2025 BTC Price Prediction: Navigating Market Cycles and Institutional Adoption in the Post-Halving Era

Introduction: BTC's Market Position and Investment Value

Bitcoin (BTC), as the pioneer and leader of the cryptocurrency market, has achieved remarkable success since its inception in 2009. As of 2025, Bitcoin's market capitalization has reached $2.25 trillion, with a circulating supply of approximately 19,918,300 coins and a price hovering around $112,969. This asset, often hailed as "digital gold," is playing an increasingly crucial role in the global financial system and digital economy.

This article will provide a comprehensive analysis of Bitcoin's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. BTC Price History Review and Current Market Status

BTC Historical Price Evolution

- 2009: Bitcoin launched, price essentially zero

- 2013: First major bull run, price reached $1,000

- 2017: Massive bull market, price peaked at nearly $20,000

- 2018-2019: Bear market, price dropped to around $3,000

- 2021: New all-time high of over $60,000

BTC Current Market Situation

As of September 9, 2025, Bitcoin (BTC) is trading at $112,969.1. The cryptocurrency has shown significant growth over the past year, with a 105.88% increase. In the last 24 hours, BTC has seen a modest gain of 0.93%, while its 7-day performance shows a 2.28% increase. However, there's a slight decline of 4.5% over the past 30 days.

Bitcoin's market capitalization stands at $2,250,152,424,530, maintaining its position as the largest cryptocurrency with a market dominance of 54.10%. The current circulating supply is 19,918,300 BTC, which is 94.85% of its maximum supply of 21,000,000 BTC.

The 24-hour trading volume for Bitcoin is $1,059,485,178.78, indicating strong market activity. BTC reached its all-time high of $124,128 on August 14, 2025, and its all-time low was $67.81 on July 6, 2013, showcasing its long-term growth potential.

Click to view the current BTC market price

BTC Market Sentiment Indicator

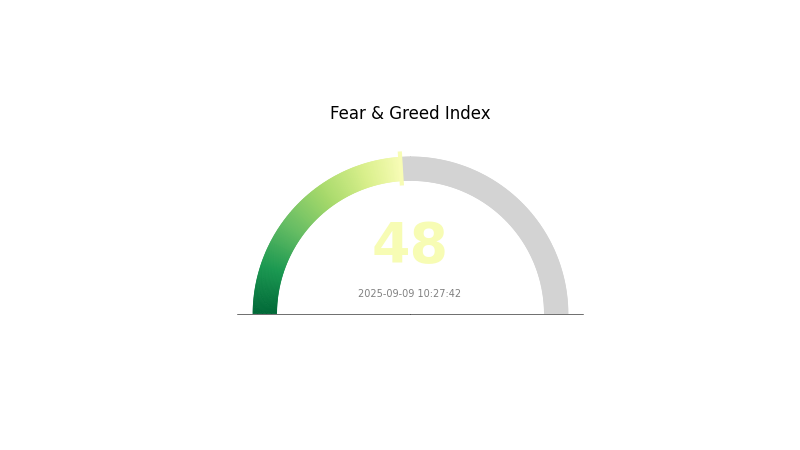

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 48, indicating a neutral stance. This suggests investors are neither overly fearful nor excessively greedy. Such equilibrium often precedes significant market movements. Traders should stay vigilant, as this neutral sentiment could quickly shift towards fear or greed based on emerging news or events. It's crucial to monitor key indicators and maintain a well-balanced portfolio during these uncertain times.

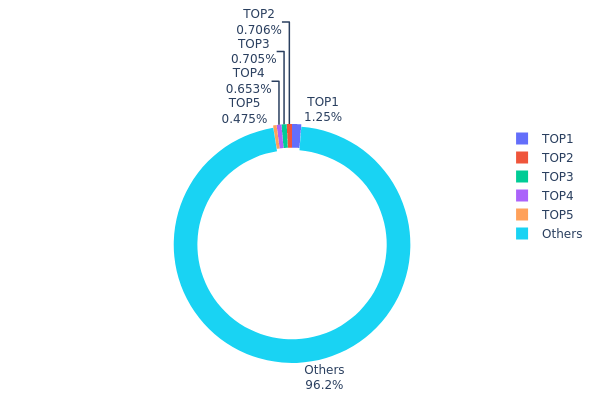

BTC Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of Bitcoin ownership. Analysis of the top 5 addresses reveals that they collectively hold 3.79% of the total BTC supply, with the largest address containing 1.25% of all bitcoins. This distribution indicates a relatively decentralized ownership structure, as the vast majority (96.21%) of BTC is spread across numerous other addresses.

Such a distribution pattern suggests a healthy level of decentralization in the Bitcoin network. The absence of extreme concentration among top holders reduces the risk of market manipulation by individual large stakeholders. However, it's worth noting that the top addresses still hold significant amounts, which could potentially impact market dynamics if large transactions occur.

The current distribution reflects a mature market structure with a diverse range of participants. This diversity contributes to the overall stability of the Bitcoin ecosystem, potentially reducing volatility and enhancing resistance to centralized control. The widespread distribution also aligns with Bitcoin's core principle of decentralization, indicating a robust on-chain structure that supports long-term sustainability and adoption.

Click to view the current BTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248.60K | 1.25% |

| 2 | bc1ql4...8859v2 | 140.57K | 0.71% |

| 3 | 3M219K...DjxRP6 | 140.40K | 0.70% |

| 4 | bc1qgd...jwvw97 | 130.01K | 0.65% |

| 5 | bc1qaz...uxwczt | 94.64K | 0.48% |

| - | Others | 19163.93K | 96.21% |

II. Key Factors Influencing Future BTC Price

Supply Mechanism

- Halving: Bitcoin's supply is programmed to decrease every four years, creating scarcity.

- Historical Pattern: Previous halvings have led to significant price increases in the following years.

- Current Impact: The next halving is expected to further reduce supply and potentially drive up prices.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are increasingly holding Bitcoin as a reserve asset.

- Corporate Adoption: Companies like MicroStrategy have added Bitcoin to their balance sheets.

- National Policies: Some countries, like El Salvador, have adopted Bitcoin as legal tender.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, affect Bitcoin's appeal as an alternative asset.

- Inflation Hedging Properties: Bitcoin is often viewed as a hedge against inflation in uncertain economic times.

- Geopolitical Factors: International tensions and economic instability can drive interest in Bitcoin as a safe haven.

Technical Development and Ecosystem Building

- Lightning Network: This Layer 2 solution aims to improve Bitcoin's transaction speed and scalability.

- Taproot Upgrade: Enhances privacy and smart contract functionality on the Bitcoin network.

- Ecosystem Applications: Growing DeFi applications on Bitcoin, including lending and yield platforms.

III. BTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $95,921 - $112,848

- Neutral prediction: $112,848 - $121,876

- Optimistic prediction: $121,876 - $130,000 (requires sustained institutional adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market continuation

- Price range forecast:

- 2027: $115,432 - $156,344

- 2028: $113,423 - $192,063

- Key catalysts: Halving event, increased mainstream adoption, regulatory clarity

2030 Long-term Outlook

- Base scenario: $212,842 - $250,000 (assuming continued adoption and technological advancements)

- Optimistic scenario: $250,000 - $312,878 (assuming widespread institutional integration and favorable regulations)

- Transformative scenario: $312,878 - $350,000 (assuming BTC becomes a global reserve asset)

- 2030-12-31: BTC $312,878 (potential peak of long-term bull cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 121876.81 | 112848.9 | 95921.57 | 0 |

| 2026 | 174870.66 | 117362.86 | 107973.83 | 3 |

| 2027 | 156344.93 | 146116.76 | 115432.24 | 29 |

| 2028 | 192063.17 | 151230.84 | 113423.13 | 33 |

| 2029 | 254037.57 | 171647.01 | 149332.9 | 51 |

| 2030 | 312878.16 | 212842.29 | 172402.25 | 88 |

IV. Professional BTC Investment Strategies and Risk Management

BTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors looking for long-term value appreciation

- Operation suggestions:

- Dollar-cost averaging (DCA) to reduce timing risk

- Hold for at least 4-5 years to ride out market cycles

- Store BTC in a secure hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

BTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5%

- Moderate investors: 5-10%

- Aggressive investors: 10-20%

(2) Risk Hedging Solutions

- Options strategies: Use put options to protect against downside risk

- Diversification: Allocate across different crypto assets and traditional investments

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Use two-factor authentication, backup seeds securely

V. Potential Risks and Challenges for BTC

BTC Market Risks

- Volatility: Extreme price fluctuations can lead to significant losses

- Liquidity risk: Large trades can impact market price in times of low liquidity

- Market manipulation: Potential for whale activity to influence prices

BTC Regulatory Risks

- Government crackdowns: Potential for bans or severe restrictions in some jurisdictions

- Tax implications: Evolving tax laws may impact profitability

- AML/KYC requirements: Stricter regulations may affect privacy and ease of use

BTC Technical Risks

- 51% attack: Theoretical risk of network takeover, though increasingly unlikely

- Quantum computing threat: Future advancements could potentially break cryptography

- Scaling issues: Network congestion during high activity periods

VI. Conclusion and Action Recommendations

BTC Investment Value Assessment

Bitcoin remains the leading cryptocurrency with strong long-term value proposition due to its scarcity and network effects. However, short-term volatility and regulatory uncertainties pose significant risks.

BTC Investment Recommendations

✅ Beginners: Start with small, regular investments using DCA strategy

✅ Experienced investors: Consider a core holding with tactical trading around market cycles

✅ Institutional investors: Explore Bitcoin as a portfolio diversifier and inflation hedge

BTC Trading Participation Methods

- Spot trading: Direct purchase and holding of BTC

- Futures contracts: Leveraged exposure to BTC price movements

- Bitcoin ETFs: Regulated investment vehicles for traditional market exposure

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 Bitcoin be worth in 2025?

Based on current projections, 1 Bitcoin is expected to be worth between $125,000 and $200,000 in 2025, driven by ETF inflows and increased institutional adoption.

What will Bitcoin be worth in 2030?

Bitcoin is projected to reach over $500,000 by 2030, with some forecasts predicting it could exceed $1 million, based on global adoption trends.

How high can Bitcoin realistically go?

Bitcoin could potentially reach $200,000 in the current bull run, with some experts predicting it may hit $1 million long-term. Its future price depends on market conditions and investor sentiment.

Can Bitcoin reach $1 million?

While possible, it's unlikely without massive global adoption. It would require 20-40% of the world's population to adopt Bitcoin, which is not feasible in current market conditions.

Share

Content