2025 AIV Fiyat Tahmini: AIV Teknoloji Sektörü’nde Piyasa Trendlerinin ve Geleceğe Yönelik Değerleme Perspektiflerinin Analizi

Giriş: AIV’in Piyasa Konumu ve Yatırım Potansiyeli

AIVille (AIV), BNBChain üzerinde MCP destekli ilk üretken yapay zeka oyun protokolü olarak öne çıkıyor ve kuruluşundan bu yana kayda değer bir ilerleme sergiledi. 2025 itibarıyla AIV’in piyasa değeri 11.625.191,76 ABD doları, dolaşımdaki arzı yaklaşık 2.777.160.000 token ve fiyatı ise 0,004186 ABD doları seviyesinde bulunuyor. “Web3 kasaba simülatörü” olarak anılan bu varlık, yapay zeka, blokzincir oyunları ve merkeziyetsiz finansın buluşma noktasında giderek daha stratejik bir rol üstleniyor.

Makale boyunca, 2025-2030 yılları arasında AIV’in fiyat hareketleri; geçmiş veriler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam ışığında detaylı olarak analiz edilecek; yatırımcılar için profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. AIV Fiyat Geçmişi ve Mevcut Piyasa Durumu

AIV’in Tarihsel Fiyat Seyri

- 2025: Proje lansmanı, fiyat yaklaşık 0,004 ABD doları seviyesinde dalgalandı

- 29 Eylül 2025: AIV, tüm zamanların en yüksek seviyesi olan 0,009 ABD dolarına ulaştı

- 6 Ekim 2025: AIV, tüm zamanların en düşük seviyesi olan 0,003875 ABD dolarına indi

AIV Mevcut Piyasa Görünümü

AIV şu anda 0,004186 ABD doları seviyesinden işlem görüyor ve son 24 saatte %2,67 oranında yükseldi. Tokenin son 30 gündeki %19,78’lik düşüşü, yakın dönemdeki piyasadaki negatif baskıyı gösteriyor. Bununla birlikte, AIV son bir yılda %398,37’lik güçlü bir büyüme kaydetti.

Güncel piyasa değeri 11.625.191,76 ABD doları ve dolaşımdaki arz 2.777.160.000 token. Tam seyreltilmiş piyasa değeri ise 41.860.000 ABD doları seviyesinde; bu da ileride daha fazla token piyasaya girdikçe büyüme potansiyeline işaret ediyor.

Son 24 saatlik işlem hacmi 112.703,43 ABD doları ile orta düzeyde bir piyasa hareketliliği gösteriyor. Toplamda 14.640 sahip ile AIV, yatırımcı ve kullanıcı topluluğunu istikrarlı bir şekilde artırıyor.

Güncel AIV piyasa fiyatını görüntüleyin

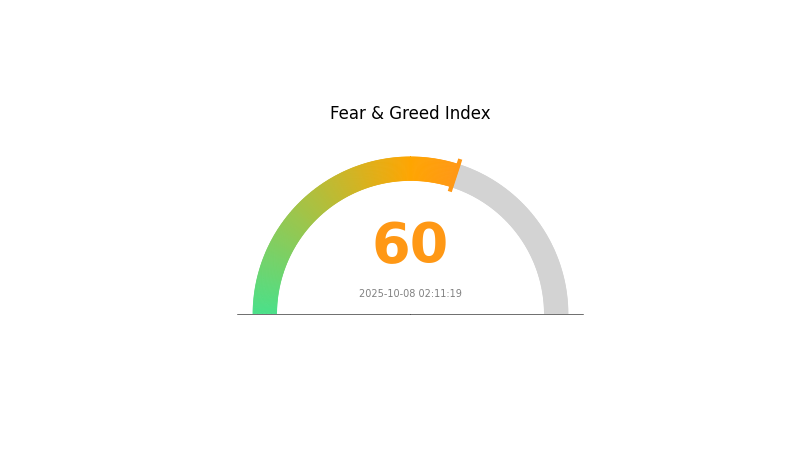

AIV Piyasa Duyarlılığı Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini inceleyin

Kripto piyasasında duyarlılık açgözlülük yönünde şekilleniyor ve Korku & Açgözlülük Endeksi’nde 60 puan ile yatırımcıların iyimserliğini yansıtıyor. Bu durum fiyatların yükselmesine zemin hazırlayabilir; ancak aşırı açgözlülük piyasa düzeltmelerine yol açabileceği için dikkatli olunmalı. Yatırımcılar portföylerini çeşitlendirmeli, kar koruma için stop-loss seviyeleri koymalı, önemli direnç noktalarını ve piyasayı etkileyebilecek haberleri düzenli olarak takip etmelidir. Her zaman olduğu gibi, kapsamlı araştırma ve etkin risk yönetimi bu ortamda kritiktir.

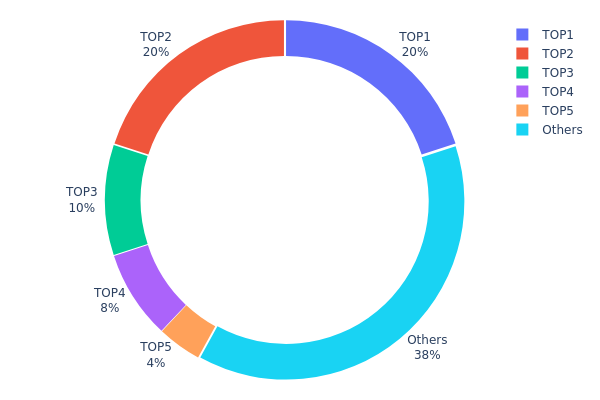

AIV Varlık Dağılımı

Adres varlık dağılımı verileri, AIV tokenlarının cüzdanlar arasındaki yoğunlaşma düzeyine dair önemli bulgular sunuyor. Analize göre, en büyük yatırımcı adreslerinde yüksek düzeyde token konsantrasyonu bulunuyor. İlk iki adres toplam arzın %40’ına yakınını kontrol ediyor (sırasıyla %20 ve %19,99). İlk beş adres ise tüm AIV tokenlarının %62’sine sahip; bu da belirgin bir merkezileşmeye işaret ediyor.

Bu durum, piyasa istikrarı ve olası fiyat manipülasyonu için endişe kaynağı oluşturuyor. Tokenların büyük bölümü az sayıda adreste toplandığında, bu adreslerin satış veya transfer işlemleri piyasada yüksek dalgalanmalara yol açabilir. Ayrıca, merkezileşme projenin merkeziyetsizlik iddiasını zayıflatarak yatırımcı güvenini olumsuz etkileyebilir.

Mevcut dağılım, AIV için henüz olgunlaşmamış bir piyasa yapısına işaret ediyor; tokenların geniş tabana yayılması sınırlı. Bu konsantrasyon, likiditeyi azaltıp az sayıdaki oyuncunun hamleleriyle fiyatlarda sert hareketlere neden olabilir. Yatırımcılar ve piyasa aktörleri, AIV’in dinamiklerini ve gelecekteki gelişmelerini değerlendirirken bu yapısal özellikleri mutlaka göz önüne almalıdır.

Güncel AIV Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xa817...997f53 | 2.000.000,00K | 20,00% |

| 2 | 0xa815...302d0f | 1.999.840,00K | 19,99% |

| 3 | 0x8b78...bd6862 | 1.000.000,00K | 10,00% |

| 4 | 0xb66f...d95686 | 800.000,00K | 8,00% |

| 5 | 0xf7f4...7b4016 | 400.000,00K | 4,00% |

| - | Diğerleri | 3.800.160,00K | 38,01% |

II. AIV’in Gelecek Fiyatını Etkileyen Ana Faktörler

Arz Mekanizması

- Teknolojik Gelişim: AIVille’ın teknoloji yol haritasındaki ilerleme, orta ve uzun vadeli fiyat seviyelerini belirleyen ana etken olacak. Proje planına göre, Q3 2025’te çoklu zincirli AI ajan ağı devreye alınacak ve eMCP, BSC’ye taşınacak.

Kurumsal ve Büyük Yatırımcı Etkisi

- Kurumsal Benimseme: AIV’in tanınmış şirketler tarafından benimsenmesi, fiyat üzerinde önemli etki yaratabilir.

Makroekonomik Faktörler

- Enflasyona Karşı Koruma: Enflasyonist ortamda AIV’in performansı fiyat hareketlerine doğrudan etki edebilir.

Teknoloji ve Ekosistem Gelişimi

- Çoklu Zincirli AI Ajan Ağı: Q3 2025’te devreye alınacak olan ağ, eMCP’nin BSC’ye genişlemesini sağlayarak hem fiyat hem de benimsenme üzerinde etkili olabilir.

- Ekosistem Uygulamaları: Büyük DApp ve ekosistem projeleri, AIV’in değerini yukarıya taşıyabilir.

III. 2025-2030 AIV Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,00355 - 0,00400 ABD doları

- Tarafsız tahmin: 0,00400 - 0,00430 ABD doları

- İyimser tahmin: 0,00430 - 0,00450 ABD doları (olumlu piyasa duyarlılığı ile)

2027-2028 Görünümü

- Piyasa fazı: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00304 - 0,00647 ABD doları

- 2028: 0,00464 - 0,00675 ABD doları

- Temel tetikleyiciler: Artan benimseme ve teknolojik ilerleme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00624 - 0,00696 ABD doları (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,00767 - 0,00946 ABD doları (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,00946 - 0,01000 ABD doları (çığır açan gelişmeler ile)

- 31 Aralık 2030: AIV 0,00946 ABD doları (dönem zirvesi olasılığı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,0043 | 0,00417 | 0,00355 | 0 |

| 2026 | 0,00572 | 0,00424 | 0,00258 | 1 |

| 2027 | 0,00647 | 0,00498 | 0,00304 | 19 |

| 2028 | 0,00675 | 0,00572 | 0,00464 | 37 |

| 2029 | 0,00767 | 0,00624 | 0,00349 | 49 |

| 2030 | 0,00946 | 0,00696 | 0,00355 | 67 |

IV. AIV için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AIV Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Yapay zeka ve oyun teknolojilerine uzun vadeli ilgi duyan yatırımcılar

- İzlenecek adımlar:

- Piyasa düşüşlerinde AIV token biriktirin

- Proje gelişimi için en az 1-2 yıl tutun

- Tokenları donanım cüzdanında güvenli şekilde saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve giriş/çıkış noktalarını belirlemede kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/satım durumlarını izlemek için

- Swing trade’de dikkat edilecekler:

- Net stop-loss ve kar alma seviyeleri belirleyin

- Proje gelişmeleri ve piyasa duyarlılığını takip edin

AIV Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-8’i

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Yaklaşımları

- Diversifikasyon: Yatırımları farklı AI ve oyun tokenlarına yaymak

- Stop-loss emirleri: Zararları sınırlamak için kullanmak

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı alternatifi: Resmi AIVille cüzdanı (varsa)

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı

V. AIV için Potansiyel Riskler ve Zorluklar

AIV Piyasa Riskleri

- Yüksek volatilite: AIV fiyatı ciddi dalgalanmalara açık

- Rekabet: Yeni AI oyun projeleri AIV’in pazar payını azaltabilir

- Piyasa duyarlılığı: Kripto piyasası duyarlılığı değişimleri AIV performansını etkileyebilir

