2025 BTRST Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of BTRST

Braintrust (BTRST) is an Ethereum token that powers a decentralized talent network connecting freelancers with organizations. Since its launch in September 2021, BTRST has established itself as a governance and incentive mechanism within the Web3 talent ecosystem. As of December 2025, BTRST maintains a market capitalization of approximately $30.28 million, with a circulating supply of 241.35 million tokens out of a total supply of 250 million. The token is currently trading at $0.1211, reflecting its evolving market dynamics.

This asset plays an increasingly important role in decentralized labor markets and community-driven talent acquisition, positioning itself as a unique player in the Web3 infrastructure space. BTRST serves dual functions within its network: facilitating governance decisions and rewarding user participation and referrals.

This article provides a comprehensive analysis of BTRST's price trajectory and market outlook through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors. Our analysis will equip investors with professional price forecasting and actionable investment strategies to navigate the opportunities and risks in the BTRST market.

I. BTRST Price History Review and Market Status

BTRST Historical Price Evolution Trajectory

- September 2021: BTRST token launched on Ethereum with an initial price of $11.394, marking the entry of Braintrust's decentralized talent network into the market.

- September 16, 2021: BTRST reached its all-time high (ATH) of $46.82, representing a gain of over 311% from its launch price.

- October 19, 2021: BTRST experienced a significant correction, reaching its all-time low (ATL) of $0.1049 during this market cycle, marking a sharp decline from peak valuations.

- 2022-2025: Extended bearish period with BTRST trading substantially below its historical peaks, as the broader cryptocurrency market faced headwinds and the token struggled to maintain momentum.

BTRST Current Market Status

As of December 19, 2025, BTRST is trading at $0.1211, reflecting a 24-hour decline of -4.68%. The token exhibits significant bearish pressure across multiple timeframes:

- Short-term performance: Down -0.74% in the past hour and -7.76% over the past 7 days

- Annual performance: Down -73.33% year-over-year, indicating prolonged downward trend

- Market capitalization: $29.23 million (circulating supply value)

- Fully diluted valuation: $30.28 million based on maximum supply of 250 million tokens

- Trading volume (24h): $44,927.58, indicating relatively low liquidity

- Token distribution: 241.35 million tokens in circulation (96.54% of total supply), with 3,668 token holders

- Market sentiment: Extreme Fear (VIX: 16), reflecting broader market pessimism

The token's market dominance stands at 0.00095%, positioning it as a micro-cap asset. Current price levels are approximately 99.74% below the all-time high, with BTRST trading near its historical lows.

Click to view current BTRST market price

BTRST Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting 16. This indicates significant market pessimism and heightened selling pressure across digital assets. Such extreme fear levels typically present contrarian trading opportunities for investors with strong risk tolerance. Market participants should exercise caution and conduct thorough research before making investment decisions. Consider monitoring Gate.com's real-time market data to track sentiment shifts and identify potential entry points during this period of market uncertainty.

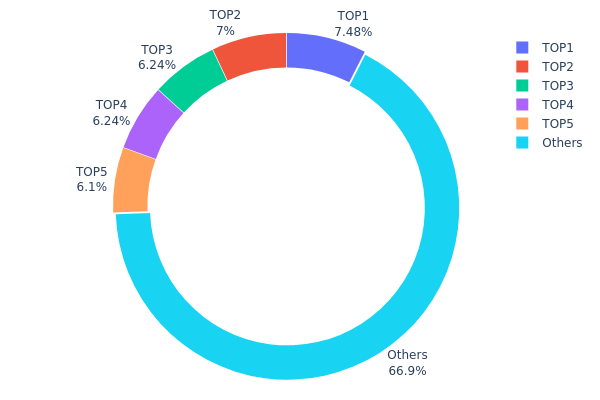

BTRST Holdings Distribution

The address holdings distribution chart illustrates how BTRST tokens are allocated across different blockchain addresses, serving as a critical indicator of token concentration and decentralization levels. By analyzing the top holders and their respective market shares, investors can assess the potential for price manipulation, market stability, and the overall health of the token's distribution ecosystem.

BTRST currently demonstrates a moderately balanced holdings structure with meaningful but not excessive concentration among major stakeholders. The top five addresses collectively control approximately 33.04% of the total token supply, with the largest holder commanding 7.48% and the second-largest holding 6.99%. This distribution pattern suggests a relatively healthy level of decentralization compared to highly concentrated tokens, where top holders often exceed 20-30% individually. The remaining 66.96% of tokens are distributed across numerous addresses, indicating a broad base of smaller holders that provides inherent resistance to coordinated market manipulation.

