2025 ASR Fiyat Tahmini: Otomatik Konuşma Tanıma Sektöründe Piyasa Trendleri, Teknolojik İlerlemeler ve Yatırım Olanaklarının Analizi

Giriş: ASR'nin Piyasa Konumu ve Yatırım Potansiyeli

AS Roma Fan Token (ASR), AS Roma futbol kulübü için 2020 yılında hayata geçen taraftar etkileşim token'ı olarak spor ve eğlence sektöründe öne çıkmaktadır. 2025 itibarıyla ASR'nin piyasa değeri 18.162.919 $'a ulaşmış, dolaşımdaki arzı yaklaşık 7.914.126 token, fiyatı ise 2,295 $ civarında seyretmektedir. "Taraftarlar ile kulüpler arasında köprü" olarak tanımlanan bu varlık, taraftar katılımı ve kulüp yönetiminde giderek daha stratejik bir rol üstlenmektedir.

Makale kapsamında, ASR'nin 2025-2030 dönemindeki fiyat hareketleri; geçmiş piyasa verileri, arz-talep dengesi, ekosistem büyümesi ve makroekonomik faktörler ışığında detaylı biçimde analiz edilecek, profesyonel fiyat öngörüleri ve yatırımcılar için uygulamalı yatırım stratejileri aktarılacaktır.

I. ASR Fiyat Geçmişi ve Güncel Piyasa Durumu

ASR Tarihsel Fiyat Gelişimi

- 2020: ASR Aralık ayında piyasaya sürüldü, ilk işlem fiyatı yaklaşık 20,18 $

- 2020: 29 Aralık'ta tüm zamanların en yüksek seviyesi olan 26,64 $'a ulaştı

- 2025: 7 Nisan'da tüm zamanların en düşük seviyesi olan 0,965551 $ kaydedildi

ASR Güncel Piyasa Görünümü

06 Ekim 2025 itibarıyla ASR'nin fiyatı 2,295 $ seviyesindedir. Token, farklı dönemlerde dalgalı bir performans sergilemiştir. Son 24 saatte ASR, %0,21 düşerken işlem hacmi 36.291,74 $ olarak gerçekleşmiştir. Mevcut fiyat, Nisan 2025'teki dip seviyeden önemli bir toparlanmayı gösterse de Aralık 2020'deki zirvenin oldukça altındadır.

Son bir haftada ASR, %2,05 artışla pozitif bir momentum yakalamıştır. Ancak 30 günlük süreçte %4,14 düşüş gözlenmiş, kısa vadede volatilite olduğunu göstermiştir. Bir yıllık performans ise %12,67 artışla uzun vadede olumlu bir büyüme eğilimi işaret etmektedir.

ASR'nin piyasa değeri 18.162.919 $ olup, kripto para sıralamasında 1.149. sıradadır. 9.995.000 toplam arzın 7.914.126'sı dolaşımdadır ve dolaşım oranı yaklaşık %79,18'dir.

Güncel ASR piyasa fiyatını görüntüleyin

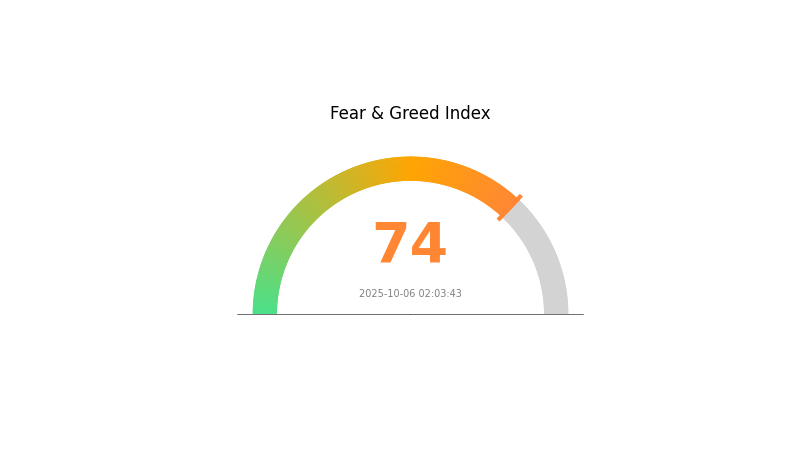

ASR Piyasa Duyarlılık Endeksi

2025-10-06 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında açgözlülük hakim, Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu yüksek skor, yatırımcıların aşırı iyimserliğe kapıldığını ve fiyatların sürdürülemez seviyelere çıkabileceğini gösteriyor. Olumlu hava yükselişi destekleyebilir ancak temkinli yaklaşmak gerekir. Tarihsel olarak aşırı açgözlülük dönemleri genellikle piyasa düzeltmelerini tetiklemiştir. Yatırımcılar kar almayı veya pozisyonlarını hedge etmeyi değerlendirmeli; çeşitlendirme ve risk yönetimi dalgalı piyasa koşullarında kritik önemdedir.

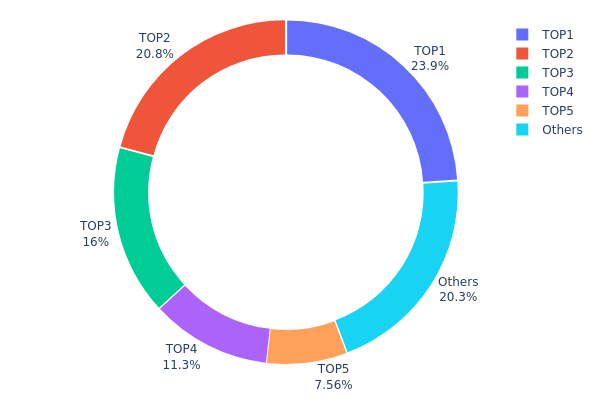

ASR Varlık Dağılımı

ASR'nin adres bazlı varlık dağılımı, sahipliğin yoğun şekilde merkezileştiğini göstermektedir. En büyük 5 adres toplam arzın %79,68'ini elinde tutarken, en büyük adres %23,94 paya sahiptir. Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı risklerini artırmaktadır.

Böyle bir dağılım, ASR'nin piyasada merkeziyetinin oldukça yüksek olduğunu gösterir. En büyük sahipler, token'ın dolaşımdaki arzı ve fiyat hareketleri üzerinde belirleyici rol oynar. Özellikle büyük sahiplerin hareketleri, fiyat volatilitesini ciddi biçimde etkileyebilir.

Piyasa yapısı açısından bu tablo, ASR'nin merkeziyetsizliğinin düşük olduğunu gösterir. Kısa vadede istikrar sağlayabilirken, uzun vadede ekosistemin sürdürülebilirliği ve adil işleyişi için riskler barındırmaktadır. Yatırımcılar, portföylerine ASR eklerken bu sahiplik dinamiklerini dikkate almalıdır.

Güncel ASR Varlık Dağılımını görüntüleyin

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xF977...41aceC | 2.392,99K | 23,94% |

| 2 | 0x6F45...41a33D | 2.080,87K | 20,82% |

| 3 | 0x76eC...78Fbd3 | 1.601,44K | 16,02% |

| 4 | 0x5bdf...03F7Ef | 1.133,88K | 11,34% |

| 5 | 0x8791...988062 | 756,08K | 7,56% |

| - | Diğerleri | 2.029,73K | 20,32% |

II. ASR'nin Gelecekteki Fiyatını Etkileyecek Ana Faktörler

Arz Mekanizması

- Piyasa Arz ve Talep: ASR'nin fiyatı esas olarak arz-talep ilişkisiyle şekillenir.

- Kısa Vadeli Etki: Kripto para piyasasında arz ve talep dinamikleri kısa vadeli fiyat hareketlerinde belirleyicidir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Katılım: AS Roma Futbol Kulübü'nün performansı ve girişimleri, token'ın kulüp ekosistemine doğrudan bağlı olması nedeniyle ASR'nin değerini etkiler.

Makroekonomik Faktörler

- Jeopolitik Etkenler: Uluslararası gelişmeler ve küresel ekonomik koşullar, ASR dahil olmak üzere genel kripto para piyasasını etkileyebilir.

Teknik Gelişim ve Ekosistem Büyümesi

- Platform Geliştirme: ASR'yi destekleyen taraftar token platformunun sürekli gelişimi ve genişlemesi, fiyat üzerinde etkilidir.

- Ekosistem Uygulamaları: AS Roma fan token ekosisteminde uygulama ve kullanım alanlarının büyümesi, ASR talebini artırabilir.

III. 2025-2030 ASR Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 1,93 - 2,30 $

- Nötr tahmin: 2,30 - 2,60 $

- İyimser tahmin: 2,60 - 2,85 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Beklentisi

- Piyasa aşaması: Volatilitenin arttığı büyüme fazı olasılığı

- Fiyat aralığı:

- 2027: 1,61 - 4,24 $

- 2028: 2,03 - 4,45 $

- Kilit tetikleyiciler: Kripto piyasası genel trendleri, proje gelişmeleri ve benimseme oranları

2030 Uzun Vadeli Beklenti

- Temel senaryo: 4,20 - 4,73 $ (istikrarlı piyasa büyümesi)

- İyimser senaryo: 4,73 - 5,63 $ (güçlü proje performansı ve piyasa koşulları)

- Dönüştürücü senaryo: 5,63 - 6,52 $ (çok elverişli piyasa ve benimseme ortamı)

- 2030-12-31: ASR 6,52 $ (muhtemel tepe fiyat)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 2,85076 | 2,299 | 1,93116 | 0 |

| 2026 | 3,19285 | 2,57488 | 2,49763 | 12 |

| 2027 | 4,23928 | 2,88387 | 1,61496 | 25 |

| 2028 | 4,45197 | 3,56157 | 2,0301 | 55 |

| 2029 | 5,44921 | 4,00677 | 2,12359 | 74 |

| 2030 | 6,52463 | 4,72799 | 4,20791 | 106 |

IV. ASR için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ASR Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun kitle: Uzun vadeli yatırımcılar ve AS Roma taraftarları

- İşlem önerileri:

- Piyasa düşüşlerinde ASR biriktirin

- Token değerini artırmak için kulüp kararlarına katılım sağlayın

- Token'ları güvenli cüzdanlarda ve düzenli yedeklerle muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik Analiz Araçları:

- Hareketli Ortalamalar: Trend ve alım/satım noktalarını belirlemek için kullanılır

- RSI: Aşırı alım ve aşırı satım durumlarını izleyin

- Dalgalı Alım-Satımda Temel Unsurlar:

- Kulüp haberlerini ve performansını takip ederek fiyat etkilerini öngörün

- Zararı sınırlamak için stop-loss emirleri kullanın

ASR Risk Yönetimi Modeli

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyoneller: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı taraftar token'larda yatırım dağıtımı

- Stop-loss emirleri: Zarar sınırları belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak Cüzdan: Gate Web3 cüzdan

- Soğuk Saklama: Donanım cüzdanı ile uzun vadeli muhafaza

- Güvenlik Önlemleri: İki faktörlü doğrulama ve güçlü şifreler kullanımı

V. ASR için Potansiyel Riskler ve Zorluklar

ASR Piyasa Riskleri

- Volatilite: Taraftar token fiyatları yüksek dalgalanma gösterebilir

- Likidite: Düşük işlem hacmi fiyat istikrarını olumsuz etkileyebilir

- Kulüp Performansı: Takımın sportif başarısı token değerini etkiler

ASR Düzenleyici Riskler

- Belirsiz Düzenlemeler: Taraftar token'lar regülasyon riskine tabi olabilir

- Sınır Ötesi Kısıtlamalar: Uluslararası mevzuat kullanımda engel oluşturabilir

- Vergi Durumu: Bazı ülkelerde vergisel uygulamalar belirsizdir

ASR Teknik Riskler

- Akıllı Sözleşme Açıkları: Sistem açıkları veya yazılım hataları riski

- Blokzincir Ağ Sorunları: Chiliz Chain'de tıkanıklık veya erişim kesintisi

- Cüzdan Güvenliği: Hack veya anahtar kaybı riski

VI. Sonuç ve Eylem Önerileri

ASR Yatırım Değeri Analizi

ASR, AS Roma taraftarlarına özel katılım olanakları sunar ancak önemli piyasa ve regülasyon riskleri taşır. Uzun vadeli değer; kulüp başarısı ve token ekosisteminin benimsenmesine bağlıdır.

ASR Yatırım Tavsiyeleri

✅ Yeni Başlayanlar: Düşük miktarlarla başlayıp kulüp yönetimini öğrenmeye odaklanın ✅ Deneyimli Yatırımcılar: ASR'yi çeşitlendirilmiş taraftar token portföyünde değerlendirin ✅ Kurumsal Yatırımcılar: ASR'yi diğer spor ve eğlence token'ları ile karşılaştırarak analiz edin

ASR Katılım Yolları

- Gate.com'da Alım: ASR token'larını doğrudan borsadan satın alın

- Socios Uygulaması: Kulüp kararlarına katılım ve ödül kazanımı

- Yönetim İçin Tutma: Token'larla kulüp yönetiminde oy kullanma

Kripto para yatırımları yüksek risk taşır, bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kendi risk profillerine göre karar vermeli, profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Kripto Para Dünyasında ASR Nedir?

ASR, AS Roma Fan Token için yardımcı token olup, taraftar etkileşimini oylama ve ödüller yoluyla artırır. Chiliz blokzincirinde çalışır, geleneksel kripto paralardan ziyade taraftar etkileşimine odaklanır.

2030 için AXS fiyat tahmini nedir?

İstatistiksel modellere göre AXS'nin 2030 ortasında yaklaşık 0,34 $ ve yıl sonunda 0,37 $ seviyelerine ulaşması bekleniyor. Gerçek fiyatlar değişkenlik gösterebilir.

2030 için ASTR fiyat tahmini nedir?

Piyasa analizine göre Astar (ASTR), 2030'da 0,1365 $ ile 0,1112 $ arasında bir fiyat aralığına ulaşabilir. Uzmanlar mevcut trendler nedeniyle potansiyel değer artışı öngörüyor.

2026 için API3 fiyat tahmini nedir?

API3'ün güncel piyasa analizi ve trendler doğrultusunda 2026'da 1,7 $ zirve ve 0,814 $ dip seviyeleri görmesi beklenmektedir.

Yatırım Yapmak için En Çok Hangi Sebep Sizinle Yankı Buluyor ve Neden?

Kripto'da Boğa ve Ayı Piyasaları: Web3 Yatırımcıları için Piyasa Döngülerini Anlamak

Bir Ajan veya Broker Hangi Faaliyetleri Yapmasına İzin Verilir? Açıklamalı

2025 IDPrice Tahmini: Dijital Kimlik Değerlemelerinde Yükselen Eğilimler ve Piyasa Analizi

2025 FORT Fiyat Öngörüsü: Halving Sonrası Kripto Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Değerlendirilmesi

2025 ATS Fiyat Tahmini: Otomatik Alım Satım Sistemi Token'ının Piyasa Eğilimleri ve Gelecekteki Değerlemesinin Analizi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması