciation.

DXCT Regulatory Risks

- Gaming Regulation Uncertainty: Play-to-earn gaming tokens face increasing regulatory scrutiny in multiple jurisdictions regarding gambling classification and consumer protection requirements.

- Blockchain Compliance: Changes in BNB Smart Chain regulations or Chinese regulatory actions targeting game-based tokens could negatively impact DXCT's operational environment.

- Jurisdiction-Specific Restrictions: Various countries may restrict or prohibit the trading and promotion of gaming-focused tokens, limiting market access.

DXCT Technical Risks

- Smart Contract Vulnerabilities: Any security issues with the DXCT smart contract (0x5b1baec64af6dc54e6e04349315919129a6d3c23) on BSC could result in token loss or devaluation.

- Ecosystem Development: The success of DXCT depends entirely on continuous development and user adoption of the DNAxCAT gaming platform, with no guarantee of sustained player engagement.

- Blockchain Network Risks: Disruptions to the BNB Smart Chain network or transaction failures could impair token utility and trading functionality.

VI. Conclusion and Action Recommendations

DXCT Investment Value Assessment

DNAxCAT (DXCT) represents a highly speculative play-to-earn gaming token with significant risk factors. While the metaverse gaming sector offers long-term innovation potential, DXCT's 99.86% decline from historical highs, minimal liquidity, concentrated market structure, and single-exchange availability present substantial challenges. The token's viability depends critically on sustained player adoption and ecosystem development within the DNAxCAT platform. Current fundamentals suggest positioning DXCT as an extreme high-risk allocation rather than a core portfolio holding.

DXCT Investment Recommendations

✅ Beginners: Avoid direct DXCT investment until ecosystem maturity improves; alternatively, allocate only 0.5-1% of total portfolio as speculative exposure while learning the gaming platform mechanics.

✅ Experienced Investors: Consider 2-3% portfolio allocation with active ecosystem participation, implementing strict stop-loss orders at -20% below entry prices and maintaining position discipline.

✅ Institutional Investors: Assess DXCT only as part of broader gaming token research initiatives with dedicated risk management protocols, liquidity analysis, and clear exit strategies.

DXCT Trading Participation Methods

- Direct Trading on Gate.com: Execute spot trading of DXCT directly through Gate.com's platform with real-time price discovery and proper position management.

- Ecosystem Participation: Earn DXCT rewards through active gameplay in the DNAxCAT Metaverse by breeding, battling, and trading digital cats.

- On-Chain Transactions: Transfer DXCT tokens directly on BNB Smart Chain using the contract address 0x5b1baec64af6dc54e6e04349315919129a6d3c23, ensuring proper wallet compatibility and network selection.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make careful decisions based on their individual risk tolerance and strongly consider consulting professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is DXCT? What are its uses and value?

DXCT is a digital payment token enabling instant, secure, low-cost transactions for e-commerce and cross-border payments globally. Its value lies in efficient worldwide payment applications and growing adoption potential in digital commerce ecosystems.

What is DXCT's historical price performance? What is the price change over the past year?

DXCT has declined over 99% in the past year. The all-time high price reached 46.99 RON, while the current price is approximately 0.03487 RON, representing a significant downtrend in valuation.

What are the main factors affecting DXCT price?

DXCT price is primarily influenced by market sentiment, investor confidence, and adoption developments. Trading volume, overall crypto market trends, and technical breakthroughs also play significant roles in price movements.

What is the future price prediction for DXCT? What do experts think?

Experts forecast optimistic growth for DXCT, with predictions reaching $0.01736 to $0.01945 by end of 2025. WalletInvestor and PricePrediction.net lead bullish outlooks, though some analysts remain cautious on long-term prospects.

What are the advantages or disadvantages of DXCT compared to similar tokens?

DXCT offers strong market adaptability with applications across finance, commerce, and blockchain services. Its diverse use cases and robust technology infrastructure provide competitive advantages in the digital asset space.

What risks should I pay attention to when investing in DXCT?

DXCT investment involves market volatility risks and requires careful due diligence. Evaluate project fundamentals, team credibility, and market conditions before investing. Diversify your portfolio and only invest what you can afford to lose.

Where can I buy DXCT? How is the liquidity?

DXCT is available on decentralized exchanges (DEX). Liquidity on DEXs is typically lower compared to centralized platforms. Trading volume and liquidity may vary depending on the specific DEX and trading pairs available.

2025 MATR1X Price Prediction: Analyzing Potential Growth and Market Factors for the Emerging Cryptocurrency

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

2025 WEMIX Price Prediction: Analyzing Market Trends and Future Potential in the Evolving Crypto Landscape

2025 COPI Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Digital Asset Landscape

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

2025 HIGHPrice Prediction: Analyzing Market Trends and Future Valuation of the HIGH Token in a Post-Regulation Crypto Landscape

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange

SEI Price Analysis: Technical Formation Indicating Potential Bullish Breakout