AIV Düzenleyici Riskler

- Belirsiz düzenlemeler: Gelecekteki düzenlemeler AIV’in faaliyetlerini etkileyebilir

- Sınır ötesi uyum: Farklı ülkelerdeki düzenleyici ortam, AIV’in küresel erişimini kısıtlayabilir

- Vergi mevzuatı: Değişen vergi kuralları AIV sahiplerini etkileyebilir

AIV Teknik Riskler

- Akıllı kontrat açıkları: AIV’in akıllı kontratlarında hata riski mevcut

- Ölçeklenebilirlik sorunları: Artan kullanıcı ile başa çıkmada zorluklar yaşanabilir

- BNBChain’e bağlılık: BNBChain’deki teknik aksaklıklar AIV’i olumsuz etkileyebilir

VI. Sonuç ve Eylem Önerileri

AIV Yatırım Değerinin Değerlendirilmesi

AIV, yükselen AI oyun sektöründe önemli bir potansiyele sahip fakat aynı zamanda güçlü rekabet ve düzenleme belirsizliğiyle karşı karşıya. Uzun vadeli değer, AIVille platformunun başarısına bağlı; kısa vadeli riskler ise yüksek volatilite ve piyasa duyarlılığındaki değişimlerdir.

AIV Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayıp projeyi öğrenmeye odaklanmalı ✅ Deneyimli yatırımcılar: Yüksek riskli portföyün bir kısmını AIV’e ayırmayı değerlendirmeli ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapmalı, AIV’i çeşitlendirilmiş portföye dahil etmeyi düşünmeli

AIV Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden AIV token alım ve tutma

- Staking: Uygun program varsa AIV staking’e katılım

- Oyun oynama: AIVille platformunda etkileşim ile AIV token kazanma

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

2025 için hedef fiyat nedir?

Piyasa analizine göre, AIV’in 2025 hedef fiyatı 100,77 ABD doları olup, mevcut seviyeye göre %12,88 artış anlamına gelmektedir.

AIV için analist değerlendirmeleri nelerdir?

AIV için analist notları arasında Güçlü Al, Al ve Tut bulunuyor. Bu notlar, mevcut piyasa duyarlılığı ve uzman görüşlerini yansıtıyor.

Hisse fiyat tahmini için en iyi yapay zeka hangisidir?

Hibrit GARCH-LSTM modelleri, istatistiksel volatilite analizini gelişmiş yapay zeka ile birleştirerek hisse fiyat tahminlerinde yüksek doğruluk ve güvenilirlik sunar.

2030’da Aitx hisse fiyatı ne olur?

Yapay zeka sektöründeki büyüme projeksiyonlarına göre, Aitx hissesi 2030’da hisse başına 50-100 ABD doları aralığına ulaşabilir; bu, sürekli yenilik ve pazar genişlemesi varsayımıyla mümkündür.

2025 VIRTUAL Fiyat Tahmini: Dijital Varlık Ekosistemindeki Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 ARIA Fiyat Tahmini: Bu oyun token’ı kripto piyasasında yeni zirvelere ulaşacak mı?

GameGPT (DUEL) iyi bir yatırım mı?: Blockchain oyun tokenının potansiyelinin ve risklerinin analizi

Bir Kripto Projesinin Temel Analizi Nasıl Yapılır: 5 Maddede İnceleme

PAL ve THETA: Yapay Zeka ile Desteklenen Problem Çözümünde İki Önde Gelen Yaklaşımın Karşılaştırılması

2025’te BEAT İçin Fiyat Tahmini Nedir?

Metaverse'te Sanal Arazi Satın Alma Rehberi

2024 yılında yatırım için göz önünde bulundurabileceğiniz en önemli NFT'ler

Yeni başlayanlar için uygun başlıca kripto madencilik havuzları

ERC20 Standardını Anlamak: Tanımı ve İşlevselliği

Dijital varlıkların güvenli şekilde alım satımı için tercih edilen en iyi platformlar