2025 ADP Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: ADP's Market Position and Investment Value

Adappter Token (ADP) serves as a blockchain-based intermediary platform for ecosystem content partnerships, establishing a transparent and fair token distribution system since its launch in 2020. As of 2025, ADP has achieved a market capitalization of $3,903,762.62 with a circulating supply of approximately 4.47 billion tokens, currently trading at $0.0008727. This innovative asset is playing an increasingly critical role in enabling fair value distribution between enterprises and users through its Activity Point (AP) compensation mechanism and decentralized ecosystem.

This article will provide a comprehensive analysis of ADP's price trends throughout 2025, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to blockchain-based content partnership platforms.

Adappter Token (ADP) Market Analysis Report

I. ADP Price History Review and Market Status

ADP Historical Price Evolution

-

March 2022: ADP reached its all-time high of $0.158038, marking the peak of its price performance during the early adoption phase of the platform.

-

December 2025: ADP declined to its all-time low of $0.00077575 on November 21, 2025, reflecting significant market pressure and price compression over the extended period.

ADP Current Market Position

As of December 24, 2025, Adappter Token (ADP) is trading at $0.0008727, representing a 2.21% decline in the 24-hour period. The token demonstrates modest volatility with an intra-day range between $0.0008597 and $0.0009236.

Market Capitalization and Supply Metrics:

- Current market capitalization: $3,903,762.62

- Fully diluted valuation: $8,727,000.00

- Circulating supply: 4,473,201,118 ADP (44.73% of total supply)

- Maximum supply: 10,000,000,000 ADP

- Market dominance: 0.00027%

Trading Activity:

- 24-hour trading volume: $11,832.58

- Market capitalization ratio to fully diluted valuation: 44.73%

- Number of active holders: 2,933

- Listed on 3 exchanges

Price Performance Trends:

- 1-hour change: +0.6%

- 7-day change: +7.64%

- 30-day change: -2.13%

- 1-year change: -44.91%

The token maintains a presence on the Ethereum blockchain with its contract address: 0xc314b0e758d5ff74f63e307a86ebfe183c95767b.

Visit ADP Market Price on Gate.com for real-time quotations

ADP Market Sentiment Index

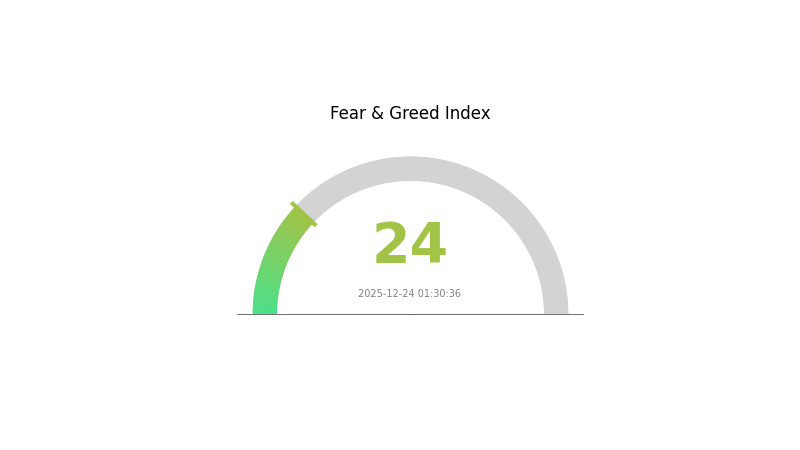

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 24. This represents a significantly bearish sentiment, indicating investors are highly risk-averse and pessimistic about near-term market prospects. Such extreme fear levels often present contrarian opportunities for experienced traders, as historically these periods have preceded market reversals. However, caution remains warranted until indicators show signs of stabilization. Monitor key support levels and market fundamentals closely before making investment decisions.

ADP Holdings Distribution

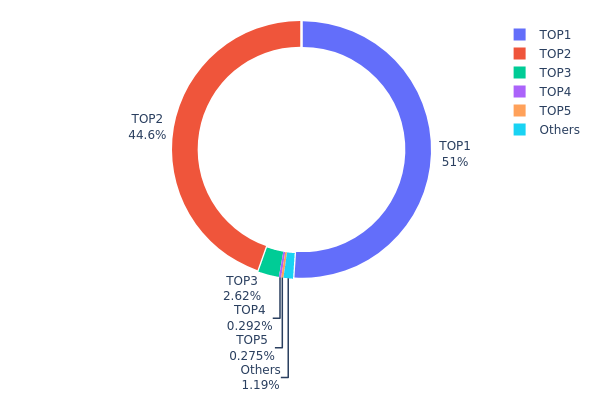

The address holdings distribution map illustrates the concentration of token ownership across the blockchain network by tracking the top wallet addresses and their respective token quantities. This metric serves as a critical indicator of decentralization levels, market structure stability, and potential systemic risks associated with wealth concentration.

ADP currently exhibits a pronounced concentration pattern, with the top two addresses controlling 95.61% of the total token supply. The leading address (0x0000...00dead) holds 51.03% of all ADP tokens, while the second address (0x942a...d7ea21) commands 44.58%. This extreme concentration represents a significant centralization risk, as the combined holdings of these two entities far exceed healthy decentralization thresholds. The remaining top three addresses collectively represent only 3.17% of the supply, with the third-largest holder maintaining just 2.61%. This stark disparity underscores a highly asymmetrical distribution structure.

Such concentrated ownership creates notable implications for market dynamics and stability. The dominance of these two major holders presents considerable price volatility risks, as coordinated or even unilateral movements by either address could substantially impact token valuations and liquidity conditions. The potential for market manipulation is elevated when such a large percentage of circulating supply resides within a limited number of addresses. Additionally, the minimal participation from diverse stakeholders—with "Others" accounting for merely 1.22%—suggests limited organic adoption and suggests that ADP's current market structure is characterized by low decentralization levels and higher operational risk concentration than typically considered healthy for a mature blockchain asset.

Click to view current ADP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 5103628.65K | 51.03% |

| 2 | 0x942a...d7ea21 | 4458763.28K | 44.58% |

| 3 | 0xc55a...a174ff | 261538.45K | 2.61% |

| 4 | 0x19b1...847303 | 29240.43K | 0.29% |

| 5 | 0xb0a2...bbcbed | 27510.00K | 0.27% |

| - | Others | 119319.19K | 1.22% |

Core Factors Affecting ADP's Future Price

Supply Mechanism

- Total Token Supply: ADP has a total supply of 10 billion tokens, which directly impacts coin price and investment value.

- Historical Performance: Supply fluctuations have historically driven ADP price volatility.

- Investment Significance: Scarcity serves as the core support for long-term value.

Macroeconomic Environment

-

Federal Reserve Policy Impact: The U.S. Federal Reserve has implemented consecutive rate cuts, reducing the federal funds rate target range to 3.75%-4.00%. However, Fed officials show divergent views on future monetary policy. Some officials, including Kansas City Fed President Schmid, oppose further rate cuts citing concerns about inflation pressures from economic growth and investment. The December interest rate decision remains uncertain, with Fed officials indicating that data-dependent policy adjustments will guide future decisions.

-

Employment Data Influence: ADP employment data has shown consecutive negative readings for two months, indicating significant labor market slowdown. October private sector employment additions reached only 42,000 positions, primarily driven by trade, transportation, and utilities sectors. Weak employment data has supported market expectations for Federal Reserve rate cuts and influenced U.S. dollar weakness. Market participants anticipate October non-farm employment may have increased by only approximately 50,000 positions, with unemployment potentially rising to 4.4%.

-

Market Sentiment: Overall ADP market sentiment remains pessimistic, with current prices approaching historical lows. Market performance is primarily influenced by overall cryptocurrency market trends and project developments. You can check the latest ADP market prices on Gate.com.

III. 2025-2030 ADP Price Forecast

2025 Outlook

- Conservative Prediction: $0.00079 - $0.00087

- Neutral Prediction: $0.00087 (average level)

- Optimistic Prediction: $0.00121 (requiring sustained market momentum)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and growth phase with increasing institutional interest and market maturation

- Price Range Forecast:

- 2026: $0.00082 - $0.00133 (19% potential upside)

- 2027: $0.00083 - $0.00148 (35% potential upside)

- 2028: $0.00084 - $0.0019 (52% potential upside)

- Key Catalysts: Increased adoption of blockchain infrastructure, expansion of decentralized finance applications, and growing mainstream recognition of crypto assets

2029-2030 Long-term Outlook

- Base Case: $0.00134 - $0.00186 (85% appreciation by 2029)

- Optimistic Scenario: $0.00186 - $0.00217 (assuming accelerated ecosystem development and enhanced market liquidity through platforms like Gate.com)

- Transformative Scenario: $0.00217+ (under conditions of major protocol upgrades, significant enterprise adoption, and favorable regulatory environment)

- December 24, 2025: ADP trading near mid-range levels with consolidation pattern observed

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00121 | 0.00087 | 0.00079 | 0 |

| 2026 | 0.00133 | 0.00104 | 0.00082 | 19 |

| 2027 | 0.00148 | 0.00119 | 0.00083 | 35 |

| 2028 | 0.0019 | 0.00133 | 0.00084 | 52 |

| 2029 | 0.0021 | 0.00161 | 0.00134 | 85 |

| 2030 | 0.00217 | 0.00186 | 0.00124 | 112 |

Adappter Token (ADP) Professional Investment Analysis Report

Executive Summary

Adappter Token (ADP) is a blockchain-based platform token designed to facilitate content partnership ecosystems. As of December 24, 2025, ADP is trading at $0.0008727, representing a 2.21% decline over the past 24 hours. The token has a circulating supply of 4.47 billion ADP against a total supply of 10 billion, with a fully diluted market capitalization of $8.73 million.

