2025 ATMPrice Prediction: Market Analysis and Future Trends for Automated Teller Machine Costs

Introduction: ATM's Market Position and Investment Value

Atletico Madrid Fan Token (ATM) has established itself as a prominent fan engagement token in the sports industry since its inception in 2020. As of 2025, ATM's market capitalization stands at $10,453,109, with a circulating supply of approximately 7,199,607 tokens and a price hovering around $1.4519. This asset, often referred to as a "fan governance token," is playing an increasingly crucial role in sports fan engagement and club decision-making processes.

This article will comprehensively analyze ATM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. ATM Price History Review and Current Market Status

ATM Historical Price Evolution

- 2020: ATM launched in December, initial price at $20.88

- 2021: Reached all-time high of $58.46 on May 16

- 2025: Hit all-time low of $0.935011 on June 23

ATM Current Market Situation

As of October 8, 2025, ATM is trading at $1.4519. The token has experienced a 3.93% decrease in the last 24 hours, with a trading volume of $49,642.97. ATM's market cap currently stands at $10,453,109, ranking it 1392nd in the crypto market.

The token has shown mixed performance across different timeframes. While it has gained 0.22% in the past hour and 15.54% over the last 30 days, it has declined by 6.17% in the past week and 35.86% over the past year. The current price represents a significant drop from its all-time high, but a recovery from its recent all-time low in June.

With a circulating supply of 7,199,607 ATM out of a total supply of 10,000,000, the token has a circulation ratio of 71.99%. The fully diluted market cap is $14,519,000.

Click to view the current ATM market price

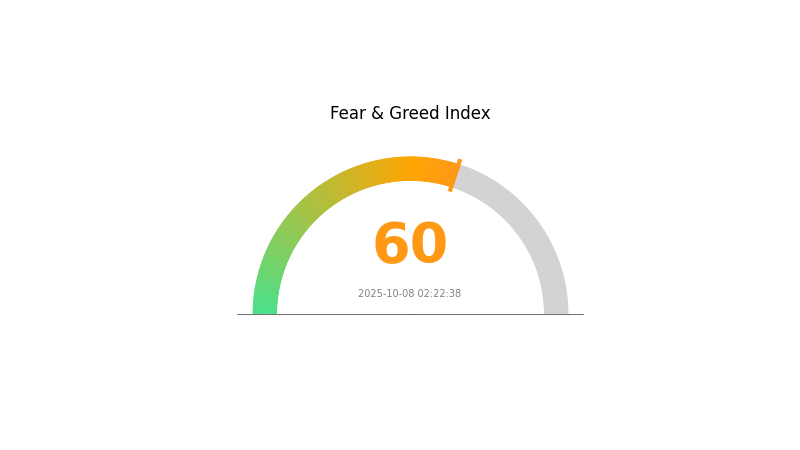

ATM Market Sentiment Indicator

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index at 60. This indicates growing optimism among investors, potentially driven by recent price rallies or positive news. However, it's crucial to remain cautious as excessive greed can lead to overvaluation and increased volatility. Traders should consider diversifying their portfolios and setting stop-loss orders to protect against sudden market shifts. As always, conduct thorough research and manage your risk wisely in this dynamic market environment.

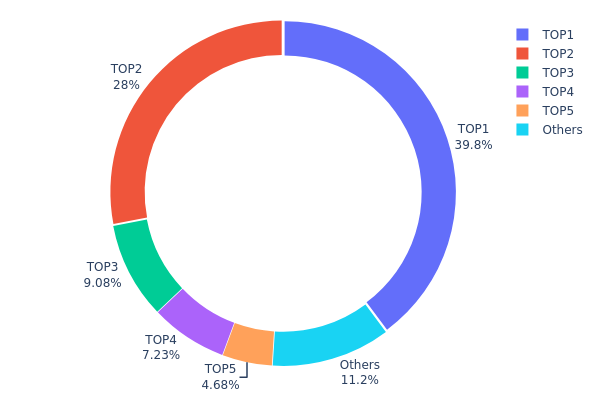

ATM Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of ATM tokens among various addresses. Analysis of this data reveals a highly concentrated ownership structure, with the top five addresses controlling 88.8% of the total supply. The largest holder possesses 39.80% of ATM tokens, followed by the second-largest with 28.00%, indicating significant centralization.

This level of concentration raises concerns about market stability and potential price manipulation. With nearly 68% of tokens held by just two addresses, there's a risk of large-scale sell-offs or coordinated actions that could dramatically impact ATM's price. Furthermore, the high concentration suggests limited decentralization, which may conflict with the principles of distributed blockchain networks.

The current distribution pattern implies a relatively immature market structure for ATM, with potential barriers to wider adoption and liquidity. While this concentration could provide short-term price stability, it also poses long-term risks to the token's ecosystem health and market dynamics. Investors and stakeholders should monitor these top holders' activities closely, as their actions could significantly influence ATM's future trajectory.

Click to view the current ATM holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xF977...41aceC | 3979.87K | 39.80% |

| 2 | 0x6F45...41a33D | 2800.39K | 28.00% |

| 3 | 0x8791...988062 | 908.33K | 9.08% |

| 4 | 0x76eC...78Fbd3 | 723.50K | 7.24% |

| 5 | 0xc80A...e92416 | 467.67K | 4.68% |

| - | Others | 1120.23K | 11.2% |

II. Key Factors Affecting ATM's Future Price

Supply Mechanism

- Market Dynamics: The supply of ATMs is influenced by market demand and technological innovations.

- Historical Patterns: Past trends show that changes in ATM supply have impacted pricing structures.

- Current Impact: Current supply changes are expected to affect ATM pricing based on evolving market needs and technological advancements.

Institutional and Whale Movements

- Corporate Adoption: Some companies are exploring ATM technologies as part of their financial service offerings.

- National Policies: Regulatory changes in various countries are influencing the ATM market trends and future developments.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly regarding interest rates and inflation, may affect ATM usage and pricing.

- Inflation Hedging Properties: In inflationary environments, ATM fees and structures may be adjusted to maintain value.

- Geopolitical Factors: International situations can impact currency values and cross-border transactions, affecting ATM operations and pricing.

Technical Development and Ecosystem Building

- Fee Structure Innovation: Advancements in fee structures and pricing models are shaping the future of ATM services.

- Service Model Upgrades: New service offerings and technological integrations are influencing ATM functionality and user experience.

- Ecosystem Applications: The integration of ATMs with broader financial ecosystems and digital payment systems is driving market evolution.

III. ATM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.94 - $1.45

- Neutral prediction: $1.45 - $1.80

- Optimistic prediction: $1.80 - $2.15 (requires favorable market conditions)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $1.31 - $2.34

- 2027: $1.57 - $2.65

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $2.01 - $2.58 (assuming steady market growth)

- Optimistic scenario: $2.58 - $2.66 (with strong market performance)

- Transformative scenario: $2.66 - $3.00 (with breakthrough innovations and widespread adoption)

- 2030-12-31: ATM $2.58 (78% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.15 | 1.4527 | 0.94426 | 0 |

| 2026 | 2.34175 | 1.80135 | 1.31498 | 24 |

| 2027 | 2.65158 | 2.07155 | 1.57438 | 42 |

| 2028 | 2.43241 | 2.36157 | 1.48779 | 62 |

| 2029 | 2.78051 | 2.39699 | 1.77377 | 65 |

| 2030 | 2.66641 | 2.58875 | 2.01922 | 78 |

IV. Professional ATM Investment Strategies and Risk Management

ATM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Sports enthusiasts and long-term crypto investors

- Operational suggestions:

- Accumulate ATM tokens during market dips

- Stay updated on Atletico Madrid's performance and fan engagement initiatives

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Track Atletico Madrid's match schedules and results

- Monitor fan voting events on the Socios platform

ATM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple fan tokens and cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ATM

ATM Market Risks

- Volatility: Fan token prices can be highly volatile

- Team performance: Poor performance of Atletico Madrid could negatively impact token value

- Fan engagement: Declining fan interest may reduce token utility

ATM Regulatory Risks

- Changing regulations: Potential for stricter regulations on fan tokens

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Unclear tax treatment of fan token transactions

ATM Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying technology

- Scalability issues: Limitations of the Chiliz Chain network

- Integration problems: Challenges in maintaining seamless integration with Socios platform

VI. Conclusion and Action Recommendations

ATM Investment Value Assessment

ATM offers unique exposure to the sports fan token market, with potential for growth tied to Atletico Madrid's success and fan engagement. However, investors should be aware of high volatility and regulatory uncertainties.

ATM Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about fan token dynamics ✅ Experienced investors: Consider ATM as part of a diversified crypto portfolio ✅ Institutional investors: Explore ATM for thematic investments in sports and entertainment tokens

ATM Participation Methods

- Direct purchase: Buy ATM tokens on Gate.com

- Fan engagement: Participate in Socios platform activities to earn rewards

- DCA strategy: Implement a dollar-cost averaging approach for long-term accumulation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for API3 in 2026?

Based on forecasts, API3 is expected to have a minimum price of $0.8567 and an average price of $0.935 per coin in 2026.

What crypto has the highest price prediction?

Bitcoin (BTC) is predicted to have the highest price in 2025. It remains a top choice for investors, showing a consistent upward trend.

How much is the ATM crypto coin?

As of 2025-10-08, the ATM crypto coin is priced at $0.0000000569, with no recent trading volume reported.

What is the price prediction for Ath crypto in 2030?

Based on market analysis, the price prediction for ATH in 2030 ranges from $0.066 to $0.114, with potential for higher growth.

Share

Content