The current address distribution reflects a structurally sound market composition that mitigates extreme concentration risks. While the top five addresses maintain significant influence, their individual holdings remain fragmented enough to prevent any single entity from exercising dominant control over price movements. This distributed structure supports greater market resilience and reduces the likelihood of sudden large-scale liquidations causing severe price volatility. The substantial participation of smaller holders across the remaining addresses further strengthens the token's decentralization profile, suggesting that BTRST maintains a reasonably secure on-chain foundation with distributed governance potential.

Click to view current BTRST holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb6f1...33990b | 18712.45K | 7.48% |

| 2 | 0xe754...87600a | 17499.99K | 6.99% |

| 3 | 0x3977...fc5ff9 | 15611.02K | 6.24% |

| 4 | 0xc87c...fedb3e | 15594.58K | 6.23% |

| 5 | 0x0768...b88627 | 15250.00K | 6.10% |

| - | Others | 167331.97K | 66.96% |

II. Core Factors Influencing the Future Price of BTRST

Supply and Demand Dynamics

- Supply-Demand Mechanism: BTRST price movement is primarily driven by supply and demand factors. The token's price fluctuations reflect market sentiment, user adoption trends, and external factors affecting the Braintrust ecosystem.

- Historical Patterns: From 2021 to 2022, Braintrust's Gross Service Volume (GSV) experienced significant growth of 225%, demonstrating expanding platform adoption and transaction activity that impacts token demand.

- Current Impact: Ongoing platform growth and user adoption continue to influence BTRST's price trajectory through increased network activity and token utility.

Macroeconomic Environment

- Inflation Hedge Properties: BTRST demonstrates decoupling characteristics from mainstream cryptocurrency market movements, offering potential volatility reduction in inflationary environments. This positions the token as a relatively more stable asset during periods of economic uncertainty.

- Geopolitical Factors: Economic recession risks may suppress BTRST prices, with severe recessionary conditions potentially exerting downward pressure on token valuations.

Market Sentiment and Regulatory Environment

- Investor Confidence: Market sentiment and investor confidence directly influence BTRST price movements. Shifts in market psychology and confidence levels have immediate impacts on trading activity and valuation.

- Regulatory Changes: Real-world events such as regulatory policy changes, enterprise and government adoption announcements, and security incidents (including exchange hacks) significantly affect BTRST pricing.

III. 2025-2030 BTRST Price Forecast

2025 Outlook

- Conservative Forecast: $0.07788 - $0.118

- Neutral Forecast: $0.118

- Bullish Forecast: $0.16284 (requires sustained market recovery and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Consolidation phase with gradual recovery trajectory, characterized by increasing institutional participation and ecosystem development maturation.

- Price Range Forecast:

- 2026: $0.12638 - $0.1671

- 2027: $0.14761 - $0.21526

- 2028: $0.14945 - $0.21034

- Key Catalysts: Network upgrade implementation, strategic partnership announcements, expansion of DeFi integration, and broader market sentiment improvement towards mid-cap digital assets.

2029-2030 Long-term Outlook

- Base Case: $0.10266 - $0.25468 (assuming moderate regulatory clarity and steady ecosystem growth)

- Bullish Case: $0.1718 - $0.25996 (assuming accelerated mainstream adoption and positive macroeconomic conditions)

- Transformative Case: $0.25996+ (under conditions of breakthrough technological innovation, significant enterprise partnerships, and favorable regulatory environment globally)

Key Observations: The five-year projection indicates a cumulative upside potential of 86% by 2030, with volatility expected to normalize as market maturation progresses. Monitoring through Gate.com and other major venues is recommended for real-time price action analysis.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16284 | 0.118 | 0.07788 | -2 |

| 2026 | 0.1671 | 0.14042 | 0.12638 | 15 |

| 2027 | 0.21526 | 0.15376 | 0.14761 | 26 |

| 2028 | 0.21034 | 0.18451 | 0.14945 | 52 |

| 2029 | 0.25468 | 0.19743 | 0.10266 | 63 |

| 2030 | 0.25996 | 0.22605 | 0.1718 | 86 |

Braintrust (BTRST) Professional Investment Strategy and Risk Management Report

IV. BTRST Professional Investment Strategy and Risk Management

BTRST Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Individuals seeking exposure to decentralized talent network ecosystems and those who believe in the long-term adoption of Web3 recruitment platforms.

-

Operational Recommendations:

- Accumulate BTRST during market downturns when prices are below historical averages, leveraging the current 96.54% market cap to FDV ratio which suggests limited inflation risk.

- Dollar-cost averaging (DCA) approach: invest fixed amounts at regular intervals to reduce timing risk, particularly given the 73.33% year-over-year decline.

- Hold through market cycles while monitoring Braintrust network adoption metrics and user growth on the platform.

-

Storage Solution:

- Utilize Gate Web3 Wallet for secure, non-custodial storage of BTRST tokens on the Ethereum blockchain (Contract: 0x799ebfabe77a6e34311eeee9825190b9ece32824).

- Enable hardware wallet integration for enhanced security of long-term holdings.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range ($0.1157 - $0.1307) as immediate trading boundaries. Historical all-time high of $46.82 (September 16, 2021) and all-time low of $0.1048 (October 19, 2021) provide extended reference points.

- Moving Average Convergence Divergence (MACD): Utilize for identifying trend reversals and momentum shifts in BTRST price action.

-

Wave Trading Key Points:

- Capitalize on intraday volatility: the 1-hour decline of 0.74% and 24-hour decline of 4.68% suggest ongoing price compression that may precede directional moves.

- Monitor 7-day price action: the 7.76% weekly decline indicates bearish sentiment; traders should await reversal signals before establishing long positions.

BTRST Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1.5% of portfolio allocation (BTRST represents extreme risk due to 73.33% annual decline).

- Active Investors: 2% - 4% of portfolio allocation, with stops at 10% below entry price.

- Professional/Institutional Investors: 3% - 5% of allocation, with structured entry/exit frameworks and hedging strategies.

(2) Risk Hedging Solutions

- Stablecoin Pairs: Maintain 40% of intended BTRST investment in USDT or USDC stablecoins for rapid risk mitigation during sharp declines.

- Diversification Across Web3 Sectors: Balance BTRST holdings with exposure to other decentralized service protocols to reduce single-protocol risk.

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet offers convenient access for active traders while maintaining non-custodial control and direct blockchain interaction.

- Cold Storage Best Practice: For holdings exceeding $10,000 USD equivalent, consider hardware wallet solutions to mitigate exchange or smart contract vulnerabilities.

- Security Considerations:

- Never share private keys or seed phrases with third parties.

- Verify smart contract addresses before interactions (BTRST Ethereum address: 0x799ebfabe77a6e34311eeee9825190b9ece32824).

- Enable multi-signature authentication where available.

- Regularly audit connected wallet permissions and revoke unnecessary approvals.

V. Potential Risks and Challenges

BTRST Market Risks

-

Extreme Price Volatility: BTRST has experienced a 73.33% decline over the past year and 4.68% decline in 24 hours, indicating high volatility unsuitable for risk-averse investors. The token's relatively small market cap of approximately $30.3 million makes it susceptible to rapid repricing from large market participants.

-

Liquidity Constraints: With 24-hour trading volume of approximately $44,927 USD and only 3 exchange listings, BTRST faces significant liquidity challenges. Large position exits may experience substantial slippage, reducing execution quality for institutional traders.

-

Market Sentiment and Adoption Risk: The project's price has declined significantly from its all-time high of $46.82, suggesting either overvaluation at launch or insufficient user adoption on the Braintrust platform. Sustained market underperformance may indicate investors lack confidence in the platform's competitive positioning versus centralized talent networks.

BTRST Regulatory Risks

-

Token Classification Uncertainty: Regulatory authorities in various jurisdictions continue debating whether utility tokens like BTRST constitute securities. Changes in classification could trigger delisting from exchanges or impose compliance burdens on the project.

-

Jurisdiction-Specific Restrictions: Different countries implement varying restrictions on decentralized finance tokens and protocols. Users in certain jurisdictions may face legal barriers to BTRST acquisition, holding, or trading.

-

Compliance Evolution: As decentralized recruitment platforms operate in an evolving regulatory landscape, Braintrust may face requirements to implement Know Your Customer (KYC), Anti-Money Laundering (AML), or other compliance measures that could disrupt platform functionality or user experience.

