2025 COOK Fiyat Tahmini: En Önde Gelen DeFi Token’ın Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Giriş: COOK'un Piyasadaki Konumu ve Yatırım Potansiyeli

mETH Protocol (COOK), piyasadaki ilk tam dikey entegre staking ve yeniden staking protokolü olarak kurulduğu günden bu yana kayda değer ilerleme göstermiştir. 2025 yılı itibarıyla COOK'un piyasa değeri 15.216.000 $'a ulaşmış, dolaşımdaki arz yaklaşık 960.000.000 token ve fiyatı 0,01585 $ civarındadır. “Sermaye verimliliğini artırma” özelliğiyle bilinen bu varlık, Ethereum staking ve getiri birikiminde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, COOK'un 2025 ile 2030 yılları arasındaki fiyat trendleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde analiz edilerek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. COOK Fiyat Geçmişi ve Mevcut Piyasa Durumu

COOK Tarihsel Fiyat Seyri

- 2024: mETH Protocol lansmanı, fiyat tüm zamanların en yüksek seviyesi olan 0,04584 $'a ulaştı

- 2025: Piyasa düzeltmesi, fiyat tüm zamanların en düşük seviyesi olan 0,0064 $'a geriledi

- 2025: Toparlanma süreci, fiyat mevcut seviyeye yükseldi

COOK Güncel Piyasa Durumu

7 Ekim 2025 itibarıyla COOK, 0,01585 $ seviyesinde işlem görmekte ve 24 saatlik işlem hacmi 154.640 $'a ulaşmıştır. Token, son 24 saatte %0,39'luk hafif bir gerileme yaşarken, son bir haftada %29,36 ve son 30 günde %49,66 artış ile güçlü performans sergilemiştir.

COOK'un dolaşımdaki arzı 960 milyon token, toplam arzı ise 5 milyar adet olup, mevcut piyasa değeri 15.216.000 $'dır ve kripto para piyasasında 1.232. sıradadır. Tam seyreltilmiş piyasa değeri 79.250.000 $'dır; dolaşımdaki arz, toplam arzın %19,2'sini oluşturmaktadır.

Token'ın tüm zamanların en yüksek değeri olan 0,04584 $ 9 Kasım 2024'te, en düşük değeri olan 0,0064 $ ise 20 Nisan 2025'te kaydedilmiştir. COOK şu anda ATH'nin %65,42 altında ve ATL'nin %147,66 üzerinde işlem görmektedir; bu durum, büyüme potansiyelinin yanı sıra geçmiş oynaklık nedeniyle temkinli olunması gerektiğini göstermektedir.

COOK'a yönelik piyasa hissiyatı yükseliş yönünde; son fiyat performansı ve artan işlem hacmi bu durumu doğrulamaktadır. Yine de, kripto para piyasasının yüksek oynaklık ve öngörülemezlik içerdiği unutulmamalıdır.

Güncel COOK piyasa fiyatını görüntülemek için tıklayın

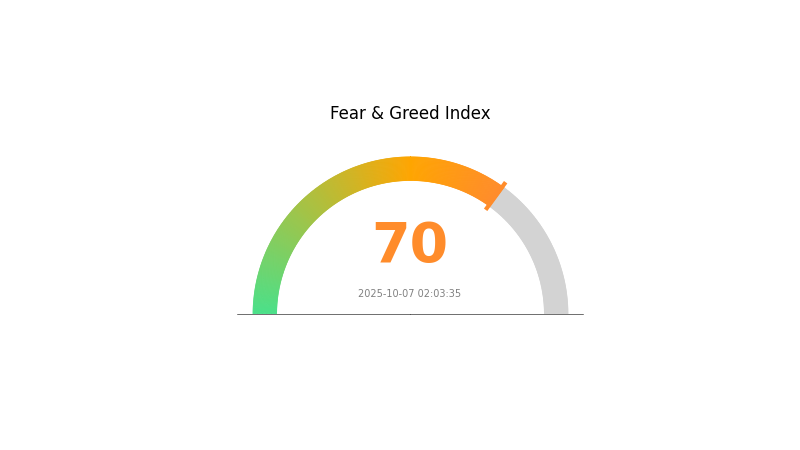

COOK Piyasa Hissiyatı Göstergesi

07 Ekim 2025 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında aşırı iyimserlik gözleniyor; Korku ve Açgözlülük Endeksi'nin 70'e yükselmesi, açgözlülük seviyesinin hakim olduğunu gösteriyor. Bu durum, yatırımcıların yükselişe geçtiğini ve fiyatların yukarı yönlü baskılandığını gösterse de, bu tür yoğun hissiyatlar çoğu zaman piyasa düzeltmelerinin habercisi olabilir. Yatırımcılar temkinli olmalı, kar realizasyonu veya risk yönetimi stratejilerini devreye almalıdır. Unutmayın, piyasalar irrasyonel kaldığı sürece varlığınızdan daha uzun süre dayanabilir. Coşkulu piyasa ortamında dikkatli davranın ve FOMO kaynaklı işlemlerden kaçının.

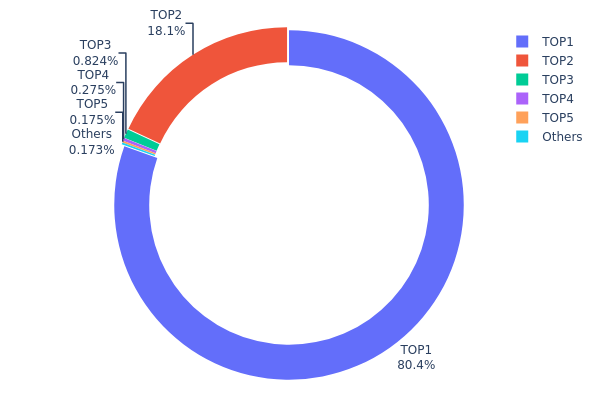

COOK Varlık Dağılımı

COOK'un adres bazında varlık dağılımı verileri, son derece yoğunlaşmış bir sahiplik yapısını gösteriyor. En büyük adres, toplam arzın %80,43'ünü elinde bulundurup 4.021.928,66K COOK tokenına sahipken, ikinci büyük adres %18,11'lik paya sahip. Bu iki adres, COOK tokenlarının %98,54'ünü kontrol etmekte olup, oldukça merkezileşmiş bir dağılım sergiliyor.

Böylesi bir yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı açısından ciddi riskler barındırmaktadır. Tokenların büyük bölümünün az sayıda adreste toplanması, bu adreslerin yapacağı herhangi bir hareketin piyasada orantısız etki yaratmasına yol açabilir. Yeterince geniş dağılımın olmaması likiditeyi sınırlar ve büyük satışlar halinde ani fiyat dalgalanmalarına neden olabilir.

Merkeziyetsizlik açısından COOK'un mevcut dağılımı idealin gerisindedir. İki adreste yoğunlaşma, zincir üstü yapısal istikrarın düşük olduğuna ve piyasa manipülasyonuna karşı dayanıklılığın sınırlı olabileceğine işaret ediyor. Bu dağılım modeli, adil piyasa uygulamalarına önem veren yatırımcıları caydırabilir ve COOK'un uzun vadeli sürdürülebilirliğini etkileyebilir.

Güncel COOK varlık dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xc144...0bdca9 | 4.021.928,66K | 80,43% |

| 2 | 0x0035...20cb6a | 905.736,95K | 18,11% |

| 3 | 0xf89d...5eaa40 | 41.202,77K | 0,82% |

| 4 | 0x66be...6883da | 13.741,46K | 0,27% |

| 5 | 0x0d07...b492fe | 8.753,01K | 0,17% |

| - | Diğerleri | 8.637,15K | 0,2% |

II. COOK'un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Kilit Açma: Çekirdek katkıcı tokenlarının büyük bir bölümü (toplam arzın %23,8'i) 29 Kasım 2025'ten itibaren doğrusal olarak açılmaya başlayacak.

- Tarihsel Model: Yeterli veri mevcut değil.

- Mevcut Etki: Kilit açma sürecinin satış baskısı yaratması ve 2025-2027 döneminde fiyatın %60-80 oranında gerilemesine yol açması bekleniyor.

Kurumsal ve Whale Dinamikleri

- Kurumsal Varlıklar: COOK için kurumsal varlıklar hakkında bilgi yok.

- Kurumsal Benimseme: COOK'u benimseyen şirketlerle ilgili veri yok.

- Ulusal Politikalar: COOK'a dair spesifik ulusal politika açıklanmadı.

Makroekonomik Ortam

- Parasal Politika Etkisi: Faiz oranları ve para politikaları, COOK dahil olmak üzere genel kripto piyasasını etkileyebilir.

- Enflasyona Karşı Koruma Özellikleri: COOK'un enflasyona karşı koruma özellikleriyle ilgili bilgi yok.

- Jeopolitik Faktörler: Ülkeler arası tarifeler ve ekonomik gerilimler kripto piyasasını ve COOK fiyatını dolaylı olarak etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- DeFi Rekabeti: Canlanan DeFi sektörü, Cook Finance için ciddi rakipler ve olası güvenlik açıkları doğuruyor.

- Piyasa Entegrasyonu: Cook Finance, merkezi borsaların verimliliğine yaklaşan spot ve vadeli işlemlerde sorunsuz ticaret deneyimi sunmayı hedefliyor.

- Ekosistem Uygulamaları: Cook Finance, EVM ile programlanabilir entegrasyon, yüksek performanslı ticaret motoru ve stablecoin altyapısı geliştiriyor.

Not: Gate.com'daki Cook Protocol (COOKPROTOCOL) fiyat tahminlerine göre, 2025'te ortalama fiyat ¥0,000987; dalgalanma aralığı ise ¥0,0008587 ile ¥0,001075 arasında olacaktır.

III. COOK 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00938 $ - 0,01589 $

- Tarafsız tahmin: 0,01589 $ - 0,01748 $

- İyimser tahmin: 0,01748 $ - 0,01907 $ (olumlu piyasa hissiyatı gerektirir)

2027-2028 Görünümü

- Piyasa fazı: Kademeli büyüme ve artan benimseme

- Fiyat aralığı tahmini:

- 2027: 0,0108 $ - 0,02395 $

- 2028: 0,01741 $ - 0,02182 $

- Kritik katalizörler: Teknolojik ilerlemeler ve genişleyen kullanım alanları

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,02140 $ - 0,02653 $ (dengeli piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,02653 $ - 0,03167 $ (yaygın benimseme ile)

- Dönüştürücü senaryo: 0,03167 $ - 0,03500 $ (çığır açıcı uygulama ve ortaklıklarla)

- 31 Aralık 2030: COOK 0,02812 $ (yıl sonu olası fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,01907 | 0,01589 | 0,00938 | 0 |

| 2026 | 0,01853 | 0,01748 | 0,01014 | 10 |

| 2027 | 0,02395 | 0,01801 | 0,0108 | 13 |

| 2028 | 0,02182 | 0,02098 | 0,01741 | 32 |

| 2029 | 0,03167 | 0,0214 | 0,01754 | 34 |

| 2030 | 0,02812 | 0,02653 | 0,01645 | 67 |

IV. COOK Profesyonel Yatırım Stratejileri ve Risk Yönetimi

COOK Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli değer arayanlar ve Ethereum staking'e inananlar

- Operasyon önerileri:

- Piyasa düşüşlerinde COOK token biriktirin

- COOK tokenlarını stake ederek ek getiri elde edin

- Tokenları güvenli, saklama dışı cüzdanlarda saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve olası dönüşleri belirlemek için

- RSI (Göreli Güç Endeksi): Aşırı alım veya aşırı satım seviyelerini izlemek için

- Dalgalı işlem için kritik noktalar:

- ETH staking getirilerini takip edin; COOK'un değerini etkileyebilir

- mETH Protocol ekibinden gelen haberleri ve güncellemeleri izleyin

COOK Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: COOK'u diğer kripto varlıklarla dengeleyin

- Stop-loss emirleri: Olası kayıpları sınırlamak için önceden çıkış noktaları belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. COOK'a Yönelik Olası Riskler ve Zorluklar

COOK Piyasa Riskleri

- Oynaklık: COOK, ciddi fiyat dalgalanmaları yaşayabilir

- Likidite: Düşük işlem hacmi kayma riskini artırabilir

- Korelasyon: Performans, genel kripto piyasa hissiyatına bağlı olabilir

COOK Düzenleyici Riskleri

- Staking düzenlemeleri: Staking kurallarındaki değişiklikler mETH Protocol'ü etkileyebilir

- Token sınıflandırılması: COOK'un menkul kıymet olarak sınıflandırılma ihtimali

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen düzenlemeler

COOK Teknik Riskleri

- Akıllı sözleşme açıkları: Olası istismar veya hata riski

- Ölçeklenebilirlik sorunları: Artan kullanıcı ilgisine yanıt verme kapasitesi

- Birlikte çalışabilirlik: Diğer blokzincir ağlarıyla uyumluluk sorunları

VI. Sonuç ve Eylem Önerileri

COOK Yatırım Değeri Değerlendirmesi

COOK, Ethereum staking ekosisteminde özgün bir fırsat sunarak ETH'nin uzun vadeli yükselişine inananlar için değer potansiyeli taşır. Bununla birlikte, kısa vadeli fiyat oynaklığı ve düzenleyici belirsizlikler önemli risk unsurlarıdır.

COOK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlar ile başlayıp staking hakkında bilgi edinin ✅ Deneyimli yatırımcılar: ETH varlıklarının bir kısmını COOK'a tahsis etmeyi değerlendirin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapıp düzenleyici gelişmeleri yakından takip edin

COOK İşlem Katılım Yöntemleri

- Spot işlem: Gate.com'da COOK alım-satımı yapın

- Staking: mETH Protocol staking programına katılın

- DeFi entegrasyonu: Varsa likidite sağlama imkânlarını değerlendirin

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermelidir. Profesyonel bir finansal danışmana başvurulması tavsiye edilir. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Cook'un 2025 için hisse fiyatı tahmini nedir?

Mevcut tahminlere göre, COOK'un hisse fiyatının 2025'te ortalama 2,04 $ olması; en yüksek 4,06 $ ve en düşük 0,02 $ seviyelerine ulaşması beklenmektedir.

Cook token için fiyat tahmini nedir?

Cook token'ın mevcut piyasa trendlerine göre; 2025'te 2,00 $, 2026'da 3,00 $, 2027'de 4,00 $, 2028'de 5,00 $ ve 2030'da 10,00 $ seviyelerine ulaşması bekleniyor.

Cook için fiyat hedefi nedir?

COOK için fiyat hedefi 1,75 $ olarak öngörülüyor; tahminler 2026 yılı için 1,25 $ ile 3,00 $ arasında değişmektedir ve mevcut piyasa analizleri ile uzman görüşlerine dayanmaktadır.

Hangi kripto paranın fiyat tahmini en yüksektir?

Bitcoin, en yüksek fiyat tahminine sahip olup; 2025'te 139.045 $ seviyesine ulaşacağı öngörülüyor. Mevcut fiyatı yaklaşık 124.798 $'dır.

Gate'de USD1 stablecoin: WLFI Token için Analiz ve Yatırım Fırsatları

STETH nedir: Likit Staking Türev Tokeni ve Ethereum Ekosistemindeki Yeri

USD1 Puan Programı Lansmanı: Gate ve WLFI Birçok Kazanım Fırsatı İçin Bir Araya Geliyor

Gate, stablecoin yatırım deneyimini kapsamlı bir şekilde geliştirmek için WLFI ile USD1 puan programını başlattı.

Gate ve WLFI, USD1 puan programını başlatıyor: stablecoin kullanımında yeni bir dönem

ENA Nedir: European Nucleotide Archive’a (Avrupa Nükleotit Arşivi) Kapsamlı Bir Rehber

Solana üzerinde yer alan Amerika'nın simgesel dijital meme coin'i hakkında kapsamlı bir rehber

Popüler Meme Coin’lere Güvenli Yatırım Yapmanın Yolları