2025 ACM Price Prediction: Future Trends and Forecasting Models for Association for Computing Machinery Membership Costs

Introduction: ACM's Market Position and Investment Value

AC Milan Fan Token (ACM) has established itself as a prominent fan engagement token in the sports and entertainment industry since its launch in 2021. As of 2025, ACM's market capitalization has reached $9,025,156, with a circulating supply of approximately 10,219,858 tokens and a price hovering around $0.8831. This asset, often referred to as a "digital fan voice," is playing an increasingly crucial role in connecting football fans with their favorite club.

This article will comprehensively analyze ACM's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ACM Price History Review and Current Market Status

ACM Historical Price Evolution

- 2021: ACM reached its all-time high of $23.2 on February 24, 2021, shortly after its launch

- 2023: The token experienced a significant decline, dropping to lower price levels

- 2025: ACM hit its all-time low of $0.697211 on June 23, 2025, marking a major market cycle bottom

ACM Current Market Situation

As of October 9, 2025, ACM is trading at $0.8831, representing a 1.82% increase in the last 24 hours. The token has shown mixed performance across different timeframes, with a 0.32% gain in the past hour but a 5.52% decline over the last 30 days. The current price is significantly below its all-time high, indicating a prolonged bearish trend.

ACM has a market capitalization of $9,025,156.60, ranking it at 1472 in the overall cryptocurrency market. The token's 24-hour trading volume stands at $17,232.14, suggesting moderate liquidity. With a circulating supply of 10,219,858 ACM out of a total supply of 19,920,000, approximately 51.30% of the tokens are in circulation.

The current market sentiment for ACM appears cautiously optimistic, with short-term gains contrasting against longer-term losses. However, the token remains well above its recent all-time low, potentially indicating some level of price stabilization or early recovery signs.

Click to view the current ACM market price

ACM Market Sentiment Indicator

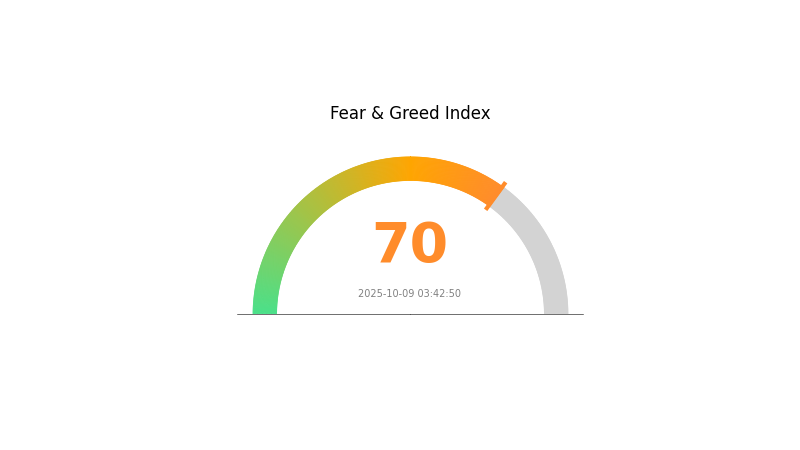

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index hitting 70. This suggests investors are becoming overly optimistic, potentially leading to overbought conditions. While the positive sentiment may drive short-term gains, it's crucial to remain cautious. Experienced traders often view such high greed levels as a signal to consider taking profits or hedging positions. As always, it's essential to conduct thorough research and manage risk appropriately in this volatile market.

ACM Holdings Distribution

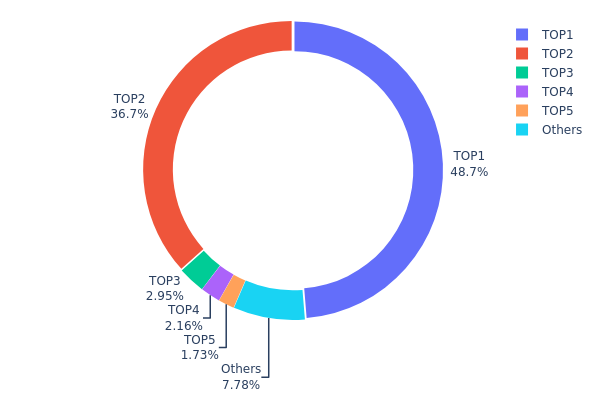

The address holdings distribution data reveals a highly concentrated ownership structure for ACM tokens. The top two addresses collectively hold 85.38% of the total supply, with the largest holder possessing 48.70% and the second-largest controlling 36.68%. This extreme concentration raises concerns about centralization and potential market manipulation risks.

Such a top-heavy distribution can significantly impact market dynamics. With a small number of addresses controlling the majority of tokens, there's an increased likelihood of price volatility and susceptibility to large-scale sell-offs or accumulations. This concentration also implies a low level of decentralization, which may conflict with the principles of distributed ownership often associated with blockchain projects.

The current holdings distribution suggests a fragile on-chain structure for ACM. While the presence of smaller holders (7.78% held by "Others") indicates some level of retail participation, the overwhelming control by top addresses may deter new investors and limit organic market growth. This imbalance could potentially hinder the token's long-term stability and adoption prospects.

Click to view the current ACM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 9700.14K | 48.70% |

| 2 | 0xF977...41aceC | 7306.53K | 36.68% |

| 3 | 0xc80A...e92416 | 587.88K | 2.95% |

| 4 | 0xc368...816880 | 430.00K | 2.16% |

| 5 | 0x8791...988062 | 345.43K | 1.73% |

| - | Others | 1550.03K | 7.78% |

II. Key Factors Affecting ACM's Future Price

Supply Mechanism

- Cyclical Fluctuations: As a chemical product, ACM prices exhibit significant cyclical fluctuations. Historical sales price data over the past 10 years demonstrates this cyclical nature.

- Current Impact: ACM sales prices are currently at the bottom of the cycle, with limited room for further decline in the future.

Macroeconomic Environment

- Monetary Policy Impact: Changes in monetary policies can significantly influence ACM's price trends. The performance of US Treasury bonds and their yield fluctuations have a notable impact on global capital markets.

- Geopolitical Factors: Financial, regulatory, or political events can affect ACM prices, potentially leading to high volatility.

Technical Development and Ecosystem Construction

- Industry Trends: The advanced composite materials (ACM) industry faces both opportunities and challenges in the context of "carbon neutrality". Current emission reduction progress and future trends are key factors to consider.

- Market Research: Analysis of production and sales situations of leading companies in the industry provides insights into market dynamics and potential price movements.

Note: Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading can amplify financial risks. You should thoroughly consider the risks before deciding to trade any financial instrument or cryptocurrency.

III. ACM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.78525 - $0.8823

- Neutral prediction: $0.8823 - $1.0

- Optimistic prediction: $1.0 - $1.28816 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.80334 - $1.3134

- 2028: $0.85422 - $1.5143

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $1.40428 - $1.67812 (assuming steady market growth)

- Optimistic scenario: $1.67812 - $2.34937 (assuming strong market performance)

- Transformative scenario: Above $2.34937 (extreme favorable conditions)

- 2030-12-31: ACM $2.34937 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.28816 | 0.8823 | 0.78525 | 0 |

| 2026 | 1.46506 | 1.08523 | 0.62943 | 22 |

| 2027 | 1.3134 | 1.27514 | 0.80334 | 44 |

| 2028 | 1.5143 | 1.29427 | 0.85422 | 46 |

| 2029 | 1.95196 | 1.40428 | 0.73023 | 59 |

| 2030 | 2.34937 | 1.67812 | 0.95653 | 90 |

IV. ACM Professional Investment Strategies and Risk Management

ACM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Fans of AC Milan and long-term crypto investors

- Operation suggestions:

- Accumulate ACM tokens during market dips

- Participate in AC Milan fan activities to maximize token utility

- Store tokens in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor AC Milan's performance and fan engagement initiatives

- Stay updated on Socios platform developments

ACM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance ACM with other crypto assets and traditional investments

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ACM

ACM Market Risks

- Volatility: Fan tokens can experience significant price swings

- Limited liquidity: May face challenges in large-volume trades

- Dependency on team performance: AC Milan's success can impact token value

ACM Regulatory Risks

- Unclear regulations: Fan tokens may face scrutiny from financial authorities

- Potential restrictions: Future regulations could limit token utility or trading

ACM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token's code

- Blockchain network issues: Chiliz Chain disruptions could affect ACM transactions

- Wallet security: Risk of loss due to hacking or user error

VI. Conclusion and Action Recommendations

ACM Investment Value Assessment

ACM offers unique engagement opportunities for AC Milan fans but carries significant volatility and regulatory uncertainty. Long-term value depends on the club's performance and Socios platform growth.

ACM Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about fan token ecosystems ✅ Experienced investors: Consider ACM as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate ACM within the broader context of sports and entertainment tokens

ACM Trading Participation Methods

- Spot trading: Buy and sell ACM on Gate.com

- Fan engagement: Participate in AC Milan decisions and activities through Socios

- Hold for potential staking: Future opportunities for NFT rewards through staking

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is ACM a buy or sell?

ACM is currently considered a strong buy. Analysts unanimously recommend purchasing ACM stock, based on positive market sentiment and growth potential.

What is the price prediction for ACM stock?

ACM stock is predicted to reach $186.76 by December 2025, with a low of $150.92 in October. The average trading price is expected to be around $168.84.

What is the price target for ACM?

The price target for ACM ranges from $118.00 to $151.00, with an average target indicating a 0.60% upside potential.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, forecasted to reach $139,249. Chainlink follows with a predicted peak of $59.67.

Share

Content