2025 BMEX Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: BMEX's Market Position and Investment Value

BitMEX Token (BMEX) serves as the native utility token of the BitMEX ecosystem, fueling growth and providing users with exclusive benefits since its launch in 2022. As of December 2025, BMEX has established itself as a key component within the derivatives trading ecosystem, with a market capitalization of approximately $10.02 million and a circulating supply of roughly 99.75 million tokens, currently trading at $0.1005 per unit. This token ecosystem offers users distinctive advantages including trading fee discounts, enhanced staking rewards, and exclusive privileges across the crypto trading landscape.

This article will comprehensively analyze BMEX's price trajectory and market dynamics, combining historical patterns, supply-demand fundamentals, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies for informed decision-making in the cryptocurrency market.

BitMEX Token (BMEX) Market Analysis Report

I. BMEX Price History Review and Current Market Status

BMEX Historical Price Evolution

- April 2023: BMEX reached its all-time high (ATH) of $0.6, marking the peak valuation period for the token since its launch.

- November 2024: BMEX declined to its all-time low (ATL) of $0.0901, representing a significant correction from historical peaks.

- December 2025: BMEX is currently trading at $0.1005, down 28.11% over the past year, reflecting sustained downward pressure in the market.

BMEX Current Market Stance

As of December 22, 2025, BMEX is trading at $0.1005 with a 24-hour trading volume of $14,571.46. The token has experienced:

- Short-term decline: Down 0.4% in the last hour and 1.37% over the past 24 hours

- Medium-term weakness: Lost 8.3% over the past 7 days and 26.86% over the past 30 days

- Market capitalization: Currently valued at approximately $10.02 million based on circulating supply, with a fully diluted valuation of $45.23 million

- Circulating supply: 99.75 million BMEX tokens out of a maximum supply of 450 million, representing 22.17% circulation ratio

- Market position: Ranked 1,171st by market capitalization with a market dominance of 0.0014%

- Price range: Trading between $0.1 (24-hour low) and $0.1019 (24-hour high)

- Holder base: 580 active token holders

- Trading availability: Listed on 2 exchanges

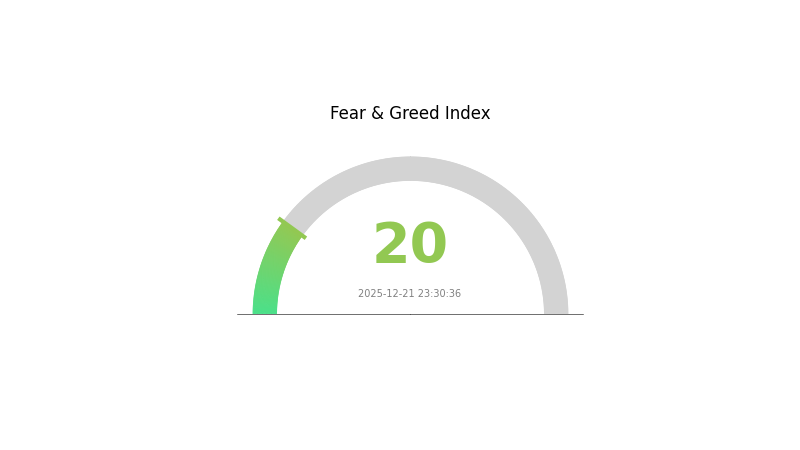

The token's market performance reflects broader cryptocurrency market conditions, with current market sentiment indicating extreme fear (VIX level: 20 as of December 21, 2025).

Click to view current BMEX market price

BMEX Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the index hitting 20, indicating significant market pessimism. This level typically reflects heightened investor anxiety and risk aversion across digital assets. When fear reaches such extremes, it often presents contrarian opportunities for long-term investors, as panic selling can create attractive entry points. However, traders should exercise caution and conduct thorough analysis before making investment decisions. Monitor key support levels and market developments closely during this period of heightened uncertainty.

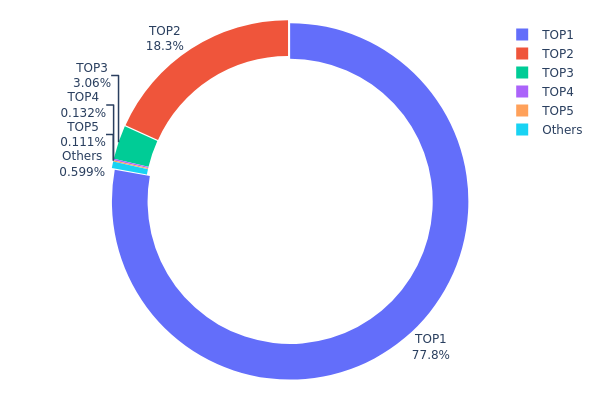

BMEX Holdings Distribution

The address holdings distribution chart illustrates the concentration of BMEX tokens across different wallet addresses on the blockchain, serving as a critical metric for assessing token centralization and market structure stability. By analyzing the top holders and their respective token quantities, investors can evaluate the degree of decentralization and potential risks associated with large-scale token concentration.

Current data reveals a highly concentrated distribution pattern within the BMEX ecosystem. The top address commands approximately 77.83% of total holdings with 350.25 million tokens, while the second-largest holder maintains 18.26% of the supply. These two addresses collectively control over 96% of all BMEX tokens in circulation, indicating substantial concentration risk. The third address, which appears to be a burn wallet (0x0000...00dead), holds 3.05% of tokens that have been permanently removed from circulation. The remaining addresses demonstrate minimal individual influence, with the fourth-largest holder controlling merely 0.13% of the total supply.

This extreme concentration pattern presents notable implications for market dynamics and structural integrity. The overwhelming dominance of the top two addresses creates significant centralization, which could potentially enable coordinated market activities and elevated volatility risk. However, the presence of a substantial burn wallet (3.05%) indicates intentional token reduction mechanisms, which may provide some counterbalance to inflationary pressures. The fragmented distribution of remaining tokens across numerous smaller wallets suggests limited retail participation relative to institutional concentration. This structure underscores a market characterized by heavy dependence on a limited number of key stakeholders, warranting careful monitoring of their strategic decisions and transaction patterns.

Click to view current BMEX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x65a3...d28232 | 350250.00K | 77.83% |

| 2 | 0xeea8...4c4294 | 82205.83K | 18.26% |

| 3 | 0x0000...00dead | 13754.53K | 3.05% |

| 4 | 0xeea9...cd5966 | 592.37K | 0.13% |

| 5 | 0xb6a7...400fe9 | 500.01K | 0.11% |

| - | Others | 2697.26K | 0.62% |

II. Core Factors Affecting BMEX's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Macroeconomic uncertainty remains a significant variable influencing cryptocurrency market trends. As the global monetary environment enters a new phase, traditional interest rate cycles and central bank policies, particularly those of major institutions like the Federal Reserve, play crucial roles in determining price movements.

-

Market Sentiment and Trading Volume: Short-term price movements are primarily driven by market sentiment and trading volume, functioning like a voting mechanism. Investors must monitor market dynamics and policy changes to make informed decisions, as market momentum significantly influences near-term price performance.

-

Long-term Fundamentals: While short-term prices are sentiment-driven, long-term valuations ultimately revert to fundamental factors. Macroeconomic conditions and enterprise fundamentals become increasingly important over extended periods, requiring investors to shift focus from short-term noise to long-term value assessment.

Three、2025-2030 BMEX Price Forecast

2025 Outlook

- Conservative Forecast: $0.06935 - $0.09493

- Neutral Forecast: $0.09493 - $0.12864

- Optimistic Forecast: $0.12864 (requires sustained market momentum and positive regulatory developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual accumulation, transitioning towards sustainable growth as market fundamentals strengthen

- Price Range Forecast:

- 2026: $0.05843 - $0.16498

- 2027: $0.07129 - $0.14816

- 2028: $0.12957 - $0.1814

- Key Catalysts: Institutional adoption expansion, ecosystem development advancement, macroeconomic policy shifts, and increased liquidity on platforms such as Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.08622 - $0.2245 (assumes steady technological progress and moderate market adoption)

- Optimistic Scenario: $0.16268 - $0.26135 (assumes accelerated mainstream adoption and significant network effects)

- Transformative Scenario: $0.26135+ (extreme favorable conditions including breakthrough technological achievements, comprehensive institutional integration, and paradigm shifts in digital asset valuation frameworks)

- 2030-12-22: BMEX at $0.26135 (representing 92% cumulative appreciation from baseline, reflecting substantial long-term value recognition)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.12864 | 0.1005 | 0.06935 | 0 |

| 2026 | 0.16498 | 0.11457 | 0.05843 | 14 |

| 2027 | 0.14816 | 0.13978 | 0.07129 | 39 |

| 2028 | 0.1814 | 0.14397 | 0.12957 | 43 |

| 2029 | 0.2245 | 0.16268 | 0.08622 | 61 |

| 2030 | 0.26135 | 0.19359 | 0.12196 | 92 |

BitMEX Token (BMEX) Professional Investment Analysis Report

IV. BMEX Professional Investment Strategy and Risk Management

BMEX Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Institutional traders and professional cryptocurrency investors seeking exposure to BitMEX ecosystem benefits

- Operational Recommendations:

- Accumulate BMEX tokens during market downturns to benefit from fee discounts and staking rewards within the BitMEX ecosystem

- Hold tokens to participate in exclusive privileges and governance opportunities as the BitMEX ecosystem matures

- Reinvest staking yields to compound returns over extended time horizons

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor 24-hour volatility patterns: BMEX currently trades at $0.1005 with 24-hour trading volume of $14,571.46

- Track resistance levels near the all-time high of $0.60 (April 2023) and support levels near the all-time low of $0.0901 (November 2024)

- Trading Entry Points:

- Consider accumulating near support levels established during market corrections

- Take partial profits when price approaches previous resistance levels

BMEX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio

- Active Investors: 3-7% of portfolio

- Professional Traders: 7-15% of portfolio

(2) Risk Mitigation Strategies

- Portfolio Diversification: Allocate BMEX as a small percentage of a diversified cryptocurrency portfolio to limit downside exposure

- Dollar-Cost Averaging: Enter positions gradually over multiple months to reduce timing risk, particularly given the token's 28.11% decline over the past year

(3) Secure Storage Solutions

- Hot Wallet Options: Use Gate.com Web3 Wallet for active trading and staking participation within the BitMEX ecosystem

- Cold Storage Methods: Transfer long-term holdings to secure offline storage to mitigate hacking and exchange risks

- Security Best Practices: Enable two-factor authentication, use hardware security keys, and never share private keys or seed phrases

V. BMEX Potential Risks and Challenges

BMEX Market Risk

- Price Volatility: BMEX has experienced significant declines, losing 28.11% over the past year and 26.86% in the past month, indicating high price instability

- Low Market Liquidity: With only 580 token holders and $14,571 in 24-hour volume, the token faces limited trading liquidity and potential slippage on large orders

- Market Concentration Risk: The relatively low market capitalization of $10.02 million makes the token susceptible to manipulation and sharp price movements from institutional transactions

BMEX Regulatory Risk

- Exchange Regulatory Uncertainty: As BitMEX operates in the derivatives trading space, changes to global regulatory frameworks could impact the platform's operations and BMEX token utility

- Jurisdictional Restrictions: Trading restrictions in certain jurisdictions may limit BMEX adoption and reduce the token's long-term value proposition

BMEX Technology Risk

- Smart Contract Risk: As an Ethereum-based token, BMEX is subject to smart contract vulnerabilities and network-level technical issues

- Ecosystem Development Risk: The token's value depends on BitMEX's ability to successfully develop and expand its ecosystem offerings and maintain user engagement

VI. Conclusion and Action Recommendations

BMEX Investment Value Assessment

BMEX functions as a utility token designed to provide fee discounts, enhanced staking yields, and exclusive privileges within the BitMEX ecosystem. However, the token has experienced substantial price depreciation (28.11% annually) and operates in a highly illiquid market with only 580 holders. The token's value proposition remains heavily dependent on BitMEX platform growth and cryptocurrency market conditions. While long-term ecosystem development could create future value, current market conditions present elevated risk relative to potential rewards.

BMEX Investment Recommendations

✅ Beginners: Start with minimal allocations (1% or less) focused on understanding BitMEX ecosystem utilities; consider this a high-risk educational investment rather than a core portfolio holding

✅ Experienced Investors: Implement dollar-cost averaging strategies during market downturns; use BMEX primarily as a satellite position for accessing BitMEX-specific benefits rather than as a standalone investment thesis

✅ Institutional Investors: Conduct comprehensive due diligence on BitMEX's regulatory compliance and market position before allocation; consider BMEX exposure only as part of diversified cryptocurrency derivative platform strategies

BMEX Trading Participation Methods

- Gate.com Exchange: Trade BMEX directly through Gate.com's spot trading platform for efficient order execution and competitive pricing

- Staking Programs: Participate in BitMEX ecosystem staking to earn yield on BMEX holdings through designated reward mechanisms

- Ecosystem Integration: Hold BMEX to unlock fee discounts and exclusive privileges when trading on BitMEX derivatives platform

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for BMX in 2030?

Based on current market trends, BMX is predicted to reach approximately $1.95 by 2030, assuming a 5% annual price change. However, actual price movements will depend on market conditions and project development.

What factors influence BMEX price movements?

BMEX price movements are influenced by market demand, trading volume, regulatory developments, cryptocurrency market trends, and official announcements from the platform.

How does BMEX compare to other similar blockchain projects in terms of value potential?

BMEX features limited supply and strong exchange utility, positioning it competitively within the derivatives ecosystem. Its value potential is driven by ecosystem adoption and trading volume growth, offering distinct advantages compared to broader blockchain projects.

What is the current market cap and trading volume of BMEX?

As of 2025-12-21, BMEX has a market cap of $11.37 million and a 24-hour trading amount of $44,870. The current price stands at $0.11.

2025 BMEX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

What Does “Liquidated” Actually Mean?

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

2025 LUNC Price Prediction: Will Terra Luna Classic Reach $1 After Recent Market Recovery?

Crypto Assets Pump Club: Risks Every Trader Should Know

Is Perpetual Protocol (PERP) a Good Investment?: A Comprehensive Analysis of Its Long-term Potential in the DeFi Derivatives Market

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange