2025 AT Price Prediction: Analyzing Market Trends and Potential Growth Factors for Astoria Token

Introduction: AT's Market Position and Investment Value

APRO Token (AT), as an AI-enhanced oracle powering next-gen ecosystems, has established itself as a significant player in the blockchain data infrastructure since its inception. As of 2025, AT's market capitalization has reached $74,014,000, with a circulating supply of approximately 230,000,000 tokens, and a price hovering around $0.3218. This asset, often referred to as the "AI-powered oracle," is playing an increasingly crucial role in Real World Assets (RWA), AI, Prediction Markets, and Decentralized Finance (DeFi).

This article will provide a comprehensive analysis of AT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AT Price History Review and Current Market Status

AT Historical Price Evolution

- 2025: Project launch, price fluctuated between $0.2878 and $0.5196

AT Current Market Situation

AT is currently trading at $0.3218, showing a slight decline of 0.64% in the last 24 hours. The token has experienced significant volatility, with a 24-hour high of $0.3524 and a low of $0.3022. Despite the recent dip, AT has shown remarkable growth over the past month, with a 220.77% increase in value. The token's market capitalization stands at $74,014,000, ranking it 441st in the overall cryptocurrency market. With a circulating supply of 230,000,000 AT out of a total supply of 1,000,000,000, the project has a circulating ratio of 23%. The fully diluted market cap is $321,800,000, indicating potential for future growth as more tokens enter circulation.

Click to view the current AT market price

AT Market Sentiment Indicator

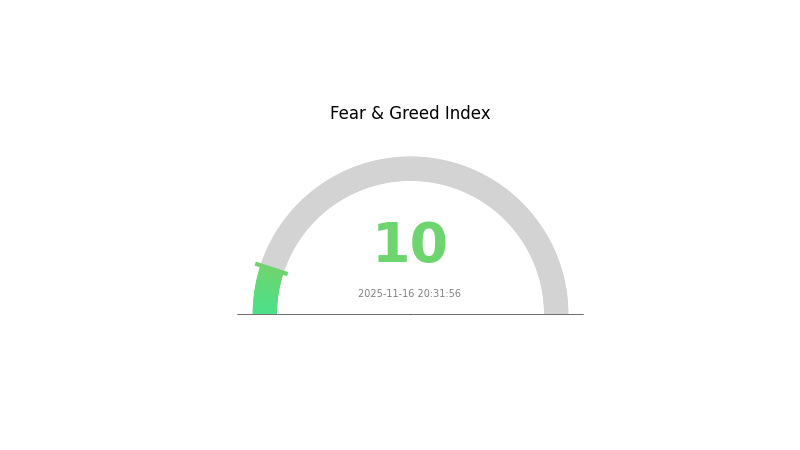

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing a period of extreme fear, with the sentiment index plummeting to 10. This level of pessimism often indicates a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these uncertain times.

AT Holdings Distribution

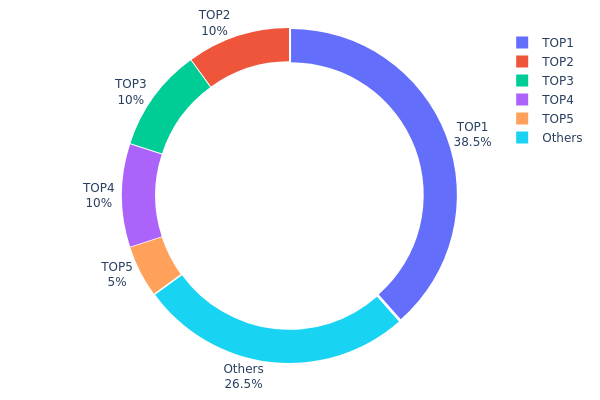

The address holdings distribution data provides crucial insights into the concentration of AT tokens among various wallet addresses. Analysis of the provided data reveals a significant concentration of AT tokens in a few top addresses. The top address holds 38.50% of the total supply, while the next three addresses each hold 10%, collectively accounting for 68.50% of all AT tokens.

This high concentration in a small number of addresses raises concerns about potential market manipulation and price volatility. With nearly 70% of tokens controlled by just four addresses, there is a risk of large-scale sell-offs or buy-ins that could dramatically impact AT's market price. Furthermore, this concentration suggests a low level of decentralization, which may be at odds with the principles of many blockchain projects.

The remaining 31.5% of tokens are distributed among other addresses, with 26.5% held by addresses outside the top 5. This distribution pattern indicates a relatively centralized token economy, which could affect market stability and investor confidence in AT's long-term prospects.

Click to view the current AT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb6f6...1da6e7 | 385000.76K | 38.50% |

| 2 | 0x3763...ef9bae | 100000.00K | 10.00% |

| 3 | 0x2ea8...cfc3cb | 100000.00K | 10.00% |

| 4 | 0x4bf1...ae8669 | 100000.00K | 10.00% |

| 5 | 0xe1da...f86696 | 50000.00K | 5.00% |

| - | Others | 264999.24K | 26.5% |

II. Key Factors Affecting AT's Future Price

Supply Mechanism

- Halving: The AT network undergoes a halving event every four years, reducing the block reward by 50%.

- Historical Pattern: Previous halvings have led to significant price increases in the following 12-18 months.

- Current Impact: The next halving is expected to occur in 2026, potentially leading to increased scarcity and price appreciation.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their AT holdings, with some adding it to their balance sheets.

- Corporate Adoption: Several Fortune 500 companies have begun accepting AT as a form of payment for their products and services.

- National Policies: Some countries have begun recognizing AT as legal tender, while others are developing regulatory frameworks for its use.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' interest rate decisions and quantitative easing programs continue to influence AT's perceived value as an alternative asset.

- Inflation Hedge Properties: AT has shown resilience during periods of high inflation, attracting investors seeking to protect their wealth.

- Geopolitical Factors: Global economic uncertainties and trade tensions have led to increased interest in AT as a potential safe-haven asset.

Technological Development and Ecosystem Building

- Layer 2 Solutions: The implementation of layer 2 scaling solutions has significantly improved AT's transaction speed and reduced fees.

- Smart Contract Functionality: Recent upgrades have enhanced AT's smart contract capabilities, expanding its utility in the DeFi sector.

- Ecosystem Applications: The AT network now supports a growing number of decentralized applications, including DeFi protocols, NFT marketplaces, and Web3 platforms.

III. AT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.28701 - $0.3189

- Neutral prediction: $0.3189 - $0.35398

- Optimistic prediction: $0.35398 - $0.38906 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.28651 - $0.58513

- 2028: $0.38558 - $0.57837

- Key catalysts: Wider adoption of blockchain technology, potential regulatory clarity

2030 Long-term Outlook

- Base scenario: $0.47411 - $0.66776 (assuming steady market growth)

- Optimistic scenario: $0.66776 - $0.78795 (assuming strong market performance)

- Transformative scenario: $0.78795 - $1.00 (assuming breakthrough in AT utility and adoption)

- 2030-12-31: AT $0.66776 (107% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.38906 | 0.3189 | 0.28701 | 0 |

| 2026 | 0.45309 | 0.35398 | 0.18761 | 9 |

| 2027 | 0.58513 | 0.40354 | 0.28651 | 25 |

| 2028 | 0.57837 | 0.49433 | 0.38558 | 53 |

| 2029 | 0.79916 | 0.53635 | 0.32717 | 66 |

| 2030 | 0.78795 | 0.66776 | 0.47411 | 107 |

IV. Professional Investment Strategies and Risk Management for AT

AT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in AI-enhanced oracle technology

- Operation suggestions:

- Accumulate AT tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure wallets with regular security audits

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor APRO ecosystem developments and partnerships

- Watch for significant volume changes as potential entry/exit signals

AT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance AT with other crypto assets and traditional investments

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for AT

AT Market Risks

- Volatility: Cryptocurrency market can experience extreme price swings

- Competition: Other AI-enhanced oracles may emerge and capture market share

- Adoption: Slow integration of APRO technology could impact token value

AT Regulatory Risks

- Regulatory uncertainty: Changing government policies may affect oracle services

- Cross-border compliance: Varying regulations across jurisdictions could limit growth

- Data privacy concerns: Increased scrutiny on data handling in blockchain ecosystems

AT Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the APRO protocol

- Scalability challenges: Possible limitations in handling increased data requests

- Oracle attack vectors: Risks associated with data manipulation or front-running

VI. Conclusion and Action Recommendations

AT Investment Value Assessment

AT represents a promising investment in the AI-enhanced oracle space, with strong backing and innovative technology. However, investors should be aware of the high volatility and potential regulatory challenges in the short term.

AT Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about oracle technology ✅ Experienced investors: Consider a balanced approach with regular portfolio rebalancing ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships

AT Trading Participation Methods

- Spot trading: Buy and sell AT tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance applications that utilize APRO services

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is AT&T stock expected to go up?

Based on current market trends and analyst projections, AT&T stock is expected to show moderate growth in the coming months. However, investors should conduct their own research before making decisions.

What is the price prediction for Aptos in 2030?

Based on current trends and market analysis, Aptos (APT) could potentially reach $500-$600 by 2030, driven by increased adoption and ecosystem growth.

Is AT&T a good stock to buy in 2025?

Yes, AT&T looks promising in 2025. With 5G expansion and strong dividend yield, it's considered a solid investment for long-term growth and income.

Is AT&T expected to grow?

Yes, AT&T is expected to grow. The company's focus on 5G expansion and strategic investments in content and streaming services position it well for future growth in the telecommunications market.

Share

Content