BTRST Technical Risks

-

Smart Contract Vulnerabilities: Any undiscovered vulnerabilities in the BTRST token contract or Braintrust protocol smart contracts could result in token loss, frozen funds, or platform downtime. While audits mitigate this risk, they do not eliminate it entirely.

-

Ethereum Network Dependency: BTRST operates exclusively on the Ethereum blockchain. Network congestion increases transaction costs and reduces the economic viability of smaller transactions on the Braintrust platform.

-

Scalability Limitations: As Ethereum continues evolving through Layer 2 solutions, projects that fail to migrate to or integrate with scaling solutions may experience competitive disadvantages versus more modern implementations.

VI. Conclusions and Action Recommendations

BTRST Investment Value Assessment

Braintrust (BTRST) represents a speculative investment in the decentralized talent network sector. The token's 96.54% market cap to fully diluted valuation ratio indicates minimal inflationary pressure from remaining unminted supply, a favorable technical characteristic. However, the 73.33% year-over-year price decline, small market capitalization ($30.3 million), and limited exchange presence suggest the project faces significant adoption and competitive challenges. The current price of $0.1211 remains substantially below the $46.82 all-time high, reflecting either fundamental valuation repricing or lost investor confidence. Investors should carefully assess Braintrust platform adoption metrics, user growth, and competitive positioning against both decentralized and centralized talent acquisition solutions before committing capital.

BTRST Investment Recommendations

✅ For Beginners: Approach BTRST only with capital you can afford to lose completely. Start with minimal positions (less than 0.5% of portfolio) to understand the platform and token mechanics. Prioritize learning about the Braintrust protocol's competitive advantages before increasing exposure.

✅ For Experienced Investors: Implement structured dollar-cost averaging strategies during periods of elevated volatility. Utilize Gate.com's trading infrastructure to actively manage positions, but maintain strict stop-loss discipline given the 73.33% annual decline trend. Consider this allocation a satellite position rather than core holdings.

✅ For Institutional Investors: Conduct comprehensive due diligence on Braintrust's platform adoption, user acquisition costs, and competitive positioning versus centralized talent networks. Consider this investment category suitable only for diversified cryptocurrency exposure strategies or specialized Web3 venture allocations.

BTRST Trading Participation Methods

-

Spot Trading on Gate.com: Execute immediate BTRST purchases at current market prices. Gate.com provides reliable order execution and custody infrastructure for active traders seeking direct price exposure.

-

Limit Orders: Set predetermined buy orders at technical support levels ($0.1157 24-hour low or below) and sell orders at resistance levels ($0.1307 24-hour high or above) to automate systematic trading strategies.

-

Staking and Yield Programs: Monitor whether Braintrust or platform partners offer staking or yield farming opportunities for BTRST holders, which could provide returns independent of price appreciation.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and consult professional financial advisors. Never invest amounts exceeding your capacity to sustain complete loss.

FAQ

What is Braintrust (BTRST) crypto?

Braintrust (BTRST) is a decentralized talent network token enabling governance and incentives. It connects freelancers and organizations without charging talent fees, rewarding users for referrals and job matches on an equitable platform.

What is the price prediction for BTRST/BTR?

Based on current market analysis, BTRST is predicted to reach $0.3003 in 2025, with a 5-year projection of approximately $0.2573. These predictions reflect ongoing market trends and analyst assessments.

What happened to Braintrust Crypto?

Braintrust ceased operations in 2023 after facing financial difficulties. The platform, backed by Tiger Global and Coatue, shut down despite significant investor support and token investments made in 2021.

How to buy and trade BTRST tokens?

Visit a crypto platform's trading section, select BTRST, choose your desired amount, and confirm your purchase. You can then trade BTRST against other cryptocurrencies or fiat currencies based on market conditions and your trading strategy.

What are the risks and factors affecting BTRST price?

BTRST price is affected by technical breakdown risks, market-wide risk aversion, trading volume fluctuations, and support level breaks. Regulatory changes, platform adoption rates, and macroeconomic conditions also influence price movements significantly.

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

LMWR vs AAVE: Understanding the Linguistic Debate Between Language Minority Ways of Reading and African American Vernacular English

Is Vaulta (A) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 DCB Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Decubate (DCB) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Debox (BOX) a Good Investment?: Analyzing Growth Potential and Risks in the Web3 Storage Market

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange