2025 CGPU Price Prediction: Expert Analysis and Market Outlook for GPU Computing Tokens

Introduction: CGPU's Market Position and Investment Value

ChainGPU (CGPU) operates at the intersection of blockchain technology and artificial intelligence resource democratization, establishing itself as a key player in making GPU and AI resources more accessible to the broader ecosystem. Since its launch in August 2024, CGPU has demonstrated significant market volatility, reflecting the dynamic nature of emerging AI-focused blockchain projects. As of January 2026, CGPU maintains a market capitalization of approximately $346,400, with a circulating supply of 1.73 million tokens trading around $0.03464 per unit. This innovative asset, recognized for its role in creating a symbiotic ecosystem connecting hardware owners, AI enthusiasts, and enterprises, is increasingly gaining traction in the convergence of blockchain and artificial intelligence sectors.

This comprehensive analysis will examine CGPU's price trajectories and market dynamics through 2031, integrating historical performance patterns, market supply-demand mechanics, ecosystem development milestones, and macroeconomic factors. Our analysis aims to provide investors with data-driven price forecasts and actionable investment strategies grounded in current market conditions and fundamental project developments.

I. CGPU Price History Review and Current Market Status

CGPU Historical Price Evolution Trajectory

- October 2024: Project launch phase, CGPU reached its all-time high (ATH) of $75.00 on October 22, 2024, marking the peak of initial market enthusiasm.

- December 2025: Market correction phase, CGPU declined significantly to an all-time low (ATL) of $0.01941 on December 12, 2025, representing a severe drawdown from peak levels.

- January 2026: Current recovery phase, CGPU traded at $0.03464, showing a modest rebound from recent lows.

CGPU Current Market Posture

As of January 5, 2026, CGPU exhibits the following market characteristics:

Price Performance Metrics:

- Current Price: $0.03464

- 24-Hour Change: +8.86% ($0.002819 increase)

- 7-Day Change: +10.20%

- 30-Day Change: +44.39%

- Year-to-Date Change: -99.48% (from initial launch price of $0.25)

Market Capitalization and Liquidity:

- Market Cap: $59,927.20 (based on circulating supply)

- Fully Diluted Valuation: $346,400.00

- 24-Hour Trading Volume: $13,171.06

- Market Cap to FDV Ratio: 17.3%

- Current Price Range (24H): $0.03182 - $0.0399

Supply Dynamics:

- Circulating Supply: 1,730,000 CGPU (17.30% of total supply)

- Total Supply: 10,000,000 CGPU

- Token Holders: 4,698

Market Position:

- Global Ranking: #5519

- Market Dominance: 0.000010%

- Available on Gate.com with active trading functionality

Despite the substantial year-over-year decline of -99.48% from the launch price, CGPU has demonstrated short-term recovery momentum with consecutive weeks of positive performance. The 24-hour surge of 8.86% and 30-day gain of 44.39% suggest renewed interest in the project's GPU and AI resource democratization proposition.

