2025 DESO Price Prediction: Analyzing Growth Potential and Market Trends for the Social Blockchain Token

Introduction: DESO's Market Position and Investment Value

Decentralized Social (DESO), as a cryptocurrency designed for decentralized social media applications, has made significant strides since its inception in 2021. As of 2025, DESO's market capitalization has reached $72,346,051, with a circulating supply of approximately 10,532,253 coins, and a price hovering around $6.869. This asset, often referred to as the "social media blockchain," is playing an increasingly crucial role in the realm of decentralized social networking and content monetization.

This article will provide a comprehensive analysis of DESO's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. DESO Price History and Current Market Status

DESO Historical Price Evolution

- 2021: DESO reached its all-time high of $198.68 on June 20, marking a significant milestone in its early trading history.

- 2024: The project experienced a major downturn, with the price hitting its all-time low of $2.7 on November 5.

- 2025: DESO has shown signs of recovery, with the price currently at $6.869, representing a 154% increase from its all-time low.

DESO Current Market Situation

As of November 17, 2025, DESO is trading at $6.869, with a market capitalization of $72,346,051.94. The token has seen a 1.26% increase in the last 24 hours and a more substantial 62.8% gain over the past year. However, it has experienced a 3.50% decrease in the last 7 days and a 2.48% decline over the past 30 days. The current price is still significantly below its all-time high, indicating potential for growth if market conditions improve. With a circulating supply of 10,532,253.8854 DESO and a total supply of 10,808,492.6854 DESO, the token has a relatively high circulating supply ratio of 97.44%.

Click to view the current DESO market price

DESO Market Sentiment Indicator

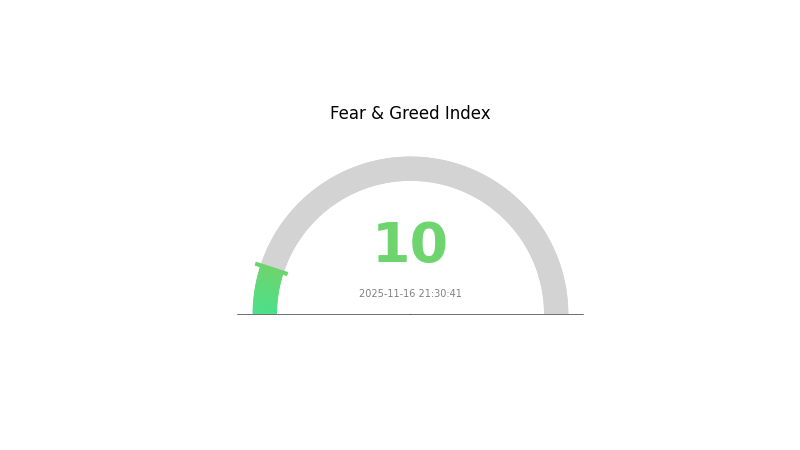

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Seasoned traders on Gate.com are closely monitoring key support levels and technical indicators for signs of a potential trend reversal. Remember, while fear can present opportunities, it's crucial to conduct thorough research and manage risk appropriately in these uncertain times.

DESO Holdings Distribution

The address holdings distribution chart provides insight into the concentration of DESO tokens among different wallet addresses. In this case, the absence of data in the provided table suggests a lack of information or potentially widespread distribution of DESO tokens across numerous addresses.

Without specific concentration data, it's challenging to definitively assess the degree of centralization in DESO holdings. However, this absence might indicate a relatively decentralized distribution, where no single address holds a significant percentage of the total supply. Such a scenario could be viewed positively for the network's resilience and reduced risk of market manipulation.

The potential widespread distribution, if confirmed, could contribute to a more stable market structure and reduced volatility. It may also suggest a higher level of decentralization in the DESO ecosystem, aligning with blockchain principles of distributed ownership and control.

Click to view the current DESO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing DESO's Future Price

Technical Development and Ecosystem Building

- Decentralized Social Network: DESO is designed as a blockchain-based social media platform, aiming to provide a decentralized alternative to traditional social networks.

- Ecosystem Applications: The DESO ecosystem includes various decentralized applications (DApps) built on its blockchain, focusing on social media and content creation functionalities.

III. DESO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $4.39 - $5.50

- Neutral forecast: $6.50 - $7.50

- Optimistic forecast: $8.00 - $8.93 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range predictions:

- 2027: $9.29 - $11.71

- 2028: $5.56 - $14.01

- Key catalysts: Technological advancements, wider institutional adoption, and favorable regulatory environment

2029-2030 Long-term Outlook

- Base scenario: $12.35 - $14.14 (assuming steady growth and adoption)

- Optimistic scenario: $14.14 - $15.93 (with accelerated adoption and positive market conditions)

- Transformative scenario: $15.93 - $18.00 (with groundbreaking innovations and mainstream acceptance)

- 2030-12-31: DESO $14.14 (105% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 8.9297 | 6.869 | 4.39616 | 0 |

| 2026 | 11.45406 | 7.89935 | 7.2674 | 15 |

| 2027 | 11.70881 | 9.6767 | 9.28964 | 40 |

| 2028 | 14.00751 | 10.69276 | 5.56023 | 55 |

| 2029 | 15.93167 | 12.35014 | 7.78059 | 79 |

| 2030 | 15.41359 | 14.1409 | 9.61582 | 105 |

IV. DESO Professional Investment Strategy and Risk Management

DESO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in decentralized social media

- Operation suggestions:

- Accumulate DESO during market dips

- Hold for at least 3-5 years to ride out market volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor for overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor DeSo platform adoption metrics for fundamental analysis

DESO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance DESO with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official DeSo wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for DESO

DESO Market Risks

- High volatility: Price can fluctuate dramatically in short periods

- Limited liquidity: May face challenges in executing large trades

- Competition: Other blockchain-based social media projects may emerge

DESO Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting decentralized social platforms

- Privacy concerns: Increased scrutiny on data protection and user privacy

- Content moderation issues: Challenges in balancing free speech with content control

DESO Technical Risks

- Scalability concerns: Potential limitations in handling large-scale user adoption

- Smart contract vulnerabilities: Risks associated with bugs or exploits in the underlying code

- Network security: Possibility of 51% attacks or other blockchain-specific threats

VI. Conclusion and Action Recommendations

DESO Investment Value Assessment

DESO presents a unique value proposition in the decentralized social media space, with potential for long-term growth. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

DESO Investment Recommendations

✅ Beginners: Consider small, regular investments to build a position over time ✅ Experienced investors: Implement a balanced approach with both long-term holding and active trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider DESO as part of a diversified crypto portfolio

DESO Trading Participation Methods

- Spot trading: Purchase DESO tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- Social token creation: Engage with the DeSo platform by creating and trading social tokens

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of Deso?

Deso's future looks promising with potential growth in user adoption, ecosystem expansion, and increased decentralization. It may become a leading social media blockchain platform, revolutionizing content creation and monetization.

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, or metaverse sectors could potentially see massive growth. Always research thoroughly before investing.

What happened to Deso crypto?

Deso crypto has evolved into a leading social blockchain platform, gaining significant adoption and value. Its innovative approach to decentralized social media has attracted investors and users alike, driving up its market cap and utility in the Web3 ecosystem.

Can sol go to $1000?

Yes, SOL could potentially reach $1000 in the long term, given its strong ecosystem growth and increasing adoption in the Web3 space. However, it would require significant market expansion and continued technological advancements.

Share

Content