2025 ADX Price Prediction: Potential Market Trends and Growth Analysis for the Average Directional Index

Introduction: Market Position and Investment Value of ADX

AdEx (ADX), as an innovative web3 marketing platform, has made significant strides in creating a transparent and fraud-protected ad-buying experience since its inception in 2017. As of 2025, AdEx's market capitalization has reached $15,899,250, with a circulating supply of approximately 147,900,000 tokens, and a price hovering around $0.1075. This asset, often hailed as the "blockchain advertising solution," is playing an increasingly crucial role in the realm of web3 marketing and programmatic advertising.

This article will provide a comprehensive analysis of AdEx's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. ADX Price History Review and Current Market Status

ADX Historical Price Evolution Trajectory

- 2018: All-time high reached, price peaked at $3.49 on January 9

- 2020: Market downturn, price hit all-time low of $0.03511504 on March 13

- 2025: Current market cycle, price fluctuating around $0.1075

ADX Current Market Situation

As of October 6, 2025, ADX is trading at $0.1075. The token has experienced a slight decline of 0.15% in the past 24 hours, with a trading volume of $82,976.94. ADX's market capitalization stands at $15,899,250, ranking it 1201st in the cryptocurrency market. The circulating supply is 147,900,000 ADX, which represents 98.6% of the total supply of 150,000,000 tokens.

Over the past week, ADX has seen a decrease of 1.40% in its value. The 30-day performance shows a more significant decline of 13.10%, while the yearly performance indicates a substantial drop of 24.99%. Despite these downward trends, the token has shown a slight positive movement of 0.16% in the last hour.

The current price of ADX is significantly below its all-time high of $3.49, recorded on January 9, 2018. However, it remains well above its all-time low of $0.03511504, which occurred on March 13, 2020. This suggests that while the token has lost considerable value since its peak, it has maintained some stability above its lowest point.

Click to view the current ADX market price

ADX Market Sentiment Indicator

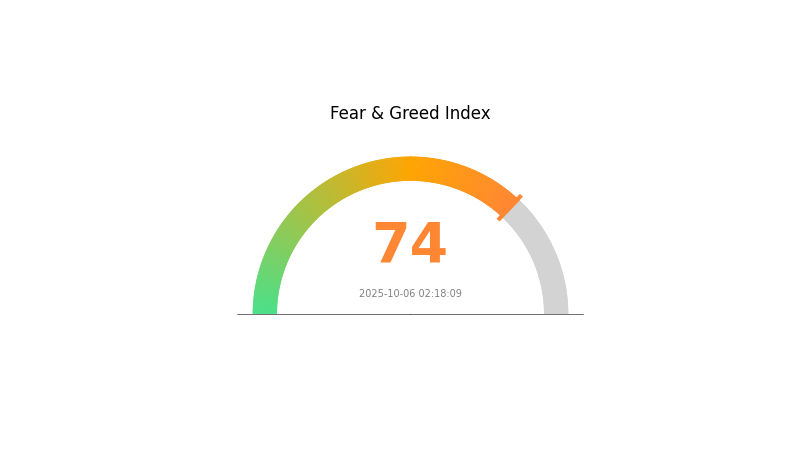

2025-10-06 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a surge of optimism, with the Fear and Greed Index reaching 74, indicating strong greed. This heightened sentiment suggests investors are becoming increasingly bullish, potentially driving up asset prices. However, such extreme levels of greed often precede market corrections. Traders should exercise caution and consider taking profits or implementing risk management strategies. Remember, market sentiment can shift rapidly, and it's crucial to stay informed and make balanced decisions based on thorough analysis rather than emotions.

ADX Holdings Distribution

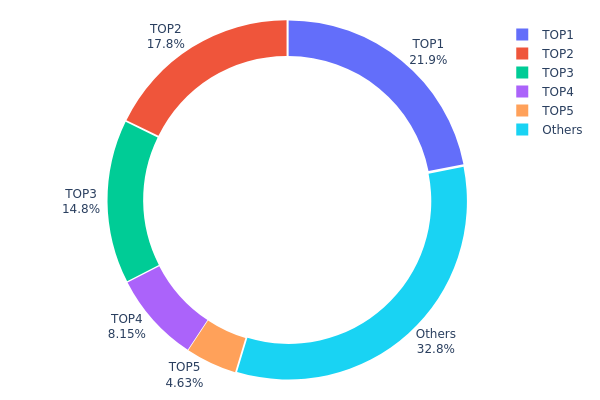

The address holdings distribution data for ADX reveals a highly concentrated ownership structure. The top five addresses collectively hold 67.2% of the total supply, with the largest holder possessing 21.90% of all tokens. This concentration level raises concerns about potential market manipulation and centralization risks.

The second and third largest holders control 17.76% and 14.77% respectively, further emphasizing the consolidated nature of ADX ownership. Such a top-heavy distribution can lead to increased price volatility, as large holders have the capacity to significantly impact market dynamics through their trading activities. Moreover, this concentration may undermine the project's decentralization ethos, potentially affecting governance decisions and overall ecosystem stability.

While 32.8% of tokens are distributed among other addresses, the dominance of a few large holders suggests a need for improved token distribution to enhance market resilience and reduce manipulation risks. This current structure may deter some investors due to concerns about price stability and fair market practices.

Click to view the current ADX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb645...13491a | 44475.23K | 21.90% |

| 2 | 0x4846...b9c534 | 36071.45K | 17.76% |

| 3 | 0xf977...41acec | 30000.00K | 14.77% |

| 4 | 0x5a52...70efcb | 16557.88K | 8.15% |

| 5 | 0x23c2...52c5e9 | 9401.47K | 4.62% |

| - | Others | 66558.60K | 32.8% |

II. Key Factors Affecting Future ADX Price

Technical Development and Ecosystem Building

- Trend Strength Measurement: ADX focuses on measuring the strength of market trends, assessing trend continuity and its intensity.

- Market Volatility Analysis: ADX helps investors understand market volatility, enabling them to develop more appropriate trading strategies.

Macroeconomic Environment

- Monetary Policy Impact: Recent economic data suggests a more robust economy, but central bank decisions on interest rates may influence future trends.

- Inflation Hedge Properties: Quarterly consumer price index is likely to be emphasized as a key indicator for future market directions.

Institutional and Large Holder Dynamics

- Market Sentiment: ADX is influenced by overall market sentiment and can help identify potential price reversals.

- Trading Volume: Increased trading volume usually indicates trend continuation, while decreased volume may signal trend weakening or reversal.

III. ADX Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.06771 - $0.10748

- Neutral forecast: $0.10748 - $0.12038

- Optimistic forecast: $0.12038 - $0.13328 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Expected market phase: Potential growth and consolidation

- Price range predictions:

- 2027: $0.10611 - $0.17599

- 2028: $0.10689 - $0.20462

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.15869 - $0.18670 (assuming steady market growth)

- Optimistic scenario: $0.18670 - $0.19474 (with increased institutional adoption)

- Transformative scenario: $0.19474 - $0.20462 (with breakthrough use cases and mainstream integration)

- 2030-12-31: ADX $0.19417 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13328 | 0.10748 | 0.06771 | 0 |

| 2026 | 0.13843 | 0.12038 | 0.10834 | 11 |

| 2027 | 0.17599 | 0.12941 | 0.10611 | 20 |

| 2028 | 0.20462 | 0.1527 | 0.10689 | 42 |

| 2029 | 0.19474 | 0.17866 | 0.16794 | 66 |

| 2030 | 0.19417 | 0.1867 | 0.15869 | 73 |

IV. ADX Professional Investment Strategies and Risk Management

ADX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate ADX during market dips

- Set price targets for partial profit-taking

- Store ADX in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- RSI (Relative Strength Index): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor ADX's correlation with major cryptocurrencies

- Set stop-loss orders to manage downside risk

ADX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official AdEx wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ADX

ADX Market Risks

- Volatility: ADX price can experience significant fluctuations

- Liquidity: Lower trading volume compared to major cryptocurrencies

- Market sentiment: Susceptible to overall crypto market trends

ADX Regulatory Risks

- Uncertain regulations: Potential for stricter crypto regulations globally

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Possible limitations on international transactions

ADX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Ethereum network issues may affect ADX transactions

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

ADX Investment Value Assessment

ADX offers potential long-term value in the web3 advertising space but faces short-term volatility and adoption challenges. Investors should carefully consider their risk tolerance before investing.

ADX Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the project ✅ Experienced investors: Consider dollar-cost averaging and set clear profit targets ✅ Institutional investors: Conduct thorough due diligence and explore partnerships with AdEx Network

ADX Participation Methods

- Spot trading: Buy and sell ADX on Gate.com

- Staking: Participate in AdEx Network's staking program for potential rewards

- Utilize the platform: Engage with AdEx Network's advertising ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is ADX coin a good investment?

ADX coin is considered a high-risk investment with poor return potential. Current data suggests it may not be profitable in the near future.

What is the price prediction for ADX in 2030?

Based on technical analysis, the price prediction for ADX in 2030 is $1.30. This forecast suggests potential growth for ADX over the long term.

What is the stock price prediction for ADX?

ADX price is predicted to reach $0.136052 in the next 5 years, based on current market analysis and trends.

Is ADX a good stock to buy?

ADX is not recommended for purchase currently. Projections indicate a potential 25% decline in value over the next year. Always review latest market analyses for informed decisions.

Share

Content