I. ADP Market Overview

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.0008727 |

| 24-Hour Change | -2.21% |

| 7-Day Change | +7.64% |

| 30-Day Change | -2.13% |

| 1-Year Change | -44.91% |

| Market Cap | $3.90 million |

| Fully Diluted Valuation | $8.73 million |

| 24-Hour Trading Volume | $11,832.58 |

| All-Time High | $0.158038 (March 18, 2022) |

| All-Time Low | $0.00077575 (November 21, 2025) |

| Circulating Supply | 4,473,201,118 ADP |

| Total Supply | 10,000,000,000 ADP |

| Market Dominance | 0.00027% |

| Token Holders | 2,933 |

Price Performance Analysis

ADP has experienced significant volatility since its inception. The token peaked at $0.158038 in March 2022, representing an approximately 181x return from current levels. Over the past year, ADP has declined 44.91%, reflecting broader market pressures affecting mid-cap tokens. Short-term performance shows mixed signals, with a 7-day gain of 7.64% partially offset by a 24-hour decline of 2.21%.

II. ADP Project Overview & Utility

Project Foundation

Adappter is a blockchain-powered intermediary platform connecting ecosystem content partners. The platform leverages blockchain technology to create transparent partnerships and fair value distribution mechanisms within digital content ecosystems.

Core Features & Value Proposition

Platform Architecture:

- SDK (Software Development Kit): Reduces development costs for ecosystem partners by providing pre-built tools and integrations

- Activity Point (AP) System: Tracks user engagement and contributions across the platform

- User Compensation Mechanism: Rewards users through transparent allocation of platform value

Token Utility (ADP):

- Rewards & Airdrops: Users receive ADP tokens through transparent distribution mechanisms based on activity points generated on the platform

- Commerce: ADP can be used to purchase products and services within the Adappter store

- Currency Exchange: Tokens can be exchanged for fiat currency or other digital assets

Ecosystem Model

The Adappter platform establishes a three-party ecosystem:

- Content Partners: Benefit from reduced development costs through SDK tools

- Users: Earn ADP rewards for platform engagement and activity

- Enterprises: Gain access to reliable user data for fair value distribution

III. ADP Technical & Blockchain Infrastructure

Blockchain Deployment

- Network: Ethereum (ETH)

- Contract Address: 0xc314b0e758d5ff74f63e307a86ebfe183c95767b

- Standard: ERC-20 compatible token

Token Economics

- Total Supply: 10,000,000,000 ADP (fixed cap)

- Circulating Supply: 4,473,201,118 ADP (44.73% of total)

- Supply Distribution: 55.27% of tokens remain in non-circulating supply

GitHub Repository

The project maintains active development resources on GitHub: https://github.com/sinestcorp/Adappter

IV. ADP Professional Investment Strategy & Risk Management

ADP Investment Methodology

(1) Long-Term Hold Strategy

Given ADP's small market cap ($3.90 million) and limited liquidity ($11,832.58 daily volume), long-term holding is primarily suitable for investors with high risk tolerance and extended investment horizons.

- Suitable For: Speculative investors, ecosystem participants, or those with conviction in the Adappter platform's long-term development

- Operational Recommendations:

- Establish positions gradually over time rather than lump-sum purchases to manage slippage and price impact

- Monitor platform adoption metrics and community engagement as indicators of project viability

- Maintain portfolio allocation discipline; consider ADP as a high-risk allocation component only

(2) Active Trading Strategy

The extremely low trading volume ($11,832.58 daily) presents significant challenges for active traders:

- Liquidity Constraints: Limited daily volume creates high slippage costs and difficulty exiting positions

- Volatility Considerations: Historical 1-year decline of 44.91% indicates substantial drawdown risk

- Market Efficiency: Low trading activity may limit price discovery efficiency

ADP Risk Management Framework

(1) Asset Allocation Principles

Given ADP's micro-cap status, extreme illiquidity, and volatility profile:

- Conservative Investors: 0-0.5% of crypto portfolio maximum

- Aggressive Investors: 0.5-2% of crypto portfolio maximum

- Institutional Investors: Not recommended for significant allocation due to illiquidity constraints

(2) Risk Mitigation Strategies

- Position Sizing: Limit individual position size to ensure losses remain manageable within overall portfolio context

- Diversification: Treat ADP as a speculative allocation only; maintain substantial holdings in more established assets

- Liquidity Planning: Account for extremely limited trading volume when planning entry and exit strategies

(3) Secure Storage Solutions

- Smart Contract Risk: As an ERC-20 token on Ethereum, verify contract addresses on Etherscan before any transaction

- Wallet Recommendations:

- For small holdings: Gate.com Web3 wallet for accessible management

- For larger amounts: Hardware-backed solutions with proper custody

- Security Best Practices:

- Never share private keys or seed phrases

- Verify contract addresses independently before approving transactions

- Use established platforms like Gate.com for trading to reduce counterparty risk

V. ADP Potential Risks & Challenges

Market Risks

- Extreme Illiquidity: Daily trading volume of $11,832.58 creates severe execution challenges and high slippage costs

- Micro-Cap Volatility: With a $3.90 million market cap, the token is susceptible to substantial price swings from relatively small capital flows

- Historical Underperformance: 44.91% decline over one year and 99.45% decline from all-time high indicates sustained weakness

Adoption & Operational Risks

- Platform Traction: Limited public information available regarding user adoption, transaction volume, or ecosystem activity

- Partnership Development: Success depends on ecosystem partner adoption of the Adappter platform, which faces competition from established solutions

- Market Demand: Unclear demand for the specific use cases the platform targets

Regulatory Risks

- Cryptocurrency Regulation: Global regulatory uncertainty regarding token classification and usage could impact token utility

- Jurisdictional Variations: Different regulatory frameworks across geographies may limit platform expansion

Technical Risks

- Smart Contract Vulnerabilities: ERC-20 implementation subject to standard blockchain contract risks

- Network Dependency: Platform functionality depends on Ethereum network stability and gas costs

VI. Conclusion & Action Recommendations

ADP Investment Value Assessment

Adappter Token represents an extremely high-risk, speculative investment opportunity. The project operates in a highly competitive ecosystem content market with limited demonstrated traction. The token's 99.45% decline from all-time highs, combined with minimal trading volume and a small market cap, creates substantial execution challenges. While the blockchain-based intermediary platform concept has merit, investors should only consider ADP allocation if they can afford complete loss of capital.

ADP Investment Recommendations

✅ Beginners: Do not recommend ADP as an entry point into cryptocurrency investing. Focus first on understanding more established, liquid assets.

✅ Experienced Investors: If pursuing ADP as a speculative position, limit allocation to less than 1% of total crypto holdings and only with capital you can afford to lose completely.

✅ Institutional Investors: Not recommended for institutional portfolios due to illiquidity constraints and insufficient market depth for meaningful allocations.

ADP Trading & Participation Methods

- Gate.com Trading: Access ADP trading pairs on Gate.com platform for spot trading and basic portfolio management

- Direct Contract Interaction: Advanced users can interact directly with the ERC-20 smart contract on Ethereum for transfers (requires technical knowledge)

- Ecosystem Participation: Direct engagement with the Adappter platform through its official website (https://adappter.io/) to earn AP (Activity Points) and potential ADP distributions

Cryptocurrency investment carries extreme risk. This analysis does not constitute investment advice. Investors must carefully evaluate their risk tolerance, conduct independent research, and consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely. Crypto assets are highly volatile and subject to regulatory uncertainty.

FAQ

Is ADP a buy hold or sell?

ADP is currently rated Neutral by analysts. With mixed signals from the market, holding your position is recommended while monitoring price trends and market fundamentals for potential entry or exit opportunities.

Is ADP a good long-term investment?

Yes, ADP demonstrates strong long-term potential with consistent revenue growth and solid free cash flow generation. Its robust financial foundation and reinvestment capacity make it attractive for long-term investors seeking stable growth exposure.

Is ADP undervalued?

Yes, ADP is currently undervalued by approximately 6.1% based on intrinsic value analysis. The market price is significantly below its calculated intrinsic value, suggesting potential upside opportunity for investors seeking value appreciation.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Latest analysis and investment prospects for Toncoin price in June 2025

Sui Price Market Analysis and Long-term Investment Potential in 2025

Where to Find Alpha in the 2025 Crypto Spot Market

Bitcoin Cash (BCH) Price Analysis and Investment Outlook for 2025

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange