2025 CUSD Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: CUSD's Market Position and Investment Value

Celo Dollar (CUSD) has established itself as a stablecoin pegged to the US dollar on the Celo blockchain since its inception. As of 2025, CUSD's market capitalization has reached $35,639,296, with a circulating supply of approximately 35,553,466 coins, maintaining a price around $1.0024. This asset, known as a "mobile-first stablecoin," is playing an increasingly crucial role in facilitating faster, cheaper, and more convenient financial transactions in developing economies.

This article will comprehensively analyze CUSD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

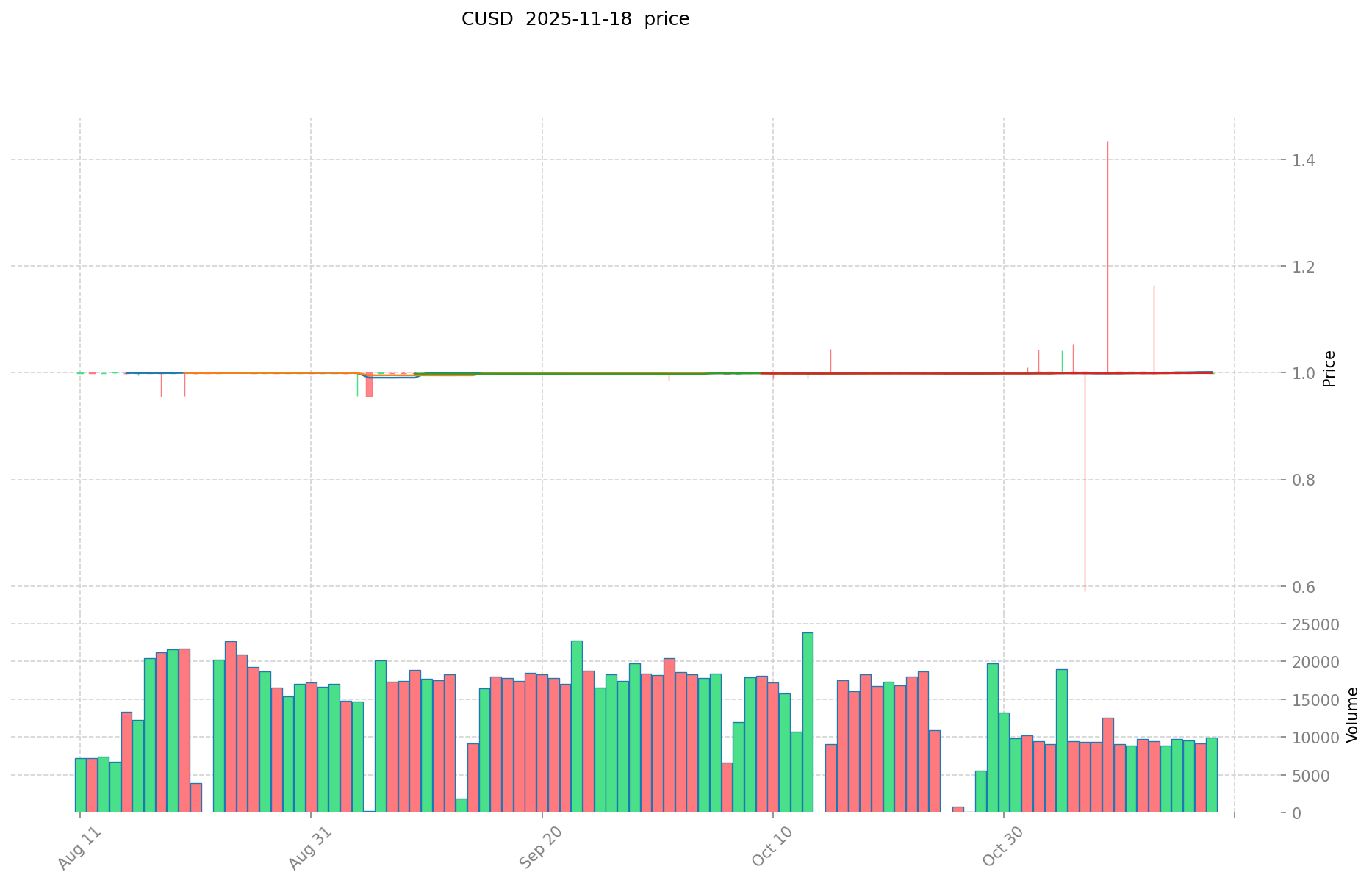

I. CUSD Price History Review and Current Market Status

CUSD Historical Price Evolution

- 2021: CUSD reached its all-time high of $1.14 on September 10, marking a significant milestone.

- 2025: The token experienced its all-time low of $0.498806 on October 11, demonstrating substantial volatility.

CUSD Current Market Situation

As of November 18, 2025, CUSD is trading at $1.0024, maintaining its stability as a stablecoin pegged to the US dollar. The token has shown minimal fluctuations in the past 24 hours, with a slight increase of 0.02%. The 24-hour trading volume stands at $9,860.14, indicating moderate market activity.

CUSD's market capitalization is currently $35,638,794.50, ranking it at 686th position in the overall cryptocurrency market. The circulating supply of CUSD is 35,553,466.18, which is very close to its total supply of 35,553,967.18, suggesting a high level of token distribution.

The token has demonstrated resilience in maintaining its peg, with recent price trends showing small but positive movements: 0.37% increase over the past week and 0.24% over the last month. This stability is crucial for CUSD's role as a stablecoin within the Celo ecosystem.

Click to view the current CUSD market price

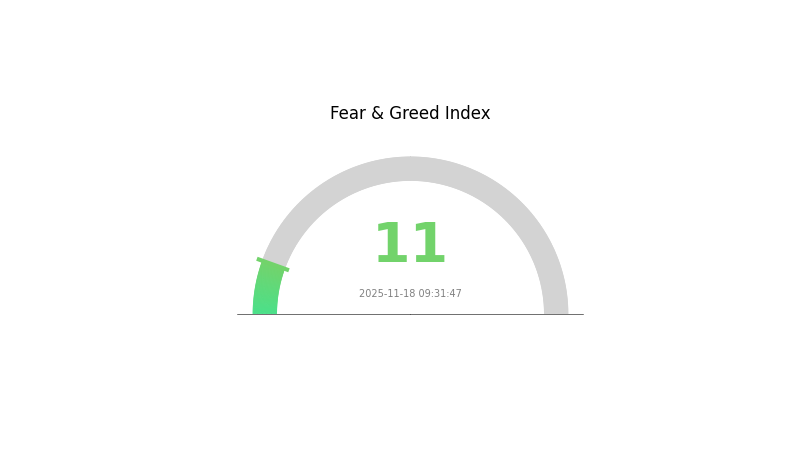

CUSD Market Sentiment Indicator

2025-11-18 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment can be volatile. Traders on Gate.com should consider diversifying their portfolios and implementing risk management strategies. Remember, while fear can present opportunities, it's crucial to conduct thorough research and make informed decisions based on your own risk tolerance and investment goals.

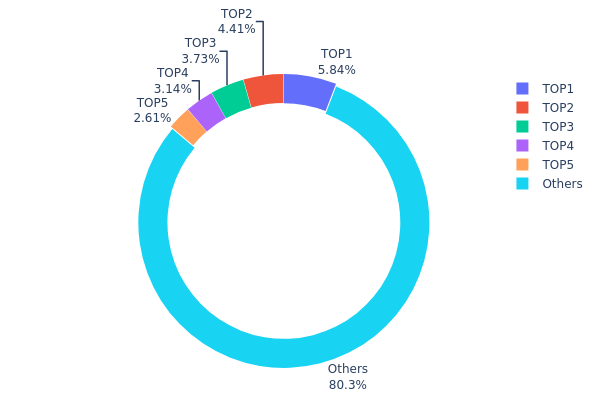

CUSD Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of CUSD tokens across different wallets. According to the provided data, the top 5 addresses collectively hold 19.73% of the total CUSD supply, with the largest holder possessing 5.84% of the tokens. This distribution suggests a moderate level of concentration, as no single address controls an overwhelmingly large portion of the supply.

The relatively balanced distribution among the top holders, with percentages ranging from 2.61% to 5.84%, indicates a healthier market structure compared to scenarios where a few addresses dominate the majority of tokens. However, it's important to note that 80.27% of the supply is held by addresses outside the top 5, suggesting a broader distribution among smaller holders. This distribution pattern may contribute to reduced volatility and lower risk of market manipulation, as no single entity has disproportionate control over the token supply.

Overall, the current CUSD holdings distribution reflects a moderate level of decentralization and a relatively stable on-chain structure. While there is some concentration among top holders, the significant portion held by smaller addresses suggests a diverse user base, which is generally favorable for the token's long-term stability and adoption potential.

Click to view the current CUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9181...4EDBc3 | 992.73K | 5.84% |

| 2 | 0xCA31...311270 | 750.00K | 4.41% |

| 3 | 0xF424...26725E | 633.89K | 3.73% |

| 4 | 0x5dC6...3d249f | 534.16K | 3.14% |

| 5 | 0x0D07...b492Fe | 444.26K | 2.61% |

| - | Others | 13635.94K | 80.27% |

Core Factors Affecting CUSD's Future Price

Macroeconomic Environment

- Impact of Monetary Policy: Major central banks' policy expectations will influence CUSD's value.

- Inflation Hedging Properties: CUSD's performance in inflationary environments will affect its value storage attributes.

- Geopolitical Factors: International situations and policy changes will impact CUSD's global circulation and value performance.

