2025 BCH Price Prediction: Will Bitcoin Cash Reach $1,000 Amid Growing Adoption?

Introduction: BCH's Market Position and Investment Value

Bitcoin Cash (BCH), as a leading cryptocurrency focused on fast, low-cost transactions, has achieved significant milestones since its inception in 2017. As of 2025, BCH's market capitalization has reached $9.89 billion, with a circulating supply of approximately 19,952,787 coins, and a price hovering around $495.5. This asset, often referred to as "digital cash," is playing an increasingly crucial role in facilitating peer-to-peer electronic payments and promoting financial inclusion.

This article will provide a comprehensive analysis of BCH's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. BCH Price History Review and Current Market Status

BCH Historical Price Evolution

- 2017: BCH hard forked from Bitcoin, initial price of $555.89

- 2017: Reached all-time high of $3,785.82 on December 20

- 2018: Market downturn, price dropped to all-time low of $76.93 on December 16

BCH Current Market Situation

As of November 14, 2025, Bitcoin Cash (BCH) is trading at $495.5, ranking 17th in the cryptocurrency market. The 24-hour trading volume stands at $7,584,732.48, with a market capitalization of $9,886,606,155. BCH has experienced a 6.06% decrease in the last 24 hours, but shows a 1.87% increase over the past week. The current price represents a 86.91% decrease from its all-time high and a 544.08% increase from its all-time low. With a circulating supply of 19,952,787 BCH, the asset has a maximum supply cap of 21,000,000 coins.

Click to view current BCH market price

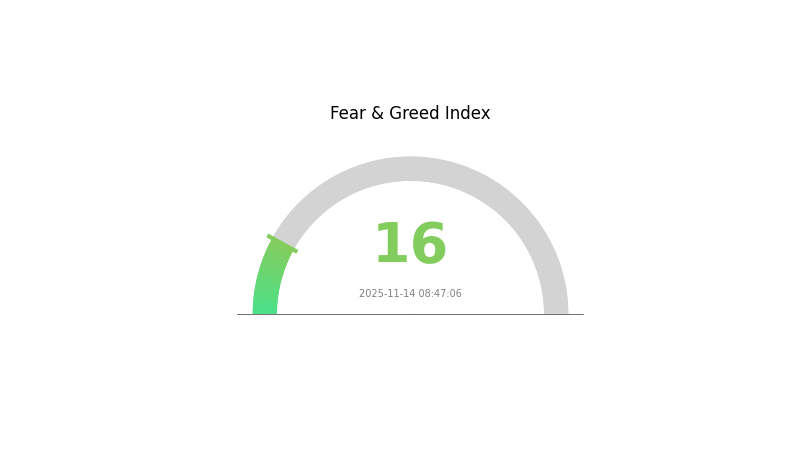

BCH Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 16. This low reading suggests investors are highly cautious and pessimistic about BCH's short-term prospects. Such extreme fear often precedes potential buying opportunities, as assets may be undervalued. However, traders should exercise caution and conduct thorough research before making any decisions. Remember, market sentiment can shift rapidly, and it's crucial to stay informed about broader market trends and fundamental factors affecting BCH.

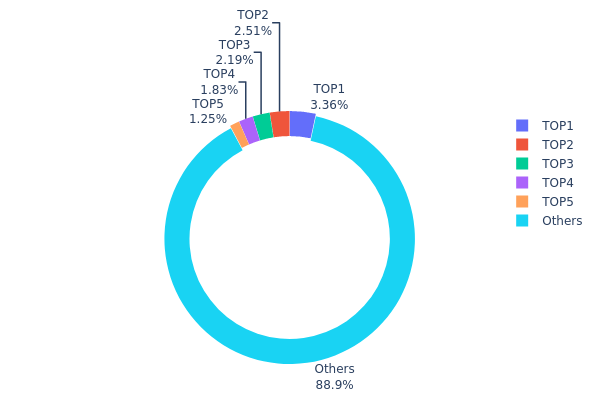

BCH Holdings Distribution

The address holdings distribution for Bitcoin Cash (BCH) provides valuable insights into the current state of token concentration and market structure. Analyzing the top 5 addresses, we observe that the largest holder possesses 3.35% of the total supply, with the subsequent four addresses holding between 1.24% and 2.50% each. Collectively, these top 5 addresses control approximately 11.11% of the BCH supply, while the remaining 88.89% is distributed among other addresses.

This distribution pattern suggests a relatively decentralized ownership structure for BCH. The absence of any single address holding a dominant share (e.g., >10%) indicates a reduced risk of market manipulation by individual large holders. However, the cumulative holdings of the top addresses still represent a significant portion that could potentially impact market dynamics if coordinated actions were to occur.

The current address distribution reflects a balanced ecosystem, which is generally positive for BCH's long-term stability and resistance to centralized control. This level of decentralization may contribute to more organic price movements and potentially lower volatility, as no single entity appears to have disproportionate influence over the market.

Click to view the current BCH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | qrmfke...wse7ve | 669.54K | 3.35% |

| 2 | qrwcmu...e0z839 | 500.55K | 2.50% |

| 3 | qre24q...28z85p | 436.97K | 2.19% |

| 4 | qqwj7g...yyk82r | 365.99K | 1.83% |

| 5 | qpz8uc...mwzsl9 | 248.95K | 1.24% |

| - | Others | 17730.64K | 88.89% |

II. Key Factors Affecting BCH's Future Price

Supply Mechanism

- Block Reward Halving: Bitcoin Cash follows a halving schedule similar to Bitcoin, where the block reward is reduced by half approximately every four years.

- Historical Pattern: Previous halvings have generally led to increased scarcity and potential price appreciation in the long term.

- Current Impact: The next halving is expected to further reduce the rate of new BCH entering circulation, potentially supporting price growth if demand remains stable or increases.

Institutional and Whale Dynamics

- Enterprise Adoption: Some businesses have started accepting BCH as a payment method, contributing to its real-world utility.

Macroeconomic Environment

- Inflation Hedging Properties: BCH, like other cryptocurrencies, is sometimes viewed as a potential hedge against inflation, though its effectiveness in this role is still debated.

Technical Development and Ecosystem Building

- Scalability Improvements: BCH continues to focus on on-chain scaling solutions to improve transaction capacity and reduce fees.

- Ecosystem Applications: The BCH ecosystem includes various DApps and projects aimed at enhancing its utility and adoption in areas such as decentralized finance and digital payments.

III. BCH Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $252.53 - $400

- Neutral forecast: $400 - $500

- Optimistic forecast: $500 - $599.13 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $519.98 - $689.12

- 2028: $394.68 - $841.98

- Key catalysts: Technological advancements, wider acceptance of cryptocurrencies, and potential regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $749.89 - $881.12 (assuming steady market growth and adoption)

- Optimistic scenario: $881.12 - $1012.35 (assuming favorable market conditions and increased utility)

- Transformative scenario: $1012.35 - $1312.87 (assuming major breakthroughs in blockchain technology and widespread institutional adoption)

- 2030-12-31: BCH $881.12 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 599.13 | 495.15 | 252.53 | 0 |

| 2026 | 705.81 | 547.14 | 454.13 | 10 |

| 2027 | 689.12 | 626.48 | 519.98 | 26 |

| 2028 | 841.98 | 657.8 | 394.68 | 32 |

| 2029 | 1012.35 | 749.89 | 389.94 | 51 |

| 2030 | 1312.87 | 881.12 | 854.69 | 77 |

IV. BCH Professional Investment Strategies and Risk Management

BCH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational suggestions:

- Accumulate BCH during market dips

- Set price targets for partial profit-taking

- Use secure cold storage solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor BCH's correlation with Bitcoin price movements

- Pay attention to network upgrades and potential forks

BCH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, regularly update software

V. Potential Risks and Challenges for BCH

BCH Market Risks

- Price volatility: BCH price can experience significant fluctuations

- Competition: Increased competition from other cryptocurrencies and payment solutions

- Adoption challenges: Slower than expected merchant and user adoption

BCH Regulatory Risks

- Regulatory uncertainty: Potential for stricter regulations on cryptocurrencies

- Tax implications: Evolving tax laws related to cryptocurrency transactions

- Cross-border restrictions: Possible limitations on international BCH transfers

BCH Technical Risks

- Network security: Potential for 51% attacks or other security vulnerabilities

- Scaling challenges: Future scalability issues as transaction volume grows

- Development conflicts: Disagreements within the BCH community on future upgrades

VI. Conclusion and Action Recommendations

BCH Investment Value Assessment

BCH offers potential long-term value as a payment-focused cryptocurrency with a large community. However, it faces short-term risks from market volatility and regulatory uncertainties.

BCH Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider BCH as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate BCH's potential role in long-term blockchain strategy

BCH Trading Participation Methods

- Spot trading: Buy and sell BCH on Gate.com's spot market

- Derivatives: Utilize BCH futures or options for leveraged exposure

- Staking: Explore potential Staking opportunities if available on Gate.com

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will Bitcoin Cash be worth in 2025?

Based on current market trends and expert predictions, Bitcoin Cash (BCH) could potentially reach a value of $2,500 to $3,000 by 2025, driven by increased adoption and technological advancements.

Will Bitcoin Cash reach $1000?

Yes, Bitcoin Cash has the potential to reach $1000 by 2025. With increasing adoption and technological improvements, BCH could see significant price growth in the coming years.

What is the price prediction for BCH in 2030?

Based on current trends and market analysis, BCH could potentially reach $5,000 to $7,000 by 2030, driven by increased adoption and technological advancements.

Will BCH ever reach 100k?

While BCH reaching 100k is highly unlikely, it could potentially hit new highs in the long term with increased adoption and market growth.

Share

Content