Click to view current CGPU market price

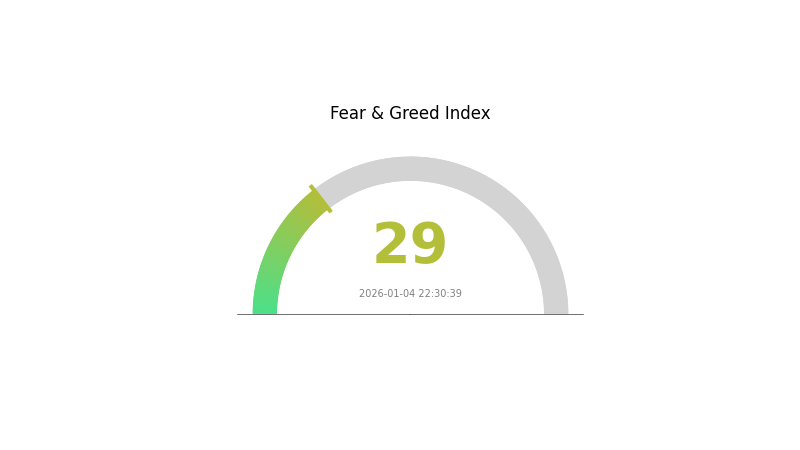

CGPU Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This level indicates heightened market anxiety and risk aversion among investors. When the Fear and Greed Index drops to this range, it typically reflects concerns about market volatility, regulatory pressures, or macroeconomic headwinds affecting digital assets. Such fearful conditions often present potential opportunities for long-term investors to accumulate positions at lower valuations. However, caution remains warranted as market uncertainty persists. Traders should implement proper risk management strategies and avoid emotional decision-making during periods of elevated fear in the cryptocurrency market.

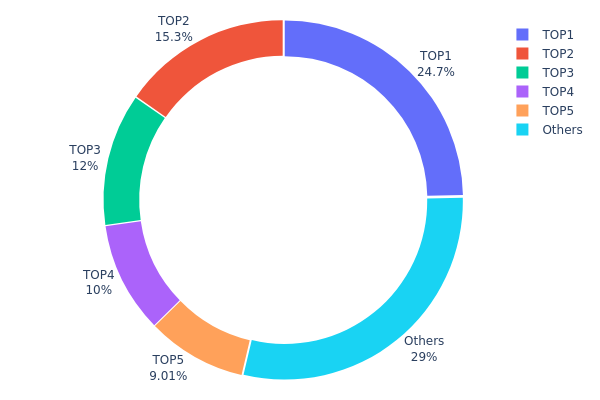

CGPU Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing market decentralization and potential systemic risks. By tracking the top holders and their proportional stakes, this analysis reveals the degree to which token supply is concentrated among key market participants.

CGPU currently exhibits moderate concentration characteristics, with the top five addresses collectively controlling approximately 70.94% of the total token supply. The leading address dominates with 24.67% of holdings, while the second and third largest holders maintain positions of 15.31% and 11.96% respectively. This distribution pattern indicates that while significant wealth concentration exists among the top-tier holders, the remaining 29.06% dispersed across other addresses suggests an emerging decentralization trend. The relatively balanced decline in holdings from rank one through rank five demonstrates a gradual rather than extreme concentration gradient.

From a market structure perspective, this distribution presents both opportunities and considerations. The concentration among top five addresses creates potential liquidity pools and decision-making influence, which could theoretically impact price volatility during large liquidation or accumulation events. However, the presence of nearly 30% holdings outside the top five indicates a healthier distribution than severely compromised tokens, reducing concerns about coordinated market manipulation. The current configuration reflects a market transitioning toward broader participation while maintaining sufficient depth among institutional or significant stakeholders to provide trading stability.

Click to view current CGPU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8bfe...3dcffc | 2465.64K | 24.67% |

| 2 | 0xbcdd...0c2ad6 | 1530.00K | 15.31% |

| 3 | 0xb6f1...338348 | 1196.00K | 11.96% |

| 4 | 0xd57f...a82f59 | 1000.00K | 10.00% |

| 5 | 0xc1fe...0d6261 | 900.00K | 9.00% |

| - | Others | 2900.33K | 29.06% |

II. Core Factors Affecting CGPU's Future Price

Supply Mechanism

-

Advanced Process Node Constraints: Current domestic Chinese GPU manufacturers face limitations in accessing 7nm and below process technologies. To overcome this bottleneck, companies like Biren employ Chiplet technology, combining different process nodes (5nm+12nm) to achieve performance comparable to advanced process chips while reducing dependency on a single process node.

-

Historical Patterns: As production scales increase and companies transition from small-batch, high-value customized cluster solutions to standardized product cards, gross margins naturally adjust. Biren's gross margin declined from 76.4% (2023) to 53.2% (2024) to 31.9% (H1 2025), reflecting this market evolution.

-

Current Impact: With China's 12-inch wafer factory production capacity expected to reach 3.21 million wafers per month by 2026, and domestic wafer manufacturers raising prices by approximately 10% on BCD processes, upstream supply costs are increasing. This will likely pressure GPU manufacturers' pricing strategies and profitability in the near term.

Institutional and Major Holder Dynamics

-

Institutional Holdings: The "Four Dragon" GPU companies (Moore Threads, Muxi, Biren, and Tengsun) have collectively raised billions in funding from institutional investors. Moore Threads has completed over 10 rounds of financing totaling over 10 billion RMB, with pre-IPO valuation reaching 30 billion RMB. Muxi attracted over 100 investment institutions with seven funding rounds totaling tens of billions RMB, with post-investment valuation at 21.071 billion RMB. Biren completed 10 rounds over five years, raising over 9 billion RMB pre-IPO with pre-money valuation of 19 billion RMB.

-

Enterprise Adoption: Moore Threads has secured contracts with major data centers for its "Kuaer" 10,000-card cluster platform. Muxi reported 1.43 billion RMB in hand orders and large-scale delivery contracts with regional intelligent computing centers for H1 2025 revenue acceleration. Tengsun achieved 7nm GPGPU mass production with high compatibility test pass rates in internet and intelligent manufacturing sectors.

-

National Policy: Chinese government objectives require domestic intelligent computing chip market share to reach 30% by 2027. Domestic GPU products' market share increased from 8.3% (2022) to 17.4% (2024), with projections exceeding 50% by 2029. This policy environment represents a critical two-year "life-or-death sprint period" for domestic GPU manufacturers.

Macroeconomic Environment

-

AI and Data Center Demand: Global semiconductor market size is projected to reach $7,722.43 billion in 2025 (22.5% YoY growth) and approach $1 trillion by 2026 (26.3% growth). China's high-end AI chip market is expected to grow over 60% in 2026, with domestic chipmakers capturing approximately 50% market share. AI and data center demand represents the primary driver sustaining semiconductor market expansion.

-

Geopolitical Factors: International trade shifts and geopolitical changes are prompting China to significantly expand independent core supply systems. Supply chain regionalization is catalyzing repeated construction and strategic stockpiling, amplifying market scale in the short term. GPU supply chains face potential constraints from EDA, advanced process nodes, advanced packaging, and system software—disruptions in any segment could severely impact domestic GPU commercialization and mass production.

Technology Development and Ecosystem Construction

-

Chiplet Technology Integration: Biren Technology pioneered 2.5D Chiplet packaging of dual AI computing bare dies in China, enabling flexible product combinations. Single chiplet configurations serve low-power applications while dual chiplet assemblies deliver high-performance versions, providing hardware-level extensibility and improved yield rates critical for mass production.

-

Software Stack Development: To break NVIDIA's CUDA ecosystem monopoly, domestic manufacturers employ differentiated strategies. Moore Threads introduced the MUSA ecosystem for high CUDA compatibility and lower developer migration costs. Muxi developed the MXMACA software stack. Biren constructed a "chip-server-industry solution" collaborative ecosystem. However, domestic GPU ecosystems remain significantly less mature than CUDA, which has attracted millions of global developers since its 2006 launch.

-

Ecosystem Applications: Moore Threads targets graphic rendering and AI computing dual-track platforms covering broader markets. Muxi emphasizes practical engineering delivery and industry implementation with low-to-high-end market coverage. Tengsun deployed "Tianshu" (training) and "Zhikai" (inference) dual-line products with strong vertical market presence in finance and security sectors. These commercial implementations validate domestic GPU capabilities in critical fields.

Three、2026-2031 CGPU Price Forecast

2026 Outlook

- Conservative Forecast: $0.02812 - $0.03472

- Neutral Forecast: $0.03472

- Optimistic Forecast: $0.04514 (requires sustained market confidence and increased adoption)

2027-2029 Medium-Term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual accumulation, transitioning toward sustainable growth trajectory

- Price Range Forecast:

- 2027: $0.02476 - $0.0551 (15% upside potential)

- 2028: $0.04514 - $0.05132 (37% cumulative growth)

- 2029: $0.0252 - $0.05386 (42% cumulative growth)

- Key Catalysts: Ecosystem development maturity, institutional investment interest, technological upgrades, and broader market sentiment improvement

2030-2031 Long-Term Outlook

- Base Case: $0.04544 - $0.05784 (49% cumulative growth by 2030, representing stable mid-range valuation)

- Optimistic Case: $0.05474 - $0.06404 (58% cumulative growth by 2031, assuming strong market expansion)

- Transformative Case: $0.06404+ (assumes significant protocol innovations, major partnership announcements, and substantial increase in network utility and adoption)

- 2031-12-31: CGPU trading near $0.06404 (achieving highest projected valuation with sustained bullish momentum)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.04514 | 0.03472 | 0.02812 | 0 |

| 2027 | 0.0551 | 0.03993 | 0.02476 | 15 |

| 2028 | 0.05132 | 0.04751 | 0.04514 | 37 |

| 2029 | 0.05386 | 0.04941 | 0.0252 | 42 |

| 2030 | 0.05784 | 0.05164 | 0.04544 | 49 |

| 2031 | 0.06404 | 0.05474 | 0.04105 | 58 |

ChainGPU (CGPU) Professional Investment Strategy and Risk Management Report

IV. CGPU Professional Investment Strategy and Risk Management

CGPU Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: AI and GPU resource enthusiasts, blockchain technology believers, and long-term crypto portfolio builders

- Operational Suggestions:

- Accumulate during market downturns when prices show significant weakness

- Hold positions through market volatility cycles to benefit from potential ecosystem growth in AI resource democratization

- Dollar-cost averaging (DCA) strategy to reduce timing risk given the token's 99.48% decline over the past year

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the current price of $0.03464 against the 24-hour range ($0.03182 - $0.0399) to identify entry and exit points

- Volume Analysis: Track the 24-hour trading volume of $13,171.06 to assess market liquidity and momentum strength

- Wave Trading Key Points:

- Capitalize on the 8.86% 24-hour price momentum for short-term positions

- Be cautious of low market liquidity as only 4,698 token holders currently exist, increasing slippage risk

- Consider the 30-day uptrend of 44.39% as a potential reversal signal given extreme historical volatility

CGPU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation maximum

- Active Investors: 3-5% of portfolio allocation maximum

- Professional Investors: 5-10% of portfolio allocation maximum

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance CGPU holdings with stablecoins and established cryptocurrencies to mitigate concentration risk

- Position Sizing: Implement strict stop-loss orders at 15-20% below entry points to protect capital in case of adverse market movements

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for active trading and frequent transactions with multi-layer security protocols

- Cold Storage Method: Transfer majority holdings to cold storage solutions for long-term security, minimizing smart contract and exchange risks

- Security Precautions: Never share private keys, enable two-factor authentication (2FA) on all accounts, regularly audit wallet access, and verify contract addresses before transactions

V. CGPU Potential Risks and Challenges

CGPU Market Risks

- Extreme Price Volatility: CGPU has experienced a 99.48% decline over one year and an all-time high of $75 versus current price of $0.03464, indicating severe price instability and potential for further depreciation

- Low Liquidity Risk: With only $13,171.06 in 24-hour trading volume and 4,698 token holders, the market exhibits extremely low liquidity, making large transactions difficult and increasing slippage costs

- Small Market Capitalization: The fully diluted valuation of $346,400 and circulating market cap of $59,927.20 represent a micro-cap token with minimal market infrastructure and high susceptibility to price manipulation

CGPU Regulatory Risks

- Regulatory Uncertainty: As an AI and GPU resource platform operating in the blockchain space, CGPU faces evolving regulatory frameworks across different jurisdictions that could impact token utility and trading availability

- Compliance Changes: Future regulations on AI resource trading or blockchain-based infrastructure could require significant platform modifications or operational restrictions

CGPU Technology Risks

- Smart Contract Vulnerabilities: As a BEP20 token on the BSC network, any security flaws or exploits in the underlying smart contract could result in token loss or value depreciation

- Ecosystem Development Risk: The success of ChainGPU depends on widespread adoption of its GPU and AI resource democratization platform; failure to achieve network effects could render the token economically worthless

- Integration Challenges: Technical difficulties in integrating with GPU networks or AI applications could delay or prevent the realization of the platform's value proposition

VI. Conclusion and Action Recommendations

CGPU Investment Value Assessment

ChainGPU presents an interesting but highly speculative opportunity in the emerging AI and GPU resource sharing space. While the project's vision of democratizing AI resources aligns with significant industry trends, the token has demonstrated extreme volatility with a 99.48% decline from historical highs. The combination of ultra-low market liquidity, minimal circulating supply adoption (17.3% of total supply), and micro-cap status creates a high-risk environment suitable only for risk-tolerant investors. The project's success depends entirely on achieving significant ecosystem adoption and market validation.

CGPU Investment Recommendations

✅ Beginners: Consider avoiding CGPU or allocating only 1% of capital as an experimental position; focus on understanding the project fundamentals through the whitepaper before committing funds

✅ Experienced Investors: May consider 3-5% portfolio allocation with strict risk management protocols, dollar-cost averaging strategies, and predetermined stop-losses to manage downside risk

✅ Institutional Investors: Suitable for venture capital or blockchain development funds with high risk tolerance; conduct thorough due diligence on the team, technology, and market adoption metrics before institutional allocation

CGPU Trading Participation Methods

- Direct Trading on Gate.com: Access CGPU/USDT trading pairs on Gate.com exchange platform for spot trading with competitive fees and reliable liquidity infrastructure

- Peer-to-Peer (P2P) Transactions: Engage directly with community members through secure channels to negotiate token purchases or sales outside centralized exchange environments

- Decentralized Opportunities: Participate in liquidity provision or yield farming programs if available on the ChainGPU ecosystem, though thoroughly audit smart contracts before participation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is CGPU and what is its purpose?

CGPU is a utility token designed for decentralized GPU computing networks. It enables users to access distributed computing power for AI, machine learning, and data processing tasks while allowing token holders to participate in network governance and earn rewards through staking and resource contribution.

CGPU的当前价格是多少,历史价格走势如何?

CGPU current price is $0.03455. Historical high reached $73.51 on October 22, 2024, while the lowest price was $0.01996 on December 12, 2025. The token has shown significant volatility with 73.1% recovery from its recent low.

What are the main factors affecting CGPU price prediction?

CGPU price prediction is primarily influenced by market sentiment, regulatory environment, trading volume, technological developments, and industry news. Market sentiment and regulatory clarity significantly impact price movements, while increased trading volume and positive technological innovations typically drive upward pressure on prices.

What are the risks to note when investing in CGPU?

CGPU investment carries high capital expenditure risks that may exceed operational returns. Intense market competition and rapid technological updates require careful evaluation of investment returns and market timing.

What is the difference between CGPU and other GPU-related tokens?

CGPU enables multiple containers to share one GPU card, improving resource utilization while ensuring business isolation through virtualization technology, unlike traditional exclusive GPU usage models.

What are CGPU's future development prospects and value potential?

CGPU demonstrates strong growth potential driven by increasing GPU demand in AI and computing sectors. With advancing technology and expanding market adoption, CGPU is positioned for significant value appreciation. Industry trends suggest substantial upside potential in the coming years.

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Is PinGo (PINGO) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 AIOT Price Prediction: Expert Analysis and Market Trends for the Next Generation of Connected Devices

2025 PINGO Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

Is Bless (BLESS) a good investment? Comprehensive Analysis of Features, Risks, and Market Potential

What is Stop Loss Hunting? How to Avoid Whale Liquidity Traps

Snoop Dogg and Bored Ape Yacht Club Launch Animated Avatars on Telegram via TON

Bill Gates on Digital Currency

Hamster Kombat Cipher Code Guide: How to Enter Codes and Earn Rewards

Why Is China Banning Cryptocurrencies?