Technological Development and Ecosystem Building

- Core Mechanism Innovations: Breakthroughs in stablecoin concepts, such as delta-neutral hedging mechanisms and soft liquidation mechanisms, have driven market growth.

- Ecosystem Expansion: Support for agent markets allowing autonomous resource trading promotes the growth of stablecoin infrastructure.

Regulatory Environment

- Government Regulations: The recognition of certain types of crypto assets as financial instruments by governments has opened doors for industry innovation. For example, the GENIUS Act in the US (requiring 1:1 reserves, AML/KYC compliance, and banning uncollateralized algorithmic stablecoins), MiCA regulations in Europe, and related frameworks in the UK and Asia have facilitated institutional adoption and increased market confidence.

Market Sentiment and Adoption

- Institutional Adoption: Increasing recognition and use of CUSD by financial institutions could significantly impact its price.

- Reserve Transparency: On-chain audits monitoring reserve ratios contribute to user trust and price stability.

- Market Volatility: The dynamic nature of the cryptocurrency market and rapid changes in sentiment can affect CUSD's price, despite its status as a stablecoin.

III. CUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.91 - $0.95

- Neutral estimate: $0.95 - $1.00

- Optimistic estimate: $1.00 - $1.07 (requires stable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.95 - $1.42

- 2027: $0.73 - $1.57

- Key catalysts: Increased adoption of stablecoins, regulatory clarity

2028-2030 Long-term Outlook

- Base scenario: $1.40 - $1.87 (assuming continued market stability)

- Optimistic scenario: $1.87 - $2.16 (assuming widespread adoption)

- Transformative scenario: $2.16+ (extremely favorable market conditions)

- 2030-12-31: CUSD $1.86 (86% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.07257 | 1.0024 | 0.91218 | 0 |

| 2026 | 1.42135 | 1.03748 | 0.95449 | 3 |

| 2027 | 1.57366 | 1.22942 | 0.72536 | 22 |

| 2028 | 1.99018 | 1.40154 | 1.05115 | 39 |

| 2029 | 2.03503 | 1.69586 | 1.08535 | 69 |

| 2030 | 2.16392 | 1.86545 | 1.10061 | 86 |

IV. CUSD Professional Investment Strategies and Risk Management

CUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational suggestions:

- Dollar-cost averaging to accumulate CUSD over time

- Hold CUSD as a hedge against USD inflation

- Store CUSD in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor CUSD/USD peg stability

- Track Celo ecosystem developments for potential price impacts

CUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Collateralization: Use CUSD as collateral in DeFi protocols

(3) Secure Storage Solutions

- Web3 wallet recommendation: Gate web3 wallet

- Hardware wallet option: Cold storage for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CUSD

CUSD Market Risks

- Peg instability: Fluctuations in CUSD/USD exchange rate

- Liquidity risk: Potential challenges in converting large amounts

- Market sentiment: Negative perception of stablecoins affecting demand

CUSD Regulatory Risks

- Increased scrutiny: Potential regulatory clampdowns on stablecoins

- Compliance requirements: Changes in KYC/AML regulations

- Cross-border restrictions: Limitations on stablecoin usage in certain jurisdictions

CUSD Technical Risks

- Smart contract vulnerabilities: Potential exploits in the CUSD protocol

- Network congestion: Delays in transactions during high network activity

- Oracle failures: Inaccurate price feeds affecting peg stability

VI. Conclusion and Action Recommendations

CUSD Investment Value Assessment

CUSD offers a stable store of value within the Celo ecosystem, with potential for modest yield generation. Short-term risks include regulatory uncertainty and market volatility.

CUSD Investment Recommendations

✅ Beginners: Start with small allocations to understand stablecoin dynamics

✅ Experienced investors: Utilize CUSD in DeFi strategies on Celo

✅ Institutional investors: Consider CUSD for treasury management and cross-border transactions

CUSD Participation Methods

- Direct purchase: Buy CUSD on Gate.com

- Yield farming: Provide liquidity in Celo-based DeFi protocols

- Payments: Use CUSD for fast and low-cost transactions within the Celo network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can compound reach $1000?

Reaching $1000 is possible but uncertain. It depends on DeFi growth, market demand, and crypto conditions. COMP's previous high was $911 in 2021, so $1000 isn't far-fetched given continued sector expansion.

Can Coti reach $10?

Yes, COTI could potentially reach $10. Its advancements in privacy, integration with Ethereum Layer 2, and enhanced scalability may drive significant demand and price growth in the future.

How much is the Trump coin expected to be worth?

Based on current trends, the Trump coin (TRUMP) is expected to trade around $5-$6 in the near term. However, market volatility and political factors could significantly impact its value.

Can KDA reach $100?

Given the current market cap and halted development, it's unlikely for KDA to reach $100 in the near term. Significant changes and renewed growth would be necessary for such a price target.

Share

Content